In some ways, construction is like any other business: You need a good product or service, motivated employees, and a healthy client base to succeed. But finding success in the building industry is a lot tougher than most: According to Census Bureau data, over the last 10 years, construction businesses failed at nearly 1.5 times the rate of companies in other sectors.

Why do contractors and suppliers run such a high risk of bankruptcy? In almost all cases, construction companies fail for several reasons, though the most common problem is cash flow. We’ll talk through all of the reasons why construction companies fail — and what they could be doing differently.

1. Cash flow concerns sink businesses

A lot of construction professionals mistakenly believe that profit is the key to success in the industry. As long as revenue exceeds expenses, the business is safe from financial ruin, right? Unfortunately, this is wrong — and this false belief drives many, many companies out of business.

It’s a classic paradox of business: Profit is necessary for a construction company to grow, but it won’t keep it alive. This is because revenue and profit are largely “paper” measures — they show up on your income statement, but they don’t tell you how much cash you have in the bank.

You can run the most profitable construction business in the world, but if you don’t have enough cash coming in to cover your bills, you will be forced to look for additional contractor financing (if you can get it) or declare bankruptcy.

Cash flow is a challenge for any company, but it hits construction businesses particularly hard. Because the gap between providing a service and getting paid is longer than almost any other industry, construction companies rely heavily on financing and credit.

With advance deposits largely obsolete, construction businesses typically see a large outflow of cash upfront — purchasing materials, leasing equipment, and paying back-office employees — before the shovel ever hits the dirt. By the time they start work on a project, the business is already in a financial hole.

Of course, they do this with the promise of payment at a later date. If they fulfill the contract, get paid on time, and have accounted for all of the financial costs of carrying debt, construction companies can keep cash flow positive, turn a profit, and continue to grow.

But that’s a capital “IF.” There are so many things that can go wrong along the way that can wreak havoc on cash flow and force a contractor or supplier into failure.

2. Slow payment woes cut across the industry

The average DSO (days sales outstanding) for construction businesses is a whopping 83 days. That means that accounts are marked as “receivable” for nearly three months before they are paid. During those three months, the business still has bills to pay. You can’t just put off supplier invoices, employee paychecks, rent, and other overhead costs while you wait for payment to come in.

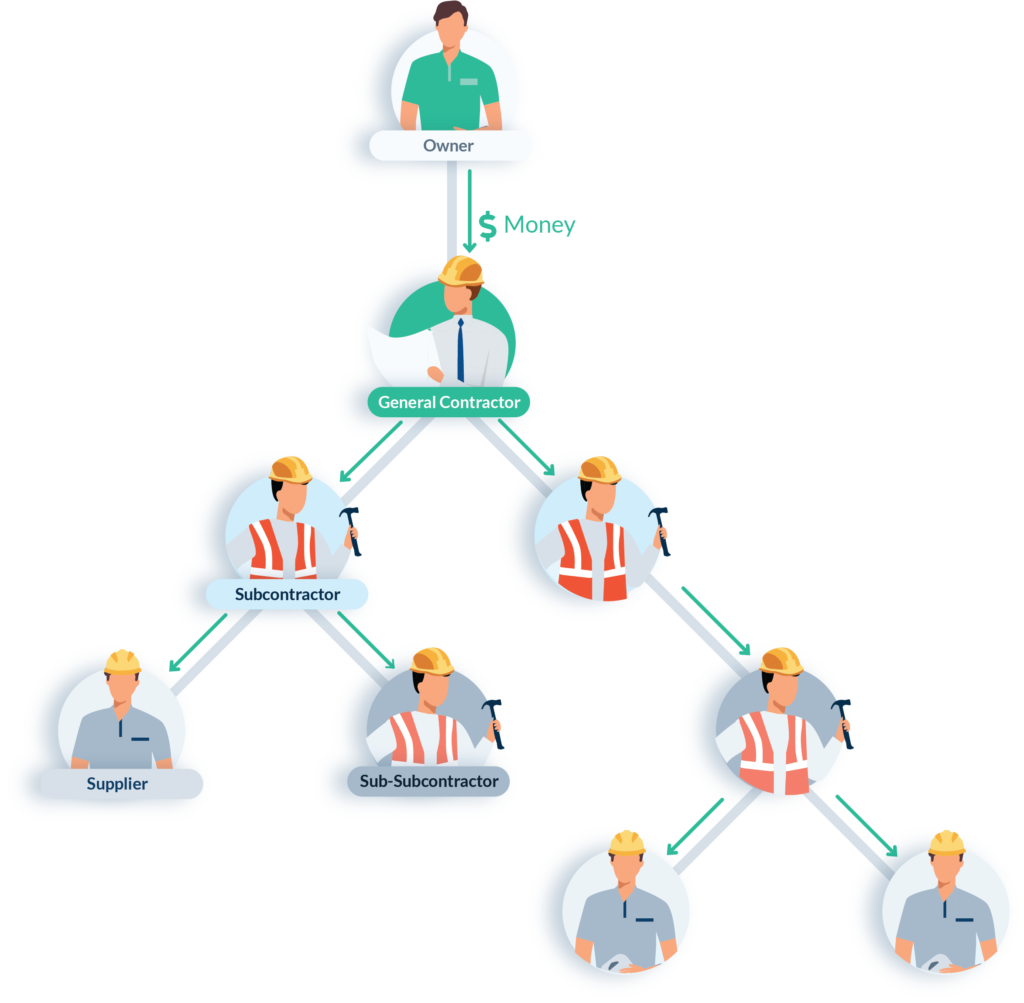

One of the chief reasons for slow payments in construction is the structure of the payment chain. Money flows in a waterfall on construction projects, starting with the property owner and trickling down each level, step by step, until it reaches the subs and suppliers at the bottom of the chain.

Every level that stands between your business and the checkbook (i.e. the property owner or the lender on a project), the longer you will have to wait for payment — and the greater the risk to your company’s cash flow.

But there are a number of other factors that can delay payments, too. The complexity of a construction project means that those at the top of the chain don’t always know who is working on the project. This lack of visibility creates more risk for subcontractors and suppliers and is a frequent source of delays.

Further reading: 5 Tips to Reduce Your DSO On Construction Invoices

3. Poor credit & collection processes hampers finances

Often, slow payments can be driven by factors that are entirely within the contractor’s control. A construction business’ credit and collection practices will have a huge impact on their ability to get paid on time and improve their cash flow position. Unfortunately, many contractors are their own worst enemy — their bad collection habits actually train their customers to delay their payments.

Some of these bad habits are due to slapdash or non-existent training. Many office or credit managers simply “fall” into the role of collecting invoices with little-to-no preparation. They are forced to learn as they go, and often continue the same poor practices the business used before.

Another problem: Construction companies simply accept slow payments as the status quo. To many, it’s just the cost of doing business. In a 2020 survey, 53% of contractors said they are happy with how quickly they get paid, even though 3 in 4 said they don’t always get paid on time according to their contract.

As a result, many contractors and suppliers don’t adopt the tools and strategies that would improve their payment speed and reduce the majority of their cash flow problems.

Thea Dudley teaches credit & collections

Join the free certificate course to learn the foundations of credit & collections in construction with 30-year industry veteran Thea Dudley.

4. Economic recessions hit construction hard

In an economic downturn, cash flow can suffer as a company’s backlog of work dries up. But a booming economy can be equally as dangerous for construction businesses, if not more so. Though quickly adding new clients and projects may sound like a good thing, periods of rapid growth can actually make a business’s existing cash flow problems even worse.

Rapid business growth puts additional strain on construction CFOs and other financial professionals. If the business didn’t have a secure handle on cash flow in leaner times, a bull market is likely to drain their bank balance and drive contractors and suppliers to extinction.

5. Poor estimating & bidding dooms a business from the start

“If you fail to plan,” Benjamin Franklin famously said, “you plan to fail.” The first signs of business failure will crop up well before breaking ground on a project, when the job is out for bid.

Creating an accurate estimate is essential to ensuring that your company will be able to complete the project successfully — and cover the cash requirements of the job as it progresses.

6. Inaccurate accounting is hard to overcome

Good accounting practices can provide a snapshot of business health, and help contractors identify financial problems while they’re still able to solve them. Construction businesses have unique accounting needs: They not only need to track cash flow for each project, but they also have to manage significant overhead costs.

Inaccurate books will hide cash flow problems that need attention. But even with good accounting practices, many businesses fail because they don’t read the reports correctly. Business owners often get seduced by the profit they’re making on paper, without paying proper attention to the financial statements that will make or break a construction company’s bottom line.

7. Paper processes leave some businesses in the lurch

In many ways, the construction industry is one of the most innovative sectors in the world. But when it comes to back-office processes, many construction companies are stuck in the last century, still heavily reliant on paper documents, from purchase orders to scheduling to actual payments.

Technology and software solutions already exist that help construction businesses track payments, exchange documents, and spot problems in real-time. Companies that depend entirely on paper processes may not even realize their payment is late until several days after it was due to arrive in the mail.

How construction businesses can prevent bankruptcy

While there are a number of reasons why construction companies go bankrupt, they will virtually always come back to cash flow. To succeed in this industry, contractors and suppliers need to prioritize good cash management practices and keep a close eye on the money flowing in and out of their business.

Take steps to get paid faster

Perhaps the most important thing construction companies can do to prevent cash flow problems from sinking their business is to adopt tried-and-true practices that speed up payment. This includes understanding the payment laws that protect construction businesses, prequalifying your customers before signing onto a project, and following up consistently on outstanding invoices.

But one of the easiest ways to prevent the cash flow problems associated with slow payment is to send preliminary notices on every project. These simple documents help avoid most of the issues caused by the complex payment chain by making your company more visible on a project to both the general contractor and property owner. They have a vested interest in making sure that you are paid for your work. Letting them know you’re on the job and expecting payment is a simple but powerful way to put your company in the best position to be paid on time.

In most states, sending a preliminary notice will also protect your right to file a mechanics lien — the most powerful tool in a contractor’s toolbox — if your company isn’t paid.

Pay attention to the right financial statements

While construction companies use a variety of financial statements, the cash flow statement and cash flow projection report are two of the most critical to protecting your bottom line and fending off business failure. These two statements work hand-in-hand to help you spot current financial problems and plan the flow of funds on upcoming projects.

In addition, there are several accounting reports you can use to track your collection rates on both past projects and jobs in progress.

Make smarter financing choices

There are a variety of financing options available to contractors, but finding the right solution will depend on what you need cash for. Traditional bank loans or a line of credit may work for some construction businesses, but are often limited to those with financial statements prepared by a CPA.

Invoice factoring may be a viable option for construction businesses to collect on payment applications as soon as they are submitted. And for contractors struggling to pay supplier costs up front, you can find 120-day financing for materials to relieve much of the cash flow pressure on any project.

While personal or business credit cards can be used to build a contractor’s credit history, they will not help you dig your company out of a cash shortage.

Success and failure in the construction industry ultimately come down to cash flow. By the nature of the way money moves on a project, contractors and suppliers carry significant financial risk — but that risk can be reduced with the right tools.

It’s not enough to know your numbers: Successful construction businesses take active and continual steps to improve them. By keeping a close eye on cash flow — and using tools to get paid faster — construction businesses can find the financial footing they need to weather any economic storm.