Preliminary Notice Deadlines

Rhode Island

Rhode Island

Rhode Island

Rhode Island

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 2 years of the same last furnishing date, or under the maximum time limit as contained within any labor or material payment bond, whichever period is longer.

Rhode Island

Rhoda Island

For those who did not contract with the prime, must file a bond claim with the prime contractor within 90 days of last furnishing labor or materials to the project (good practice for those who did contract with prime as well). Enforcement lawsuit must be filed within 2 years of the same last furnishing date, or under the maximum time limit as contained within any labor or material payment bond, whichever period is longer.

Rhode Island provides broad protection to parties who furnish labor and/or materials to a public project. So long as the project meets the $50,000 threshold that mandates the general contractor provide a bond, all parties who supply labor and/or materials to the project have a right to make a bond claim. Apparently all tiers of participant in the project, even suppliers to suppliers, are protected.

A bond claim in Rhode Island must be given within 90 days after the claimant last furnished labor and/or materials to the project.

It is worth noting that a claimant in Rhode Island is also allowed to make a bond claim on a public project by following the requirements set forth to make a claim on a private works payment bond. If the claimant chooses to do so, this claim is in the alternative to a claim under the public projects section, and the private bond claim requirements apply.

In Rhode Island, the claimant’s bond claim is only required to be given to the contractor supplying the bond. It may be best practice, however, to also provide notice of the claim to the contracting public entity and the surety (if known).

Generally, a suit to enforce the bond claim on a public project in Rhode Island must be initiated more than 90 days, but less than 2 years after the claimant’s last furnishing of labor and/or materials to the project. However, if the bond itself provides for a longer time limit, the longer time limit will control. Also, if the claimant never delivered the bond claim to the general contractor, and the bond provides a shorter time limit in which suit must be initiated, that shorter time period will control.

In Rhode Island, a bond claim must include the name of the party for whom the labor and/or material was furnished, and a statement of the amount claimed. It may also be advisable, however, to also include the name of the general contractor, the contracting public entity, and to identify the labor and/or materials furnished, and the project itself.

A Rhode Island bond claim must be sent by certified mail.

We may be selling material to a sub-contractor on a public job. they are pushing back on our terms, though they have accepted them in...

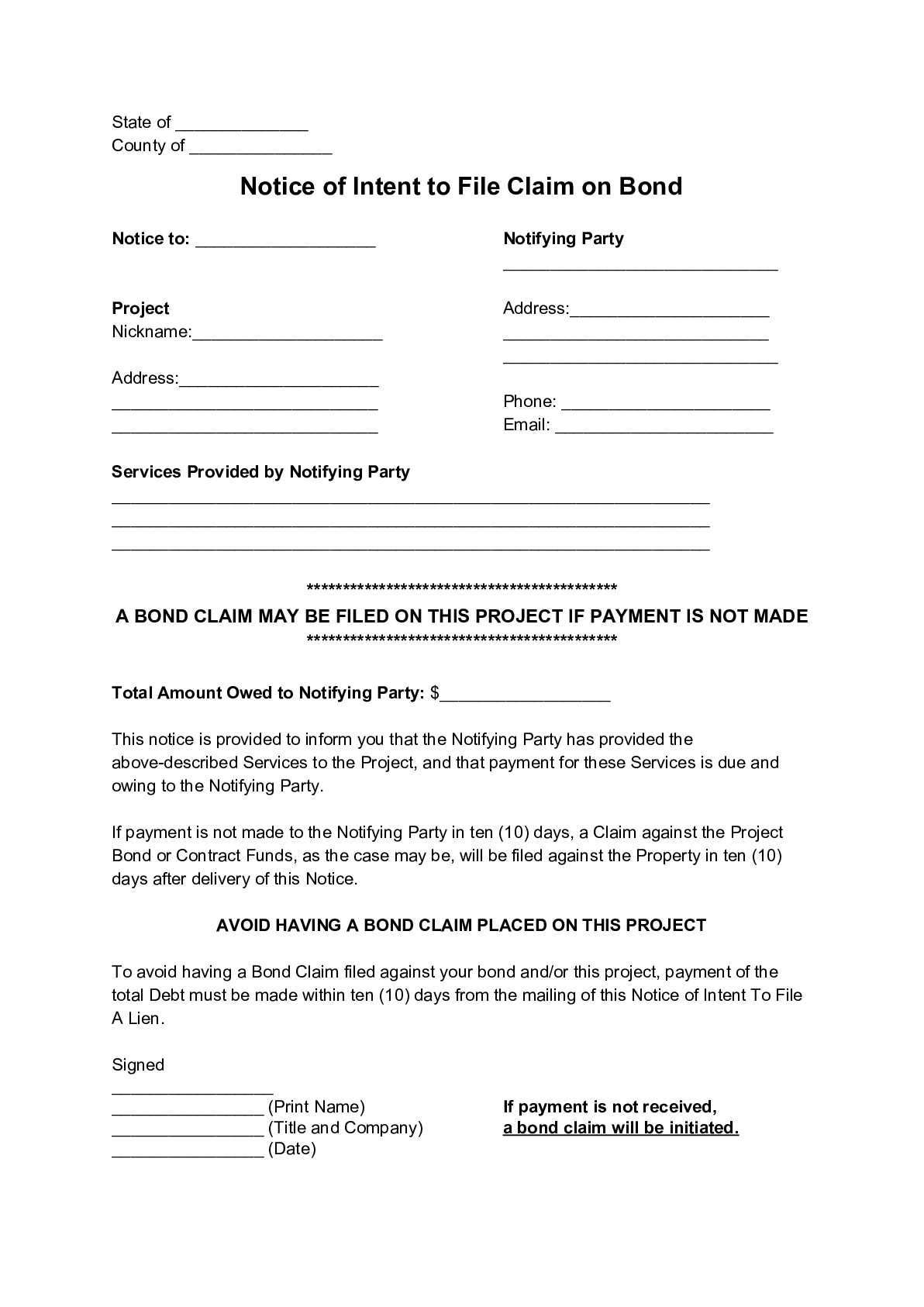

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Rhode Island, and are not paid, you can file a “lien” against the project pursuant to Rhode Island’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Rhode Island’s Little Miller Act is found in Rhode Island General Laws, Title 37, Chapter 37-12, and is reproduced below.

(a) Every person (which word for the purposes of this chapter shall include a copartnership, a number of persons engaged in a joint enterprise, or a corporation), before being awarded a contract by the department of transportation or by the department of administration, as the case may be, and every person awarded such a contract as a general contractor or construction or project manager for the construction, improvement, completion, or repair of any public road or portion thereof or of any bridge in which the contract price shall be in excess of one hundred and fifty thousand dollars ($150,000), or for a contract for the construction, improvement, completion, or repair of any public building, or portion thereof, shall be required to furnish to the respective department a bond of that person to the state, with good and sufficient surety or sureties (hereafter in this chapter referred to as surety), acceptable to the respective department, in a sum not less than fifty percent (50%) and not more than one hundred percent (100%) of the contract price, conditioned that the contractor, principal in the bond, the person’s executors, administrators, or successors, shall in all things, well and truly keep and perform the covenants, conditions, and agreements in the contract, and in any alterations thereof made as therein provided, on the person’s part to be kept and performed, at the time and in the manner therein specified, and in all respects according to their true intent and meaning, and shall indemnify and save harmless the state, the respective department, and all of its officers, agents, and employees, as therein stipulated, and shall also promptly pay for all such labor performed or furnished and for all such materials and equipment furnished, (which as to equipment shall mean payment of the reasonable rental value, as determined by the respective department, of its use during the period of its use), as shall be used in the carrying on of the work covered by the contract, or shall see that they are promptly paid for, whether or not the labor is directly performed for or furnished to the contractor or is even directly performed upon the work covered by the contract, and whether or not the materials are furnished to the contractor or become component parts of the work, and whether or not the equipment is furnished to the contractor or even directly used upon the work. The bond shall contain the provisions that it is subject to all such rights and powers of the respective department and such other provisions as are set forth in the contract and the plans, specifications, and proposal incorporated by reference in the contract, and that no extension of the time of performance of the contract or delay in the completion of the work thereunder or any alterations thereof, made as therein provided, shall invalidate the bond or release the liability of the surety thereunder. Back to Top

Every person who shall have performed labor and every person who shall have furnished or supplied labor, material, or equipment in the prosecution of the work provided for in the contract, in respect of which a payment bond is furnished under § 37-12-1, and who has not been paid in full therefor before the expiration of a period of ninety (90) days after the day on which the last of the labor was performed or furnished by him or her, or material or equipment furnished or supplied by him or her for which a claim is made, shall have the right to sue on the payment bond for the amount, or the balance thereof, unpaid at the time of institution of the suit and to prosecute the action to final execution and judgment for the sum or sums justly due him or her; provided, however, that any person having direct contractual relationship with a subcontractor but no contractual relationship express or implied with the contractor furnishing the payment bond shall have a right of action upon the payment bond upon giving written notice to the contractor within ninety (90) days from the date on which the person furnished or performed the last of the labor, or furnished or supplied the last of the material or equipment for which the claim is made, stating with substantial accuracy the amount claimed and the name of the party to whom the labor was furnished or performed or the material or equipment was furnished or supplied. The notice shall be served by mailing the same by certified mail, postage prepaid, in an envelope addressed to the contractor at any place he or she maintains an office, conducts his or her business, or his or her residence. Back to Top

The remedy on the bond shall be by a civil action brought in the superior court for the counties of Providence and Bristol and in any suit brought on the bond the rights of the state shall be prior to those of all creditors. The rights of persons who shall have performed labor as aforesaid shall be prior to the rights of all other creditors, and there shall be no priorities among laborers or among other creditors under the bond. The state, either after having recovered a judgment against the contractor on the contract or without having recovered a judgment, may bring a suit on the bond against the contractor and surety on the bond, and may join as parties defendant in the suit any persons claiming to have rights under the bond as creditors; and, if it has not brought such a suit, it may at any time before a final and conclusive decree, intervene and become a party in any suit brought, as hereafter provided in this chapter, by any person claiming to be a creditor under the bond. Back to Top

Any person claiming to be a creditor under the bond may at any time intervene and become a party in any pending suit brought as aforesaid by the state on the bond, and by so intervening may have the rights to the person adjudicated in the suit. Back to Top

No suit instituted under § 37-12-2 shall be commenced after the expiration of two (2) years, or under the maximum time limit as contained within any labor or material payment bond required under § 37-12-1, whichever period is longer, after the day on which the last of the labor was furnished or performed or material or equipment was furnished or supplied by any person claiming under the section. Back to Top

When a suit has been so brought on the bond by a person claiming to be a creditor under the bond and is pending, any other person claiming to be a creditor under the bond may intervene and become a party in the first suit thus brought and pending and by so intervening may have the rights of the other person adjudicated in the suit. If two (2) or more of the suits be filed in the court on the same day, the one in which the larger sum shall be claimed shall be regarded as the earlier suit. All suits brought upon the bond as provided in this chapter shall be consolidated together by the court and heard as one suit. Back to Top

In any suit brought under the provisions of this chapter such personal notice of the pendency of the suit as the court may order shall be given to all such known creditors and persons claiming to be creditors under the bond as shall not have entered their appearances in the suit and, in addition to the notice, notice of the pendency of the suit shall be given by publication in some newspaper published in this state of general circulation in the city or town or every city or town in which the work covered by the contract was carried on, once a week for three (3) successive weeks, in such form as the court may order. The court, however, may dispense with the notices if satisfied that sufficient notices shall have been given in some other suit brought under the provisions of this chapter. Back to Top

Any person claiming to be a creditor under the bond and having filed a claim with the respective department, in accordance with the requirements of § 37-12-2, shall have the right, at any time when the person could under this chapter file a suit or intervene in a pending suit, to require the respective department to furnish to the person certified copies of the contract, proposal, plans specifications, and bond. Back to Top

The surety on the bond may pay into the registry of the court, for distribution among those who may be or become entitled thereto under the decree of the court, the penal sum named in the bond less any amount which the surety may have paid to the state in satisfaction of the liability of the surety to the state under the bond, and then shall be entitled to be discharged from all further liability under the bond. Back to Top

(a) Upon substantial completion of the work required by a contract aggregating in amount less than five hundred thousand dollars ($500,000) with any municipality, or any agency or political subdivision thereof, for the construction, reconstruction, alteration,remodeling, repair, or improvement of sewers and water mains, or any public works project defined in § 37-13-1, the awarding authority may deduct from its payment a retention to secure satisfactory performance of the contractual work not exceeding five percent (5%) of the contract price unless otherwise agreed to by the parties. Upon substantial completion of the work required by a contract aggregating in an amount of five hundred thousand dollars ($500,000) or greater with any municipality, or any agency or political subdivision thereof, for the construction, reconstruction, alteration, remodeling, repair, or improvement of sewers and water mains, or any public works project defined in § 37-13-1, the awarding authority may deduct from its payment a retention to secure satisfactory performance of the contractual work not exceeding five percent (5%) of the contract price. In the case of periodic payments with respect to contracts less than the aggregate amount of five hundred thousand dollars ($500,000), the awarding authority may deduct from its payment a retention to secure satisfactory performance of the contractual work not exceeding five percent (5%) of the approved amount of any periodic payment unless otherwise agreed to by the parties. In the case of periodic payments with respect to contracts in the aggregate amount of five hundred thousand dollars ($500,000) or greater, the awarding authority may deduct from its payment a retention to secure satisfactory performance of the contractual work not exceeding five percent (5%) of the approved amount of any periodic payment. (b) The retainage shall be paid to any contractor or subcontractor within ninety (90) days of the date the work is accepted by the awarding authority unless a dispute exists with respect to the work. If payment is not made within ninety (90) days for any reason other than a dispute, which, if resolved and it is not the fault of the contractor, interest shall be assessed at the rate of ten percent (10%) per annum on all money which is to be paid to the contractor or subcontractor. (c) The retainage shall be paid to any contractor or subcontractor within ninety (90) days of the date his or her work is completed and accepted by the awarding authority. If payment is not made, interest shall be assessed at the rate of ten percent (10%) per annum. (d) There shall also be deducted and retained from the contract price an additional sum sufficient to pay the estimated cost of municipal police traffic control on any public works project. Municipalities shall directly pay the officers working traffic details and shall bill and be reimbursed by the withholding authority for which the contract is being performed every thirty (30) days until the project is complete. Back to Top

(a) Where any public works contract as defined by § 37-13-1 provides for the retention of earned estimates by the state of Rhode Island, the contractor may, from time to time, withdraw the whole or any portion of the amount retained for payments to the contractor pursuant to the terms of the contract, upon depositing with the general treasurer either; (1) United States treasury bonds, United States treasury notes, United States treasury certificates of indebtedness, or United States treasury bills; (2) Bonds or notes of the state of Rhode Island; or (3) Bonds of any political subdivision in the state of Rhode Island. (b) No amount shall be withdrawn in excess of the market value of the securities at the time of deposit or of the par value of the securities, whichever is lower. The general treasurer shall, on a regular basis, collect all interest or income on the obligations so deposited and shall pay the interest or income, when and as collected, to the contractor who deposited the obligations. If the deposit is in the form of coupon bonds, the general treasurer shall deliver each coupon as it matures to the contractor. Any amount deducted by the state, or by any public department or official thereof, pursuant to the terms of the contract, from the retained payments otherwise due the contractor, shall be deducted, first from that portion of the retained payments for which no security has been substituted, then from the proceeds of any deposited security. In the latter case, the contractor shall be entitled to receive interest, coupons, or income only from those securities which remain after the amount has been deducted. The securities so deposited shall be properly endorsed by the contractor in such manner so as to enable the general treasurer to carry out the provisions of this section. Back to Top