There comes a time when every subcontractor outgrows their current list of GCs and needs to move on to bigger and better jobs. When that time comes, larger general contracting firms like Turner Industries can help subcontractors grow their business and keep their pipeline full. But it’s important that your company values and the general contractor’s business jive to ensure it’s a positive relationship.

Working with Turner Industries could be a great move, but ensuring the companies are a good fit takes research. This guide will provide all the information you need to make up your mind about subcontracting with Turner Industries.

Turner Industries company overview

Turner Industries is a Baton Rouge, Louisiana-based construction company with a 60-year history. The company specializes in industrial general contracting but also deals in pipe fabrication, specialized transportation, maintenance, and specialty services.

While Turner Industries’ headquarters is in Baton Rouge, it also has seven other locations, including:

- Beaumont, Texas

- Corpus Christi, Teas

- Decatur, Alabama

- Freeport Texas

- Houston, Texas

- Geismar, Louisiana

- Lake Charles, Louisiana

Past projects include:

- Air Products and Chemicals Facility – Garyville, Louisiana

- Delayed Coker Replacement – McPherson, Kansas

- Citgo Petroleum – Lake Charles, Louisiana

- Diamond Green Diesel – Norco, Louisiana

- Fluor/Total – Port Arthur, Texas

- J. Ray McDermott Alen Central Processing Platform – Amelia, Louisiana

ENR ranked Turner Industries at number 26 of its 2020 Top 400 Contractors list.

Before working with Turner Industries

Before you start working with Turner Industries or any other general contractor, it’s essential to do as much research as possible. You can think of the process as prequalification. After all, a general contractor will put you through the wringer to prequalify you; it makes sense to do the same.

Prequalifying a contractor involves the following steps:

- Dig into the company’s payment history

- Review the company’s credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with the company’s payment process

It’s critical to recognize that when you dig into a company’s history, you’re bound to find something. A few red flags are typical, especially for a company with a history as long as Turner Industries. Construction is a harsh industry, and angry subcontractors are more likely to leave negative reviews on the internet than happy contractors are to rave about their experience.

If you find a few red flags or something stands out, reach out to Turner Industries directly. When a big general contractor like Turner Industries is upfront about disputes and issues they’ve had in the past, it can say a lot about what the company is like to work for.

Turner Industries Payment Profile

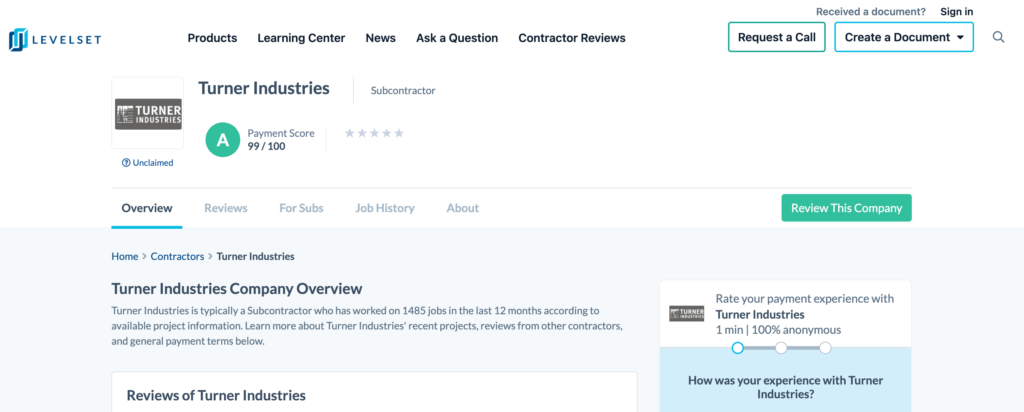

Turner Industries’ Payment Profile shows a payment score of 99 out of 100, giving it an A rating. It’s extremely rare for a large general contractor to score that high, especially one so large that it ranks so well in ENR’s Top 400.

For a clear understanding of the payment profiles, a payment score is given to a contractor after collecting data about their payment practices. Once that data is collected, it’s compared against the scores of thousands of other contractors. These scores give subcontractors a baseline to compare general contractors against each other before working with them. Learn more about how a contractor’s scores are calculated here.

Payment disputes and subcontractor reviews

One way to get a better understanding of how a general contractor treats its subs is by looking at its payment disputes. Disputes can include anything from slow payment reports, threats of liens, and liens filed against projects managed by the contractor.

In the past 12 months, subcontractors have reported slow payments seven times on projects run by Turner Industries. There are no threats of liens or lien filings to mention in that time frame.

While seven reports of slow payment might concern you, understand that Turner Industries manages lots of projects across the nation. A better benchmark might be looking at Turner’s payment performance over the years. In the past 12 months, 100% of projects went off without a payment hitch.

The same goes for 2021 alone, as well as 2020. The year 2019 did see a slight drop, with 98% of projects completed without a payment incident. In 2018, that number was back up at the 100% mark.

Getting paid with Turner Industries

Turner Industries’ payment score and job history are impressive, but everyone knows that construction is a tough and volatile industry. Things happen from time to time. Because the industry can be so unpredictable, it’s important to learn as much as possible about a general contractor’s payment policies before partnering.

Before work starts

Before your portion of the project can start, a big general contractor like Turner Industries will have some specific paperwork that you’ll have to provide. These documents usually include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

Suppliers looking to partner with Turner Industries will also have to complete the supplier registry.

The project manager on your given job site will likely contact you for these documents, as well as any additional items Turner Industries might require.

First payments

Turner Industries has several branches and offices and works on many projects at the same time. Typically, when a GC’s influence and territory grows that much, they prefer to streamline their paperwork system so personnel from every office will be familiar with the documentation process. Industry-standard docs like AIA billing, G702 payment applications, and G703 continuation sheets are usually the preferred methods for billing.

You should also be sure to ask the project manager when payment applications are due each month. Usually, they’re due on the 1st, 5th, 15th, or 20th, but this can fluctuate slightly depending on the job and contractor. Be sure to ask so you don’t miss a window.

Learn more: Pay Applications: What Contractors Need to Know to Get Paid

Progress payments

Turner Industries builds a lot of industrial plants and complexes, and the jobs take years to complete. If you’re subcontracting for Turner, you can’t wait years for the project to wrap up to get paid. For that reason, be sure to use progress payments to keep cash coming in each month.

While you’re sending in your payment application, be sure to include an updated schedule of values to streamline the process.

Project closeout

All general contractors have their own processes and requirements for close-out. However, there are some general documents and processes you expect:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

A word of caution about project closeout: Closeout is an exciting time, as you’ll be receiving your final payments, plus any retainage withheld throughout the project. But be careful of what you’re signing. This is the point where you’re most likely to see a lien waiver or two. Don’t sign any lien waivers for projects that you haven’t been paid for yet. Otherwise, you could be prematurely throwing away your rights to a mechanics lien if a payment dispute occurs.

3 tips to getting paid on every construction project

There are always going to be things that are out of your control, especially in construction. But if you use the following three tips, you’ll be as in control as possible. You’ll also be able to protect your payments and cash flow.

1. Send preliminary notices

You need to be sending a preliminary notice on every one of your projects. In some states, sending these documents is a requirement for maintaining your right to a lien —and in the event of a payment dispute, that’s critical.

But even if the project is in a state that doesn’t require preliminary notices, they’re still a good idea. These documents serve as a professional introduction between your company and the folks writing the checks. If there’s anyone on the job who you want to remember your name, it’s those folks.

2. Visibility matters

Preliminary notices aren’t the only documents that can refresh the minds of a general contractor or accounts payable department. If your invoice is sitting at the bottom of the pile, an invoice reminder is sometimes all it takes to bring it to the top of the heap again. Should that not work, sending a notice of intent to lien or a demand letter might be appropriate.

3. Lien rights need to be a priority

For most subcontractors, the thought of partnering with a bigger GC means company growth and more money. But you need to protect that money on all of your projects, regardless of the size or if you’ve worked that GC before. The best way to protect that money is to know the mechanics lien laws in the states in which you work.

Mechanics liens are tremendously powerful, so states take lien rights very seriously. In fact, a mechanics lien can force the sale of a property, so it’s not a power to be taken lightly. For that reason, most states have stringent rules and requirements surrounding mechanics liens, and ensuring you can file one if you need it means making your lien rights a priority on every job.