Colorado

Notice of Intent Requirement

Colorado

Notice of Intent Deadline

Send a Notice

Colorado

Colorado

Colorado

Colorado

Colorado

Colorado

A Notice of Intent to Lien (NOI) is a powerful tool to help contractors and suppliers get paid, even when the NOI is not specifically required. Many parties use demand (or dunning) letters in an attempt to initiate payment, and a Notice of Intent to Lien is like a demand letter powered by the strength of a potential mechanics lien.

Generally, a Notice of Intent is a form sent to the property owner (and sometimes other interested parties) to inform them of a payment dispute and the imminent filing of a lien if it is not satisfactorily resolved. Notice of Intent service and content requirements can be complex and often differ from state to state.

Colorado is one of only 11 states with a specific Notice of Intent to Lien requirement set forth by the state’s mechanics lien laws. In Colorado, an NOI must be sent by all project participants in order to retain the ability to file a valid and enforceable mechanics lien. Since all parties in Colorado must send a Notice of Intent to Lien to maintain the ability to file a mechanics lien, it is important for all project participants to understand the rules and requirements that must be met.

This requirement is set forth by § 38-22-109(3), which specifically requires an NOI to be sent at least 10 days prior to the date the lien itself is filed. As far as what should be included in the NOI, its best practice to include the information that would be contained on the lien statement, or include a copy of the lien to be filed itself.

The process is important to get right, since lien rights are dependent on a sufficient NOI and its timely delivery. A Colorado construction participant can fill out, print, and send a Notice of Intent themselves, or, of course, they can make the Notice of Intent process really easy by just sending the document using an online platform.

This page provides frequently asked questions, forms, and other helpful information about the Colorado Notice of Intent to Lien.

Yes. All participants on a Colorado private construction project must send a Notice of Intent to Lien before they can file a CO mechanics lien. This requirement is set forth specifically by § 38-22-109(3), which states, in part:

“In order to preserve any lien for work performed or laborers or materials furnished, there must be a notice of intent to file a lien statement served upon the owner or reputed owner of the property or the owner’s agent and the principal or prime contractor or his or her agent . . .“

A Colorado Notice of Intent to Lien must be served “at least ten days before the time of filing the lien statement with the county clerk and recorder.“An important thing to note, sending a Notice of Intent to Lien won’t extend your lien deadline – so it’s important to figure out what your deadline is and to plan accordingly.

Furthermore, an additional notice won’t be required if an Amendment to CO Lien Claim is filed; only when the initial lien statement is filed.

In Colorado, the NOI must be “served upon the owner or reputed owner of the property or the owner’s agent and the principal or prime contractor or his or her agent.” It’s important to remember that GCs also need to be served a copy of this notice in Colorado to be valid.

• For more on this see: We missed an owner on our NOI, how would this affect our lien rights?

While the statute does not specifically set forth the content requirements for a Colorado Notice of Intent to Lien, other than a statement of the intention to file a lien, best practice is to include all of the information that would be required on the lien claim itself. This includes:

• The name of the person claiming the lien, the name of the person who furnished the laborers or materials or performed the labor for which the lien is claimed, and the name of the contractor when the lien is claimed by a subcontractor or by the assignee of a subcontractor, or, if unknown, a statement to that effect

• Property owner or reputed owner’s name; if unknown, a statement to that effect

• A description of the property “sufficient for identification”

• See: CO Supreme Court Complicates Describing Property

• A statement of the amount due or owing such claimant.

In fact, a copy of the actual lien to be filed can be attached to the NOI and served on the property owner at the same time to meet service requirements for the lien – as long as the lien affidavit is not filed with the county until at least 10 days later.

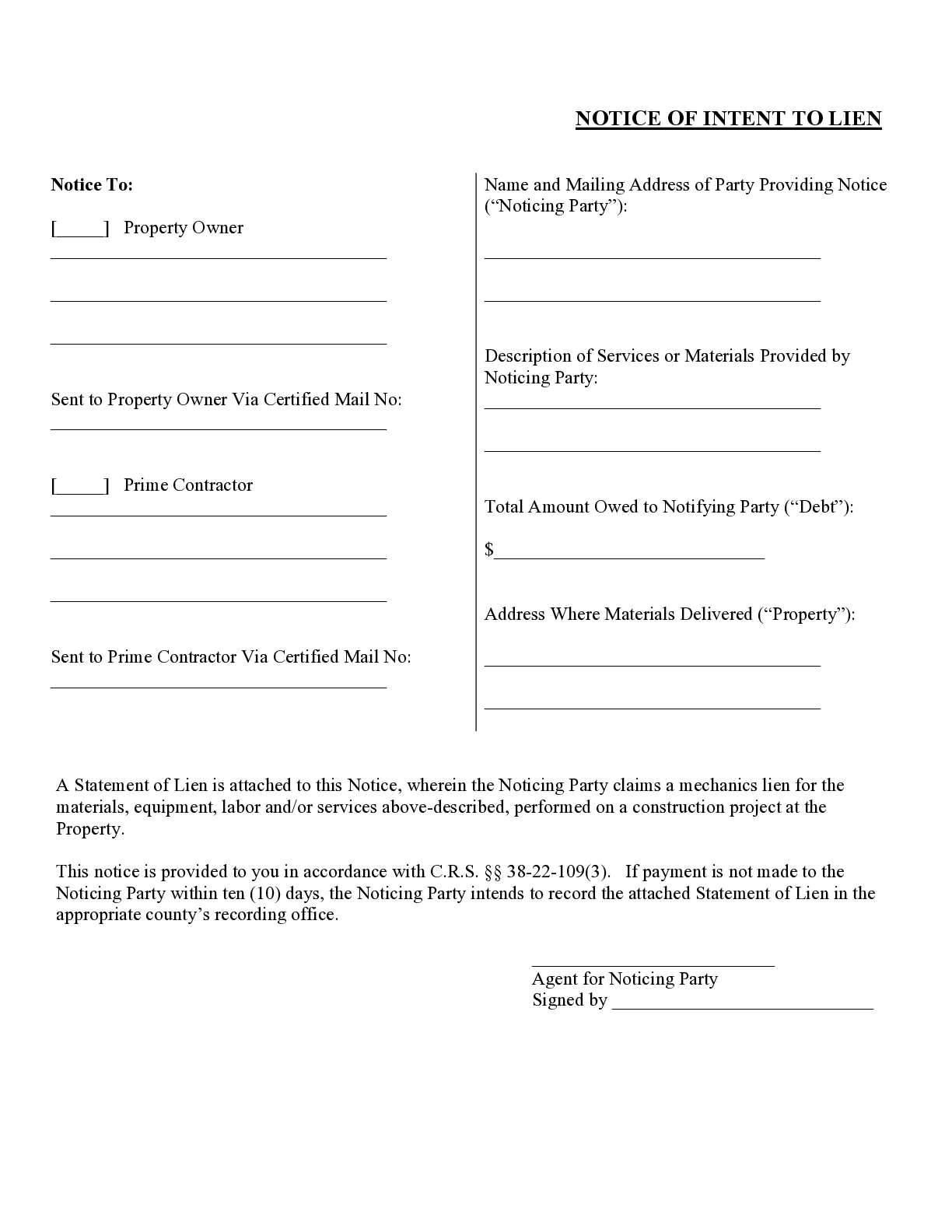

→ Download a free, Colorado Notice of Intent to Lien form here

A Colorado Notice of Intent to Lien can either be served by personal service or by mail. If mailing, then the notice must be sent by registered or certified mail with return receipt requested to the last known address of such persons.

If serving by personal service, then the NOI requirements are met when the parties actually receive the notice. However, if serving the NOI by mail, then the CO NOI is considered served upon deposit in the mail (as long as mailed in the appropriate manner); actual receipt or confirmation of receipt is not required.

• See: What do I do if the customer refused to pick up their notice of intent?

Failing to send a Notice of Intent to Lien on time, or at all, will prevent a claimant from filing a valid and enforceable mechanics lien.

Likewise, and similarly, a mechanics lien in Colorado may not be filed early (less than 10 days from when the NOI was sent). This means that claimants must plan ahead and understand when the NOI must be sent in order to also be able to comply with the deadline for lien filings.

Further, an affidavit of service stating that the NOI was served at least 10 days prior to the filing of the lien claim must be included to be filed with the lien claim itself.

• For more on this, see: What pertinent details must be included on an affidavit of delivery in Colorado to be valid?

No, the NOI requirement in Colorado is specifically set forth in the mechanics lien laws, and solely applicable to private projects on which a mechanics lien may be claimed. No NOI requirements exist for public projects on which the available protection would be a claim against the project payment bond in Colorado.

Im a contractor whose property is being held and invoices are not being paid by the homeowner. she has openly committed defamation of character as...

What type of lien should I file?I’m a property owner who hired a logger to build some mobile cabin structures on my property. I paid him for labor and materials up...

What if client sends partal payment after sending notice to lienI had you send a notice to lien to to my clients and they contacted me today saying they're sending a payment for we're almost...

Compliant with Colorado statutes and applicable for jobs in any Colorado county.

Fill out the form to download your free Colorado Notice of Intent to Lien Form. You can fill out the form with a PDF editor,...

Colorado’s mechanic’s lien statute can be found in Colorado Revised Statutes, §38-22-101 through §38-22-133. And, the rules and requirements specifically related to the Notice of Intent process can be found at § 38-22-109(3) Lien Statement. Updated as of 2020.

(1) Any person wishing to use the provisions of this article shall file for record, in the office of the county clerk and recorder of the county wherein the property, or the principal part thereof, to be affected by the lien is situated, a statement containing:

(a) The name of the owner or reputed owner of such property, or in case such name is not known to him, a statement to that effect;

(b) The name of the person claiming the lien, the name of the person who furnished the laborers or materials or performed the labor for which the lien is claimed, and the name of the contractor when the lien is claimed by a subcontractor or by the assignee of a subcontractor, or, in case the name of such contractor is not known to a lien claimant, a statement to that effect;

(c) A description of the property to be charged with the lien, sufficient to identify the same; and

(d) A statement of the amount due or owing such claimant.

(2) Such statement shall be signed and sworn to by the party, or by one of the parties, claiming such lien, or by some other person in his or their behalf, to the best knowledge, information, and belief of the affiant; and the signature of any such affiant to any such verification shall be a sufficient signing of the statement.

(3) In order to preserve any lien for work performed or laborers or materials furnished, there must be a notice of intent to file a lien statement served upon the owner or reputed owner of the property or the owner’s agent and the principal or prime contractor or his or her agent at least ten days before the time of filing the lien statement with the county clerk and recorder. Such notice of intent shall be served by personal service or by registered or certified mail, return receipt requested, addressed to the last known address of such persons, and an affidavit of such service or mailing at least ten days before filing of the lien statement with the county clerk and recorder shall be filed for record with said statement and shall constitute proof of such service.

(4) All such lien statements claimed for labor and work by the day or piece, but without furnishing laborers or materials therefor, must be filed for record after the last labor for which the lien claimed has been performed and at any time before the expiration of two months next after the completion of the building, structure, or other improvement.

(5) Except as provided in subsections (10) and (11) of this section, the lien statements of all other lien claimants must be filed for record at any time before the expiration of four months after the day on which the last labor is performed or the last laborers or materials are furnished by such lien claimant.

(6) New or amended statements may be filed within the periods provided in this section for the purpose of curing any mistake or for the purpose of more fully complying with the provisions of this article.

(7) No trivial imperfection in or omission from the said work or in the construction of any building, improvement, or structure, or of the alteration, addition to, or repair thereof, shall be deemed a lack of completion, nor shall such imperfection or omission prevent the filing of any lien statement or filing of or giving notice, nor postpone the running of any time limit within which any lien statement shall be filed for record or served upon the owner or reputed owner of the property or such owner’s agent and the principal or prime contractor or his or her agent, or within which any notice shall be given. For the purposes of this section, abandonment of all labor, work, services, and furnishing of laborers or materials under any unfinished contract or upon any unfinished building, improvement, or structure, or the alteration, addition to, or repair thereof, shall be deemed equivalent to a completion thereof. For the purposes of this section, “abandonment” means discontinuance of all labor, work, services, and furnishing of laborers or materials for a three-month period.

(8) Subject to the prior termination of the lien under the provisions of section 38-22-110, no lien claimed by virtue of this article shall hold the property, or remain effective longer than one year from the filing of such lien, unless within thirty days after each annual anniversary of the filing of said lien statement there is filed in the office of the county clerk and recorder of the county wherein the property is located an affidavit by the person or one of the persons claiming the lien, or by some person in his behalf, stating that the improvements on said property have not been completed.

(9) Upon the filing of the notice required and the commencement of an action, within the time and in the manner required by said section 38-22-110, no annual affidavit need be filed thereafter.

(10) Within the applicable time period provided in subsections (4) and (5) of this section and subject to the provisions of section 38-22-125, any lien claimant granted a lien pursuant to section 38-22-101 may file with the county clerk and recorder of the county in which the real property is situated a notice stating the legal description or address or such other description as will identify the real property; the name of the person with whom he has contracted; and the claimant’s name, address, and telephone number. One such notice may be filed upon more than one property, and, in the case of a subdivision, one notice may describe only the part thereof upon which the claimant has or will obtain a lien pursuant to section 38-22-101. The filing of said notice shall serve as notice that said person may thereafter file a lien statement and shall extend the time for filing of the mechanic’s lien statement to four months after completion of the structure or other improvement or six months after the date of filing of said notice, whichever occurs first. Unless sooner terminated as provided in subsection (11) of this section, the notice provided for in this subsection (10) shall automatically terminate six months after the date said notice is filed. In the event that said structure or other improvements have not been completed prior to the termination of said notice, a claimant, prior to said termination date, may file a new or amended notice which shall remain effective for an additional period of six months after the date of filing or four months after the date of completion of said structure or other improvements, whichever occurs first.

(11) Upon termination of agreement to provide labor, laborers, or materials, the owner, or someone in such owner’s behalf, may demand from the person filing said notice a termination of said notice, which termination shall identify the properties upon which labor has not been performed or to which laborers or materials have not been furnished and as to which said notice is terminated. Upon the filing of said termination in the office of the county clerk and recorder in the county wherein said property is situated, such notice no longer constitutes notice as provided in subsection (10) of this section as to the property described in said termination.

(12) The notices provided for in subsections (10) and (11) of this section shall be recorded in the office of the county clerk and recorder of the county wherein the real property is located.