Laws provide structure to our society and the way we run our businesses. There are a wide variety of laws that affect the relationships formed during a construction project. From contracts to mechanic’s liens, prompt payment, and licensing — these construction laws all affect contractors’ and suppliers’ ability to get paid. Construction companies need to be aware of these laws and make sure that they are following them. Otherwise, they may unwittingly give up their rights to collect payment for work they’ve performed.

Contract law

Contracts form the basis for all relationships in the construction industry. From architects and engineers, to subcontractors and suppliers, everyone is linked by a contract, whether written or verbal. Although written contracts are not required for every agreement, they are strongly recommended by construction attorneys and insurance companies as a way to protect everyone involved. In addition, a written contract may be needed to secure mechanics lien rights, as several states require a written contract in order to secure and maintain those rights.

Contracts often contain specific clauses that describe how payments will be made and their timing. These clauses should be reviewed carefully, as they can restrict lower tier contractor’s rights to collect in a timely fashion. In particular, pay if paid, pay when paid, and flow down clauses can affect when, and even whether, a subcontractor or supplier gets paid.

When disputes arise on a project, contract provisions spell out the procedures for filing a claim against the other party to recover losses. Such notice requirements have to be followed precisely to protect the right to file a claim. Breach of contract is often a major part of any claim, and clauses pertaining to it should be looked at carefully.

Mechanics lien laws

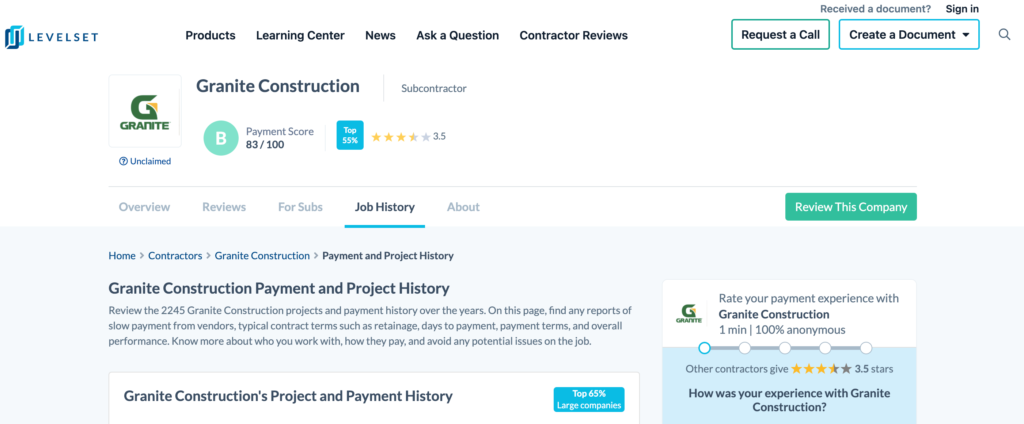

Each state has its own construction laws regarding the filing of mechanic’s liens to protect construction payments. The jurisdiction of these laws is determined by the location of the property, not the contractors involved. Contractors and suppliers should be familiar with the rules and requirements for the states they perform work in.

Mechanics lien laws can be quite complicated, with specific requirements for notices and timing of filings. Laws may require the filing of preliminary notices that let property owners know a company is working on or furnishing materials to the project. A notice of intent lets the owner know that a lien will be filed if payment is not received promptly. Lien waivers are often exchanged for payments to protect owners from fraudulent lien claims.

Some states allow all contractors and suppliers to file a lien for the total amount of work that they have provided, often called a full-price lien. Other states mandate that liens can only be filed for the balance that has not been paid to the general contractor or prime, called an unpaid balance. This means if the GC has been paid in full for a project, lower-tier subs and suppliers could lose their lien rights.

Prompt payment laws

Prompt payment laws cover federal, state, and sometimes even private projects, in most states. They help ensure that project owners make timely payments to general contractors, and that subcontractors and suppliers are also paid within a reasonable timeframe.

These laws pertain to projects funded by the federal government, state government, and in some states even to privately funded projects. If payment is not received within the timeframe set by the laws, contractors and suppliers can send demand letters based on the statutory requirements.

Although these demand letters are not liens, they provide notice to the owner that payment hasn’t been received and provide incentive for prompt payment.

Miller Act and public construction laws

The Miller Act requires general contractors on federally funded construction projects to post a payment bond that guarantees payments to subs and suppliers on the project. If a subcontractor or supplier is not paid by the general contractor, they can file a claim against the payment bond and receive funds from the surety company.

Many states have enacted similar laws, often called Little Miller Acts, to protect subcontractors and suppliers on state-funded projects. On these projects, unpaid subcontractors and suppliers file a claim against the payment bond posted by the general contractor.

Retainage laws

Retainage is often treated separately by prompt payment and mechanics lien laws. States may have specific deadlines and notice requirements that pertain to the collection of retainage. Because these funds are often held until the project is completely finished and the owner has moved in, contractors may wait six months or more for final payment.

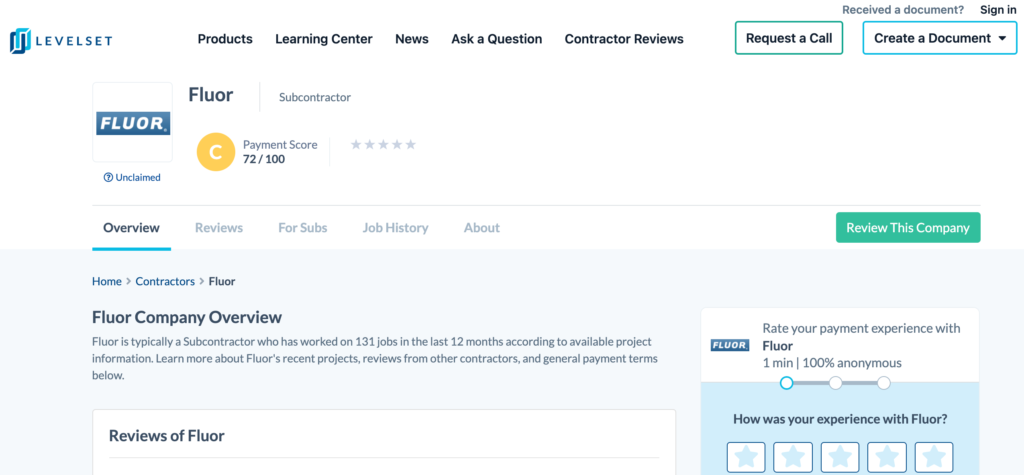

Licensing laws

Unlicensed contractors do not always have the right to file a mechanics lien or even file a lawsuit to collect unpaid amounts. In some states contractors must be licensed in order to retain their lien rights or file a lawsuit to collect unpaid funds, like California and Washington. Other states, like Louisiana, penalize unlicensed contractors by allowing them to only recover a certain amount for their work.

Not all states require contractors to be licensed, but where it’s required it is beneficial for both the contractor and their customers. Licensing protects consumers and property owners from unscrupulous companies and those that provide low-quality work or don’t warranty their work.

Read the guide

The Ultimate Guide to Contractors License Requirements in Every State

Homeowner protection construction laws

Residential contractors who are working for a homeowner on their primary residence (called a homestead in some states) may be subject to additional requirements through the state’s mechanics lien laws or licensing laws.

For example, in Texas, in order to file a lien on a homestead, there must be a signed contract between the owner and prime or general contractor. The contract must be in writing, be signed before any labor or materials are furnished, be signed by both spouses if the owner is married, and must be filed with the County Clerk. If any of these requirements are not met, the prime contractor and any subcontractors or suppliers working on the project lose their right to file a lien on the property.

Before starting work in a new state, be sure to check the lien and licensing laws so you know what to expect.

Know which construction laws apply to you

Contractors and suppliers need to be aware of the various construction laws that apply to their projects. These laws are put in place to protect contractors and their customers and provide guidance and resources to collect payment.

Companies that do not follow these laws and their requirements may find that they have limited options when it comes to collecting payments.