The right solutions can make a huge difference between constantly dealing with slow-paying customers versus consistently having your payments prioritized.

At Faulkner Haynes, a company that provides commercial HVAC services and represents HVAC manufacturers, there are two solutions that have allowed the company to reduce their days sales outstanding (DSO): adding an experienced credit manager, Natalie Damico, to their team and Levelset’s lien rights management software.

Jason Emanuel (the company’s Chief Financial Officer) hired Natalie and started using Levelset around the same time — and these two changes brought major improvements to their processes for extending credit, creating notices, and collecting receivables.

“Hiring Natalie is a big part of us seeing our DSO go down. However, there’s no question that Levelset also helps, and it certainly gives us some leverage,” said Jason.

Natalie herself isn’t available as a “solution” for every HVAC company in the country, obviously. But the way Natalie stays on top of managing credit and the way she uses Levelset to streamline their notice process are solutions credit managers at any HVAC company — or any construction company — can implement.

Read on to learn more about what life was like for Faulkner Haynes before Natalie and Levelset came on board, and how things improved after.

Before a lien rights and credit process was in place

On a majority of Faulkner Haynes’ jobs, sending a preliminary notice is required to protect their right to file a lien in the case of nonpayment. These notices are also important because they ensure Faulkner Haynes gets paid early on by making it clear that they were a supplier on the job and know their rights. However, the process for researching customers, checking deadlines, and then creating and sending these notices was extremely challenging.

“We tried to figure out how to identify which jobs it was worth spending our time doing all the legwork and research for. At the end of the day, nothing really was effective and so preliminary notices weren’t being filed. Also, we were losing lien rights on a regular basis. It was kind of a mess,” explained Jason.

Deep dive: How (and Why) to Implement Credit Policy and Procedures

Another major challenge was getting their sales team to gather the right job information for their notices.

“It’s hard to go to a salesperson and ask them to get this information just in case we have to file a lien. The salesperson is thinking, well we almost never file a lien. So it’s hard for them to make the connection between getting the money in faster, and having some leverage to collect,” Jason said.

Without gathering the right information for their job accounts, attempting to create notices was really difficult, hence why they weren’t sending these notices on a regular basis.

Then of course, without a credit professional, they didn’t have someone focused on collections.

“There’s a lot more that goes into getting money than just filing liens and sending notices. We needed someone talking to customers about getting payments and making informed decisions about credit,” said Jason.

After a lien rights and credit process was in place

Once Natalie was hired as Faulkner Haynes’ credit manager, she was able to specifically focus on collections, monitoring credit terms, and setting up credit applications. Everything she has implemented is improving the company’s bottom line. She also has an organized notice process in place, and notices are now being sent on a regular basis.

“Without Levelset, you’re going through a manual spreadsheet or using alerts in your email calendar to track notice deadlines, but Levelset eliminates that extra work,” said Natalie.

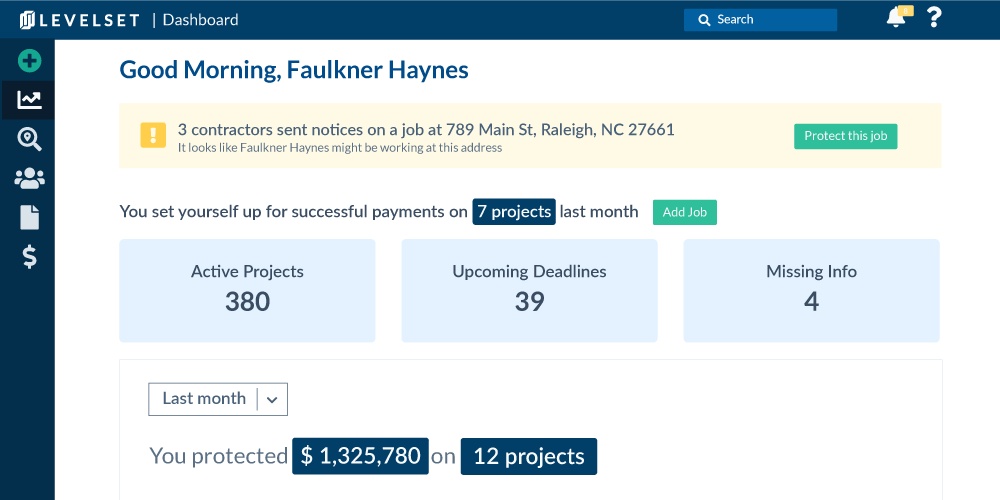

“My favorite thing about Levelset is the dashboard. I go in there every day, and I look at what I have to send so that I can stay on top of that timeline. That dashboard and the payment reminders are beyond helpful. Levelset definitely helps me do my job better on a daily basis.”

Not only is Natalie using Levelset to track deadlines, but her process for sending notices is much easier as well. In Levelset, notices automatically populate with the right information without their team having to manually research jobs or needing to push the sales team to collect this information upfront. If anything is missing from a job such as the legal property description or property owner, Scout Research fills in that information.

“Through a minimal amount of information that we’re providing, Levelset can do the legwork to get the details needed to file the preliminary notices. For us as a company, that has always been the biggest challenge,” Jason said. “If job details are missing, the Scout team finds it. I’m sure there’s a lot that goes on behind the scenes to get this information that I’m not aware of, but from my perspective, Levelset finds whatever is missing to file the notices.”

Natalie agrees, “It reminds me of the Wizard of Oz. Levelset is behind the curtain, taking care of these details every day for me, and I love you guys for that.”

Thanks to Natalie’s hard work and expertise, plus a little help from Levelset, their average DSO has gone from around 70 days to around 50 days, and they are no longer losing lien rights on jobs.

“The DSO definitely went down, but — at the end of the day — we are just more protected. We have a way to track our lien rights, and we have a way to make sure that our notices are sent on time. If you’re sending a notice on every job, you’re going to get paid faster,” said Jason.

Want to move your company to the front of the payment line?

You can empower your credit managers to do their jobs successfully, just like Jason empowered Natalie. When you or your employees are open to trying out new resources to streamline the lien rights process, anything is possible!

Talk to someone on the Levelset team today to learn how lien rights management software can help your company move to the front of the payment line.

See how you can use Levelset

Discover how you can get paid faster with a personalized tour of Levelset.