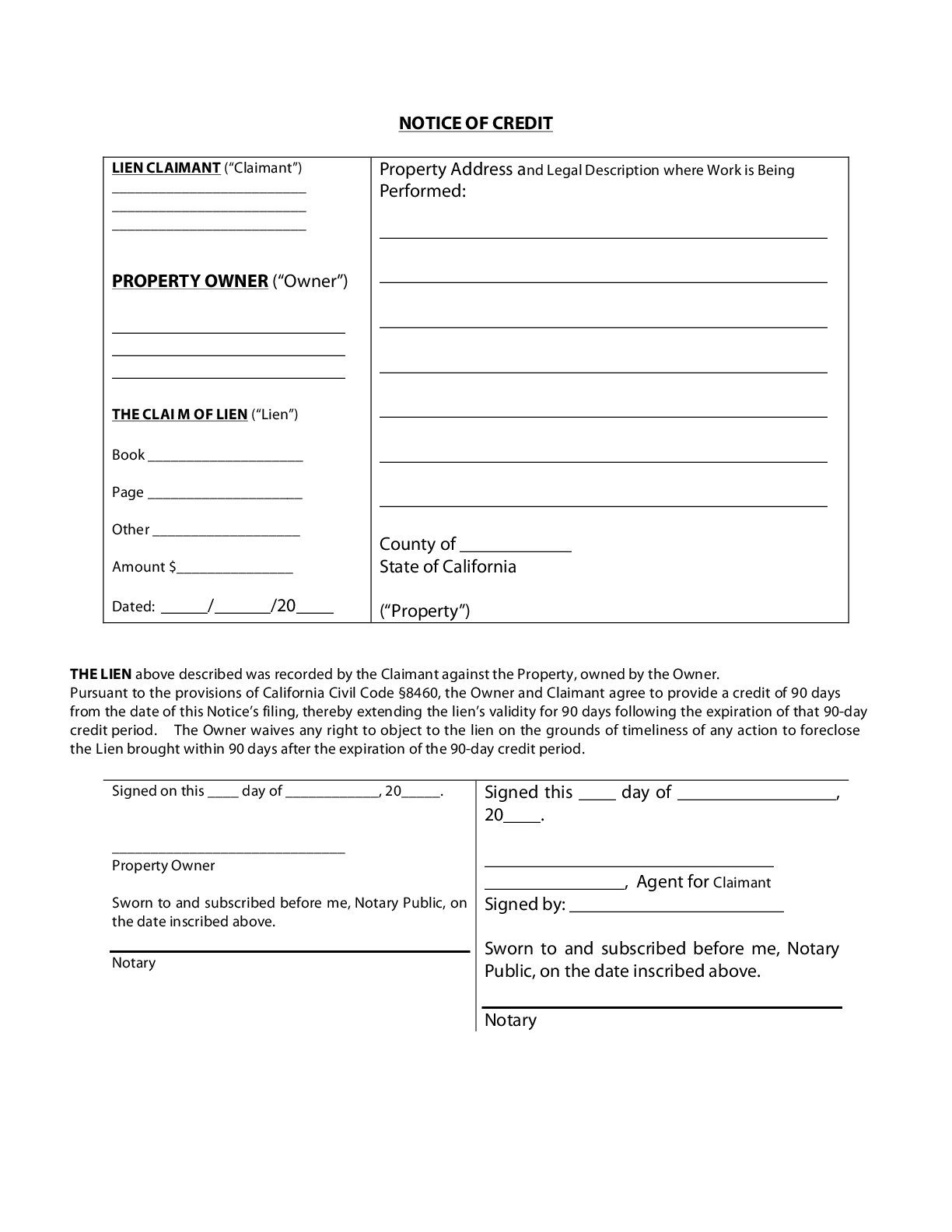

California Notice of Credit Form

DISCLAIMER: These forms are provided as an informational resource only and are offered “as-is” without any warranties, express or implied. Their use is at your own risk and not intended for commercial purposes. They are not a substitute for legal advice, and we recommend consulting a licensed attorney. The use of these forms does not create an attorney-client relationship.

Download your Notice of Credit Form | Free Downloadable Template

Subcontractors and suppliers have protected over $1,000,000,000 from non-payments. It’s fast, easy, affordable, and done right!

Get help filing your California Mechanics Lien

Liens expire 90-days after filing in California. If a party is promising to pay your claim, but just not soon enough to prevent the lien from expiring, a Notice of Credit may help. This filing extends the time period to enforce a Lien for 180 days from the date of filing.

An additional Notice of Credit can be filed even at the expiration of this period, except that it may never extend the time period more than 1 year past the actual completion of the project. Notices of Credit must be signed by the Owner and the Claimant.

Fill out the form above to download your free California Notice of Credit Form template that can be filled out with a PDF editor or by hand after printing. Use this template to extend the deadline to enforce a construction lien in the state of California.

Others are asking about California Mechanics Lien

I filed the Mechanics Lien close to the 60 days

The basic deadline to record a mechanics lien is 90 days after completion of the entire work of improvement. The deadline is shorter if the owner records a notice of completion and serves it on the contractor and subcontractors - 30 days for subs and 60 days for a direct contractor. The lien is premature if the lien claimant is still providing work when the lien is recorded. (See Civil Code, §§ 8180, 8412, 8414.) If April 21 is the date the entire project was complete, and no notice of completion was recorded and served, the deadline to record a lien should be July 20.

Mechanics Lien

I recommend that you wait and see if they file a foreclosure lawsuit on the lien. If the lien expires before they file their lawsuit, you can file a petition to the court to remove the expired lien and get an order requiring the lienor to pay your attorney's fees (which you may or may not be able to collect under the circumstances). In addition, the GC should be liable for the laborer's wages and the defective work. If the GC is solvent, you can sue them to recover your damages and to remove the lien. If you get a judgment against the GC and they don't pay it, you can notify the Contractors State License Board, and their license may be suspended until they pay.

I have not been paid and didnt file the 20 day due 9 months ago

Most likely your best course of action at this point would be a demand letter and potentially a breach of contract action against the GC who has not paid you. If there is a payment bond on the project your may still have time to make a claim against this bond. But otherwise, because you did not send preliminary notice, you would not have lien rights.

Other forms to use in California

California County Recorders

Looking to file/record a mechanics lien in California? You'll need to get your California mechanics lien filed and recorded with the county recorder in the county where the construction project is located. Here is a listing of all county recorders in California. Click on any county to find more information about how to get your lien recorded in that county.

Alameda

1106 Madison St

Oakland, CA 94607

(510) 272-6362, press 5 then 0

Calaveras

891 Mountain Ranch Road

San Andreas, CA 95249

209-754-6372

Contra Costa

555 Escobar Street Recording Section

Martinez, CA 94553

925-335-7900

Del Norte

981 H Street, Suite 160

Crescent City, CA 95531

707-464-7216

Fresno

Hall of Records, 2281 Tulare Street, Room 302

Fresno, CA 93721

(559) 600-3471

Glenn

516 West Sycamore Street, Second Floor

Willows, CA 95988

530-934-6412

Humboldt

825 5th Street, Fifth Floor

Eureka, CA 95501

707-445-7593

Imperial

940 W. Main Street, Suite 202

El Centro, CA 92243-2839

(442) 265-1076

Kings

1400 W. Lacey Blvd.

Hanford, CA 93230

559-582-3211 Ext. 2470

Lassen

220 South Lassen Street, Suite 5

Susanville, CA 96130

530-251-8234

Marin

3501 Civic Center Drive, Ste 232

San Rafael, CA 94903-9491

(415) 499-6092

Mendocino

501 Low Gap Rd., Room 1020

Ukiah, CA 95482

707-463-4376

Modoc

204 South Court Street, Basement

Alturas, CA 96101

530-233-6205

Monterey

1st floor, 168 West Alisal Street

Salinas, CA 93901

(831) 755-5041

San Bernardino

222 West Hospitality Lane

San Bernardino, CA 92415-0022

(909) 387-8306

San Diego

590 Third Ave, Rm 204

Chula Vista, CA 91910

(619) 238-8158

San Francisco

San Francisco, CA 94102-4698

Phone: (415) 554-5596

Fax: (415) 554-7915

Email: assessor@sfgov.org

San Joaquin

44 N San Joaquin Street, Suite 260

Stockton, CA 95202

209-468-3939

San Luis Obispo

1055 Monterey Street D-120

San Luis Obispo, CA 93408

805-781-5080

San Mateo

555 County Center; Recording office

Redwood City, CA 94063

650.363.4500

Santa Barbara

1100 Anacapa St.

Santa Barbara, CA 93101

805-568-2250

Santa Clara

70 West Hedding Street, East Wing, First Floor

San Jose, CA 95110

(408) 299-5688

Santa Cruz

701 Ocean Street Room 230

Santa Cruz, CA 95060

831-454-2800

Shasta

1450 Court St., Ste 208

Redding, CA 96001-1670

530-225-5671

Sierra

100 Courthouse Square, Suite 11

Downieville, CA 95936

530-289-3295

Solano

675 Texas Street, Suite 2700

Fairfield, CA 94533-6338

(707) 784-6200

Stanislaus

1021 I Street, Ste 201

Modesto, CA 95354-0847

209-525-5270

Tulare

221 South Mooney Boulevard, Rm 103

Visalia, CA 93291-4593

559-636-5050

Ventura

Hall of Admin, Main Plaza 800 S Victoria Ave

Ventura, CA 93009

805-654-2295