Missouri

Missouri Notice of Intent Overview

Missouri

Notice of Intent Requirement

Missouri

Notice of Intent Deadline

Missouri

Notice of Intent Requirement

Missouri

Notice of Intent Deadline

Only a handful of states require a Notice of Intent to Lien, and Missouri is one of them. For lien claimants hired by someone other than the property owner, a Notice of Intent to Lien must be sent before a valid and enforceable mechanics lien claim can be filed. This requirement is created by § 429.100 of Missouri’s mechanics lien statute – which states the notice must be served at least 10 days prior to a lien filing (when required).

Sending a Notice of Intent to Lien can be a powerful tool for getting paid in any state. But, because Notices of Intent to Lien are actually required in Missouri, they tend to carry a bit more weight. Since most claimants must serve a Notice of Intent before filing a lien, recipients will know that the threat of a lien claim isn’t an empty one.

Notice requirements can be intimidating, but they’re pretty straightforward in Missouri. Essentially, it’s just a simple form that’s served on the property owner via personal service through the sheriff’s office. Serving of a Notice of Intent to Lien is even easier when using an online platform.

This page will provide answers to frequently asked questions, (free) downloadable forms, and other info on the Missouri Notice of Intent to Lien requirements.

Missouri Notice of Intent FAQs

For Subcontractors, Suppliers, Equipment Rental Companies, and Others

Is a Missouri Notice of Intent to Lien required?

Usually, yes.

For contractors hired directly by the property owner, a Notice of Intent to Lien won’t be required.

For everyone else intending to utilize a Missouri mechanics lien, a Notice of Intent to Lien must be sent. This requirement is created by § 429.100, which reads, in relevant part:

“Every person except the original contractor, who may wish to avail himself of the benefit of the provisions of sections 429.010 to 429.340, shall give ten days’ notice before the filing of the lien, as herein required, to the owner, owners or agent, or either of them, that he holds a claim against such building or improvement, setting forth the amount and from whom the same is due.“

When do I need to send a Missouri Notice of Intent to Lien?

A Missouri Notice of Intent to Lien must be served at least 10 days before a mechanics lien is filed, when the notice is required.

Providing this notice won’t extend the deadline to lien, though. So, it’s important to understand your deadline and to plan accordingly.

Further, keep in mind that because a Missouri Notice of Intent to Lien must typically be given by personal service, it may take a few more days to plan and execute service – so it’s a good idea to play things safe and be cautious with deadlines.

Which parties must receive a Missouri Notice of Intent to Lien?

A Missouri Notice of Intent to Lien must be sent to the property owner, the owner’s agent, or both of them. Specifically, § 429.100 for the notice to be sent to “the owner, owners or agent, or either of them…”

Practically, though, it might be a good idea to also send the notice to the project’s GC, the project manager, or anyone else who might be able to help resolve the payment dispute.

How should the Missouri Notice of Intent to Lien be sent?

Missouri statute requires the Notice of Intent to Lien to be served by an officer authorized to serve process (i.e. the county sheriff’s office), or by a person who would be a competent witness. Proof of Service is required.

If the owner can’t be found for personal service, or if they’re not located in Missouri (and have no local agent for service), then personal service won’t be strictly required. Instead, the Notice of Intent to Lien may be recorded with the recorder of deeds under § 429.110.

Does the Notice of Intent affect my lien rights or lien deadline?

Yes. When the notice is required, it must be served – otherwise, a filed lien will be invalid and unenforceable.

What’s more, if a lien is filed less than 10 days after a Notice of Intent to Lien is served, the lien will end up being invalid and unenforceable, as well.

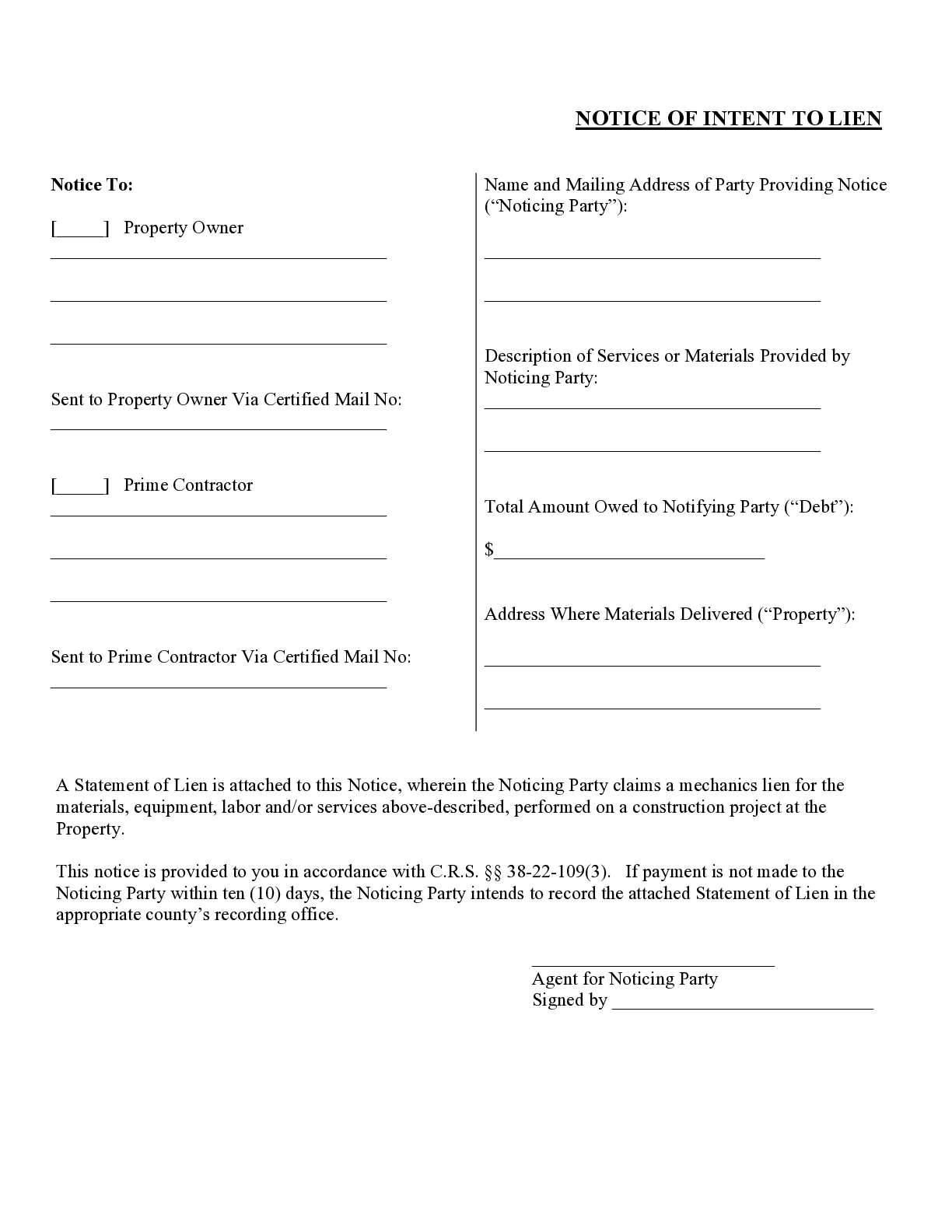

What information should be included on a Missouri NOI?

There’s very little information that actually must appear on a Missouri Notice of Intent to Lien.

Under § 429.100, the notice must include:

- The name of the person claiming a lien;

- A statement that the claimant is entitled to a lien;

- The amount of the claim; and

- The contact info for the lien claimant’s customer.

In addition to the above, it’s probably a good idea to also include the name of the owner and a description of the project property that will be liened.

For Public Projects

Does Missouri require Notices of Intent on public projects?

No.

Missouri’s Notice of Intent to Lien requirements strictly apply to privately owned construction projects since they appear in the state’s lien statutes. Still, it may be a good idea to send a similar notice on public projects anyway: Do I Need to Send a Notice of Intent Before Making a Construction Bond Claim?

Need More Help with a Missouri Notice of Intent? We're Here

Recent Q&As about NOIs in Missouri in our Expert Center

needing a civil attorney in state of colorado, needing to file mechanics lein,Im a contractor whose property is being held and invoices are not being paid by the homeowner. she has openly committed defamation of character as...

What type of lien should I file?I’m a property owner who hired a logger to build some mobile cabin structures on my property. I paid him for labor and materials up...

What if client sends partal payment after sending notice to lienI had you send a notice to lien to to my clients and they contacted me today saying they're sending a payment for we're almost...

How to file a lien in Missouri

Free Missouri Notice of Intent Forms

Compliant with Missouri statutes and applicable for jobs in any Missouri county.

Colorado Notice of Intent to Lien Form | Free Downloadable Template

Fill out the form to download your free Colorado Notice of Intent to Lien Form. You can fill out the form with a PDF editor,...

Missouri Notice of Intent Statutes

Missouri’s Notice of Intent requirements can be found at sections § 429.100 and § 429.110 of the Missouri mechanics lien statute. You can read those sections here at Missouri’s legislative site.

Those sections are also reproduced below, and you can find the full Missouri mechanics lien statute here: Missouri Mechanics Lien Statute, Guide, and FAQs.

Missouri Notice of Intent Statute

§ 429.100. Notification by Subcontractors and Others

Every person except the original contractor, who may wish to avail himself of the benefit of the provisions of sections 429.010 to 429.340, shall give ten days’ notice before the filing of the lien, as herein required, to the owner, owners or agent, or either of them, that he holds a claim against such building or improvement, setting forth the amount and from whom the same is due. Such notice may be served by any officer authorized by law to serve process in civil actions, or by any person who would be a competent witness. When served by an officer, his official return endorsed thereon shall be proof thereof, and when served by any other person, the fact of such service shall be verified by affidavit of the person so serving.

§ 429.110. When Owner Nonresident - Notice, How Given

Whenever property is sought to be charged with a lien under sections 429.010 to 429.340, and the owner of the property so sought to be charged shall not be a resident of this state, or shall have no agent in the county in which said property is situate, or when such owner shall be a resident of the state, but conceals himself, or has absconded, or absents himself from his usual place of abode, so that the notice required by section 429.100 cannot be served upon him, then, and in every such case, such notice may be recorded with the recorder of deeds of the county in which such property is situate, and when recorded shall have like effect as if served upon such owner or his agent in the manner contemplated by section 429.100. Such notice shall be accompanied by an applicable fee for recording and shall be taxed as costs in any lien suit to which the same pertains, to abide the result of the suit.