Washington

Preliminary Notice Deadlines

Washington

Washington

Washington

Washington

Must deliver Notice to Contractor to the prime contractor. If you contracted with the any party other than the owner or prime contractor, delivery must be within 10 days of first furnishing labor/materials. A claim of lien on retainage funds notice must be served within 60 days of first furnishing.

Send a Notice

Washington

Claim against the public payment bond must be made by contractors within 30 days from the acceptance of the work, and against the retainage within 45 days from the acceptance of the work.

Washington

Bond claims must be enforced within 6 years of completion; unless the bond provides otherwise. Claims on retainage funds must be initiated within 4 months of the filing of the claim.

Washington

Must deliver Notice to Contractor to the prime contractor. If you contracted with the any party other than the owner or prime contractor, delivery must be within 10 days of first furnishing labor/materials. A claim of lien on retainage funds notice must be served within 60 days of first furnishing.

Send a Notice

Washington

Claim against the public payment bond must be made by contractors within 30 days from the acceptance of the work, and against the retainage within 45 days from the acceptance of the work.

Washington

Bond claims must be enforced within 6 years of completion; unless the bond provides otherwise. Claims on retainage funds must be initiated within 4 months of the filing of the claim.

The Washington public payment bond claim laws cover all public works projects commissioned by any board, council, commission, trustee, or body acting for the state, county, or municipality, or any other public body, city, town or district.

Additionally, there is a mechanism to make a lien claim against unpaid retainage funds on certain public projects as well.

In Washington, subcontractors, sub-subcontractors, material suppliers, equipment lessors, and laborers of any tier are can make a claim against a public payment bond. Material suppliers to suppliers, however, are not protected.

But protected parties must take a step early on in the project in order to protect their right to file a bond claim or a claim against the retainage funds.

• For more on this, see: Washington Preliminary Notice Overview & FAQs

Washington law requires certain steps to secure your right to make a bond claim, including sending a Notice to Contractor within 10 days of first furnishing labor or materials to the project.

Making a successful bond claim includes several required and recommended steps:

Read the step-by-step guide to making a Washington bond claim.

Bond Claim

The bond claim must be delivered to and filed with the contracting public entity within 30 days from the completion of the contract and acceptance of the project as a whole.

Material suppliers and equipment lessors may have some difficulty calculating this deadline, therefore best practice is to send the claim within 30 days after delivery of the supplies equipment is complete.

Lien on Retainage Funds

A notice of a claim of lien on funds must be given to the contracting public agency no later than 45 days after completion of the work.

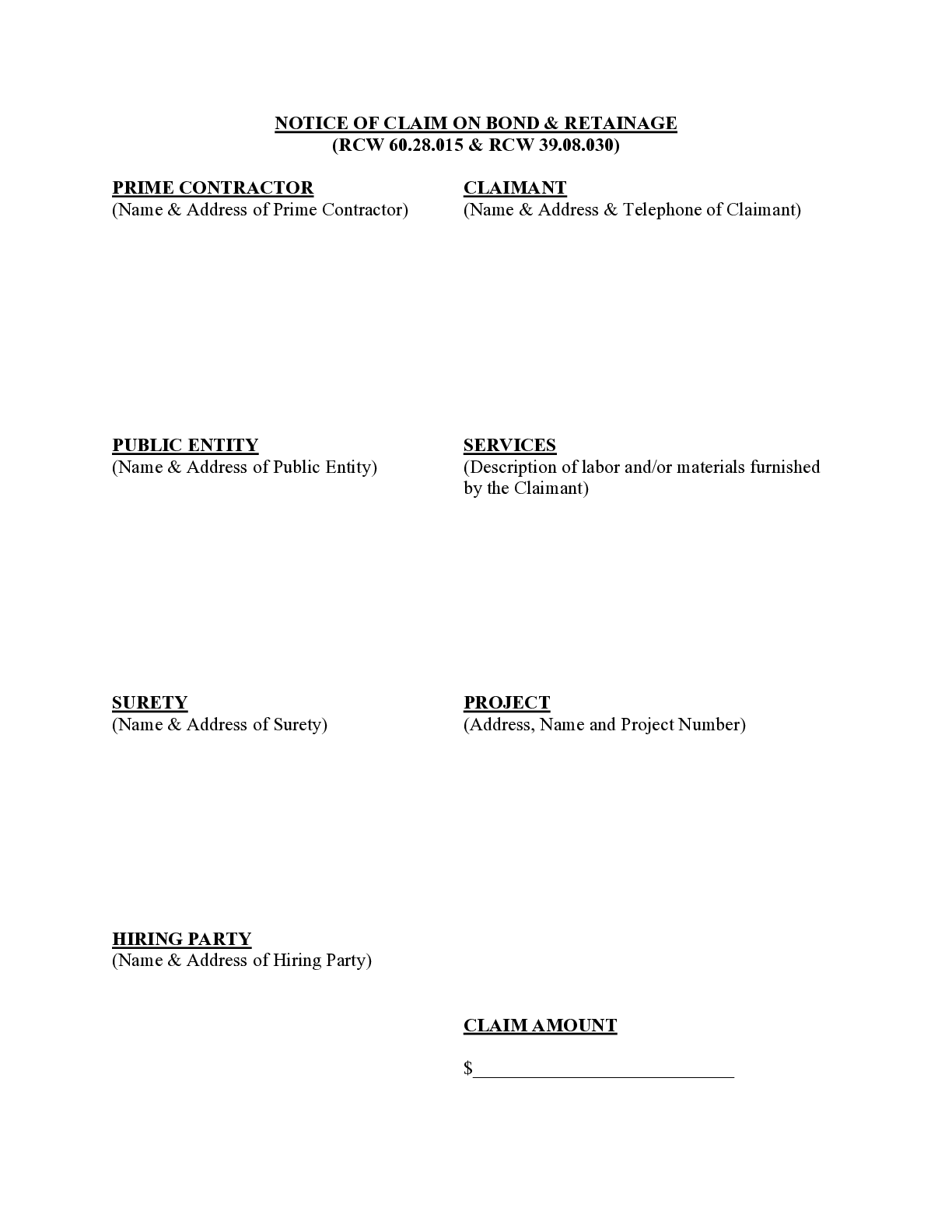

A Washington bond claim must should be in substantially the same form as provided under RCW §39.08.030(1)(a) and include the following information:

• Public entity’s name & address

• Claimant’s name

• Claim amount

• Description of labor and/or materials furnished

Also, if the claim includes unpaid retainage, the claim must also include a statement that the claim is being made against the retainage funds as well.

→ Download a free Washington Public Bond & Retainage Claim form here

Washington bond claims and claims for liens on funds must be provided to the board, council, commission, trustees or body acting for the state, county or municipality, or other public body, city, town or district. It’s also a good idea to send a copy of the claim to the surety providing the bond as well.

There is no specified method for serving a bond claim or lien on funds, as long as it is filed with the public entity. Sending the claim by registered or certified mail with return receipt requested or personal service is generally considered best practice.

There is no specified timeframe to file an action to enforce the claim provided in the Washington statutes. However, the statute of limitations for a breach of contract claim in Washington is 6 years. Furthermore, claimant’s should look to the terms of the payment bond to determine whether it specifies a shorter deadline. Also, attorney’s fees may be recovered in an action, unless the lawsuit is initiated less than 30 days after the claim was filed.

A suit to enforce the lien on funds for retainage must be initiated within 4 months of the filing of the claim.

Therefore, best practice would be to file these actions jointly at least 30 days after filing, and within 4 months of the lien on retainage funds enforcement deadline.

A contractor cancels bond insurance and buys one from a different company in the middle of the job. Which company can I file with? Does...

Can I file a mechanics lien?This is a large project on public land (a new community essentially) Yet the "Owner" of the project is an LLC. The job has gone...

Can I amend a complaint I filed against a contractor and his bond?I followed the instructions from L&I’s website and filed a summons and complaint for breach of contract against a contractor who took a large deposit,...

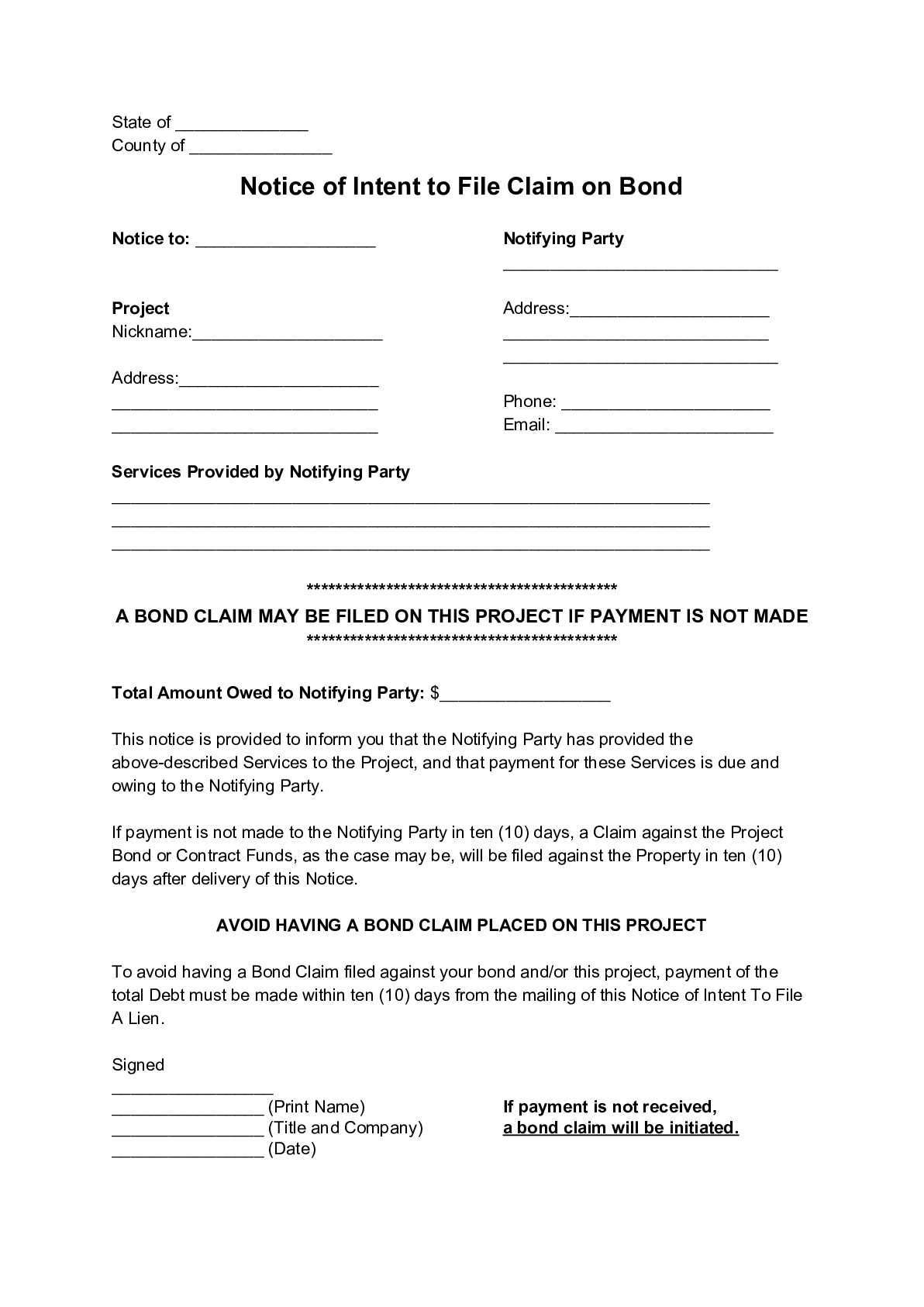

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

A Public Claim of Lien should be filed/delivered on public or government projects when labor has been performed or materials provided, and you have not...

When you perform work on a state construction project in Washington, and are not paid, you can file a “lien” against the project pursuant to Washington’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” However, Washington does allow a claim of lien upon retainage funds on public projects. Washington’s Little Miller Act is found in Washington Revised Code §§39.04.10, & 39.08.010-39.08.065, and the claim of lien on retainage funds statutes can be found under RCW §§60.28.015-60.28.030; and are reproduced below. Updated as of 2020.

The definitions in this section apply throughout this chapter unless the context clearly requires otherwise.

(1) “Award” means the formal decision by the state or municipality notifying a responsible bidder with the lowest responsive bid of the state’s or municipality’s acceptance of the bid and intent to enter into a contract with the bidder.

(2) “Contract” means a contract in writing for the execution of public work for a fixed or determinable amount duly awarded after advertisement and competitive bid, or a contract awarded under the small works roster process in RCW 39.04.155.

(3) “Municipality” means every city, county, town, port district, district, or other public agency authorized by law to require the execution of public work, except drainage districts, diking districts, diking and drainage improvement districts, drainage improvement districts, diking improvement districts, consolidated diking and drainage improvement districts, consolidated drainage improvement districts, consolidated diking improvement districts, irrigation districts, or other districts authorized by law for the reclamation or development of waste or undeveloped lands.

(4) “Public work” means all work, construction, alteration, repair, or improvement other than ordinary maintenance, executed at the cost of the state or of any municipality, or which is by law a lien or charge on any property therein. All public works, including maintenance when performed by contract shall comply with chapter 39.12 RCW. “Public work” does not include work, construction, alteration, repair, or improvement performed under contracts entered into under RCW 36.102.060(4) or under development agreements entered into under RCW 36.102.060(7) or leases entered into under RCW 36.102.060(8).

(5) “Responsible bidder” means a contractor who meets the criteria in RCW 39.04.350.

(6) “State” means the state of Washington and all departments, supervisors, commissioners, and agencies of the state.

(1)

(a) Whenever any board, council, commission, trustees, or body acting for the state or any county or municipality or any public body must contract with any person or corporation to do any work for the state, county, or municipality, or other public body, city, town, or district, such board, council, commission, trustees, or body must require the person or persons with whom such contract is made to make, execute, and deliver to such board, council, commission, trustees, or body a good and sufficient bond, with a surety company as surety, conditioned that such person or persons must:

(i) Faithfully perform all the provisions of such contract;

(ii) Pay all laborers, mechanics, and subcontractors and material suppliers, and all persons who supply such person or persons, or subcontractors, with provisions and supplies for the carrying on of such work; and

(iii) Pay the taxes, increases, and penalties incurred on the project under Titles 50, 51, and 82 RCW on:

(A) Projects referred to in RCW 60.28.011(1)(b); and/or

(B) projects for which the bond is conditioned on the payment of such taxes, increases, and penalties.

(b) The bond, in cases of cities and towns, must be filed with the clerk or comptroller thereof, and any person or persons performing such services or furnishing material to any subcontractor has the same right under the provisions of such bond as if such work, services, or material was furnished to the original contractor.

(2) The provisions of RCW 39.08.010 through 39.08.030 do not apply to any money loaned or advanced to any such contractor, subcontractor, or other person in the performance of any such work.

(3) On contracts of one hundred fifty thousand dollars or less, at the option of the contractor or the general contractor/construction manager as defined in RCW 39.10.210, the respective public entity may, in lieu of the bond, retain ten percent of the contract amount for a period of thirty days after date of final acceptance, or until receipt of all necessary releases from the department of revenue, the employment security department, and the department of labor and industries and settlement of any liens filed under chapter 60.28 RCW, whichever is later. The recovery of unpaid wages and benefits must be the first priority for any actions filed against retainage held by a state agency or authorized local government.

(4) For contracts of one hundred fifty thousand dollars or less, the public entity may accept a full payment and performance bond from an individual surety or sureties.

(5) The surety must agree to be bound by the laws of the state of Washington and subjected to the jurisdiction of the state of Washington.

If any board of county commissioners of any county, or mayor and common council of any incorporated city or town, or tribunal transacting the business of any municipal corporation shall fail to take such bond as herein required, such county, incorporated city or town, or other municipal corporation, shall be liable to the persons mentioned in RCW 39.08.010, to the full extent and for the full amount of all such debts so contracted by such contractor.

(1)

(a) The bond mentioned in RCW 39.08.010 must be in an amount equal to the full contract price agreed to be paid for such work or improvement, except under subsection (2) of this section, and must be to the state of Washington, except as otherwise provided in RCW 39.08.100, and except in cases of cities, towns, public transportation benefit areas, passenger-only ferry service districts, and water-sewer districts, in which cases such municipalities may by general ordinance or resolution fix and determine the amount of such bond and to whom such bond runs. However, the same may not be for a less amount than twenty-five percent of the contract price of any such improvement for cities, towns, public transportation benefit areas, and passenger-only ferry service districts, and not less than the full contract price of any such improvement for water-sewer districts, and may designate that the same must be payable to such city, town, water-sewer district, public transportation benefit area, or passenger-only ferry service district, and not to the state of Washington, and all such persons mentioned in RCW 39.08.010 have a right of action in his, her, or their own name or names on such bond for work done by such laborers or mechanics, and for materials furnished or provisions and goods supplied and furnished in the prosecution of such work, or the making of such improvements, and the state has a right of action for the collection of taxes, increases, and penalties specified in RCW 39.08.010: PROVIDED, That, except for the state with respect to claims for taxes, increases, and penalties specified in RCW 39.08.010, such persons do not have any right of action on such bond for any sum whatever, unless within thirty days from and after the completion of the contract with an acceptance of the work by the affirmative action of the board, council, commission, trustees, officer, or body acting for the state, county or municipality, or other public body, city, town or district, the laborer, mechanic or subcontractor, or material supplier, or person claiming to have supplied materials, provisions or goods for the prosecution of such work, or the making of such improvement, must present to and file with such board, council, commission, trustees or body acting for the state, county or municipality, or other public body, city, town or district, a notice in writing in substance as follows:

To (here insert the name of the state, county or municipality or other public body, city, town or district):

Notice is hereby given that the undersigned (here insert the name of the laborer, mechanic or subcontractor, or material supplier, or person claiming to have furnished labor, materials or provisions for or upon such contract or work) has a claim in the sum of …… dollars (here insert the amount) against the bond taken from …… (here insert the name of the principal and surety or sureties upon such bond) for the work of …… (here insert a brief mention or description of the work concerning which said bond was taken).

(here to be signed) . . . .

(b) Such notice must be signed by the person or corporation making the claim or giving the notice, and the notice, after being presented and filed, is a public record open to inspection by any person, and in any suit or action brought against such surety or sureties by any such person or corporation to recover for any of the items specified in this section, the claimant is entitled to recover in addition to all other costs, attorneys’ fees in such sum as the court adjudges reasonable. However, attorneys’ fees are not allowed in any suit or action brought or instituted before the expiration of thirty days following the date of filing of the notice as provided in this section. However, any city may avail itself of the provisions of RCW 39.08.010 through 39.08.030, notwithstanding any charter provisions in conflict with this section. Moreover, any city or town may impose any other or further conditions and obligations in such bond as may be deemed necessary for its proper protection in the fulfillment of the terms of the contract secured thereby, and not in conflict with this section. The thirty-day notice requirement under this subsection does not apply to claims made by the state for taxes, increases, and penalties specified in RCW 39.08.010.

(2) Under the job order contracting procedure described in RCW 39.10.420, bonds will be in an amount not less than the dollar value of all open work orders.

(3) Where retainage is not withheld pursuant to RCW 60.28.011(1)(b), upon final acceptance of the public works project, the state, county, municipality, or other public body must within thirty days notify the department of revenue, the employment security department, and the department of labor and industries of the completion of contracts over thirty-five thousand dollars.

Every person, firm, or corporation furnishing materials, supplies, or provisions to be used in the construction, performance, carrying on, prosecution, or doing of any work for the state, or any county, city, town, district, municipality, or other public body, shall, not later than ten days after the date of the first delivery of such materials, supplies, or provisions to any subcontractor or agent of any person, firm, or corporation having a subcontract for the construction, performance, carrying on, prosecution, or doing of such work, deliver or mail to the contractor a notice in writing stating in substance and effect that such person, firm, or corporation has commenced to deliver materials, supplies, or provisions for use thereon, with the name of the subcontractor or agent ordering or to whom the same is furnished and that such contractor and his or her bond will be held for the payment of the same, and no suit or action shall be maintained in any court against the contractor or his or her bond to recover for such material, supplies, or provisions or any part thereof unless the provisions of this section have been complied with.

Every person, firm, or corporation furnishing materials, supplies, or equipment to be used in the construction, performance, carrying on, prosecution, or doing of any work for the state, or any county, city, town, district, municipality, or other public body, shall give to the contractor of the work a notice in writing, which notice shall cover the material, supplies, or equipment furnished or leased during the sixty days preceding the giving of such notice as well as all subsequent materials, supplies, or equipment furnished or leased, stating in substance and effect that such person, firm, or corporation is and/or has furnished materials and supplies, or equipment for use thereon, with the name of the subcontractor ordering the same, and that a lien against the retained percentage may be claimed for all materials and supplies, or equipment furnished by such person, firm, or corporation for use thereon, which notice shall be given by (1) mailing the same by registered or certified mail in an envelope addressed to the contractor, or (2) by serving the same personally upon the contractor or the contractor’s representative and obtaining evidence of such service in the form of a receipt or other acknowledgment signed by the contractor or the contractor’s representative, and no suit or action shall be maintained in any court against the retained percentage to recover for such material, supplies, or equipment or any part thereof unless the provisions of this section have been complied with.

After the expiration of the forty-five day period for giving notice of lien provided in RCW 60.28.011(2), and after receipt of the certificates of the department of revenue, the employment security department, and the department of labor and industries, and the public body is satisfied that the taxes certified as due or to become due by the department of revenue, the employment security department, and the department of labor and industries are discharged, and the claims of material suppliers and laborers who have filed their claims, together with a sum sufficient to defray the cost of foreclosing the liens of such claims, and to pay attorneys’ fees, have been paid, the public body may withhold from the remaining retained amounts for claims the public body may have against the contractor and shall pay the balance, if any, to the contractor the fund retained by it or release to the contractor the securities and bonds held in escrow.

If such taxes have not been discharged or the claims, expenses, and fees have not been paid, the public body shall either retain in its fund, or in an interest bearing account, or retain in escrow, at the option of the contractor, an amount equal to such unpaid taxes and unpaid claims together with a sum sufficient to defray the costs and attorney fees incurred in foreclosing the lien of such claims, and shall pay, or release from escrow, the remainder to the contractor.

Any person, firm, or corporation filing a claim against the reserve fund shall have four months from the time of the filing thereof in which to bring an action to foreclose the lien. The lien shall be enforced by action in the superior court of the county where filed, and shall be governed by the laws regulating the proceedings in civil actions touching the mode and manner of trial and the proceedings and laws to secure property so as to hold it for the satisfaction of any lien against it: PROVIDED, That the public body shall not be required to make any detailed answer to any complaint or other pleading but need only certify to the court the name of the contractor; the work contracted to be done; the date of the contract; the date of completion and final acceptance of the work; the amount retained; the amount of taxes certified due or to become due to the state; and all claims filed with it showing respectively the dates of filing, the names of claimants, and amounts claimed. Such certification shall operate to arrest payment of so much of the funds retained as is required to discharge the taxes certified due or to become due and the claims filed in accordance with this chapter. In any action brought to enforce the lien, the claimant, if he or she prevails, is entitled to recover, in addition to all other costs, attorney fees in such sum as the court finds reasonable. If a claimant fails to bring action to foreclose his or her lien within the four months period, the reserve fund shall be discharged from the lien of his or her claim and the funds shall be paid to the contractor. The four months limitation shall not, however, be construed as a limitation upon the right to sue the contractor or his or her surety where no right of foreclosure is sought against the fund.