Iowa

Preliminary Notice Deadlines

Iowa

Iowa

Iowa

Iowa

Anyone who didn't contract directly contract with the prime contractor must send preliminary notice to the prime contractor within 30 days of first furnishing labor and/or material to a project.

Send a Notice

Iowa

Bond claim must be filed within 30 days after completion and final acceptance of the project. It may be sent later, but the amount recoverable will be limited to the unpaid balance due to the prime contractor.

Iowa

Lawsuit enforcing said claim must be filed at any time after the expiration of 30 days, and not later than 60 days, following the completion and final acceptance of the public improvement.

Iowa

Anyone who didn't contract directly contract with the prime contractor must send preliminary notice to the prime contractor within 30 days of first furnishing labor and/or material to a project.

Send a Notice

Iowa

Bond claim must be filed within 30 days after completion and final acceptance of the project. It may be sent later, but the amount recoverable will be limited to the unpaid balance due to the prime contractor.

Iowa

Lawsuit enforcing said claim must be filed at any time after the expiration of 30 days, and not later than 60 days, following the completion and final acceptance of the public improvement.

Iowa’s Little Miller Act requires a payment bond to be posted on any public improvement project where the original contract price is $25K or more.

However, these laws do not apply to projects involving improvements to a highway, bridge, or culvert.

In Iowa, any party who furnishes labor, materials, and/or services to a prime contractor or first-tier subcontractor may make a claim against the payment bond. Note that more remote claimants and suppliers to suppliers are not protected under Iowa’s Little Miller Act.

An Iowa bond claim must be received within 30 days from the completion of the project and acceptance of the work by the public entity. However, the claim may still be validly filed after that 30-day period if the public entity has not yet paid the full contract price, and no action is pending to adjudicate rights in and to the unpaid portion of the contract price.

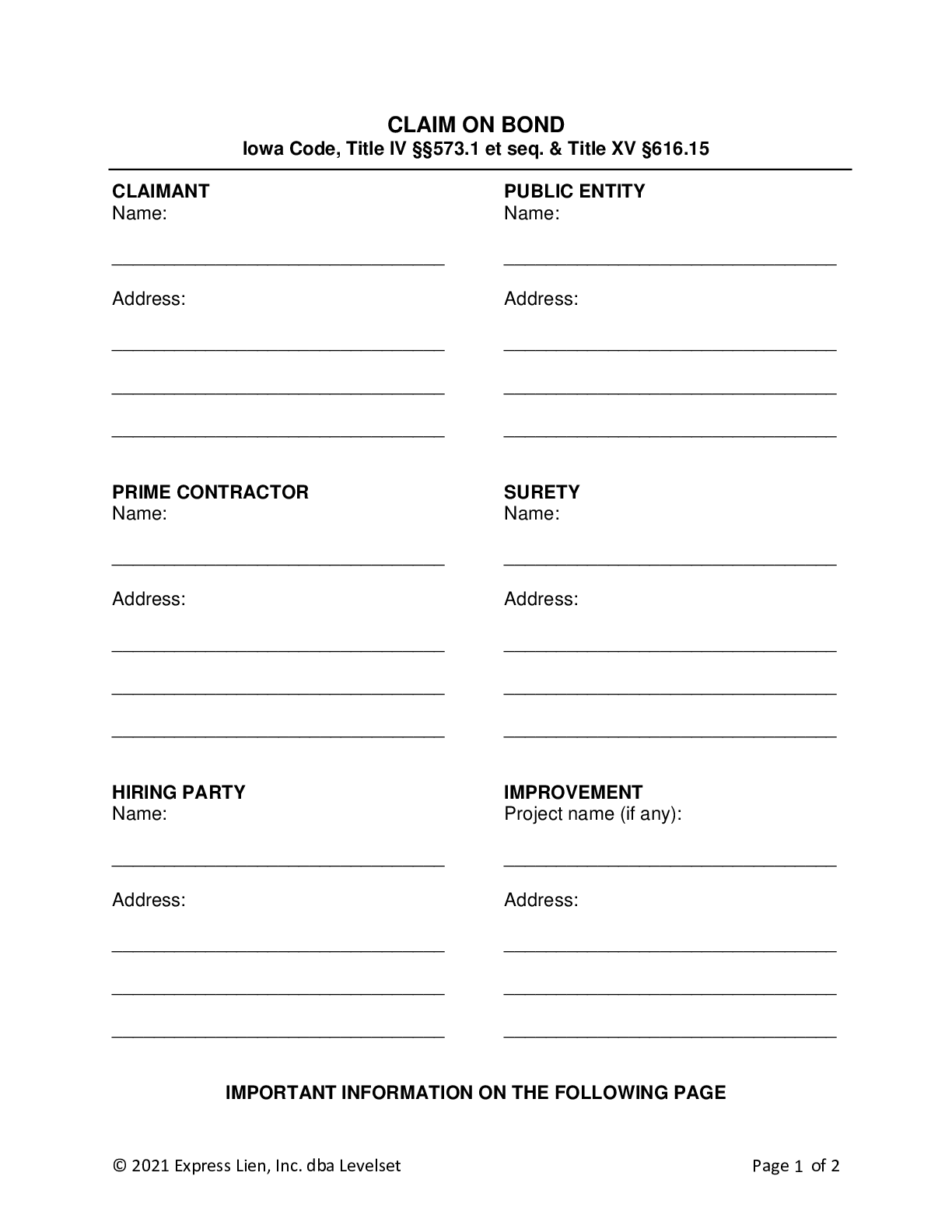

The only actual requirement under the Iowa Little Miller Act is an itemized sworn written statement of the claim, however, providing as much identifying information as possible is always considered best practice. We recommend providing the following information:

• Claimant’s name & address

• Prime Contractor;s name & address

• Hiring party’s name & address

• Public entity name & address

• Surety name & address

• Itemized sworn statement of labor and materials furnished

• Amounts due

• Claim for payment

• Property description

A bond claim in Iowa must only be provided to the officer, board, or commission authorized to let contracts for the project. If the project was a highway improvement, the claim should be delivered to the county auditor of the county letting the contract. It may also be advisable to provide notice of the claim to the general contractor and the surety (if known).

An Iowa bond claim must be filed with the officer, board, or commission authorized to let the contract, or in the case of a highway improvement project, with the county auditor of the county letting the contract. There is no specification as to how the claim must be delivered to the public entity for filing, but it is essential that the claim is actually received and filed.

A lawsuit to enforce a claim against the payment bond must be initiated more than 30 days after completion and acceptance of the project, but no later than 60 days after completion and acceptance of the work.

If, however, the claimant receives a written demand to commence an action to enforce the claim under Iowa Code §573.16, they must file a lawsuit within 30 days of receipt of the demand.

Hello, We are a metal building construction company doing a project for a community college, therefore, a state/government job. We are a subcontractor under a...

Can a supplier file against the GC's bond for slow pay?We are a small company who lost the major job supporting our operation. We were slow pay to our supplier and they filed a lien...

This is an Iowa Payment Bond Claim form. This form can be filled out with a PDF editor or by hand after printing. An Iowa...

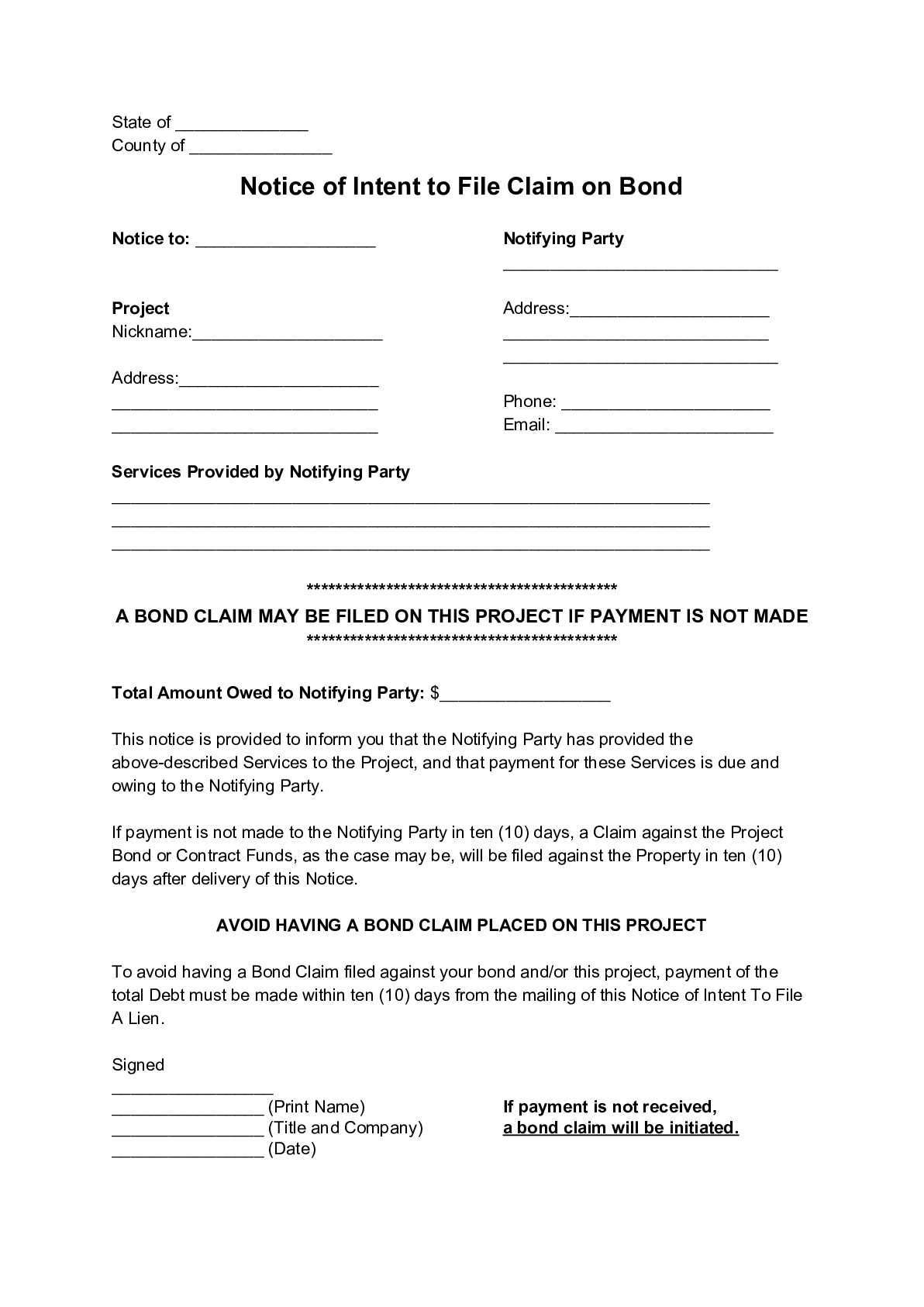

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Iowa, and are not paid, you can file a “lien” against the project pursuant to Iowa’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Iowa’s Little Miller Act is found in Iowa Code, Title IV, §573.1 – 573.27, and Title XV, § 616.15, and is reproduced below. Updated as of July 2021.

For the purpose of this chapter:

1.”Construction”, in addition to its ordinary meaning, includes repair, alteration and demolition.

2.”Material” shall, in addition to its ordinary meaning, embrace feed, gasoline, kerosene, lubricating oils and greases, provisions and fuel, and the use of forms, accessories, and equipment, but shall not include personal expenses or personal purchases of employees for their individual use.

3.”Public corporation” shall embrace the state, and all counties, cities, public school corporations, and all officers, boards, or commissions empowered by law to enter into contracts for the construction of public improvements.

4.”Public improvement” is an improvement, the cost of which is payable from taxes or other funds under the control of the public corporation, except that in cases of public improvement for drainage or levee purposes the provisions of the drainage law, chapter 468, in cases of conflict shall govern.

5.”Service” shall, in addition to its ordinary meaning, include the furnishing to the contractor of workers’ compensation insurance, and premiums and charges for such insurance shall be considered a claim for service.

Contracts for the construction of a public improvement shall, when the contract price equals or exceeds twenty-five thousand dollars, be accompanied by a bond, with surety, conditioned for the faithful performance of the contract, and for the fulfillment of other requirements as provided by law. The bond may also be required when the contract price does not equal that amount. However, if a contractor provides a performance or maintenance bond as required by a public improvement contract governed by this chapter and subsequently the surety company becomes insolvent and the contractor is required to purchase a new bond, the contractor may apply for reimbursement from the governmental agency that required a second bond and the claims shall be reimbursed from funds allocated for road construction purposes.

If the requirement for a bond is waived pursuant to section 12.44, a person, firm, or corporation, having a contract with the targeted small business or with subcontractors of the targeted small business, for labor performed or materials furnished, in the performance of the contract on account of which the bond was waived, is entitled to any remedy provided under this chapter. When a bond has been waived pursuant to section 12.44, the remedies provided for under this paragraph are available in an action against the public corporation.

The obligation of the public corporation to require, and the contractor to execute and deliver said bond, shall not be limited or avoided by contract.

A public corporation, with respect to a public improvement which is or has been competitively bid or negotiated, shall not require a contractor to procure a bond, as required under section 573.2, from a particular insurance or surety company, agent, or broker.

A deposit of money, a certified check on a solvent bank of the county in which the improvement is to be located, a credit union certified share draft, state or federal bonds, bonds issued by a city, school corporation, or county of this state, or bonds issued on behalf of a drainage or highway paving district of this state may be received in an amount equal to the amount of the bond and held in lieu of a surety on the bond, and when so received the securities shall be held on the terms and conditions applicable to a surety.

Said bond shall run to the public corporation. The amount thereof shall be fixed, and the bond approved, by the official board or officer empowered to let the contract, in an amount not less than seventy-five percent of the contract price, and sufficient to comply with all requirements of said contract and to insure the fulfillment of every condition, expressly or impliedly embraced in said bond; except that in contracts where no part of the contract price is paid until after the completion of the public improvement the amount of said bond may be fixed at not less than twenty-five percent of the contract price.

The following provisions shall be held to be a part of every bond given for the performance of a contract for the construction of a public improvement, whether said provisions be inserted in such bond or not, to wit:

1. The principal and sureties on this bond hereby agree to pay to all persons, firms, or corporations having contracts directly with the principal or with subcontractors, all just claims due them for labor performed or materials furnished, in the performance of the contract on account of which this bond is given, when the same are not satisfied out of the portion of the contract price which the public corporation is required to retain until completion of the public improvement, but the principal and sureties shall not be liable to said persons, firms, or corporations unless the claims of said claimants against said portion of the contract price shall have been established as provided by law.

2. Every surety on this bond shall be deemed and held, any contract to the contrary notwithstanding, to consent without notice:

a. To any extension of time to the contractor in which to perform the contract.

b. To any change in the plans, specifications, or contract, when such change does not involve an increase of more than twenty percent of the total contract price, and shall then be released only as to such excess increase.

c. That no provision of this bond or of any other contract shall be valid which limits to less than one year from the time of the acceptance of the work the right to sue on this bond for defects in the quality of the work or material not discovered or known to the obligee at the time such work was accepted.

Any person, firm, or corporation who has, under a contract with the principal contractor or with subcontractors, performed labor, or furnished material, service, or transportation, in the construction of a public improvement, may file, with the officer, board, or commission authorized by law to let contracts for such improvement, an itemized, sworn, written statement of the claim for such labor, or material, service, or transportation.

A person furnishing only materials to a subcontractor who is furnishing only materials is not entitled to a claim against the retainage or bond under this chapter and is not an obligee or person protected under the bond pursuant to section 573.6.

1. In case of highway improvements by the county, claims shall be filed with the county auditor of the county letting the contract. In case of contracts for improvements on the farm-to-market highway system paid from farm-to-market funds, claims shall be filed with the auditor of the state department of transportation.

2. Claims filed for credit extended for the personal expenses or personal purchases of employees for their individual use shall not cause any part of the unpaid funds of the contractor to be withheld.

The officer shall endorse over the officer’s official signature upon every claim filed with the officer, the date and hour of filing.

Claims may be filed with said officer as follows:

1. At any time before the expiration of thirty days immediately following the completion and final acceptance of the improvement.

2. At any time after said thirty-day period, if the public corporation has not paid the full contract price as herein authorized, and no action is pending to adjudicate rights in and to the unpaid portion of the contract price.

The court may permit claims to be filed with it during the pendency of the action hereinafter authorized, if it be made to appear that such belated filing will not materially delay the action.

1. Retention. Payments made under contracts for the construction of public improvements, unless provided otherwise by law, shall be made on the basis of monthly estimates of labor performed and material delivered, as determined by the project architect or engineer. The public corporation shall retain from each monthly payment not more than five percent of that amount which is determined to be due according to the estimate of the architect or engineer. The contractor may retain from each payment to a subcontractor not more than the lesser of five percent or the amount specified in the contract between the contractor and the subcontractor.

2. Prompt payment.

a.

(1) Interest shall be paid to the contractor on any progress payment that is approved as payable by the public corporation’s project architect or engineer and remains unpaid for a period of fourteen days after receipt of the payment request at the place, or by the person, designated in the contract, or by the public corporation to first receive the request, or for a time period greater than fourteen days, unless a time period greater than fourteen days is specified in the contract documents, not to exceed thirty days, to afford the public corporation a reasonable opportunity to inspect the work and to determine the adequacy of the contractor’s performance under the contract.

(2) Interest shall accrue during the period commencing the day after the expiration of the period defined in subparagraph (1) and ending on the date of payment. The rate of interest shall be determined as set forth in section 573.14.

b. A progress payment or final payment to a subcontractor for satisfactory performance of the subcontractor’s work shall be made no later than one of the following, as applicable:

(1) Seven days after the contractor receives payment for that subcontractor’s work.

(2) A reasonable time after the contractor could have received payment for the subcontractor’s work, if the reason for nonpayment is not the subcontractor’s fault. A contractor’s acceptance of payment for one subcontractor’s work is not a waiver of claims, and does not prejudice the rights of the contractor, as to any other claim related to the contract or project.

3. Interest payments.

a. If the contractor receives an interest payment under section 573.14, the contractor shall pay the subcontractor a share of the interest payment proportional to the payment for that subcontractor’s work.

b. If a public corporation other than a school corporation, county, or city retains funds, the interest earned on those funds shall be payable at the time of final payment on the contract in accordance with the schedule and exemptions specified by the public corporation in its administrative rules. The rate of interest shall be determined by the period of time during which interest accrues, and shall be the same as the rate of interest that is in effect under section 12C.6 as of the day interest begins to accrue.

A public corporation shall not be permitted to plead noncompliance with section 573.12 and the retained percentage of the contract price, which in no case shall be more than five percent, constitutes a fund for the payment of claims for materials furnished and labor performed on the improvement and shall be held and disposed of by the public corporation as provided in this chapter.

1. The fund provided for in section 573.13 shall be retained by the public corporation for a period of thirty days after the completion and final acceptance of the improvement. If at the end of the thirty-day period claims are on file, the public corporation shall continue to retain from the unpaid funds a sum equal to double the total amount of all claims on file. The remaining balance of the unpaid fund, or if no claims are on file, the entire unpaid fund, shall be released and paid to the contractor.

2. The public corporation shall order payment of any amount due the contractor to be made in accordance with the terms of the contract. Except as provided in section 573.12 for progress payments, failure to make payment pursuant to this section, of any amount due the contractor, within forty days, unless a greater time period not to exceed fifty days is specified in the contract documents, after the work under the contract has been completed and if the work has been accepted and all required materials, certifications, and other documentations required to be submitted by the contractor and specified by the contract have been furnished the awarding public corporation by the contractor, shall cause interest to accrue on the amount unpaid to the benefit of the unpaid party. Interest shall accrue during the period commencing the thirty-first day following the completion of work and satisfaction of the other requirements of this subsection and ending on the date of payment. The rate of interest shall be determined by the period of time during which interest accrues, and shall be the same as the rate of interest that is in effect under section 12C.6, as of the day interest begins to accrue, for a deposit of public funds for a comparable period of time. However, for institutions governed pursuant to chapter 262, the rate of interest shall be determined by the period of time during which interest accrues, and shall be calculated as the prime rate plus one percent per year as of the day interest begins to accrue. This subsection does not abridge any of the rights set forth in section 573.16. Except as provided in sections 573.12 and 573.16, interest shall not accrue on funds retained by the public corporation to satisfy the provisions of this section regarding claims on file. This chapter does not apply if the public corporation has entered into a contract with the federal government or accepted a federal grant which is governed by federal law or rules that are contrary to the provisions of this chapter. For purposes of this subsection, “prime rate” means the prime rate charged by banks on short-term business loans, as determined by the board of governors of the federal reserve system and published in the federal reserve bulletin.

1. A person, firm, or corporation that has performed labor for or furnished materials, service, or transportation to a subcontractor shall not be entitled to a claim against the retainage or bond under this chapter unless the person, firm, or corporation that performed the labor or furnished the materials, service, or transportation does all of the following:

a. Notifies the principal contractor in writing with a one-time notice containing the name, mailing address, and telephone number of the person, firm, or corporation that performed the labor or furnished the materials, service, or transportation, and the name of the subcontractor for whom the labor was performed or the materials, service, or transportation were furnished, within thirty days of first performing the labor or furnishing the materials, service, or transportation for which a claim may be made. Additional labor performed or materials, service, or transportation furnished by the same person, firm, or corporation to the same subcontractor for use in the same construction project shall be covered by this notice.

b. Supports the claim with a certified statement that the principal contractor received the notice described in paragraph “a”.

2. This section shall not apply to highway, bridge, or culvert projects as referred to in section 573.28.

Notwithstanding section 573.14, a public corporation may release retained funds upon completion of ninety-five percent of the contract in accordance with the following:

1. Any person, firm, or corporation who has, under contract with the principal contractor or with subcontractors, performed labor, or furnished materials, service, or transportation, in the construction of the public improvement, may file with the public corporation an itemized, sworn, written statement of the claim for the labor, or materials, service, or transportation. The claim shall be filed with the public corporation either before the expiration of the thirty days after completion of ninety-five percent of the contract or at any time after the thirty-day period if the public corporation has not paid the full contract price and no action is pending to adjudicate rights in and to the unpaid portion of the contract price.

2. The fund, as provided in section 573.13, shall be retained by the public corporation for a period of thirty days after ninety-five percent of the contract has been completed. If at the end of the thirty-day period, a claim has been filed, in accordance with this section, the public corporation shall continue to retain from the unpaid funds, a sum equal to double the total amount of all claims on file. The remaining balance of the unpaid fund, or if there are no claims on file, the entire unpaid fund, may be released and paid to the contractor.

3. The public corporation, the principal contractor, or any claimant for labor or materials, service, or transportation, who has filed a claim or the surety on any bond given for performance of the contract, at any time after the expiration of thirty days, and not later than sixty days after the completion of ninety-five percent of the contract, may bring an action in equity in the county where the public improvement is located to determine rights to moneys contained in the fund or to enforce liability on the bond. The action shall be brought in accordance with sections 573.16 through 573.18, with the completion of ninety-five percent of the contract taking the place of the date of final acceptance.

4. A public corporation that releases funds at the completion of ninety-five percent of the contract, in accordance with this section, shall not be required to retain additional funds.

The public corporation, the principal contractor, any claimant for labor or material who has filed a claim, or the surety on any bond given for the performance of the contract, may, at any time after the expiration of thirty days, and not later than sixty days, following the completion and final acceptance of said improvement, bring action in equity in the county where the improvement is located to adjudicate all rights to said fund, or to enforce liability on said bond.

Upon written demand of the contractor served, in the manner prescribed for original notices, on the person filing a claim, requiring the claimant to commence action in court to enforce the claim, an action shall be commenced within thirty days, otherwise the retained and unpaid funds due the contractor shall be released. Unpaid funds shall be paid to the contractor within twenty days of the receipt by the public corporation of the release as determined pursuant to this section. Failure to make payment by that date shall cause interest to accrue on the unpaid amount. Interest shall accrue during the period commencing the twenty-first day after the date of release and ending on the date of the payment. The rate of interest shall be determined pursuant to section 573.14. After an action is commenced, upon the general contractor filing with the public corporation or person withholding the funds, a surety bond in double the amount of the claim in controversy, conditioned to pay any final judgment rendered for the claims so filed, the public corporation or person shall pay to the contractor the amount of funds withheld.

The official board or officer letting the contract, the principal contractor, all claimants for labor and material who have filed their claim, and the surety on any bond given for the performance of the contract shall be joined as plaintiffs or defendants.

The court shall adjudicate all claims for which an action is filed under section 573.16. Payments from the retained percentage, if still in the hands of the public corporation, shall be made in the following order:

1. Costs of the action.

2. Claims for labor.

3. Claims for materials.

4. Claims of the public corporation. Upon settlement or adjudication of a claim and after judgment is entered, unpaid funds retained with respect to the claim which are not necessary to satisfy the judgment shall be released and paid to the contractor within twenty days of receipt by the public corporation of evidence of entry of judgment or settlement of the claim. Failure to make payment by that date shall cause interest to accrue on the unpaid amount. Interest shall accrue during the period commencing on the twenty-first day after receipt by the public corporation of evidence of entry of judgment and ending on the date of payment. The rate of interest shall be determined as set forth in section 573.14.

When the retained percentage is insufficient to pay all claims for labor or materials, the court shall, in making distribution under section 573.18, order the claims in each class paid in the order of filing the same.

When it appears that the unpaid portion of the contract price for the public improvement, or a part thereof, is represented in whole or in part, by property other than money, or if a deposit has been made in lieu of a surety, the court shall have jurisdiction thereover, and may cause the same to be sold, under such procedure as it may deem just and proper, and disburse the proceeds as in other cases.

The court may tax, as costs, a reasonable attorney fee in favor of any claimant for labor or materials who has, in whole or in part, established a claim.

If, after the said retained percentage has been applied to the payment of duly filed and established claims, there remain any claims that are unpaid in whole or in part, judgment shall be entered for the amount of the claims that are unpaid against the principal and sureties on the bond. In case the said percentage has been paid over as provided in this chapter, judgment shall be entered against the principal and sureties on all such claims.

When a contractor abandons the work on a public improvement or is legally excluded from work on a public improvement, the improvement shall be deemed completed for the purpose of filing claims as provided in this chapter, from the date of the official cancellation of the contract. The only fund available for the payment of the claims of persons for labor performed or material furnished shall be the amount then due the contractor, if any, and if that amount is insufficient to satisfy the claims, the claimants shall have a right of action on the bond given for the performance of the contract.

If payment for such improvement is to be made in whole or in part from the primary road fund, the county auditor shall immediately notify the state department of transportation of the filing of all claims.

The filing of any claim shall not work the withholding of any funds from the contractor except the retained percentage, as provided in this chapter.

Nothing in this chapter shall be construed as limiting in any manner the right of the public corporation to pursue any remedy on the bond given for the performance of the contract.

Notwithstanding anything in this Code to the contrary, when at least ninety-five percent of any contract for the construction of public improvements has been completed to the satisfaction of the public contracting authority and owing to conditions beyond the control of the construction contractor the remaining work on the contract cannot proceed for a period of more than sixty days, such public contracting authority may make full payment for the completed work and enter into a supplemental contract with the construction contractor involved on the same terms and conditions so far as applicable thereto for the construction of the work remaining to be done, provided however, that the contractor’s surety consents thereto and agrees that the bond shall remain in full force and effect.

1. For purposes of this section:

a. “Authorized contract representative” means the person chosen by the governmental entity or the department to represent its interests or the person designated in the contract as the party representing the governmental entity’s or the department’s interest regarding administration and oversight of the project.

b. “Department” means the state department of transportation.

c. “Governmental entity” means the state, political subdivisions of the state, public school corporations, and all officers, boards, or commissions empowered by law to enter into contracts for the construction of public improvements, excluding the state board of regents and the department.

d. “Public improvement” means a building or construction work which is constructed under the control of a governmental entity and is paid for in whole or in part with funds of the governmental entity, including a building or improvement constructed or operated jointly with any other public or private agency, but excluding urban renewal demolition and low-rent housing projects, industrial aid projects authorized under chapter 419, emergency work or repair or maintenance work performed by employees of a governmental entity, and excluding a highway, bridge, or culvert project, and excluding construction or repair or maintenance work performed for a city utility under chapter 388 by its employees or performed for a rural water district under chapter 357A by its employees.

e. “Repair or maintenance work” means the preservation of a building, storm sewer, sanitary sewer, or other public facility or structure so that it remains in sound or proper condition, including minor replacements and additions as necessary to restore the public facility or structure to its original condition with the same design.

f. “Substantially completed” means the first date on which any of the following occurs:

(1) Completion of the public improvement project or the highway, bridge, or culvert project or when the work on the public improvement or the highway, bridge, or culvert project has been substantially completed in general accordance with the terms and provisions of the contract.

(2) The work on the public improvement or on the designated portion is substantially completed in general accordance with the terms of the contract so that the governmental entity or the department can occupy or utilize the public improvement or designated portion of the public improvement for its intended purpose. This subparagraph shall not apply to highway, bridge, or culvert projects.

(3) The public improvement project or the highway, bridge, or culvert project is certified as having been substantially completed by either of the following:

(a) The architect or engineer authorized to make such certification.

(b) The authorized contract representative.

(4) The governmental entity or the department is occupying or utilizing the public improvement for its intended purpose. This subparagraph shall not apply to highway, bridge, or culvert projects.

2. Payments made by a governmental entity or the department for the construction of public improvements and highway, bridge, or culvert projects shall be made in accordance with the provisions of this chapter, except as provided in this section:

a. At any time after all or any part of the work on the public improvement or highway, bridge, or culvert project is substantially completed, the contractor may request the release of all or part of the retained funds owed. The request shall be accompanied by a sworn statement of the contractor that, ten calendar days prior to filing the request, notice was given as required by paragraphs “f” and “g” to all known subcontractors, sub-subcontractors, and suppliers.

b. Except as provided under paragraph “c”, upon receipt of the request, the governmental entity or the department shall release all or part of the retained funds. Retained funds that are approved as payable shall be paid at the time of the next monthly payment or within thirty days, whichever is sooner. If partial retained funds are released pursuant to a contractor’s request, no retained funds shall be subsequently held based on that portion of the work. If within thirty days of when payment becomes due the governmental entity or the department does not release the retained funds due, interest shall accrue on the amount of retained funds at the rate of interest that is calculated as the prime rate plus one percent per year as of the day interest begins to accrue until the amount is paid.

c. If labor and materials are yet to be provided at the time the request for the release of the retained funds is made, an amount equal to two hundred percent of the value of the labor or materials yet to be provided, as determined by the governmental entity’s or the department’s authorized contract representative, may be withheld until such labor or materials are provided.

d. An itemization of the labor or materials yet to be provided, or the reason that the request for release of retained funds is denied, shall be provided to the contractor in writing within thirty calendar days of the receipt of the request for release of retained funds.

e. The contractor shall release retained funds to the subcontractor or subcontractors in the same manner as retained funds are released to the contractor by the governmental entity or the department. Each subcontractor shall pass through to each lower-tier subcontractor all retained fund payments from the contractor.

f. Prior to applying for release of retained funds, the contractor shall send a notice to all known subcontractors, sub-subcontractors, and suppliers that provided labor or materials for the public improvement project or the highway, bridge, or culvert project.

g. The notice shall be substantially similar to the following:

NOTICE OF CONTRACTOR’S REQUEST

FOR EARLY RELEASE OF RETAINED FUNDS

You are hereby notified that [name of contractor] will be requesting an early release of funds on a public improvement project or a highway, bridge, or culvert project designated as [name of project] for which you have or may have provided labor or materials. The request will be made pursuant to Iowa Code section 573.28. The request may be filed with the [name of governmental entity or department] after ten calendar days from the date of this notice. The purpose of the request is to have [name of governmental entity or department] release and pay funds for all work that has been performed and charged to [name of governmental entity or department] as of the date of this notice. This notice is provided in accordance with Iowa Code section 573.28.

1. Suit may be brought against any company or corporation furnishing or pretending to furnish surety, fidelity, or other bonds in this state, in any county in which the principal place of business of such company or corporation is maintained in this state, or in any county wherein is maintained its general office for the transaction of its Iowa business, or in the county where the principal resides at the time of bringing suit, or in the county where the principal did reside at the time the bond or other undertaking was executed; and in the case of bonds furnished by any such company or corporation for any building or improvement, either public or private, action may be brought in the county wherein said building or improvement or any part thereof is located.

2. The secretary of state shall serve as the agent for service of process for the purposes of 31 U.S.C. § 9306, of any surety company or corporation for a surety bond written by that surety company or corporation for the federal government and issued in this state as required or permitted under federal law, if the surety company or corporation is licensed in this state and cannot be otherwise served with process. Notwithstanding section 507.14, upon request of the secretary of state, the commissioner of insurance shall provide the secretary of state with the name and address of the person designated for consent to service of process by the surety company or corporation which is on file with the commissioner.