Tennessee

Preliminary Notice Deadlines

Tennessee

Tennessee

Tennessee

Tennessee

Tennessee

Bond claim after last furnishing, but within 90 days of project completion.

Tennessee

Tennessee

Bond claim after last furnishing, but within 90 days of project completion.

The Tennessee public payment bond laws apply to all state, city, county, or state authority construction projects where the original contract is valued at $100,000 or more.

In Tennessee, all parties who furnish labor and/or materials to the general, or to first or second-tier subcontractors, are entitled to make a bond claim. Suppliers to suppliers are not protected. Land surveyors, architects, and engineers, however, are also entitled to make a bond claim in Tennessee.

Further, if the claimant receives written notice of non-responsibility from the contractor via certified mail return receipt, any claim is limited to labor and/or materials furnished prior to receiving the notice of non-responsibility.

In Tennessee, a claim against the payment bond must be made after the claimant’s last date of furnishing labor and/or materials to the project, but no later than 90 days after the completion of the project as a whole.

A Tennessee Notice of Claim against a payment bond is governed by Tenn. Code §12-4-205 and should contain the following information:

• Claimant’s information;

• Itemized account of labor and/or materials furnished;

• Balance due; &

• Description of the property improved.

Tennesse law provides that a bond claim should be provided to either the prime contractor who supplied the bond or to the public official who awarded the contract. However, the best practice would be to provide the notice of claim to both the prime contractor and the public entity.

Note: if the public official who awarded the contract is unknown; then TN law allows service on the following individuals:

• Municipal projects- the mayor

• County projects- county executive

• State project- governor

Tennessee bond claims must be served by certified mail, return receipt requested, or by personal delivery. However, the best practice is to send by certified mail, return receipt requested; in order to have proof of service.

Tennessee law requires an action to be initiated either 6 months after completion of the project as a whole, or 6 months after the claimant’s last date of furnishing labor and/or materials to the project.

Unfortunately, Tennessee statutes and case law have yet to clarify whether this means the earlier or the later of the two. Therefore, the best practice is to assume it is the shorter of the two periods; 6 months from the last date of furnishing.

Tennessee: Major Breach of Contract by General Contractor. What to do when you are the subcontractor?

Can you file a bond claim when close out documents are still pending if the claim is on retaiange?We have a project that has a balance of only retainage left on it. The contractor asked for close out documents to be worked on,...

ARE PUBLIC JOBS IN TENNESSEE BONDEDWe have a new customer from Tennessee performing work for the Memphis Gas and Light Co and are wondering if we have lien rights.

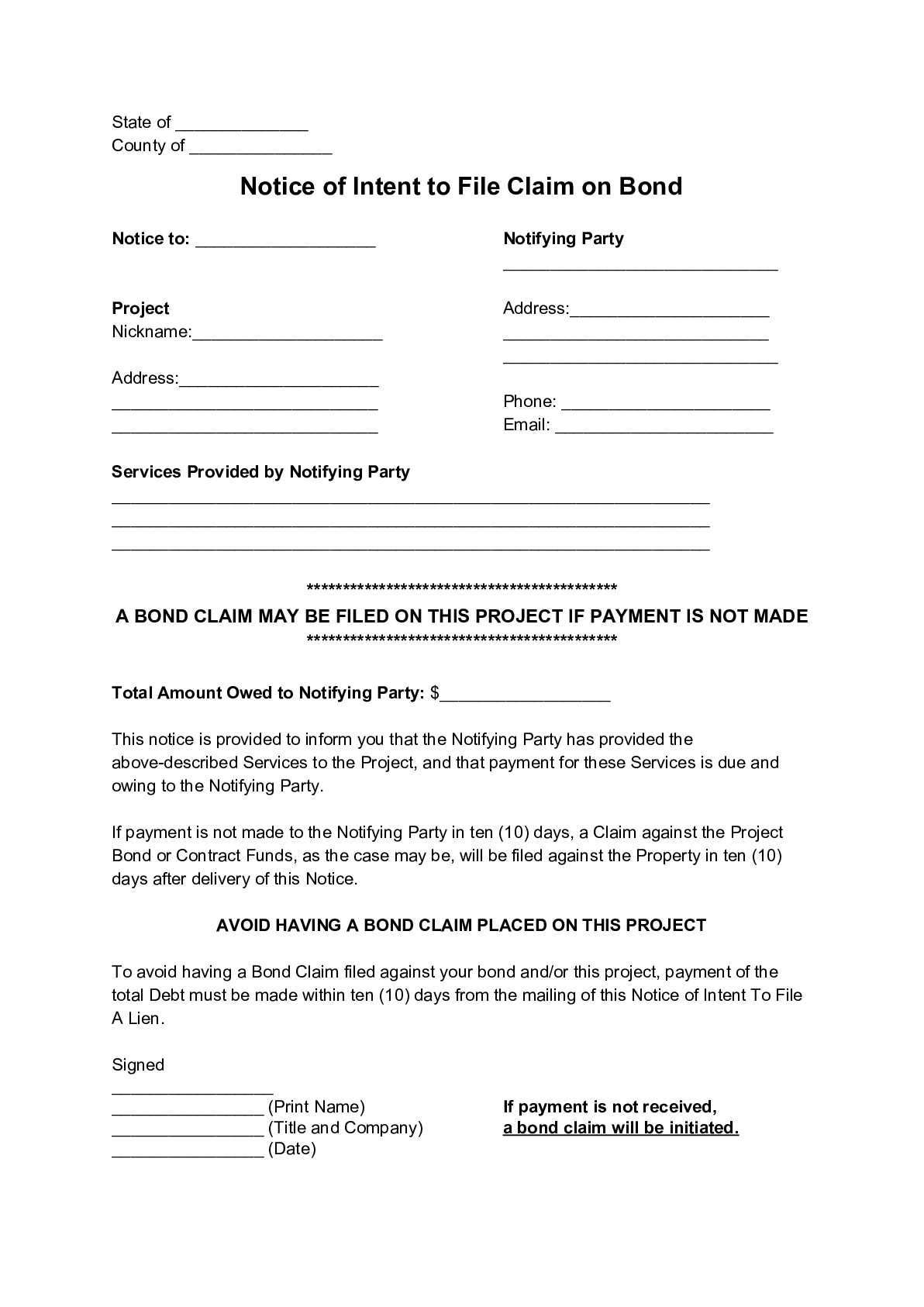

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Tennessee, and are not paid, you can file a “lien” against the project pursuant to Tennessee’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim. Tennessee’s Little Miller Act is found in Tennessee Code Title 12, Chapter 4, Part 2, and is reproduced below. Updated 2022.

(a)

(1) No contract shall be let for any public work in this state, by any city, county or state authority, until the contractor shall have first executed a good and solvent bond to the effect that the contractor will pay for all the labor and materials used by the contractor, or any immediate or remote subcontractor under the contractor, in such contract, in lawful money of the United States. The bond to be so given shall be for no less than twenty-five percent (25%) of the contract price on all contracts in excess of one hundred thousand dollars ($100,000). Where advertisement is made, the condition of the bond shall be stated in the advertisement; provided, that §§ 12-4-201 – 12-4-206 shall not apply to contracts of one hundred thousand dollars ($100,000) or less.

(2) A good and solvent bond means a bond written by a surety or insurance company listed on the United States department of the treasury financial management service list of approved bonding companies which is published annually in the federal register at the time the bond is provided in accordance with this part.

(3) No bond shall be deemed to be a good and solvent bond if it is written for an amount which is in excess of the amount indicated as approved for sureties or insurance companies by the United States department of the treasury financial management service list published at the time the bond is provided.

(4) Any surety bond written for a public work project shall be written by a surety or insurance company that is licensed and authorized to do business as a surety or insurer in this state.

(5) Any bond which is not in accordance with this section shall be null and void as against the public policy of this state and shall be rejected by the building or bidding authority.

(b)

(1) No contract let for any public work in this state, by any city, county or state authority, shall require a contractor or subcontractor to obtain any bond including, but not limited to, payment bonds, performance bonds and bid bonds, from a particular surety, agent, broker or producer.

(2) No public officer, whose duty it is to let or award contracts, shall require a contractor or subcontractor to obtain any bond, including, but not limited to, payment bonds, performance bonds and bid bonds, from a particular surety, agent, broker or producer.

(3) This subsection (b) shall not preclude a city, county, or state authority from requiring that a contractor or subcontractor obtain a bond, including payment bonds, performance bonds and bid bonds, from a properly licensed surety, agent, broker or producer.

(c) In lieu of the bond required by subsection (a), the following securities or cash may be substituted at the percentage rate required for such bond:

(1) United States treasury bonds, United States treasury notes and United States treasury bills;

(2) General obligation bonds of the state of Tennessee;

(3) Certificates of deposit or evidence of other deposits irrevocably pledged from:

(A) A state or national bank having its principal office in Tennessee;

(B) A state or federal savings and loan association having its principal office in Tennessee;

(C) Any state or national bank, that has its principal office located outside this state and that maintains one (1) or more branches in this state which are authorized to accept federally insured deposits; or

(D) Any state or federal savings and loan association that has its principal office located outside this state and that maintains one (1) or more branches in this state which are authorized to accept federally insured deposits;

(4) A letter of credit from a state or national bank or state or federal savings and loan association having its principal office in Tennessee; or any state or national bank or state or federal savings and loan association that has its principal office outside this state and that maintains one (1) or more branches in this state which are authorized to accept federally insured deposits. The terms and conditions of any letter of credit shall be subject to the approval of the public official named in the contract. The form of such letter of credit shall be provided by the bank or savings and loan association and may be based on either the Uniform Commercial Code, title 47, chapter 5, or the ICC Uniform Customs and Practice for Documentary Credits (UCP 500). All letters of credit shall be accompanied by an authorization of the contractor to deliver retained funds to the bank issuing the letter; or

(5) Cash; provided, that, where cash is posted, the contracting authority shall pay to the contractor interest at the same rate that interest is paid on funds invested in a local government investment pool established pursuant to § 9-4-704, for the contract period.

If any public officer, whose duty it is to let or award contracts, lets or awards any contract without requiring bond for payment of labor and material, in compliance with § 12-4-201, such officer commits a Class C misdemeanor.

In the event the contractor who has executed the bond gives notice, in writing, by return receipt registered mail, to any laborer or furnisher of material or to any such immediate or remote subcontractor that such contractor will not be responsible therefor, then such person who thereafter furnishes such material or labor shall not secure advantage of §§ 12-4-201 – 12-4-206, for materials furnished or labor done after the receipt of such notice.

Any laborer or furnisher of labor or material to the contractor, or to any immediate or remote subcontractor under the contractor, may bring an action on the bond, and have recovery in such laborer’s or furnisher’s own name, upon giving security, or taking the oath prescribed for poor persons as provided by law; but in the event of such suit, the city, county, or state shall not be liable for any costs accruing thereunder.

Such furnisher of labor or material, or such laborer, to secure the advantage of §§ 12-4-201 – 12-4-206, shall, after such labor or material is furnished, or such labor is done, and within ninety (90) days after the completion of such public work, give written notice by return receipt certified mail, or by personal delivery, either to the contractor who executed the bond, or to the public official who had charge of the letting or awarding of the contract; such written notice to set forth the nature, an itemized account of the material furnished or labor done, and the balance due therefor; and a description of the property improved. In the case of public work undertaken by a municipality, or any of its commissions, notice, or statement herein required, so mailed or delivered to the mayor thereof, shall be deemed sufficient. In the case of public work by any county or any of its commissions, notice or statement herein required, so mailed, or delivered to the county mayor of such county, shall be deemed sufficient. In the case of public work by the state, or any of its commissions, notice and statement herein required, so mailed, or delivered to the governor, shall be deemed sufficient.

Several persons entitled may join in one (1) suit on such bond, or one (1) of them may file a bill in equity in behalf of all such, who may, upon execution of a bond for costs, by petition assert their rights in the proceeding; provided, that action shall be brought or claims so filed within six (6) months following the completion of such public work, or of the furnishing of such labor or materials.

(a) Any person, firm or corporation entering into a formal contract with this state, or any county thereof, municipality or political subdivision, or any public board, department, commission or institution thereof for the construction or maintenance of public buildings, works or projects, or the doing of repairs to any public building, works or projects, shall be required, before commencing on such work covered by such contract, to execute the usual bond with good and sufficient sureties, as required by law, with the additional obligation that such contractor shall promptly make payment of all taxes, licenses, assessments, contributions, penalties, and interest thereon when, and if, the same may be lawfully due this state, or any county, municipality or political subdivision thereof by reason of and directly connected with the performance of such contract or any part thereof. Any such bond shall be deemed to include the foregoing obligation irrespective of whether or not the same be expressly written into such bond.

(b) On any contract of less than ten thousand dollars ($10,000), the foregoing obligation need not be undertaken, nor shall it be implied, if the contractor presents sufficient evidence that the payments required by this section have been paid. The sufficiency of the evidence presented shall be determined in the following manner:

(1) The state building commission shall make the determination of sufficiency for projects under its jurisdiction pursuant to rules lawfully promulgated by the commission;

(2) The state procurement commission shall make the determination of sufficiency in any case involving any state agency, department or institution by whatever name called, except as otherwise provided by subdivision (b)(1) or (b)(4), pursuant to rules lawfully promulgated by the procurement commission;

(3) The governing bodies of counties and municipalities or appropriate central administrative authority designated by vote of the governing bodies shall make the determination of sufficiency in the case of county or municipal agencies pursuant to rules lawfully adopted by the governing bodies or their designated central administrative authority. In making such designations and developing such rules, county and municipal operating departments and agencies shall not be given authority to determine the application of this law to specific cases without the approval of some higher central authority, whether the governing body or some central administrative authority; and

(4) For other political subdivisions, public boards, departments, commissions or institutions not otherwise covered by subdivision (b)(1), (b)(2) or (b)(3), the legally constituted governing board, or, if such does not exist, the administrative authority shall make the determination of sufficiency pursuant to rules lawfully adopted by the board or authority.

In default of the prompt payment of all such taxes, licenses, assessments, contributions, damages, penalties and interest thereon, as may be due by any such contractor, a direct proceeding on the bond may be brought in any court of competent jurisdiction by the proper officer or agency having lawful authority so to do, to enforce such payment. The right to so proceed in this matter is cumulative and in addition to such other remedies as may now be provided by law.