Connecticut

Preliminary Notice Deadlines

Connecticut

Connecticut

Connecticut

Connecticut

Connecticut

If unpaid, must serve a "Notice of Claim" on the surety and the prime contractor within 180 days from your last furnishing of materials and/or labor to the project. If the payment due is retainage, the "Notice of Claim" for the retainage payment is not due until 180 days after the prime contractor applied for payment of said retainage.

Connecticut

Connecticut

Connecticut

If unpaid, must serve a "Notice of Claim" on the surety and the prime contractor within 180 days from your last furnishing of materials and/or labor to the project. If the payment due is retainage, the "Notice of Claim" for the retainage payment is not due until 180 days after the prime contractor applied for payment of said retainage.

Connecticut

There are two types of protection available to unpaid parties on public projects in Connecticut depending on your role in the project – a bond claim/claim on the contract funds, and a claim against the state.

Bond Claim/Contract Funds

In Connecticut, parties who furnish labor and/or materials (equipment lessors) to the general contractor or a first-tier subcontractor are protected. Suppliers to suppliers may be covered, as long as they are within the protected tier.

• See: How the Payment Chain Works in Construction (And Why it Matters)

Claim Against State

This remedy is only available to those who contracted directly with the public entity.

Bond Claim/Contract Funds

The deadline for making a bond claim/claim on contract funds in Connecticut depends on whether or not the amount due to the claimant was included in the general’s submission to the contracting public entity (or the subcontractor’s submission to the general if the claimant was hired by a sub).

• If the amount due to the claimant was included in the submission the claim must be received more than 60, but less than 180, days after the payment date for the labor and/or materials furnished by the claimant.

• If the amount due to the claimant was not included in the submission, the claim must be received more than 60, but less than 180, days after the claimant’s last furnishing of labor and/or materials to the project.

• Note: if the claim is solely for retainage the deadline is 210 days after the prime contractor received retainage payments (30 days for prime to pay retainage + 180-day claim deadline).

• See Connecticut Retainage Overview & FAQs

Claim Against State

A claim against the state must be initiated after the earlier of the execution of the contract or commencement of work, but earlier than the earlier of either 2 years after acceptance of the work by the public agency or 2 years after termination of the contract.

Bond Claim/Contract Funds

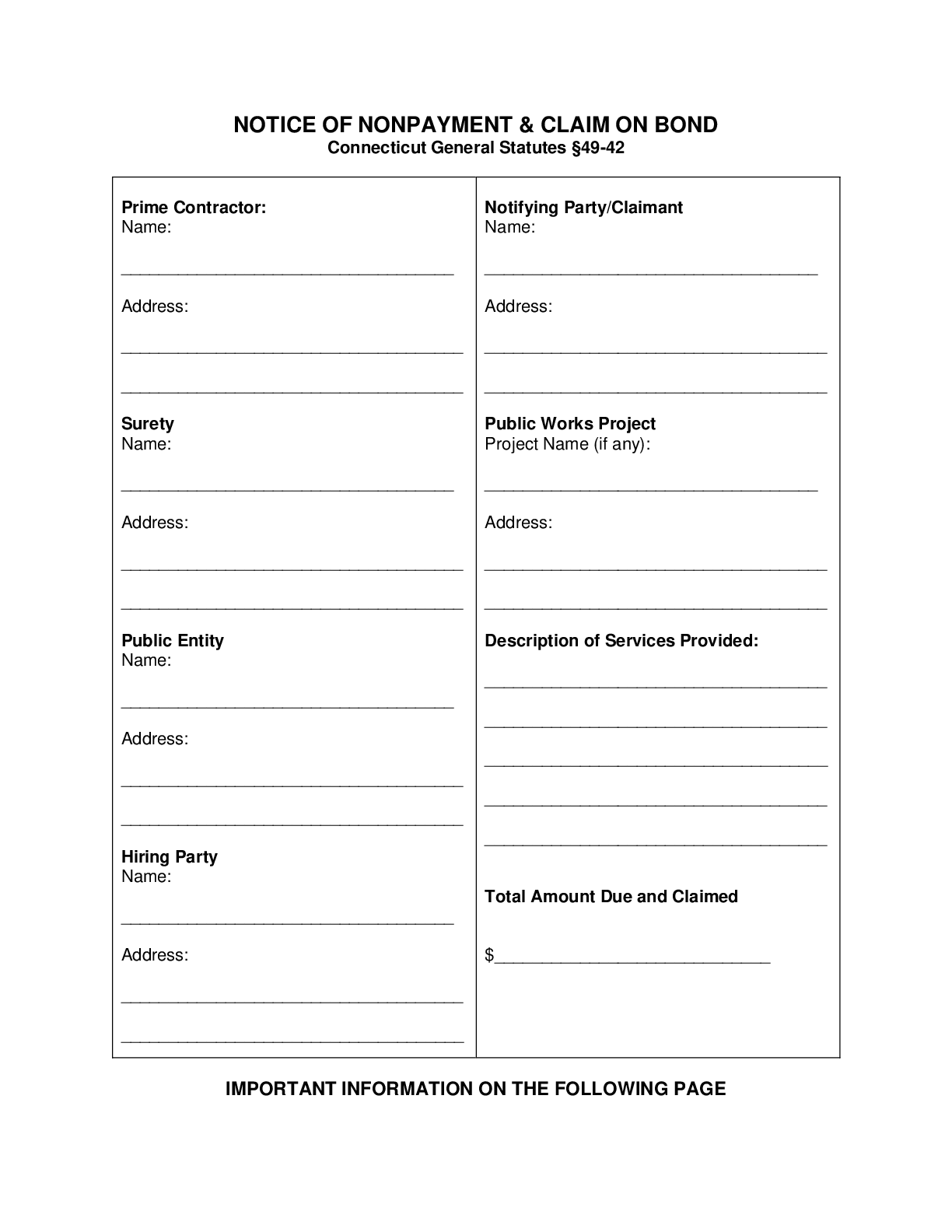

A Connecticut bond claim must include the following information:

• The amount claimed (with substantial accuracy);

• The name of the party who hired the claimant; &

• A detailed description of the project.

It may also be advisable to include a description of the labor and/or material furnished, and an identification of the contracting public entity and the general contractor (if the claimant was hired by a sub).

→ Download a free Connecticut Bond Claim form here

Claim Against State

A claim against the state must include notice of each claim made under the contract and the base for each claim. Further, as outlined by Connecticut case law, but not specifically by statute, the claim should include a statement of the claimant’s intent to pursue a claim for damages in court or through arbitration.

Bond Claim/Contract Funds

The claim must be sent to the surety who provided the payment bond, and to the general contractor named as principal in the bond.

Claim Against State

The claim must be provided to the agency head of the public entity department administering the contract.

Bond Claim/Contract Funds

Connecticut bond claims must be served via registered or certified mail; or by any other manner by which civil process is served.

Claim Against State

Connecticut does not specifically provide the manner in which a claim against the state must be “given” to the head of the contracting public entity. Therefore, the best practice may be to deliver the claim via a method that provides proof of receipt.

Bond Claim/Contract Funds

In Connecticut, an action to enforce a bond claim must be filed in the superior court for the judicial district where the contract was to be performed, within one year after the last date that materials were supplied or any work was performed by the claimant.

• Note: an exception exists that any suit solely seeking payment for retainage, must be initiated within one year from the date payment of such retainage was due.

Claim Against State

An action to enforce a claim against the state must be initiated after the execution of the contract or authorized commencement of the work (whichever is earlier) but no later than 3 years after acceptance of work, or termination of the contract (whichever is earlier).

• Alternatively, the claimant can submit the claim to arbitration.

Hello! We have affordable housing project in Connecticut, we are materials supplier, owner is non profit organization. Which project type in Levelset we should select...

Canceling/Releasing a Bond Claim?I've canceled/released Liens in the past but now I am now trying to do the same for a Bond Claim. Will you please advise the...

Can we make a claim against the City or the General contractor utilizing the little miller act? And can we also make a cI am a small WBE, SBE contracted through a large electrical company(General Contractor) to perform construction for a federally funded project for the city of...

This Connecticut Bond Claim form can be used by subcontractors, suppliers, and equipment lessors that are unpaid on public projects. If unpaid, to make a...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Connecticut, and are not paid, you can file a “lien” against the project pursuant to Connecticut’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Connecticut’s Little Miller Act and claims against the state by prime contractors can found in Connecticut General Statutes, Title 49, Chapter 847, §§ 49-41 – 49-43, and §4-61, and are reproduced below.

(a) Each contract exceeding one hundred thousand dollars in amount for the construction, alteration or repair of any public building or public work of the state or a municipality shall include a provision that the person to perform the contract shall furnish to the state or municipality on or before the award date, a bond in the amount of the contract which shall be binding upon the award of the contract to that person, with a surety or sureties satisfactory to the officer awarding the contract, for the protection of persons supplying labor or materials in the prosecution of the work provided for in the contract for the use of each such person, provided no such bond shall be required to be furnished (1) in relation to any general bid in which the total estimated cost of labor and materials under the contract with respect to which such general bid is submitted is less than one hundred thousand dollars, (2) in relation to any sub-bid in which the total estimated cost of labor and materials under the contract with respect to which such sub-bid is submitted is less than one hundred thousand dollars, or (3) in relation to any general bid or sub-bid submitted by a consultant, as defined in section 4b-55. Any such bond furnished shall have as principal the name of the person awarded the contract.

(b) Nothing in this section or sections 49-41a to 49-43, inclusive, shall be construed to limit the authority of any contracting officer to require a performance bond or other security in addition to the bond referred to in subsection (a) of this section, except that no such officer shall require a performance bond in relation to any general bid in which the total estimated cost of labor and materials under the contract with respect to which such general bid is submitted is less than twenty-five thousand dollars or in relation to any sub-bid in which the total estimated cost of labor and materials under the contract with respect to which such sub-bid is submitted is less than fifty thousand dollars.

(c) No contract for the construction, alteration or repair of any public building or public work of the state or a municipality that requires a person to supply the state or municipality with a bond may include a provision that requires the person to obtain the bond from a specific surety, agent, broker or producer. No contracting officer may require that a bond be obtained from a specific surety, agent, broker or producer.

(d) In the event that any political subdivision of the state enters into a contract described in subsection (a) of this section and fails to obtain delivery from the contractor of the bond required by this section, any person who has not been paid by the contractor for labor or materials supplied in the performance of work under the contract shall have the same legal right of action against such political subdivision of the state as such person would have had against a surety under the provisions of section 49-42. Nothing in this section shall be construed to extend liability to the state for any person’s right to payment or constitute a waiver of the state’s sovereign immunity.

(e)

(1) As used in this subsection, “owner-controlled insurance program” means an insurance procurement program under which a principal provides and consolidates insurance coverage for one or more contractors on one or more construction projects.

(2) No contract for the construction, alteration or repair of any public building or public work of the state or a municipality may include a provision that allows or requires the state or municipality to maintain an owner-controlled insurance program, except for (A) a project approved pursuant to section 10a-109e, or (B) one or more municipal projects totaling one hundred million dollars or more (i) under the supervision of one construction manager, or (ii) located within the boundaries of a municipality if under the supervision of more than one construction manager.

(3) Each contract or policy of insurance issued under an owner-controlled insurance program pursuant to this subsection shall provide that:

(A) Coverage for work performed and materials furnished shall continue from the completion of the work until the date all causes of action are barred under any applicable statute of limitations.

(B) Any notice of a change in coverage under the contract or policy or of a cancellation or refusal to renew the coverage under the contract or policy shall be provided to the principal and all contractors covered under the program.

(C) The effective date of a (i) change in coverage under the contract or policy shall be at least thirty days after the date the principal and contractors receive the notice of change in coverage as required under subparagraph (B) of this subdivision, and (ii) cancellation or refusal to renew shall be at least sixty days after the principal and contractors receive the notice of change in coverage as required under subparagraph (B) of this subdivision.

(4) Each principal or contractor shall disclose in the project plans or specifications at the time the principal or contractor is soliciting bids for the construction project that the project will be covered by an owner-controlled insurance program.

(f) Whenever a surety bond is required in connection with a contract for the construction, reconstruction, alteration, remodeling, repair or demolition of any public building for work by the state or a municipality, that is estimated to cost more than five hundred thousand dollars and is paid for, in whole or in part, with state funds, the surety contract between the contractor named as principal in the bond and the surety that issues such bond shall contain the following provision: “In the event that the surety assumes the contract or obtains a bid or bids for completion of the contract, the surety shall ensure that the contractor chosen to complete the contract is prequalified pursuant to section 4a-100 of the Connecticut general statutes in the requisite classification and has the aggregate work capacity rating and single project limit necessary to complete the contract”.

(a) When any public work is awarded by a contract for which a payment bond is required by section 49-41, the contract for the public work shall contain the following provisions: (1) A requirement that the general contractor, within thirty days after payment to the contractor by the state or a municipality, pay any amounts due any subcontractor, whether for labor performed or materials furnished, when the labor or materials have been included in a requisition submitted by the contractor and paid by the state or a municipality; (2) a requirement that the general contractor shall include in each of its subcontracts a provision requiring each subcontractor to pay any amounts due any of its subcontractors, whether for labor performed or materials furnished, within thirty days after such subcontractor receives a payment from the general contractor which encompasses labor or materials furnished by such subcontractor.

(b) If payment is not made by the general contractor or any of its subcontractors in accordance with such requirements, the subcontractor shall set forth his claim against the general contractor and the subcontractor of a subcontractor shall set forth its claim against the subcontractor through notice by registered or certified mail. Ten days after the receipt of that notice, the general contractor shall be liable to its subcontractor, and the subcontractor shall be liable to its subcontractor, for interest on the amount due and owing at the rate of one per cent per month. In addition, the general contractor, upon written demand of its subcontractor, or the subcontractor, upon written demand of its subcontractor, shall be required to place funds in the amount of the claim, plus interest of one per cent, in an interest-bearing escrow account in a bank in this state, provided the general contractor or subcontractor may refuse to place the funds in escrow on the grounds that the subcontractor has not substantially performed the work according to the terms of his or its employment. In the event that such general contractor or subcontractor refuses to place such funds in escrow, and the party making a claim against it under this section is found to have substantially performed its work in accordance with the terms of its employment in any arbitration or litigation to determine the validity of such claim, then such general contractor or subcontractor shall pay the attorney’s fees of such party.

(c) No payment may be withheld from a subcontractor for work performed because of a dispute between the general contractor and another contractor or subcontractor.

(d) This section shall not be construed to prohibit progress payments prior to final payment of the contract and is applicable to all subcontractors for material or labor whether they have contracted directly with the general contractor or with some other subcontractor on the work.

When any public work is awarded by a contract for which a payment bond is required by section 49-41 and such contract contains a provision requiring the general or prime contractor under such contract to furnish a performance bond in the full amount of the contract price, the following shall apply:

(1) In the case of a contract advertised by the Department of Administrative Services or any other state agency, except as specified in subdivision (2) of this section, (A) the awarding authority shall not withhold more than seven and one-half per cent from any periodic or final payment which is otherwise properly due to the general or prime contractor under the terms of such contract, provided, when fifty per cent of the contract is completed, said amount shall be reduced to five per cent, and (B) any such general or prime contractor shall not withhold from any subcontractor more than (i) seven and one-half per cent from any periodic or final payment which is otherwise due to the subcontractor, or (ii) the amount withheld by the awarding authority from such general or prime contractor under subparagraph (A) of this subdivision, whichever is less, provided, when fifty per cent of the contract is completed, said amount shall be reduced to five per cent. Payment shall be made not later than ninety days after a complete application for payment demonstrating that fifty per cent contract completion has been submitted to the awarding authority. Notwithstanding the provisions of this subdivision (1), the awarding authority shall establish an early release program with respect to periodic payments by general or prime contractors to subcontractors.

(2) In the case of a contract advertised by the state Department of Transportation, (A) the department shall not withhold more than two and one-half per cent from any periodic or final payment which is otherwise properly due to the general or prime contractor under the terms of such contract, and (B) any such general or prime contractor shall not withhold more than two and one-half per cent from any periodic or final payment which is otherwise due to any subcontractor.

(3) If the awarding authority is a municipality, (A) the municipality shall not withhold more than five per cent from any periodic or final payment which is otherwise properly due to the general or prime contractor under the terms of such contract, and (B) any such general or prime contractor shall not withhold more than five per cent from any periodic or final payment which is otherwise due to any subcontractor.

Any person contracting with the state shall make payment to any subcontractor employed by such contractor within thirty days of payment by the state to the contractor for any work performed or, in the case of any contract entered into on or after October 1, 1986, for materials furnished by such subcontractor, provided such contractor may withhold such payment if such contractor has a bona fide reason for such withholding and if such contractor notifies the affected subcontractor, in writing, of his reasons for withholding such payment and provides the state board, commission, department, office, institution, council or other agency through which such contractor had made the contract, with a copy of the notice, within such thirty-day period.

(a)

(1) Any person who performed work or supplied materials for which a requisition was submitted to, or for which an estimate was prepared by, the awarding authority and who does not receive full payment for such work or materials within sixty days of the applicable payment date provided for in subsection (a) of section 49-41a, or any person who supplied materials or performed subcontracting work not included on a requisition or estimate who has not received full payment for such materials or work within sixty days after the date such materials were supplied or such work was performed, may enforce such person’s right to payment under the bond by serving a notice of claim on the surety that issued the bond and a copy of such notice to the contractor named as principal in the bond not later than one hundred eighty days after the last date any such materials were supplied or any such work was performed by the claimant.For the payment of retainage, as defined in section 42-158i, such notice shall be served not later than one hundred eighty days after the applicable payment date provided for in subsection (a) of section 49-41a. The notice of claim shall state with substantial accuracy the amount claimed and the name of the party for whom the work was performed or to whom the materials were supplied, and shall provide a detailed description of the bonded project for which the work or materials were provided. If the content of a notice prepared in accordance with subsection (c) of section 49-41a complies with the requirements of this section, a copy of such notice, served not later than one hundred eighty days after the date provided for in this section upon the surety that issued the bond and upon the contractor named as principal in the bond, shall satisfy the notice requirements of this section. Not later than ninety days after service of the notice of claim, the surety shall make payment under the bond and satisfy the claim, or any portion of the claim which is not subject to a good faith dispute, and shall serve a notice on the claimant denying liability for any unpaid portion of the claim. The surety’s failure to discharge its obligations under this section shall not be deemed to constitute a waiver of defenses the surety or its principal on the bond may have or acquire as to the claim, except as to undisputed amounts for which the surety and claimant have reached agreement. If, however, the surety fails to discharge its obligations under this section, then the surety shall indemnify the claimant for the reasonable attorneys’ fees and costs the claimant incurs thereafter to recover any sums found due and owing to the claimant. The notices required under this section shall be served by registered or certified mail, postage prepaid in envelopes addressed to any office at which the surety, principal or claimant conducts business, or in any manner in which civil process may be served.

(2) If the surety denies liability on the claim, or any portion thereof, the claimant may bring an action upon the payment bond in the Superior Court for such sums and prosecute the action to final execution and judgment. An action to recover on a payment bond under this section shall be privileged with respect to assignment for trial. The court shall not consolidate for trial any action brought under this section with any other action brought on the same bond unless the court finds that a substantial portion of the evidence to be adduced, other than the fact that the claims sought to be consolidated arise under the same general contract, is common to such actions and that consolidation will not result in excessive delays to any claimant whose action was instituted at a time significantly prior to the filing of the motion to consolidate. In any such proceeding, the court judgment shall award the prevailing party the costs for bringing such proceeding and allow interest at the rate of interest specified in the labor or materials contract under which the claim arises or, if no such interest rate is specified, at the rate of interest as provided in section 37-3a upon the amount recovered, computed from the date of service of the notice of claim, provided, for any portion of the claim which the court finds was due and payable after the date of service of the notice of claim, such interest shall be computed from the date such portion became due and payable. The court judgment may award reasonable attorneys’ fees to either party if upon reviewing the entire record, it appears that either the original claim, the surety’s denial of liability, or the defense interposed to the claim is without substantial basis in fact or law. Any person having direct contractual relationship with a subcontractor but no contractual relationship express or implied with the contractor furnishing the payment bond shall have a right of action upon the payment bond upon giving written notice of claim as provided in this section.

(b) Every suit instituted under this section shall be brought in the name of the person suing, in the superior court for the judicial district where the contract was to be performed, irrespective of the amount in controversy in the suit, but no such suit may be commenced after the expiration of one year after the last date that materials were supplied or any work was performed by the claimant, except that any such suit solely seeking payment for retainage, as defined in section 42-158i, shall be commenced not later than one year after the date payment of such retainage was due, pursuant to the provisions of subsection (a) of section 49-41a.

(c) The word “material” as used in sections 49-33to 49-43, inclusive, shall include construction equipment and machinery that is rented or leased for use (1) in the prosecution of work provided for in the contract within the meaning of sections 49-33 to 49-43, inclusive, or (2) in the construction, raising or removal of any building or improvement of any lot or in the site development or subdivision of any plot of land within the meaning of sections 49-33 to 49-39, inclusive.

Each agency of the state or of any subdivision thereof, in charge of the construction, alteration or repair of any public building or public work of the state or of any subdivision thereof, shall furnish, to any person making application therefor who submits an affidavit that he has supplied labor or materials for the work and payment therefor has not been made or that he is being sued on the bond, a copy of the bond and the contract for which it was given, certified by the administrative head of the agency, which copy shall be prima facie evidence of the contents, execution and delivery of the original. Applicants shall pay for those certified copies such fees as are provided in section 1-212.

(a) Any person, firm or corporation which has entered into a contract with the state, acting through any of its departments, commissions or other agencies, for the design, construction, construction management, repair or alteration of any highway, bridge, building or other public works of the state or any political subdivision of the state may, in the event of any disputed claims under such contract or claims arising out of the awarding of a contract by the Commissioner of Administrative Services, bring an action against the state to the superior court for the judicial district of Hartford for the purpose of having such claims determined, provided notice of each such claim under such contract and the factual bases for each such claim shall have been given in writing to the agency head of the department administering the contract within the period which commences with the execution of the contract or the authorized commencement of work on the contract project, whichever is earlier, and which ends two years after the acceptance of the work by the agency head evidenced by a certificate of acceptance issued to the contractor or two years after the termination of the contract, whichever is earlier. No action on a claim under such contract shall be brought except within the period which commences with the execution of the contract or the authorized commencement of work on the contract project, whichever is earlier, and which ends three years after the acceptance of the work by the agency head of the department administering the contract evidenced by a certificate of acceptance issued to the contractor or three years after the termination of the contract, whichever is earlier. Issuance of such certificate of acceptance shall not be a condition precedent to the commencement of any action. Acceptance of an amount offered as final payment shall not preclude any person, firm or corporation from bringing a claim under this section. Such action shall be tried to the court without a jury. All legal defenses except governmental immunity shall be reserved to the state. In no event shall interest be awarded under section 13a-96 and section 37-3aby a court or an arbitrator to the claimant for the same debt for the same period of time. Interest under section 37-3a shall not begin to accrue to a claimant under this section until at least thirty days after the claimant submits a bill or claim to the agency for the unpaid debt upon which such interest is to be based, along with appropriate documentation of the debt when applicable. Any action brought under this subsection shall be privileged in respect to assignment for trial upon motion of either party.

(b) As an alternative to the procedure provided in subsection (a) of this section, any such person, firm or corporation having a claim under said subsection (a) may submit a demand for arbitration of such claim or claims for determination under (1) the rules of any dispute resolution entity, approved by such person, firm or corporation and the agency head and (2) the provisions of subsections (b) to (e), inclusive, of this section, except that if the parties cannot agree upon a dispute resolution entity, the rules of the American Arbitration Association and the provisions of said subsections shall apply. The provisions of this subsection shall not apply to claims under a contract unless notice of each such claim and the factual bases of each claim has been given in writing to the agency head of the department administering the contract within the time period which commences with the execution of the contract or the authorized commencement of work on the contract project, whichever is earlier, and which ends two years after the acceptance of the work by the agency head evidenced by a certificate of acceptance issued to the contractor or two years after the termination of the contract, whichever is earlier. A demand for arbitration of any such claim shall include the amount of damages and the alleged facts and contractual or statutory provisions which form the basis of the claim. No action on a claim under such contract shall be brought under this subsection except within the period which commences with the execution of the contract or the authorized commencement of work on the contract project, whichever is earlier, and which ends three years after the acceptance of the work by the agency head of the department administering the contract evidenced by a certificate of acceptance issued to the contractor or three years after the termination of the contract, whichever is earlier. Issuance of such certificate of acceptance shall not be a condition precedent to the commencement of any action.

(c) Once a notice of claim is given to the agency head as required by subsection (b) of this section, each party shall allow the other to examine and copy any nonprivileged documents which may be relevant either to the claimant’s claims or to the state’s defenses to such claims. Requests to examine and copy documents which have been prepared by the contractor in order to submit a bid shall be subject to a claim of privilege and grounds for an application to any court or judge pursuant to section 52-415 for a decision on whether such documents constitute trade secrets or other confidential research, development or commercial information and whether such documents shall not be disclosed to the state or shall be disclosed to the state only in a designated way. Any such documents for which no decision is sought or privilege obtained shall not be subject to disclosure under section 1-210 and shall not be disclosed by the agency to any person or agency that is not a party to the arbitration. Such documents shall be used only for settlement or litigation of the parties’ claims. The arbitrators shall determine any issue of relevance of such documents after an in camera inspection. The arbitrators shall seal such documents during arbitration and shall return such documents to the claimant after final disposition of the claim.

(d) Hearings shall be scheduled for arbitration in a manner that shall ensure that each party shall have reasonable time and opportunity to prepare and present its case, taking into consideration the size and complexity of the claims presented. Unless the parties agree otherwise, no evidentiary hearing on the merits of the claim may be held less than six months after the demand for arbitration is filed with the dispute resolution entity.

(e) The arbitrators shall conduct the hearing and shall hear evidence as to the facts, and arguments as to the interpretation and application of contractual provisions. After the hearing, the arbitrators shall issue in writing:

(1) Findings of fact,

(2) a decision in which the arbitrators interpret the contract and apply it to the facts found and

(3) an award. The arbitrators’ findings of fact and decision shall be final and conclusive and not subject to review by any forum, tribunal, court or government agency, for errors of fact or law. Awards shall be final and binding and subject to confirmation, modification or vacation pursuant to chapter 909.

(f) Claims brought pursuant to this section may be submitted for mediation under the mediation rules of such dispute resolution entity as the parties may agree upon.

(g) This section shall apply to claims brought on or after July 1, 1991. The provisions of sections 4-61, 4b-97, 13b-57a, 13b-57b and 13b-57c of the general statutes, revised to January 1, 1991, shall apply to claims brought before July 1, 1991.