Lien waivers seem simple, but they can quickly become complex. Texas, in particular, is notoriously strict when it comes to lien waivers. Getting a lien waiver right can mean the difference between payment and non-payment, so be sure to avoid these common mistakes on Texas lien waivers.

For a deep dive on Texas lien waivers:

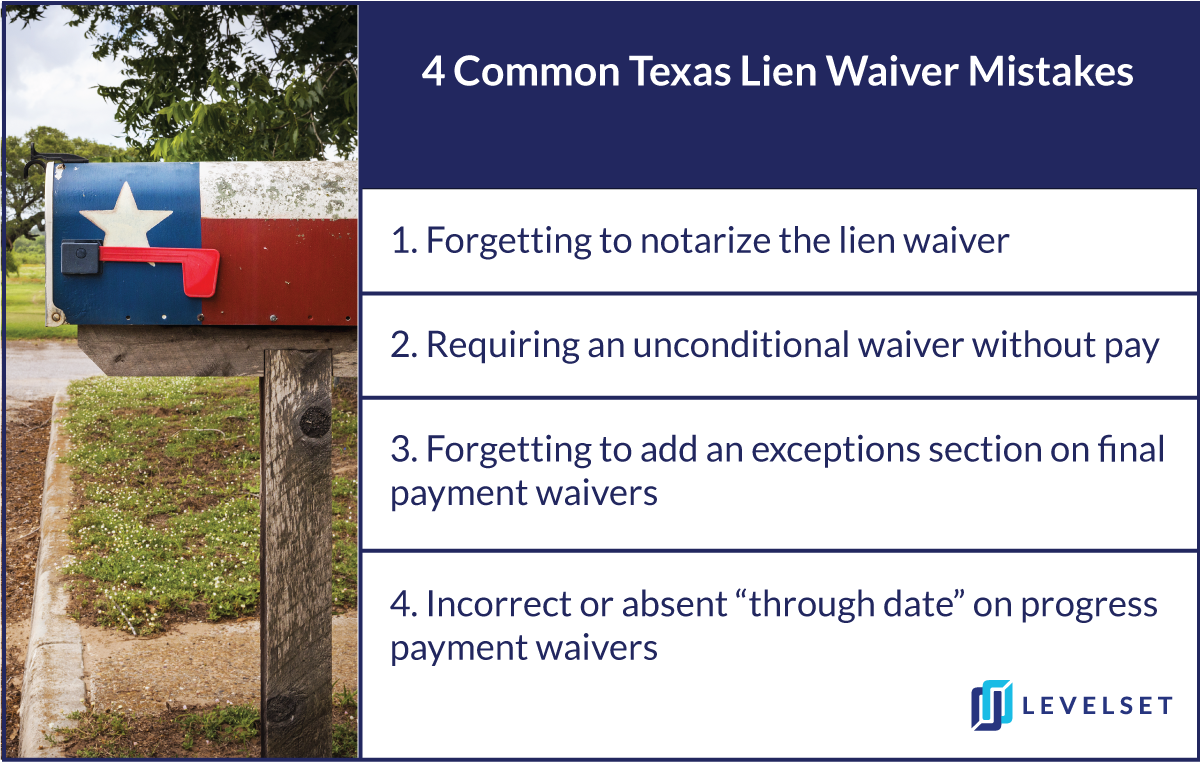

1. Forgetting to notarize the lien waiver*

Texas is one of the twelve states that provide statutory lien waiver forms, and it’s also only one of three states that require lien waivers to be notarized. According to Texas Property Code §53.281(b), a lien waiver is effective only if it’s been signed by the claimant and notarized. Failure to get a notary stamp on a Texas lien waiver is a quick and easy way to have it deemed invalid.

An important aside regarding out-of-state contractors. An out-of-state notary is able to notarize a Texas lien waiver, but they are bound by the licensing jurisdiction. This means that they can only notarize the waiver in the geographic region in which they are licensed. Out-of-state notaries will not be able to notarize a lien waiver in the state of Texas.

* Note: On projects started on or after 1/1/22, Texas lien waivers will no longer require notarization.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

2. Requiring an unconditional waiver without pay

Texas statute explicitly condemns this practice. When Texas overhauled the lien waiver statutes, legislators drafted the lien waivers to be as fair as possible to all parties involved. Texas Prop. Code §53.283. The section states that:

“a person may not require a claimant to execute an unconditional waiver unless the claimant received payment in that amount in good and sufficient funds.”

These lien waivers are binding documents and forcing a claimant to sign an unconditional waiver, can lead to problems. So much so that the Texas legislature requires similar language in the notice at the very top of the document in large type. This notice states that:

“This document waives rights unconditionally and states that you have been paid for giving up these rights. It is prohibited for a person to require you to sign this document if you have not been paid the amount set forth below. If you have not been paid, use a conditional release form.”

As such, requiring someone to sign without pay might not only invalidate the waiver itself but could also open them up to liability for misrepresentation or fraud; as well as potential actions against their construction license.

3. Forgetting to add an exceptions section on final payment waivers

Between pending change orders and retainage, there may very well be amounts outstanding when asked to sign a lien waiver. There is a specific statement provided on Texas progress payment waivers that automatically exclude certain payments and rights. The statement covers unpaid retention, pending modifications, and changes, or other items furnished.

However, when it comes to final payments, this language isn’t included. The form states that the waiver releases any mechanics lien rights and claims for payment on the project. If there are any outstanding payments or claims that the lienor wants to exclude, there should be some mention of it. Lienors should be sure that they’re excluding these payments from the scope of the waiver.

4. Incorrect or absent “through date” on progress payment waivers

This is a particular issue for progress payment waivers. It’s essential to determine which rights are actually being waived. When a progress waiver is signed, the claimant waives lien rights for work and materials furnished up until this specific date.

This is not the date the lien waiver was signed; nor is it the date on the check. This is the last day that payment is intended to cover in exchange for the waiver. Be cautious when filling out this section. Once rights are waived, there’s no going back. Providing the wrong date, or worse yet, leaving it blank, might result in waiving rights to payment of any work or unapproved change orders between the invoice date and the lien waiver date.

Bottom line

Texas is notably strict when it comes to lien waivers. But at the end of the day, everyone just wants to get paid what they’ve earned – and properly utilizing lien waivers is an invaluable way to ensure payment. Given how important they are, be sure that you don’t commit one of these mistakes. A single mistake on a Texas lien waiver can cost millions; just ask Zachry Construction!

Texas lien waiver form guides:

- Conditional Progress Waivers- Texas

- Conditional Final Waivers- Texas

- Unconditional Progress Waivers- Texas

- Unconditional Final Waivers- Texas