Colorado

Preliminary Notice Deadlines

Colorado

Colorado

Colorado

Colorado

Colorado

File a Verified Statement of Account at any time before the final settlement of the work. This will cause the public entity to withhold funds from the contractor until 90 days after final settlement of the work. To make a claim against the bond itself, no specific notice is required.

Colorado

Bond claims must be enforced within 6 months of project completion. While claims against contract funds must enforced within 90 days of final settlement.

Colorado

Colorado

To make a claim against the bond itself, no specific notice is required. For claims against contract funds, a Verified Statement of Account can be filed at any time before the final settlement of the work. This will cause the public entity to withhold funds from the contractor until 90 days after final settlement of the work.

Colorado

Bond claims must be enforced within 6 months of project completion. While claims against contract funds must enforced within 90 days of final settlement.

The public payment bond claim statutes apply to all State-funded projects over $150K and all other public works projects $50K or more.

As far as the protected parties, anyone who furnishes labor and/or materials (including rental materials and tools) to the general contractor or subcontractor are protected. Suppliers to suppliers are not covered, but there is some authority suggesting that suppliers to sub-subcontractors are protected. Note that there are two types of protection available to unpaid parties on public projects in Colorado – a bond claim and a lien on the contract funds.

Colorado recently expanded it’s protections for P3 projects. Payment bonds will now be required on those jobs.

• More on that here: New Colorado Payment Bond Requirements Create Protections for P3’s

Bond Claim

No specific claim is required by statute, however claimants should look to the language of the bond to determine if any notice or claim is required. Even if not required by the bond, sending a Notice of Intent to Make a Bond Claim is recommended.

Lien on Contract Funds

A claim against the contract funds may be made at any time during the course of the project, but no later than the final settlement of the prime contract.

• Final settlement– required to be published in a county newspaper of general circulation, or by any approved electronic means at least 10 days before final settlement

Bond Claim

The statutes do not require any specific claim or notice to be sent. However, if sending a Notice of Intent, you should include your information, the prime contractor and hiring party’s information, the amount claimed, and a description of the labor and/or materials furnished.

→ Download a free Colorado Notice of Intent to Make a Bond Claim form here

Lien on Contract Funds

The only information actually required by statute is a “verified statement of the amount due and unpaid on account of the claim.” However, some other identifying information is recommended, such as the claimant’s information, their hiring party, the project information, and a brief description of the labor and/or materials provided.

Bond Claim

Not required. However, if sending a Notice of Intent, best practice is to send it to the general contractor who posted the bond and the surety company.

Lien on Contract Funds

The claim on contract funds must be filed with the board, officer, person, or other contracting body of the public entity by which the contract was awarded.

Bond Claim

Not required, so by any means; certified or registered mail is recommended.

Lien on Contract Funds

Must be filed with the board, officer, person, or other contracting body of the public entity by which the contract was awarded. Colorado law does not specify how to the claim must be delivered to the public entity for filing.

Bond Claim

Generally, suit to recover from the bond on a Colorado public project must be initiated within 6 months of the completion of the project as a whole. However, this period may be lengthened if the specific language of the bond itself provides for a longer period in which to initiate suit.

Lien on Contract Funds

A suit to recover against the contract funds must be initiated within 90 days of the final settlement of the contract. It is also required that a lis pendens be filed contemporaneously with the initiation of the lawsuit.

Colorado does not have statutory lien waiver forms, and therefore, you can use any lien waiver forms. Since lien waivers are unregulated, be careful when reviewing and signing lien waivers. See this article: Should You Sign That Lien Waiver?. Also, Colorado state law prohibits contractors and suppliers from waiving their right to file a mechanics lien in contract. You can learn more about the prohibition of such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

We are a window and door company and we have almost $150,000 with just one GC ,HOWEVER, we have 4 months past the Lien requirements.They...

Bond ClaimHave invoices that were not paid in Tinker Air force base, Ok and Charleston Joint base for work provided. They are both for the same...

Project Bond CostIs bond cost reimbursement covered under the Miller Act?

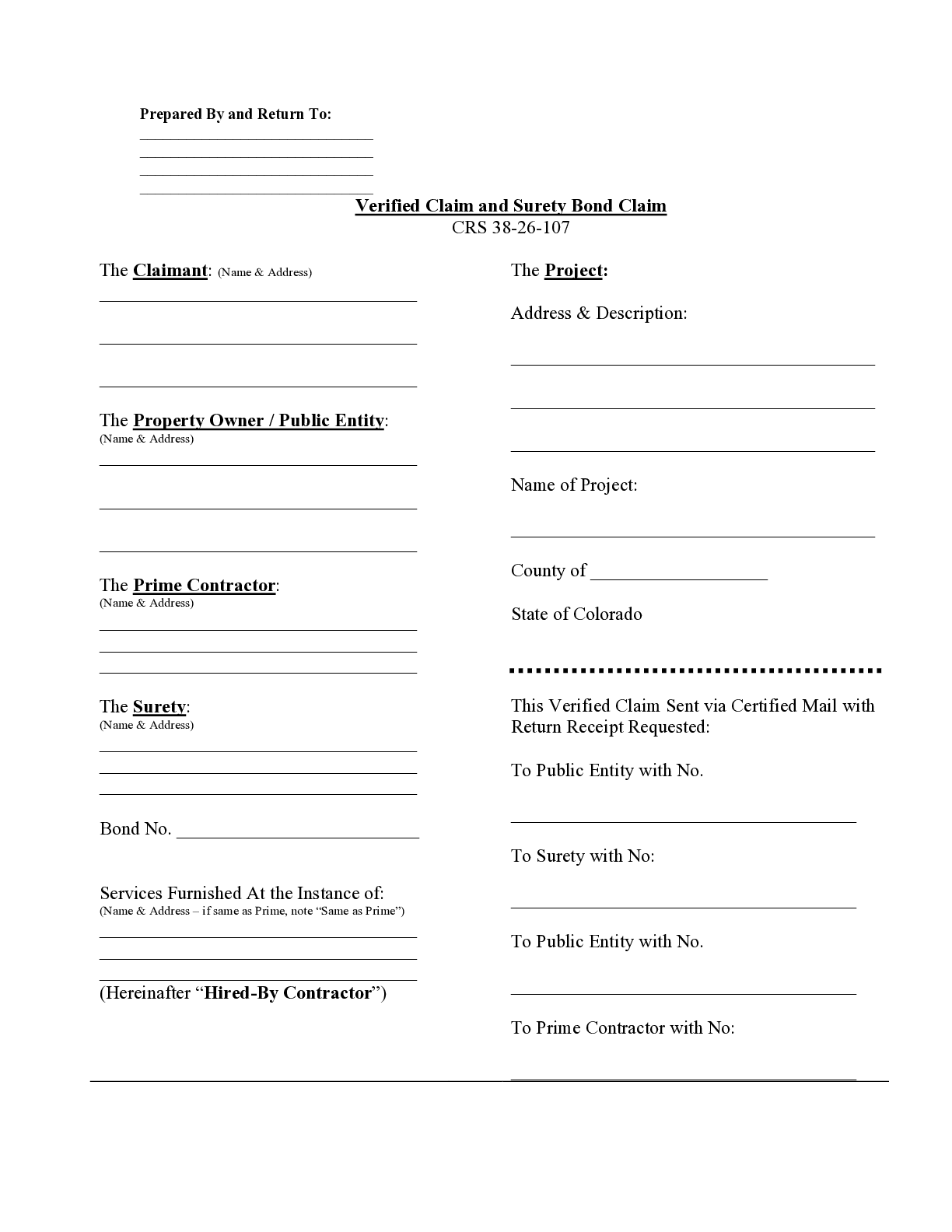

This Colorado Verified Claim form can be used by construction contractors unpaid on a public project. The rules and laws for seeking payment on an...

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Colorado, and are not paid, you can file a “lien” against the project pursuant to Colorado ‘s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Colorado’s Little Miller Act is found in Colorado Revised Statutes, Title 24, Article 105, §24-105-201 – 203, and Title 38, Article 26, §38-26-101, 105 – 110, all reproduced below. Updated as of 2020.

(1) Bid security shall be required for all invitations for bids for construction contracts when the price is estimated by the procurement agent to exceed fifty thousand dollars. Bid security shall be a bond provided by a surety company authorized to do business in this state, the equivalent in cash, or otherwise supplied in a form satisfactory to the state. Nothing in this subsection (1) prevents the requirement of such bonds on construction contracts under fifty thousand dollars.

(2) Bid security shall be in an amount equal to at least five percent of the amount of the bid.

(3) When the invitation for bids requires security, noncompliance requires that the bid be rejected as nonresponsive.

(4) After the bids are opened, they shall be irrevocable for the period specified in the invitation for bids, except as provided in section 24-103-202(6). If a bidder is permitted to withdraw his bid before award, no action shall be had against the bidder or the bid security.

(1) When a construction contract is awarded in excess of one hundred fifty thousand dollars, the following bonds or security shall be delivered to the state and shall become binding on the parties upon the execution of the contract:

(a) A performance bond satisfactory to the state, executed by a surety company authorized to do business in this state or otherwise secured in a manner satisfactory to the state, in an amount equal to fifty percent of the price specified in the contract; and

(b) A payment bond satisfactory to the state, executed by a surety company authorized to do business in this state or otherwise secured in a manner satisfactory to the state, for the protection of all persons supplying labor and material to the contractor or its subcontractors for the performance of the work provided for in the contract. The bond shall be in an amount equal to fifty percent of the price specified in the contract.

(2) Nothing in this section shall be construed to limit the authority of the state to require a performance bond or other security in addition to those bonds or in circumstances other than those specified in subsection (1) of this section.

(3) Suits on payment bonds and labor and payment bonds shall be brought in accordance with sections 38-26-105 to 38-26-107, C.R.S.

(4) This section applies to all construction contracts awarded to a private entity for construction that is situated or located on publicly owned property using any public or private money or public or private financing.

(1) The form of bonds required by this part 2 shall be as provided in sections 38-26-105 to 38-26-107, C.R.S.

(2) Any person may request and obtain from the state a certified copy of a bond upon payment of the cost of reproduction of the bond and postage, if any. A certified copy of a bond shall be prima facie evidence of the contents, execution, and delivery of the original.

The word “contractor”, as used in sections 38-26-101, 38-26-106, and 38-26-107, means any person, copartnership, association of persons, company, or corporation to whom is awarded any contract for the construction, erection, repair, maintenance, or improvement of any building, road, bridge, viaduct, tunnel, excavation, or other public work of this state or for any county, city and county, municipality, school district, or other political subdivision of the state.

(1) Subject to subsection (2) of this section, any person, company, firm, or corporation entering into a contract for more than fifty thousand dollars with any county, municipality, or school district for the construction of any public building or the prosecution or completion of any public works or for repairs upon any public building or public works is required before commencing work to execute, in addition to all bonds that may be required of it, a penal bond with good and sufficient surety to be approved by the board or boards of county commissioners of the county or counties, the governing body or bodies of the municipality or municipalities, or the district school board or boards, conditioned that such contractor shall at all times promptly make payments of all amounts lawfully due to all persons supplying or furnishing such person or such person’s subcontractors with labor, laborers, materials, rental machinery, tools, or equipment used or performed in the prosecution of the work provided for in such contract and that such contractor will indemnify and save harmless the county, municipality, or school district to the extent of any payments in connection with the carrying out of any such contract which the county or counties, municipality or municipalities, and school district or school districts may be required to make under the law. Subcontractors, materialmen, mechanics, suppliers of rental equipment, and others may have a right of action for amounts lawfully due them from the contractor or subcontractor directly against the principal and surety of such bond. Such action for laborers, materials, rental machinery, tools, or equipment furnished or labor rendered must be brought within six months after the completion of the work.

(2) Notwithstanding the monetary qualification provided in subsection (1) of this section, the state, or the governing body of any county, municipality, school district, or other political subdivision determining it to be in the best interest of this state, or any county, municipality, school district, or other political subdivision may require the execution of a penal bond for any contract of fifty thousand dollars or less.

(3) This section applies to all contracts for more than fifty thousand dollars awarded to a private entity for the construction of any public building or the prosecution or completion of any public works or for repairs upon any public building or public works that is situated or located on publicly owned property using any public or private money or public or private financing.

(1) Before entering upon the performance of any work included in the contract, a contractor shall duly execute, deliver to, and file with the board, officer, body, or person by whom the contract was awarded a good and sufficient bond or other acceptable surety approved by the contracting board, officer, body, or person, in a penal sum not less than one-half of the total amount payable under the terms of the contract; except that, for a public works contract having a total value of five hundred million dollars or more, a bond or other acceptable surety, including but not limited to a letter of credit, may be issued in a penal sum not less than one-half of the maximum amount payable under the terms of the contract in any calendar year in which the contract is performed. The contracting board, office, body, or person shall ensure that the contract requires that a bond or other acceptable surety, including but not limited to a letter of credit, be filed and current for the duration of the contract.

(2) A bond or other acceptable surety shall be duly executed by a qualified corporate surety or other qualified financial institution, conditioned upon the faithful performance of the contract, and, in addition, shall provide that, if the contractor or his or her subcontractor fails to duly pay for any labor, materials, team hire, sustenance, provisions, provender, or other supplies used or consumed by such contractor or his or her subcontractor in performance of the work contracted to be done or fails to pay any person who supplies laborers, rental machinery, tools, or equipment, all amounts due as the result of the use of such laborers, machinery, tools, or equipment, in the prosecution of the work, the surety or other qualified financial institution will pay the same in an amount not exceeding the sum specified in the bond or other acceptable surety together with interest at the rate of eight percent per annum. Unless a bond or other acceptable surety is executed, delivered, and filed, no claim in favor of the contractor arising under the contract shall be audited, allowed, or paid. A certified or cashier’s check or a bank money order made payable to the treasurer of the state of Colorado or to the treasurer or other officer designated by the governing body of the contracting local government may be accepted in lieu of a bond or other acceptable surety.

(3) This section applies to:

(a) A contractor who is awarded a contract for more than fifty thousand dollars for the construction, erection, repair, maintenance, or improvement of any building, road, bridge, viaduct, tunnel, excavation, or other public works for any county, city and county, municipality, school district, or other political subdivision of the state;

(b) A contractor who is awarded a contract for more than one hundred fifty thousand dollars for the construction, erection, repair, maintenance, or improvement of any building, road, bridge, viaduct, tunnel, excavation, or other public works for this state; and

(c) All contracts for more than one hundred fifty thousand dollars awarded by any county, city and county, municipality, school district, or other political subdivision of the state to a private entity for the construction, erection, repair, maintenance, or improvement of any building, road, bridge, viaduct, tunnel, excavation, or other public works that is situated or located on publicly owned property using any public or private money or public or private financing.

(1) Any person, as defined in section 2-4-401(8), C.R.S., that has furnished labor, materials, sustenance, or other supplies used or consumed by a contractor or his or her subcontractor in or about the performance of the work contracted to be done or that supplies laborers, rental machinery, tools, or equipment to the extent used in the prosecution of the work whose claim therefor has not been paid by the contractor or the subcontractor may, at any time up to and including the time of final settlement for the work contracted to be done, file with the board, officer, person, or other contracting body by whom the contract was awarded a verified statement of the amount due and unpaid on account of the claim. If the amount of the contract awarded to the contractor exceeds one hundred fifty thousand dollars, the board, officer, person, or other contracting body by whom the contract was awarded shall, no later than ten days before the final settlement is made, publish a notice of the final settlement at least twice in a newspaper of general circulation in any county where the work was contracted for or performed or in an electronic medium approved by the executive director of the department of personnel. It is unlawful for any person to divide a public works contract into two or more separate contracts for the sole purpose of evading or attempting to evade the requirements of this subsection (1).

(2) Upon the filing of any such claim, such board, officer, person, or other body awarding the contract shall withhold from all payments to said contractor sufficient funds to insure the payment of said claims until the same have been paid or such claims as filed have been withdrawn, such payment or withdrawal to be evidenced by filing with the person or contracting body by whom the contract was awarded a receipt in full or an order for withdrawal in writing and signed by the person filing such claim or his duly authorized agents or assigns. Such funds shall not be withheld longer than ninety days following the date fixed for final settlement as published unless an action is commenced within that time to enforce such unpaid claim and a notice of lis pendens is filed with the person or contracting body by whom the contract was awarded.

(3) At the expiration of the ninety-day period, the person or other body awarding the contract shall pay to the contractor such moneys and funds as are not the subject of suit and lis pendens notices and shall retain thereafter, subject to the final outcome thereof, only sufficient funds to insure the payment of judgments that may result from the suit. Failure on the part of a claimant to comply with the provisions of sections 38-26-101, 38-26-106, and this section shall relieve the board, officer, body, or person by whom such contract was awarded from any liability for making payment to the contractor. At any time within ninety days following the date fixed for final settlement as published, any person, copartnership, association of persons, company, or corporation, or its assigns, whose claims have not been paid by any such contractor or subcontractor may commence an action to recover the same, individually or collectively, against the surety or other qualified financial institution on the bond or other acceptable surety specified and required in section 38-26-106.

(1) Whenever a verified statement of a claim has been filed in accordance with section 38-26-107, the contractor holding the contract against which such statement has been filed, or other person who has an interest in the payments being withheld, by the contracting body that awarded the contract may, at any time, file with the clerk of the district court of the county where the contract is being performed or of the county where the office in which the verified statement of claim is located an ex parte motion for approval of a substitute corporate surety bond or any other undertaking that may be acceptable to a judge of such district court.

(2) A corporate surety bond or undertaking filed pursuant to subsection (1) of this section shall be in an amount equal to one and one-half times the amount of the claim plus costs allowed by the court up to the date of such filing and shall have been approved by an order of a judge of the district court in which such bond or undertaking is filed. The order shall state that:

(a) The corporate surety bond or undertaking is approved;

(b) The verified statement of claim is discharged;

(c) The corporate surety bond or undertaking shall be substituted for the moneys withheld pursuant to the verified statement of claim; and

(d) The contracting body that awarded the contract shall release the moneys being withheld pursuant to the verified statement of claim on the same terms and conditions as if the verified statement of claim had been released by the claimant.

(3) A corporate surety bond or undertaking filed pursuant to subsection (1) of this section shall be conditioned that, if the claimant is finally adjudged to be entitled to recover upon the claim upon which the claimant’s verified statement of a claim is based, the surety issuing the bond or undertaking or the principal thereunder, shall pay to such claimant the amount of the judgment issued upon such claim, together with any interest, costs, and other amounts awarded by the judgment.

(4) Notwithstanding the provisions of section 38-26-107, upon the issuance of an order from a judge of the district court approving a bond or undertaking filed pursuant to subsection (1) of this section, the clerk of such district court shall issue a certificate of release, which shall be served on the board, officer, person, or other contracting body by whom the contract was awarded by certified mail, return receipt requested, or by personal delivery. The certificate of release shall show that such claim against the contract has been discharged and released in full and the corporate surety bond or undertaking has been substituted. After the certificate of release is filed, payments to the contractor by the contracting body by whom the contract was awarded shall resume in accordance with the terms of the contract, and any funds previously withheld as a result of the filing of the verified statement shall be released to the contractor pursuant to the terms of the contract or, if not specified in the contract, within thirty days after the receipt of the certificate of release by the board, officer, person, or other contracting body by whom the contract was awarded.

(5) When a corporate surety bond or undertaking is substituted for a claim as provided in this section, the claimant who filed the verified statement of a claim pursuant to section 38-26-107(1) may bring an action against such bond or undertaking. Such action shall be commenced within the time allowed for the commencement of an action set forth in section 38-26-107(3).

(6) In the event that no action is commenced upon the corporate surety bond or undertaking within the time period called for by section 38-26-107, the corporate surety bond or undertaking shall be discharged and shall be returned to the contractor.

(1) All funds disbursed to any contractor or subcontractor under any contract or project subject to the provisions of this article shall be held in trust for the payment of any person that has furnished labor, materials, sustenance, or other supplies used or consumed by the contractor in or about the performance of the work contracted to be done or that supplies laborers, rental machinery, tools, or equipment to the extent used in the prosecution of the work where the person has:

(a) Filed or may file a verified statement of a claim arising from the project; or

(b) Asserted or may assert a claim against a principal or surety under the provisions of this article and for whom or which such disbursement was made.

(2) The requirements of this section shall not be construed so as to require a contractor or subcontractor to hold in trust any funds that have been disbursed to him or her for any person that has furnished labor, materials, sustenance, or other supplies used or consumed by the contractor or his or her subcontractor in the performance of the work contracted to be done; supplied laborers, rental machinery, tools, or equipment to the extent used in the prosecution of the work; filed or may file a verified statement of a claim arising from the project; or asserted or may assert a claim against a principal or surety that has furnished a bond under the provisions of this article if:

(a) The contractor or subcontractor has a good faith belief that the verified statement of a claim or bond claim is not valid; or

(b) The contractor or subcontractor, in good faith, claims a setoff, to the extent of such setoff.

(3) Each contractor or subcontractor shall maintain separate records of account of each project or account; except that nothing in this section shall be construed to require a contractor or subcontractor to deposit trust funds from a single project in a separate bank account solely for that project as long as the trust funds are not disbursed in a manner that conflicts with the requirements of this section.

(4) Any person who violates the provisions of subsections (1) and (2) of this section commits theft within the meaning of section 18-4-401, C.R.S.

(1) Any person who files a verified statement of a claim or asserts a claim against a principal or surety that has furnished a bond under this article for an amount greater than the amount due without a reasonable possibility that the amount claimed is due and with the knowledge that the amount claimed is greater than the amount due, and that fact is demonstrated in any proceedings under this article, shall forfeit all rights to the amount claimed and shall be liable to the following in an amount equal to all costs and all attorney fees reasonably incurred in bonding over, contesting, or otherwise responding in any way to the excessive verified statement of claim or excessive bond claim:

(a) The person to whom or which a disbursement would be made but for the verified statement of a claim or bond claim; or

(b) The principal and surety on the bond.