South Carolina

Preliminary Notice Deadlines

South Carolina

South Carolina

South Carolina

South Carolina

South Carolina

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year of the same last furnishing date, except for highway work, which must be filed within 1 year from final settlement of the contract.

South Carolina

South Carolina

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 1 year of the same last furnishing date, except for highway work, which must be filed within 1 year from final settlement of the contract.

In South Carolina, all parties who furnish labor and/or materials to the general, or to first-tier subcontractors, are entitled to make a bond claim. Accordingly, parties below the second-tier, and suppliers to suppliers are not protected.

A bond claim in South Carolina must be received by the general contractor within 90 days after the claimant last furnished labor and/or materials to the project.

In South Carolina, the claimant’s bond claim is only required to be given to the contractor supplying the bond. It may be best practice, however, to also provide notice of the claim to the contracting public entity and the surety (if known).

Generally, a suit to enforce the bond claim on a public project in South Carolina must be initiated more than 90 days, but less than 1 year after the claimant’s last furnishing of labor and/or materials to the project. However, if the bond itself provides for a longer time limit, the longer time limit will control. Also, if the claimant never delivered the bond claim to the general contractor, and the bond provides a shorter time limit in which suit must be initiated, that shorter time period will control.

In South Carolina, a bond claim must include the name of the party for whom the labor and/or material was furnished, and a statement of the amount claimed. It may also be advisable, however, to also include the name of the general contractor, the contracting public entity, and to identify the labor and/or materials furnished, and the project itself.

Generally the bond claim may be personally served, or sent via registered or certified mail. However, on a transportation project the claim must be sent by either registered or certified mail.

My company completed work for a federal contract we were subbed to. The prime went silent after we sent in our request for payment late...

How can I make a bond claimI am a subcontractor and the general contractor refuses to pay me even after a lien has been issued. If they bond it out to...

How can I enforce a Mechanics Lien?I filed a six-digit Mechanics Lien for nonpayment of architectural services. We have an AIA contract in place. As a result of filing the lien,...

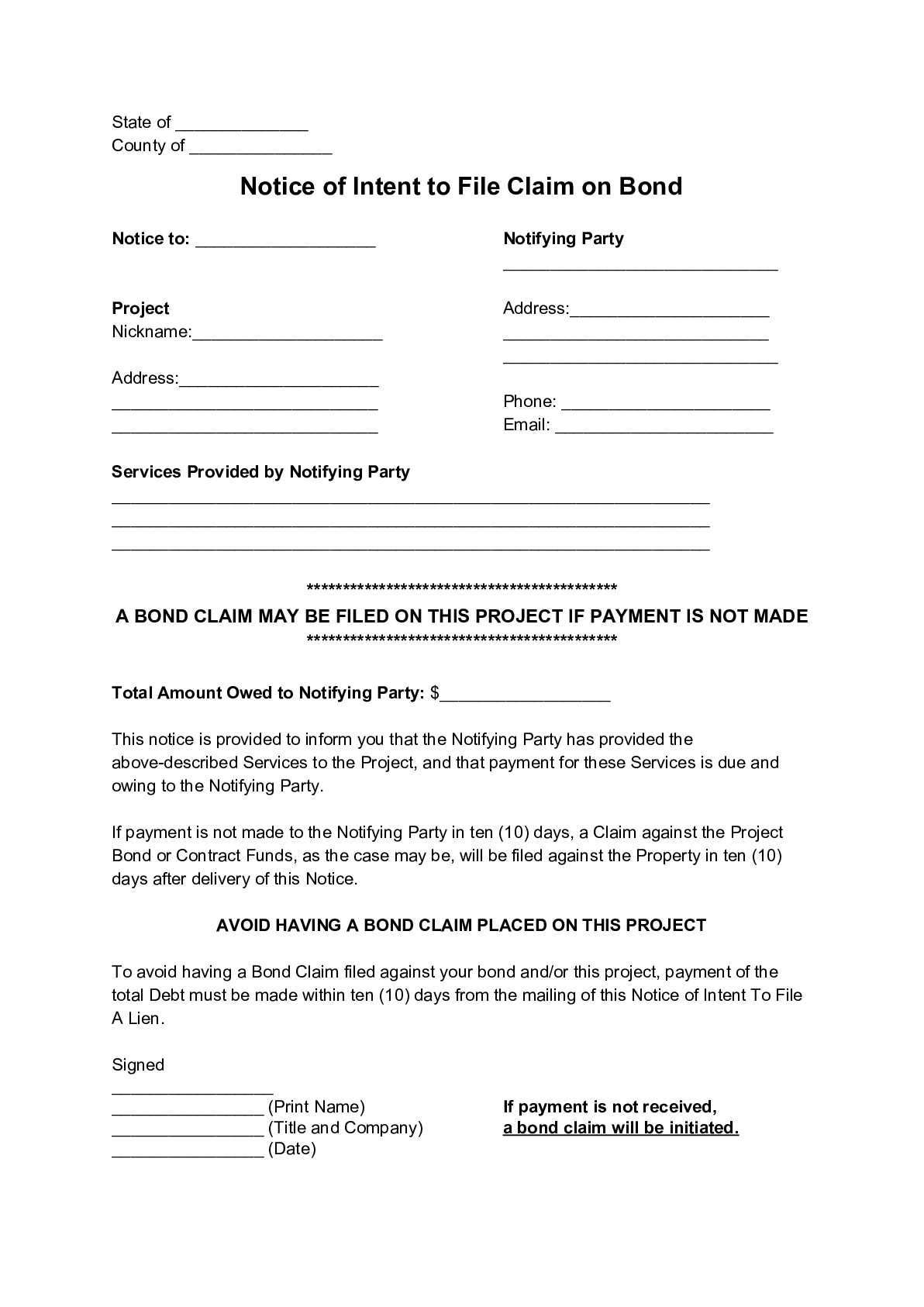

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in South Carolina, and are not paid, you can file a “lien” against the project pursuant to South Carolina’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” South Carolina’s Little Miller Act is found in South Carolina Code, Title 11, Chapter 35, and is reproduced below; updated as of 2022.

(1) Bid Security.

(a) Requirement for Bid Security. Bid security is required for all competitive sealed bidding for construction contracts in a design-bid-build procurement in excess of one hundred thousand dollars and other contracts as may be prescribed by the State Engineer’s Office. Bid security is a bond provided by a surety company meeting the criteria established by the regulations of the board or otherwise supplied in a form that may be established by regulation of the board.

(b) Amount of Bid Security. Bid security must be in an amount equal to at least five percent of the amount of the bid at a minimum.

(c) Rejection of Bids for Noncompliance with Bid Security Requirements. When the invitation for bids requires security, noncompliance requires that the bid be rejected except that a bidder who fails to provide bid security in the proper amount or a bid bond with the proper rating must be given one working day from bid opening to cure the deficiencies. If the bidder is unable to cure these deficiencies within one working day of bid opening, his bid must be rejected.

(d) Withdrawal of Bids. After the bids are opened, they must be irrevocable for the period specified in the invitation for bids. If a bidder is permitted to withdraw its bid in accordance with regulations promulgated by the board, action must not be had against the bidder or the bid security.

(2) Contract Performance Payment Bonds.

(a) When Required-Amounts. Contracts for construction must require the following bonds or security:

(i) a performance bond satisfactory to the State, executed by a surety company meeting the criteria established by the board in regulations, or otherwise secured in a manner satisfactory to the State, in an amount equal to one hundred percent of the portion of the contract price that does not include the cost of operation, maintenance, and finance;

(ii) a payment bond satisfactory to the State, executed by a surety company meeting the criteria established by the board in regulations, or otherwise secured in a manner satisfactory to the State, for the protection of all persons supplying labor and material to the contractor or its subcontractors for the performance of the construction work provided for in the contract. The bond must be in an amount equal to one hundred percent of the portion of the contract price that does not include the cost of operation, maintenance, and finance;

(iii) in the case of a construction contract valued at fifty thousand dollars or less, the governmental body may waive the requirements of subitems (i) and (ii) above, if the governmental body has protected the State;

(iv) in the case of a construction manager at-risk contract, the solicitation may provide that bonds or security are not required during the project’s preconstruction or design phase, if construction does not commence until the requirements of subitems (i) and (ii) above have been satisfied. Additionally, the solicitation may provide that bonds or security as described in subitems (i) and (ii) above may be furnished for one or more designated portions of the project, in an amount equal to one hundred percent of the value of the construction of each designated portion, and also may prescribe the time of delivery of the bonds or security. In no event may construction of any portion of the work commence until the appropriate bonds or security have been delivered to the governmental body;

(v) in the case of a design-build, design-build-operate-maintain, or design-build-finance-operate-maintain contract, the solicitation may provide that bonds or security as described in subitems (i) and (ii) above may be furnished for one or more designated portions of the project, in an amount equal to one hundred percent of the value of the design and construction of each designated portion, and also may prescribe the time of delivery of the bonds or security. In no event may design or construction of any portion of the work commence until the appropriate bonds or security have been delivered to the governmental body.

(b) Authority to Require Additional Bonds. Item (2) does not limit the authority of the board to require a performance bond or other security in addition to these bonds, or in circumstances other than specified in subitem (a) of that item in accordance with regulations promulgated by the board.

(c) Suits on Payment Bonds-Right to Institute. A person who has furnished labor, material, or rental equipment to a bonded contractor or his subcontractors for the work specified in the contract, and who has not been paid in full for it before the expiration of a period of ninety days after the day on which the last of the labor was done or performed by the person or material or rental equipment was furnished or supplied by the person for which the claim is made, has the right to sue on the payment bond for the amount, or the balance of it, unpaid at the time of institution of the suit and to prosecute the action for the sum or sums justly due the person. A remote claimant has a right of action on the payment bond only upon giving written notice to the contractor within ninety days from the date on which the person did or performed the last of the labor or furnished or supplied the last of the material or rental equipment upon which the claim is made, stating with substantial accuracy the amount claimed as unpaid and the name of the party to whom the material or rental equipment was furnished or supplied or for whom the labor was done or performed. The written notice to the bonded contractor must be served personally or served by mailing the notice by registered or certified mail, postage prepaid, in an envelope addressed to the bonded contractor at any place the bonded contractor maintains a permanent office for the conduct of its business, or at the current address as shown on the records of the Department of Labor, Licensing and Regulation. The aggregate amount of a claim against the payment bond by a remote claimant may not exceed the amount due by the bonded contractor to the person to whom the remote claimant has supplied labor, materials, rental equipment, or services, unless the remote claimant has provided notice of furnishing labor, materials, or rental equipment to the bonded contractor. The written notice to the bonded contractor must generally conform to the requirements of Section 29-5-20(B) and sent by certified or registered mail to the bonded contractor at any place the bonded contractor maintains a permanent office for the conduct of its business, or at the current address as shown on the records of the Department of Labor, Licensing and Regulation. After receiving the notice of furnishing labor, materials, or rental equipment, payment by the bonded contractor may not lessen the amount recoverable by the remote claimant. The aggregate amount of claims on the payment bond may not exceed the penal sum of the bond. A suit under this section must not be commenced after the expiration of one year after the last date of furnishing or providing labor, services, materials, or rental equipment.

For purposes of this section, “bonded contractor” means the contractor or subcontractor furnishing the payment bond, and “remote claimant” means a person having a direct contractual relationship with a subcontractor or supplier of a bonded contractor, but no expressed or implied contractual relationship with the bonded contractor. Any payment bond surety for the bonded contractor must have the same rights and defenses of the bonded contractor as provided in this section.

(d) Suits on Payment Bonds-Where and When Brought. Every suit instituted upon a payment bond must be brought in a court of competent jurisdiction for the county or circuit in which the construction contract was to be performed; except that a suit must not be commenced after the expiration of one year after the day on which the last of the labor was performed or material was supplied by the person bringing suit. The obligee named in the bond need not be joined as a party in the suit.

(3) Bonds Forms and Copies.

(a) Bonds Forms. The board shall promulgate by regulation the form of the bonds required by this section.

(b) Certified Copies of Bonds. A person may request and obtain from the governmental body a certified copy of a bond upon payment of the cost of reproduction of the bond and postage, if any. A certified copy of a bond is prima facie evidence of the contents, execution, and delivery of the original.

(4) Retention.

(a) Maximum amount to be withheld. In a contract or subcontract for construction which provides for progress payments in installments based upon an estimated percentage of completion, with a percentage of the contract’s proceeds to be retained by the State or general contractor pending completion of the contract or subcontract, the retained amount of each progress payment or installment must be no more than three and one-half percent.

(b) Release of Retained Funds. When the work to be performed on a state construction project or pursuant to a state construction contract is to be performed by multiple prime contractors or by a prime contractor and multiple subcontractors, the work contracted to be done by each individual contractor or subcontractor is considered a separate division of the contract for the purpose of retention. As each division of the contract is certified as having been completed, that portion of the retained funds which is allocable to the completed division of the contract must be released forthwith to the prime contractor, who, within ten days of its receipt, shall release to the subcontractor responsible for the completed work the full amount of retention previously withheld from him by the prime contractor.

(5) Bonds for Bid Security and Contract Performance. The requirement of a bond for bid security on a construction contract, pursuant to subsection (1), and a construction contract performance bond, pursuant to subsection (2), may not include a requirement that the surety bond be furnished by a particular surety company or through a particular agent or broker.