Maryland

Maryland Notice of Intent to Lien Overview

Maryland

Notice of Intent Requirement

Maryland

Notice of Intent Deadline

Maryland

Notice of Intent Requirement

Maryland

Notice of Intent Deadline

Maryland is one of a handful of states which requires a Notice of Intent to Lien before filing a lien. Though, not everyone must send the notice to preserve their mechanics lien rights. According to § 9-104 of Maryland’s mechanics lien statute, Notice of Intent must only be sent by those hired by someone other than the property owner.

A Notice of Intent to Lien is a powerful payment recovery tool all by itself. Even if the document isn’t required, it can lead to payment. Mechanics liens are extremely powerful – and owners, customers, and others on the job will want to do what they can to avoid a lien claim. And, as a result, the threat of lien can be used to push others to do the right thing and pay what’s owed for the work that’s been performed.

A Notice of Intent to Lien is really a pretty simple document, and its use is straightforward. With that being said, though, it’s crucial to follow all relevant requirements. And, using an online service to help with sending these documents can help to ensure compliance.

This page will provide all the information you need to know to send Maryland Notices of Intent to Lien, and we’ve got some frequently asked questions and answers below to help with that.

Maryland Notice of Intent FAQs

For Subcontractors, Suppliers, Equipment Rental Companies, and Others

Is a Maryland Notice of Intent to Lien required?

Yes, all parties who didn’t contract directly with the property owner (i.e. subcontractors, suppliers, equipment lessors, etc) must send a Notice of Intent to Lien in order to preserve their right to file a Maryland mechanics lien.

When must a Maryland Notice of Intent to Lien be sent?

A Maryland Notice of Intent to Lien must be sent within 120 days of last furnishing labor or materials to the project. Note, however, that if the project is a single-family dwelling on the owner’s land for their own residence, then the notice must also be sent prior to full payment to the general contractor, as lien claims on such projects are limited to the unpaid balance due to the GC; so the earlier the better.

This notice won’t extend the deadline for filing a Maryland lien (which is 180 days from last furnishing). That means this notice requires a lot of planning since its required a full 2 months before the lien itself.

Who needs to receive a Maryland Notice of Intent to Lien?

A Maryland Notice of Intent to Lien must be sent to the property owner. If there are multiple owners, notice to any one of those co-owners will be sufficient. But, on a condominium project, all unit owners must receive the NOI to file a claim against the entire property.

Other parties may not have to receive notice, but it’s likely a good idea to send a Notice of Intent to the project’s GC as well as other higher-tiered parties. That way, more participants are aware of the dispute and able to help resolve it.

What information should be included on a Maryland NOI?

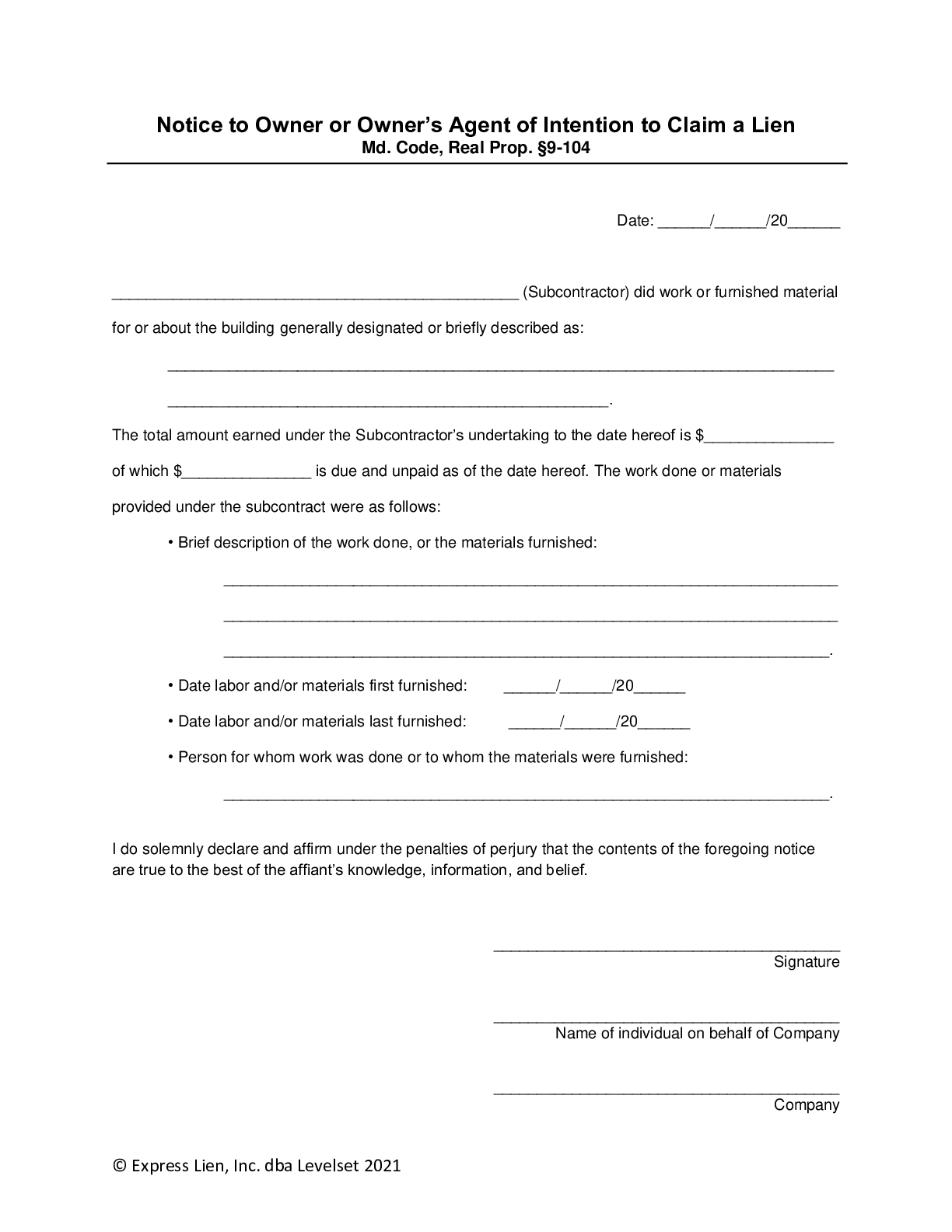

Maryland actually has a statutorily-required form for its Notice of Intent to Lien found under §9-104, and should include the following information:

• The name of the claimant;

• A brief/general description of the property;

• Amount earned to date;

• Amount currently owed but unpaid;

• A brief description of the work provided;

• The dates when work was done;

• The name of the claimant’s hiring party; &

• An affirmation that the information in the notice is true.

→ Download a free Maryland Notice of Intent to Lien form here

How should the Maryland Notice of Intent to Lien be sent?

Notice should be made either by (1) registered or certified mail, with return receipt requested; or (2) personal delivery.

If notice can’t be made by mail or personal delivery, the notice can be given by posting it to the door or other front part of the building which would be liened. But, it must be done in the presence of a competent witness – and it’s certainly a good idea to get photo documentation of that.

Further, if the owner of the property passes away before notice can be given and if their successors aren’t public record, notice by posting is sufficient.

What if a Maryland Notice of Intent to Lien is sent late?

If preliminary notice is required, the failure to provide the required notice within the 120 day time period is fatal to a mechanics lien claim in Maryland. –Tyson v. Masten Lumber & Supply, Inc.

For Public Projects

Does Maryland require Notices of Intent on public projects?

No. Maryland’s Notice of Intent requirements stem from the state’s mechanics lien statutes, and the Maryland Little Miller Act doesn’t require a Notice of Intent before making a claim on a public project.

Still, sending an NOI on a public project can help with recovery: Do I Need to Send a Notice of Intent Before Making a Construction Bond Claim?

Need More Help with a Maryland Notice of Intent? We're Here

Recent Q&As about NOIs in Maryland in our Expert Center

How to file a Property Lien/Legal Property DescriptionRecently went into contract. Both parties signed. Seller wants out. Received higher offer and agreed to buy out of the contract. Would like to place...

Is this insurance fraud ?Hello I received a notice of intent to file a lien in the mail today from a roofing company that replaced my roof and my...

what information do I need to show to be in right standing to file a mechanics lienwhat information do I need to provide to be in right standing to file a mechanics lien.

How to file a lien in Maryland

Free Maryland Notice of Intent Forms

Compliant with Maryland statutes and applicable for jobs in any Maryland county.

Maryland Notice of Intent to Lien Form

Fill out the form to download your free Maryland Notice of Intent to Lien Form. You can fill out the form with a PDF editor,...

Maryland Notice of Intent Statutes

Maryland’s mechanics lien statute can be found at Title 9 of the state’s real property code. The rules creating Maryland’s Notice of Intent requirements can be found at Md. Code, Real Prop. § 9-104; which is reproduced below. Updated as of September 2021.

Maryland Notice of Intent Statute

§ 9-104. Notice to owner by subcontractor.

(a)

(1) A subcontractor doing work or furnishing materials or both for or about a building other than a single family dwelling being erected on the owner’s land for his own residence is not entitled to a lien under this subtitle unless, within 120 days after doing the work or furnishing the materials, the subcontractor gives written notice of an intention to claim a lien substantially in the form specified in subsection (b) of this section.

(2) A subcontractor doing work or furnishing materials or both for or about a single family dwelling being erected on the owner’s land for his own residence is not entitled to a lien under this subtitle unless, within 120 days after doing work or furnishing materials for or about that single family dwelling, the subcontractor gives written notice of an intention to claim a lien in accordance with subsection (a)(1) of this section and the owner has not made full payment to the contractor prior to receiving the notice.

(b) The form of notice is sufficient for the purposes of this subtitle if it contains the information required and is substantially in the following form:

“Notice to Owner or Owner’s Agent of Intention to Claim a Lien

(Subcontractor) did work or furnished material for or about the building generally designated or briefly described as ……….

The total amount earned under the subcontractor’s undertaking to the date hereof is $ ……… of which $ ……… is due and unpaid as of the date hereof. The work done or materials provided under the subcontract were as follows: (insert brief description of the work done and materials furnished, the time when the work was done or the materials furnished, and the name of the person for whom the work was done or to whom the materials were furnished).

I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing notice are true to the best of the affiant’s knowledge, information, and belief.

(Individual) on behalf of (Subcontractor)

(Insert if subcontractor is not an individual)”

(c) The notice is effective if given by registered or certified mail, return receipt requested, or personally delivered to the owner by the claimant or his agent.

(d) If there is more than one owner, the subcontractor may comply with this section by giving the notice to any of the owners.

(e) If notice cannot be given on account of absence or other causes, the subcontractor, or his agent, in the presence of a competent witness and within 120 days, may place the notice on the door or other front part of the building. Notice by posting according to this subsection is sufficient in all cases where the owner of the property has died and his successors in title do not appear on the public records of the county.

(f)

(1) On receipt of notice given under this section, the owner may withhold, from sums due the contractor, the amount the owner ascertains to be due the subcontractor giving the notice.

(2) If the subcontractor giving notice establishes a lien in accordance with this subtitle, the contractor shall receive only the difference between the amount due him and that due the subcontractor giving the notice.

(3) Notwithstanding any other provision of this section to the contrary, the lien of the subcontractor against a single family dwelling being erected on the land of the owner for his own residence shall not exceed the amount by which the owner is indebted under the contract at the time the notice is given.