Alabama

Preliminary Notice Deadlines

Alabama

Alabama

Alabama

Alabama

hbspt.cta.load(313822, 'ba4964f6-0082-405d-8ce7-ef31425d9937', {});

hbspt.cta.load(313822, 'ba4964f6-0082-405d-8ce7-ef31425d9937', {}); Alabama

Must serve a Notice of Bond Claim with the surety at least 45 days before filing suit to enforce your rights against a bond.

Alabama

Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project.

Alabama

hbspt.cta.load(313822, 'ba4964f6-0082-405d-8ce7-ef31425d9937', {});

hbspt.cta.load(313822, 'ba4964f6-0082-405d-8ce7-ef31425d9937', {}); Alabama

Must serve a Notice of Bond Claim with the surety at least 45 days before filing suit to enforce your rights against a bond.

Alabama

Enforcement lawsuit must be filed within 1 year from last furnishing labor and/or materials to the project.

Alabama’s Little Miller Act, that governs payment bond requirements and claims, covers all public projects (state, county, local, etc.) where the original contract price is valued at $50,000 or more.

On public projects of less than the $50,000 amount, there will likely still be a payment bond on the project. However, the terms of the bond itself will govern notice, and claim requirements.

• Learn more: Get a Copy of the Payment Bond If You’re On a Public Project

In Alabama, the parties who can make a claim against a payment bond on the protected public projects include anyone who furnished labor and/or materials to the general contractor or a first tier subcontractor. Lower-tiered subs and suppliers to suppliers may be protected, but this isn’t specifically provided for in the statutes.

There is no specified deadline to send a payment bond claim in Alabama. Rather, the claim is only required to be served at least 45 days before filing suit. Since the deadline to file a suit for claims against the payment bond is 1 year from project completion, there is some leeway regarding the claim deadline.

But best practice would be to send this sooner than later to give ample time to file suit if necessary.

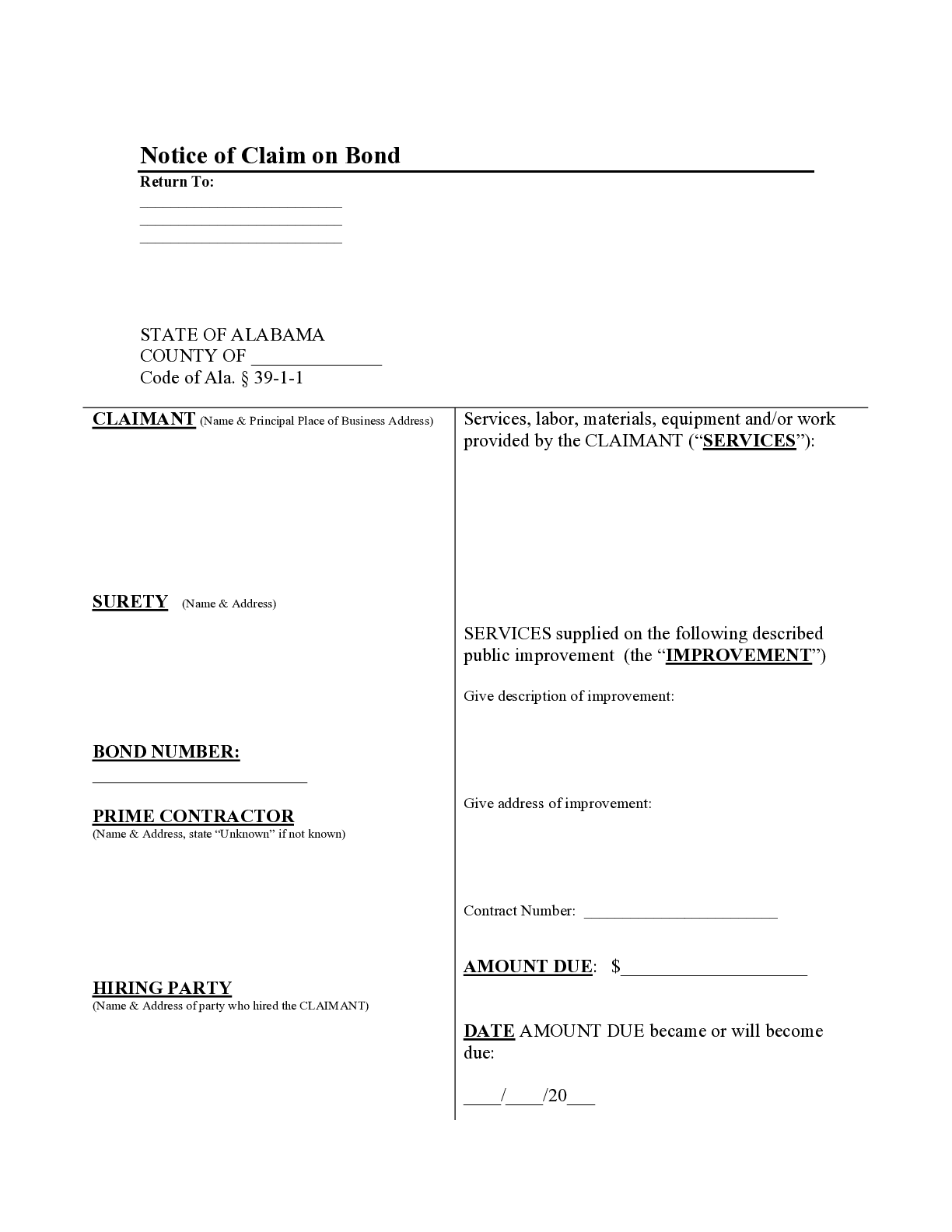

The only information required on a bond claim under Ala. Code §39-1-1(b) is:

• Claimant’s information;

• Amount claimed to be due, &

• Nature of the claim.

However, it’s always a good idea to provide as much identifying information as possible. Best practice is to also include:

• A brief description of the labor and/or materials furnished;

• Property description;

• Public entity information;

• General contractor’s information;

• Hiring party’s information (if applicable); &

• Surety’s information

The only party required to receive a Notice of Bond Claim is the surety who provided the bond. However, it’s a good idea to send a copy to the contractor who posted the bond on the project as well.

Lastly, if you don’t know who the surety is, this notice can be sent to the public entity contracting the project. The entity will then send the claimant a certified copy of the bond.

Alabama bond claims must be sent by registered or certified mail, postage prepaid to any of the receiving party’s places of business or office.

• What next? 4 Steps to take After Making a Bond Claim

A lawsuit to enforce a claim against a public payment bond in Alabama must be initiated at least 45 days after the bond claim was sent, but no later than one year from the date of final settlement of the contract, i.e. completion of the project.

Furthermore, note that after notice is provided, if the surety or contractor doesn’t pay the claim within 45 days, the claimant may be entitled to interest and attorney fees as well.

I am a steel subcontractor working on a public job in Alabama. I have two separate "contracts" for this job. A purchase order for the...

trying to find the bonding company's information to file bond claim.I have a general contractor refusing to provide the payment bond information after sending the request certified mail. what to do next? they owe my...

Three notices have been sent and County Risk Management denied claim.I would like an consultation.

Notice of Bond Claim must be filed with the surety at least 45 days before filing a lawsuit to enforce your rights against a bond....

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Alabama, and are not paid, you can file a “lien” against the project pursuant to Alabama’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Alabama’s Little Miller Act is codified in Title 39 of the Alabama Code, Public Works, Section 39-1-1, and is reproduced below. Updated as 2023.

(a) Any person entering into a contract with an awarding authority in this state for the prosecution of any public works shall, before commencing the work, execute a performance bond, with penalty equal to 100 percent of the amount of the contract price. In addition, another bond, payable to the awarding authority letting the contract, shall be executed in an amount not less than 50 percent of the contract price, with the obligation that the contractor or contractors shall promptly make payments to all persons supplying labor, materials, or supplies for or in the prosecution of the work provided in the contract and for the payment of reasonable attorneys’ fees incurred by successful claimants or plaintiffs in civil actions on the bond.

(b) Any person that has furnished labor, materials, or supplies for or in the prosecution of a public work and payment has not been made may institute a civil action upon the payment bond and have their rights and claims adjudicated in a civil action and judgment entered thereon. Notwithstanding the foregoing, a civil action shall not be instituted on the bond until 45 days after written notice to the surety of the amount claimed to be due and the nature of the claim. The civil action shall be commenced not later than one year from the date of final settlement of the contract. The giving of notice by registered or certified mail, postage prepaid, addressed to the surety at any of its places of business or offices shall be deemed sufficient under this section. In the event the surety or contractor fails to pay the claim in full within 45 days from the mailing of the notice, then the person or persons may recover from the contractor and surety, in addition to the amount of the claim, a reasonable attorney’s fee based on the result, together with interest on the claim from the date of the notice.

(c) Every person having a right of action on the last described bond as provided in this section shall, upon written application to the authority under the direction of whom the work has been prosecuted, indicating that labor, material, foodstuffs, or supplies for the work have been supplied and that payment has not been made, be promptly furnished a certified copy of the additional bond and contract. The claimant may bring a civil action in the claimant’s name on the bond against the contractor and the surety, or either of them, in the county in which the work is to be or has been performed or in any other county where venue is otherwise allowed by law.

(d) In the event a civil action is instituted on the payment bond, at any time more than 15 days before the trial begins, any party may serve upon the adverse party an offer to accept judgment in favor of the offeror or to allow judgment to be entered in favor of the offeree for the money or as otherwise specified in the offer. If within 10 days after the service of the offer, the adverse party serves written notice that the offer is accepted, either party may then file the offer and notice of acceptance together with proof of service and the clerk of the court shall enter judgment. An offer not accepted shall be deemed withdrawn and evidence of the offer shall not be admissible. If the judgment finally obtained by the offeree is less favorable than the offer, the offeree shall pay the reasonable attorney’s fees and costs incurred by the offeror after the making of the offer. An offer that is made but not accepted does not preclude a subsequent offer. When the liability of one party to another party has been determined by verdict, order, or judgment, but the amount or extent of the liability remains to be determined by further proceedings, any party may make an offer of judgment, which shall have the same effect as an offer made before trial if the offer is made no less than 10 days prior to the commencement of hearings to determine the amount or extent of liability.

(e) This section shall not require the taking of a bond to secure contracts in an amount less than fifty thousand dollars ($50,000).

(f) The contractor shall, immediately after the completion of the contract, give notice of the completion by an advertisement in a newspaper of general circulation published within the city or county in which the work has been done, for a period of four successive weeks. A final settlement shall not be made upon the contract until the expiration of 30 days after the completion of the notice. Proof of publication of the notice shall be made by the contractor to the authority by whom the contract was made by affidavit of the publisher and a printed copy of the notice published. If no newspaper is published in the county in which the work is done, the notice may be given by posting at the courthouse for 30 days, and proof of same shall be made by the judge of probate, sheriff, and the contractor.

(g) Subsection (f) shall not apply to contractors performing contracts of less than fifty thousand dollars ($50,000) in amount. In such cases, the governing body of the contracting agency, to expedite final payment, shall cause notice of final completion of the contract to be published one time in a newspaper of general circulation, published in the county of the contracting agency and shall post notice of final completion on the agency’s bulletin board for one week, and shall require the contractor to certify under oath that all bills have been paid in full. Final settlement with the contractor may be made at any time after the notice has been posted for one entire week.