Florida Prompt Payment Requirements

- Private Jobs

- Public Jobs

- Top Links

Prime Contractors

For Prime Contractors, payments accrue interest 14 days from when payment becomes due under the contract.

Subcontractors

For Subcontractors, undispited amounts must be paid within the longer of 30 days after payment is due, or 30 days from receipt of invoice. This may be modifed by contract.

Suppliers

For Suppliers, undispited amounts must be paid within the longer of 30 days after payment is due, or 30 days from receipt of invoice. This may be modifed by contract.

Interest & Fees

Interest at judgment interest rate, and attorneys' fees to be awarded to prevailing party.

Prime Contractors

For Prime (General) Contractors, payment due date dependent on type of work: local - within 25 days of invoice approval (if approval needed) or 20 days of invoice if approval not needed. Transportation projects - final payment due within 75 days of final acceptance.

Subcontractors

For Subcontractors, payment due within 10 days after payment received from above. Payment due within 7 days of payment received for payments to sub-subs.

Suppliers

For Suppliers, payment due within 10 days after payment received from above. Payment due within 7 days of payment received for payments to sub-subs.

Interest & Fees

Interest at 1% month, attorneys' fees to prevailing party if non-paying party withheld funds wrongfully with no basis in law or fact.

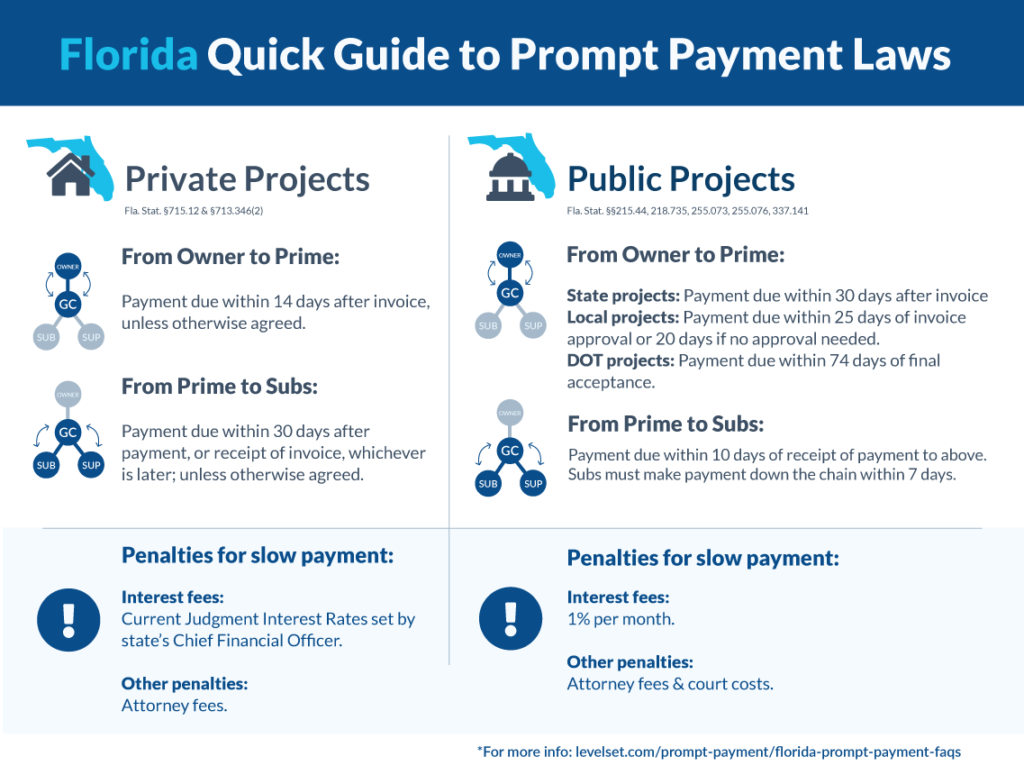

Prompt payment laws are a set of rules that regulate the acceptable amount of time in which payments must be made to contractors and subs. This is to ensure that everyone on a construction project is paid in a timely fashion. These statutes provide a framework for the timing of payments to ensure cash flow and working capital. The state of Florida regulates prompt payment on both private and public construction projects.

Private Projects

All private construction projects in Florida are governed by Fla. Stat. §§713.346(2) and 715.12.

Payment Deadlines for Private Projects

Once a contractor has performed in accordance with the contract terms, they may submit a request for payment to the owner. Upon receipt of the pay request, the owner must release payment within 14 days. However, this can be modified by the contract between the parties.

After the prime contractor has received payment, they must release payment to their subcontractors and suppliers within 30 days of either when payments became due after furnishing labor or materials, or after the request for payment was received; whichever is later. Again, this can all be modified by the contract terms.

Penalties for Late Payment on Private Projects

A party can withhold payment for reasons specified in the statutes. If none of these apply, any late or wrongfully withheld payments will be subject to interest accruing at the current judgement rate. Also, if the dispute goes to court or arbitration, the prevailing party will be awarded attorney fees.

Public Projects

Florida has several sets of statutes that regulate public works projects. These statutes are found in Fla. Stat. §§ 255.0705 et seq.; 215.422; 218.70 et seq. (Localities); and FDOT §337.141.

Payment Deadlines for Public Projects

The deadlines for payment to prime contractors on public projects depends on which public entity contracted the work.

- State projects: payment is due within 30 days after the public entity receives a request for payment.

- Local projects: meaning contracted by a county or municipal government, school board or district, or any other political subdivision thereof, payment to the prime contractor must be made within 25 days of the invoice approval or 20 days if no approval needed.

- Department of Transportation projects: only final payments are regulated, and must be made to the prime within 74 days of final acceptance.

As for payments from the prime contractor to the subs, they must be made within 10 days of receipt of payment. In turn, once the subcontractor has received payment, they must make payment down the chain within 7 days.

Penalties for Late Payment on Public Projects

Depending on the public entity, there may be justifiable reasons to withhold payment such as a bona fide or good faith dispute. However, if payment is late or wrongfully withheld, interest will accrue at a rate of 1% per month until the debt is paid. Attorney fees and court costs are only available to disputes between contractors, subs, and suppliers; and will only be awarded if payments were withheld without any reasonable basis in law or fact.