A time and materials contract reimburses a contractor for labor hours at a set hourly wage and the cost of materials.

Unlike a fixed-price contract, which has a predetermined value before a job begins, a time and materials contract has a variable cost that shifts with the actual labor hours incurred and materials purchased.

While these contracts are important for jobs that have an unclear scope of work, they can involve significant risk for property owners. Understanding the advantages and disadvantages of this type of contract is crucial for anyone involved in construction, so read on for everything you need to know.

What is a time and materials contract?

A time and materials contract, also known as a T&M contract, is a type of construction contract that pays a contractor at a set rate for the actual work performed and materials purchased.

With a T&M contract, a contractor will typically provide an estimate for the number of hours the job will take, the hourly wage for labor, and the estimated cost of materials. As the job progresses, the contractor bills for the hours of work incurred as well as the materials they purchase for the job.

Often, a time and materials contract will include a maximum cost, also called a “not-to-exceed” clause, which ensures the customer knows the upper limit of the project cost.

We’ve created a free downloadable time and materials template that you can reference to understand the crucial elements for this type and contract.

Free download:

Time and materials vs. fixed-priced contract

A time and materials contract is very different from a fixed-price contract, also called a lump sum contract.

| Time and materials contract | Fixed-price contract | |

|---|---|---|

| Definition | Contractor is paid for labor hours incurred and materials purchased for a project | Contractor receives a predetermined value for the contract regardless of actual labor and materials costs |

| Usage | Commonly used for projects with an unclear scope | Most common type of construction contract |

| Benefits | Protects contractors against jobs where the amount of work needed is unclear | Provides incentives for contractors to perform work efficiently |

| Risks | Owners face uncertainty in total job costs unless a maximum price point is set | Contractors face risks when labor or materials costs rise after signing contract |

Fixed-price contracts, which are the most common type of construction contract, set a predetermined cost for the entirety of a project, including labor, materials, overhead, and profit. Contractors typically use fixed-price contracts in situations with a clearly defined scope of work.

On the other hand, time and materials contracts do not have a set cost but rather reimburse contractors for labor at an hourly rate and for materials—usually at cost. Time and materials contracts are less common, but they are helpful for projects without a well-defined scope of work. Notably, government projects only allow for time and materials contracts when contractors demonstrate that the scope cannot be clearly determined ahead of time.

How time and materials contracts work

Time and materials contracts provide reimbursement for both labor and materials, but it’s important for contractors to understand exactly how to calculate their fees when signing this type of contract.

Notably, the hourly rate included in a T&M contract is called a loaded labor rate, which includes both the labor costs as well as overhead, general and administrative (G&A) expenses, and profit.

For construction businesses, revenue come directly from projects, but running a business has costs that aren’t directly tied to a single project—like insurance, office space, software, administrative employees, and more. For that reason, a time and materials contract needs to bill at an hourly rate that includes all of the other costs of doing business. After adding in profit, you arrive at the loaded labor rate.

Here’s how to calculate your loaded labor rate:

- First, determine your base labor rate, which is the amount you pay your employees on the job site. For example, you may compensate your workers at a rate of $50 per hour.

- Next, calculate your overhead and administrative costs, then divide them by the total number of labor hours. For example, if your business has $250,000 of annual overhead and performs 10,000 hours of work each year, you’ll need to add $25 to your base rate of $50.

- Finally, multiply to account for your profit margin. For example, if you want a 15 percent profit margin, you’d use the following calculation (75 x 1.15)—which adds 15 percent on top of your base labor rate and overhead costs.

In this example, your T&M contract would list $86.25 as the loaded labor rate, which you’d receive for each hour of work incurred.

Beyond labor costs, a time and materials contract will also typically include an estimate for the number of hours as well as a maximum price, which will not be exceeded by the contractor.

Finally, a T&M contract lays out the expected costs for materials, including costs for transportation and taxes. In some cases, materials also include a markup of 10 to 30 percent. However, contractors typically see their profit from billing for labor hours rather than material costs.

Advantages and disadvantages of T&M contracts

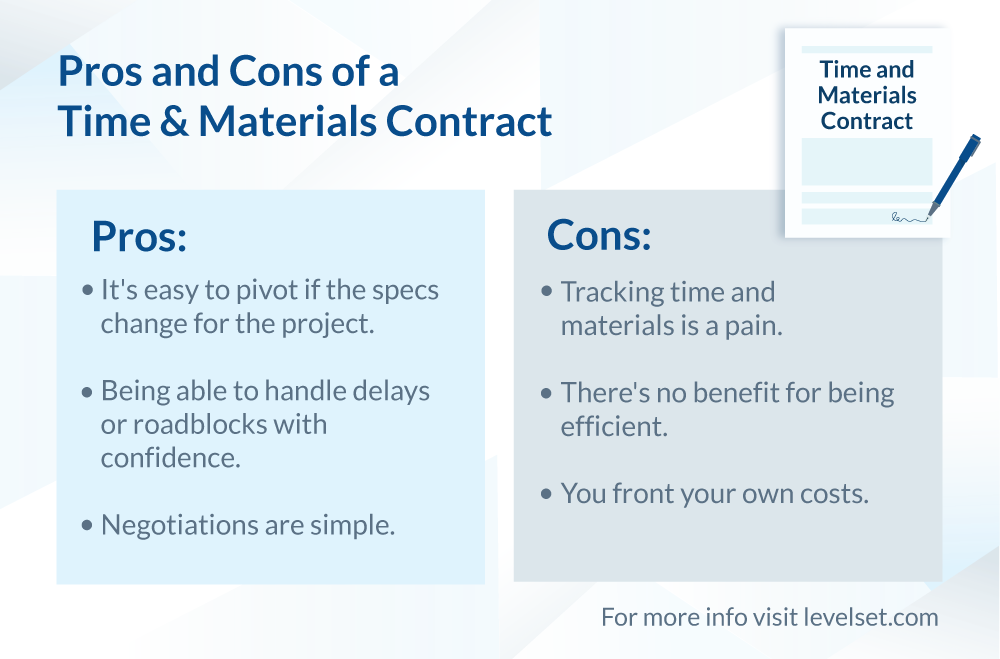

As with all construction contract types, there are both advantages and disadvantages to time and materials contracts—for both property owners and contractors.

Advantages

- Can often simplify negotiations due to the simplicity of the contract

- Contractors are generally in a better position to handle changes in costs or project scope

Disadvantages

- Property owners face uncertain costs and must mitigate risk by including a maximum price

- Contractors may have less incentive to perform work efficiently

The bottom line on time and materials contracts

Time and materials contracts serve an important function in the construction industry, enabling projects to get off the ground quickly with fewer negotiations and the ability to agilely deal with roadblocks and scope changes. However, contractors and property owners need to be aware of the risks associated with using this type of contract.

Consider which contract type may be most beneficial for your project by learning more about each one: