Washington DC

Preliminary Notice Deadlines

California

Washington DC

California

Washington DC

Washington

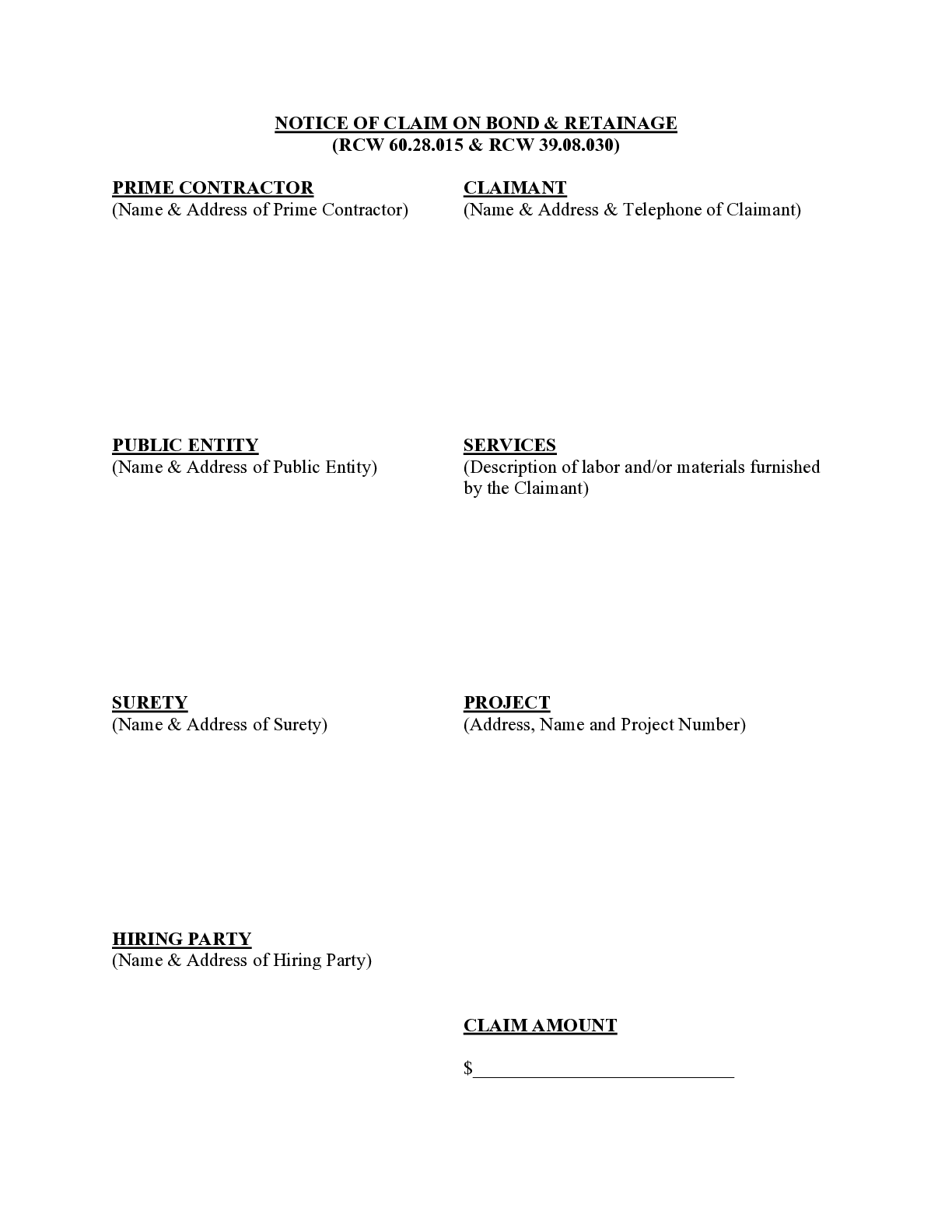

Those who did not contract with the prime contractor must file bond claim within 90 days of last furnishing labor and/or materials to the construction project, although this is a good practice for everyone. All parties must file lawsuit to enforce claim against bond within 1 year from last furnishing labor or materials.

Washington DC

Washington

Those who did not contract with the prime contractor must file bond claim within 90 days of last furnishing labor and/or materials to the construction project, although this is a good practice for everyone. All parties must file lawsuit to enforce claim against bond within 1 year from last furnishing labor or materials.

In Washington DC, subcontractors, and laborers or material suppliers to the general contractor or first-tier subcontractors are protected. A supplier to a supplier is not allowed to recover.

A bond claim in Washington DC must be received within 90 days of the claimant’s last furnishing labor and/or materials to the project.

In Washington DC, a bond claim must only be provided to the general contractor. It may also be advisable, however, to provide a copy of the bond claim to the surety.

In Washington DC, a suit to enforce a bond claim must be made more than 90 days, but less than 1 year, after the last furnishing of labor and/or materials to the project.

In Washington DC, the bond claim must only include the amount claimed and the name of the party to whom labor and/or material was furnished. However, it may be advisable to also include a description of the project and the labor and/or materials furnished, as well as an identification of the general contractor, and the contracting public entity.

For projects over $100,000 the bond claim must be personally served, or served by another means that provides actual confirmation of receipt. For all other projects, mail by registered mail (if the contracting public entity is under the direct control of the mayor), or by registered or certified mail (if a different entity) to the contractor at the general contractor’s office or residence. Personal service is also sufficient.

I am working on a project and not getting paid. I am out about 300k

Non-US subcontractor and the Miller ActCan a non-US first tier subcontractor working on a US-embassy project in Europe file a claim under the Miller Act or does the Miller Act...

How do you proceed with a Preliminary Notice if our customer will not provide the address to a Federal Public job.We have a customer that I'm trying to enter in as a New Project but they will not provide the address to where the work...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

A Public Claim of Lien should be filed/delivered on public or government projects when labor has been performed or materials provided, and you have not...

When you perform work on a state construction project in Washington DC, and are not paid, you can file a “lien” against the project pursuant to Washington DC’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Washington DC’s Little Miller Act is found in District of Columbia Code, Title 2, Chapter 2, Sub-chapter 1, §2-201.01 – 2.201.03, 2-201.11, and is reproduced below.

(a) Before any contract, exceeding $25,000 in amount, for the construction, alteration, or repair of any public building or public work of the District of Columbia is awarded to any person, such person shall furnish to the District of Columbia the following bonds, which shall become binding upon the award of the contract to such person, who is hereinafter designated as “contractor”: (1) A performance bond with a surety or sureties satisfactory to the Mayor of the District of Columbia, and in such amount as he shall deem adequate, for the protection of the District of Columbia; (2) a payment bond with a surety or sureties satisfactory to the Mayor for the protection of all persons supplying labor and material in the prosecution of the work provided for in said contract for the use of each such person. Whenever the total amount payable by the terms of the contract shall be not more than $1,000,000, the payment bond shall be in a sum equal to one-half the total amount payable by the terms of the contract. Whenever the total amount payable by the terms of the contract shall be more than $1,000,000 and not more than $5,000,000, the said payment bond shall be in a sum equal to 40 per centum of the total amount payable by the terms of the contract. Whenever the total amount payable by the terms of the contract shall be more than $5,000,000 the payment bond shall be in the sum of $2,500,000. (b) Nothing in this section shall be construed to limit the authority of the Mayor to require a performance bond or other security in addition to those, or in cases other than the cases specified in subsection (a) of this section, or the authority of the Mayor to waive the requirement for performance and payment bonds in such cases as he shall determine. (c) Any surety bond required by this section shall be executed by a surety certified by the U.S. Department of Treasury to do business pursuant to § 9305 of Title 31, United States Code, or a surety company licensed in the District of Columbia which meets the statutory capital and surplus requirements or as otherwise determined by the Mayor to be appropriate and necessary in the amount for underwriting such bonds.

(a) Every person who has furnished labor or material in the prosecution of the work provided for in such contract, in respect of which a payment bond is furnished under this subchapter and who has not been paid in full therefor before the expiration of a period of 90 days after the day on which the last of the labor was done or performed by him or material was furnished or supplied by him for which such claim is made, shall have the right to sue on such payment bond for the amount, or the balance thereof, unpaid at the time of institution of such suit and to prosecute said action to final judgment and execution for the sum or sums justly due him: Provided, that any person having direct contractual relationship with a subcontractor but no contractual relationship, express or implied, with the contractor furnishing the payment bond, shall have a right of action upon the payment bond upon giving written notice to the contractor within 90 days from the date on which such person did or performed the last of the labor, or furnished or supplied the last of the material for which such claim is made, stating with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed. Such notice shall be served by mailing the same by registered mail, postage prepaid, in an envelope addressed to the contractor at any place he maintains an office or conducts his business, or his residence, or in any manner in which the United States Marshal for the District of Columbia is authorized by law to serve summons. (b) Every suit instituted under this section shall be brought in the name of the District of Columbia for the use of the person suing, in the Superior Court of the District of Columbia, irrespective of the amount in controversy in such suit, but no such suit shall be commenced after the expiration of 1 year after the day on which the last of the labor was performed or material was supplied by him. The District of Columbia shall not be liable for the payment of any costs or expenses of any such suit.

The Mayor is authorized and directed to furnish, to any person making application therefor who submits an affidavit that he has supplied labor or materials for such work and payment therefor has not been made or that he is being sued on any such bond, a certified copy of such bond and the contract for which it was given, which copy shall be prima facie evidence of the contents, execution, and delivery of the original. Applicants shall pay for such certified copies such fees as the Mayor fixes to cover the cost of preparation thereof.

In all cases where the Mayor of the District of Columbia contracts for work or material involving a sum not exceeding $25,000 it shall not be necessary for said Mayor to require a bond with said contract.