If you’re working on a private construction project in Texas, it’s extremely likely that you must deliver some type of construction notice to preserve your mechanics lien rights. But the Texas notice scheme is extremely unique. It is unlike any other construction notice requirements in the United States. And, unfortunately, the Texas notice process can be confusing and stressful to manage.

It is apparent that Texas’ laws are clearly the most clumsy in the nation, and unfortunately, the confusion is simply the victim of very poor drafting by the Texas legislators. We can all cross our fingers that the state will one day clean up the mess — there have been lots of attempts over the years. For now, though, contractors and suppliers must comply with the existing rules.

This post has everything you need to master these notice requirements. This post — written for contractors and suppliers — provides a step-by-step guide to the Texas Monthly Notice requirements, including whether you need to send it (i.e. the rules & exceptions), how to prepare your notice forms, how to send the notices, and what best practices to follow. Read on to learn what you need to get Texas’ notices right.

What is a “Texas Monthly Notice”?

Texas contractors and suppliers must navigate a lot of different “notice” forms and requirements. The most popular and confusing of them is the “monthly notice” requirement. This notice goes by a lot of different names, including a Notice of Non-Payment, Funds Trapping Notice, Preliminary Notice, Lien Notice, Pre-Lien Notice, and Notice of Intent to Lien. Further, since the “Monthly Notice” is sent monthly, they are also sometimes referred to by the delivery month, such as the “Second Month Notice” or “Third Month Notice.”

We’re going to call them the “Monthly Notice.“

In Texas, all subcontractors and suppliers must send the “Monthly Notice” to protect their lien rights on the job. In order to keep the right to file a Texas mechanics lien, contractors and suppliers must send a lien notice for each month of work they perform that goes unpaid.

What does a “Texas Monthly Notice” do?

The Texas Monthly Notice gives the property owner notice that they owe you money on the job. You send the notice only after you have been unpaid for your work for some time. Though the notice does not threaten a lien filing, it does give warning to the owner that you have not been paid, that your amounts are (likely) overdue, and that a lien could be filed. Naturally, therefore, these notices get the property owner’s attention.

A unique feature of these notices is that you may be need to send the notice multiple times. This can happen for two reasons:

- You are a lower-tiered party and must send double-notice; or

- They don’t pay you for work that spans across multiple calendar months – as you need to send separate notice for each month of work.

This means that, on an extended project, a company may need to send a large volume of notices. What complicates things further, in the context of the confusingly drafted Texas statutes, is that some parties that need to send more than one notice for each month – and potentially, they may need to send those notices in different months.

All project stakeholders will find our Texas Monthly Notice Deadlines, Resources & FAQs helpful to better understand the notice rules & laws in Texas. We wrote this post specifically for contractors and suppliers who wish to protect their lien rights on a Texas job. This is a step-by-step guide on how to prepare and send the Texas Monthly Notices.

Step 1: Determine which types of Texas notices you need to send

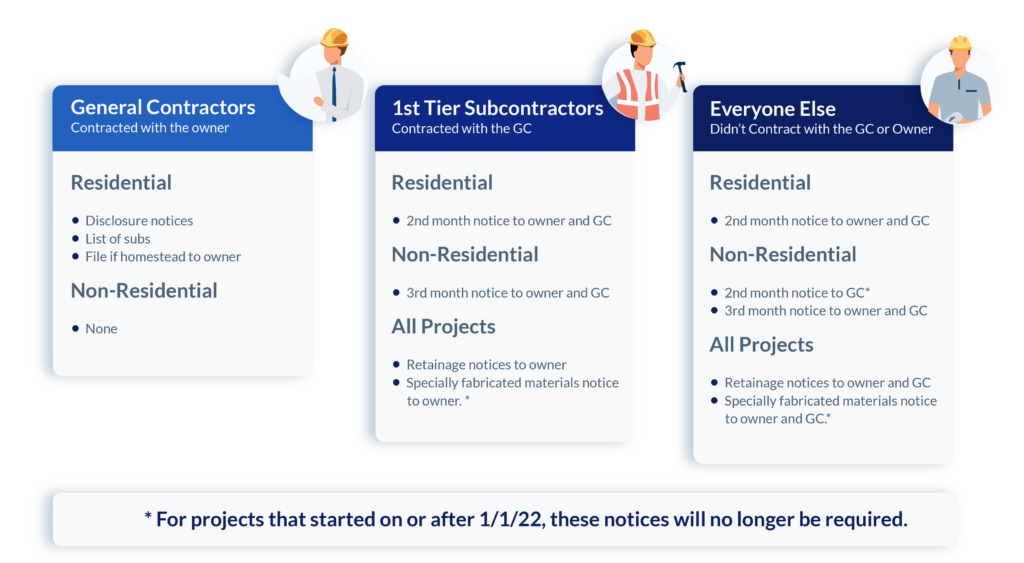

The specific Texas notice requirements that apply to you depend on where you are in the payment chain, and what type of project you’re working on. It may look intimidating but is quite simple. Pick your role, and look at the items under your job type — which is either “residential” or “not residential.”

Monthly Notice requirements

This post is mostly about the Texas Monthly Notice requirement, although there are other specialty notices in Texas. Before getting to those other notices, let’s examine the monthly notice requirement. Looking at the infographic above, ask yourself these questions:

- Are you a general contractor? If so, you may have some other notice requirements (which are discussed below), but you do not have any monthly notice requirements.

- Did the GC hire you? If so, you are a “1st tier subcontractor.” You need to send one monthly notice. If you’re on a residential project, the monthly notice is due in the 2nd month, and if you’re on a non-residential project, it’s due in the third month.

- Are you a lower-tier party? If so, you have the most burdensome monthly notice requirements. On residential jobs, you only have one monthly notice due in the 2nd month. But on non-residential projects, you need to send a monthly notice in the 2nd month and the 3rd month.*

*Note: On all projects started on or after 1/1/22, the 2nd-month notice will no longer be required on non-residential projects.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

Other Texas notices

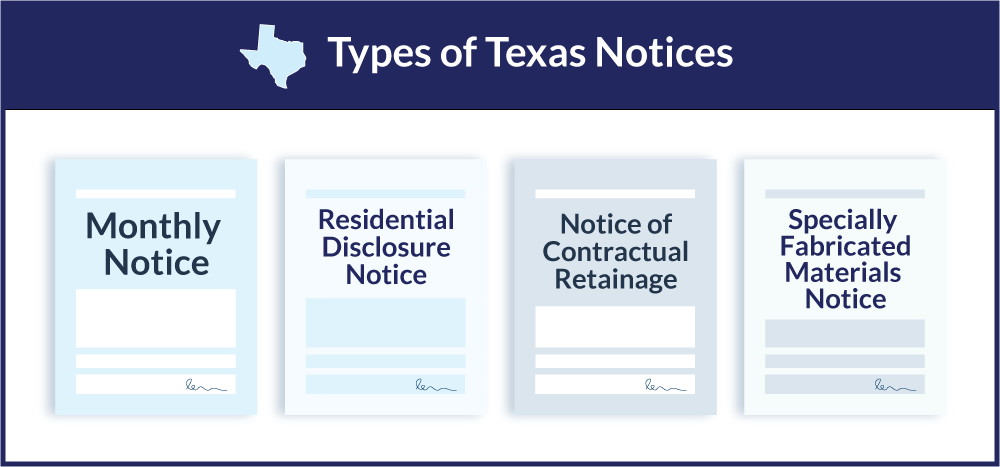

There are other notices that you might need to send in Texas. The timing and delivery methods of these notices are simpler than the monthly notice requirement, and therefore, we won’t spend much time on them here. However, here is a breakdown of the 3 other notices in Texas:

Residential Disclosure Notice: In Texas, a general contractor is generally not required to give any preliminary notice. However, when a project is residential, a GC must provide a Residential Disclosure Statement. Before a residential construction contract in Texas, the original contractor must deliver a disclosure statement to the property owner. The disclosure statement includes an overview of some of the owner’s rights, responsibilities, and risks in this transaction.

Notice of Contractual Retainage*: To protect the right to file a lien against the contractual retainage withheld on a contract, a Texas contractor must send a Notice of Contractual Retainage. You must send this Texas Notice of Contract Retainage to the owner, or the original contractor (depending on your role) within either (1) 30 days after the contract providing for retainage is completed, terminated or abandoned, or (2) 30 days after the original contract is terminated or abandoned; whichever is earlier. See here for more about how Contractual Retainage Notices are different from monthly notices.

*Note: On all projects started on or after 1/1/22, the title and form of this notice will change to a Notice of Claim for Unpaid Retainage.

Specially Fabricated Materials Notice: If you are providing materials that are specifically fabricated and made for the project, then you’ll need to serve a specific notice for this. Under the Texas Property Code Section 53.0231(a), a person who specially fabricates materials that are unsuitable for use on other projects is entitled to lien, even if the materials are never delivered to the site (i.e. the contract is canceled). To preserve this right, however, suppliers must send a Notice of Specially Fabricated Materials after executing their material contract.

*Note: On all projects started on or after 1/1/22, the Notice of Specially Fabricated Materials will no longer be required to secure lien rights.

Texas Monthly Notices on public jobs

The above monthly notices refer to “Residential” and “Non-Residential” projects, but what about public jobs? By the term “public jobs,” we mean state, county, city, municipal projects (not federal projects, which are all governed by the Miller Act). In Texas, the “monthly notice” scheme repeats on its public works, too. Complying with the notice requirements is mandatory to have bond claim rights on the job.

For parties who don’t have a contract with the prime contractor on a project, they must send a notice (and they must send it in a way that is very similar to the notice requirements on Texas private projects). These notice requirements only apply to those who are not under direct contract with the prime contractor (i.e. a sub-subcontractor or a supplier to a subcontractor).

For those that must send these notices, the notices are “2nd Month Notices,” in that they must send the notice no later than the 15th day of the 2nd month after each month in which labor was performed or material was delivered and the claimant went unpaid. The requirements for such a notice can be found in Sec. 2253.047(c) of the Texas Little Miller Act. You can also learn about them on our Texas Monthly Notices FAQs page, or learn more about Bond Claims in Texas on our Texas Public Project Bond Claims FAQs page. You can use the deadline chart above to figure out the “2nd-month notice” deadline.

Now, technically – a 3rd-month “notice” is necessary as well. However, this notice actually serves as the bond claim itself.

Step 2: Review your unpaid invoices each month

Now you know which Texas notices you need. The next step is managing when you need to send those notices. This is the most burdensome element of the Texas notice scheme because it requires you to review your invoices each and every month and to trigger notices every time invoices go unpaid for too long. It’s also where contractors and suppliers make common mistakes in managing the lien & notice process.

The statutory text reads that notices are due “on the 15th day of the month two [or three] months after the month the unpaid work was performed.” Oh my god, stop the nonsense! This language is impossible.

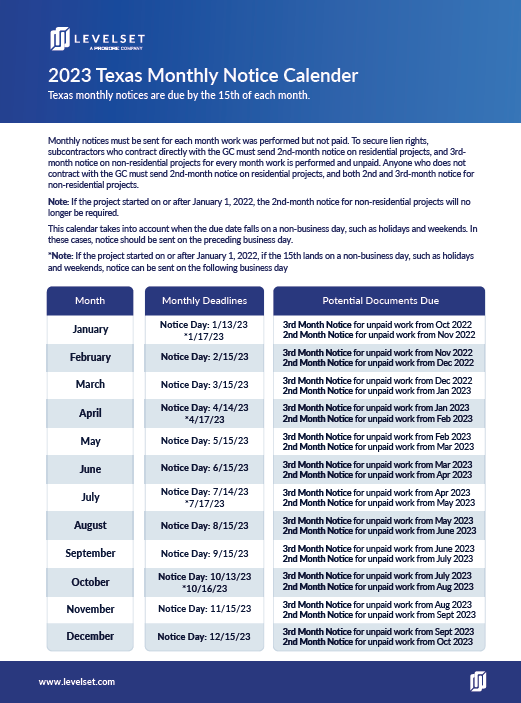

Download the 2023 Texas Monthly Notice Calendar

This calendar takes the guesswork out of calculating the deadline for your Texas monthly notices. We update it annually.

Download the calendarThe Best Practice for you is to start each month by reviewing all open and unpaid invoices. Look at this chart and see which monthly notice(s) will be due in that month, and then determine whether you have any unpaid invoices that would trigger your monthly notice.

For example, if you’re looking at this chart at the beginning of August, you’ll notice that the “2nd Month Notice” due in August is for invoices due from June and that the “3rd Month Notice” due in August is for invoices due from May. So, if you have any open invoices from May, you need to send your 3rd Month Notice. If you have any open invoices from June, you need to send your 2nd Month Notice.

Holidays mean your deadline is EARLIER*

The Texas mechanics lien laws require all of these monthly notices to be sent by the “15th of the month.” But, what happens when the 15th falls on a holiday or a weekend? The clear answer here is that you need to send your notice earlier.

As such, while the law always talks about the “15th,” the deadline is only occasionally the 15th. It’s usually earlier! You can get the exact date by reviewing our notice calendar, above.

*Note: On all new projects started on or after 1/1/22, if the deadline lands on a weekend or legal holiday, the deadline will be pushed to the following business day.

It doesn’t matter if you’re in a dispute, if the debt is due, etc.

You only send the Texas Monthly Notices a payment has not been made, but that doesn’t necessarily mean the payment is due. This causes a problem if payment is behind schedule and there aren’t any disputes, or worse when you’re just working with long payment terms. It’s no secret, after all, that slow payment is a common problem in construction. The Texas 2nd month notices are actually due before the average time for payment in construction!

You may find yourself walking on eggshells with these notices. Since the notices indicate “non-payment” and you send them to the property owner, some see them as a bit adversarial. Since all Texas notices are due on the 15th day of each month, it’s common for construction pay applications to get approved and for money to flood in on the 14th or 15th of the month, putting administrators, credit teams, contractors, and others in a time crunch to determine who should get the notice and getting the notice(s) out of the door.

But, one key thing to remember is that your lien rights depend on this notice going out. The money doesn’t have to be due, in dispute, or otherwise…it just has to be unpaid.

Step 3: Prepare your Texas Monthly Notice form

Now it’s time to prepare your monthly notice forms. For as many crazy rules that the State of Texas has in their mechanic’s lien and notice scheme, it’s surprising how little guidance there is about the notice forms and documents themselves. Texas Property Code §53-056(b) is as detailed as we get, and it simply says:

…must give…written notice of the unpaid balance…

When it comes to the contents of your Texas Monthly Notice forms, therefore, there is a lot of flexibility. And, in fact, it’s possible that instead of preparing a formal notice, you could actually just send a copy of your statement or billing in the usual and customary form.

Nevertheless, it’s a good idea and a best practice to clearly communicate about the debt, the project, and the laws that apply to your Texas Monthly Notice. You don’t want to be in a situation where you’re wondering (or fighting about) whether the notice was sufficient or not.

Here are Free Downloads for Texas Monthly Notice Forms. Construction attorneys and payment experts prepare these forms, and they stand the test of tens of thousands of uses:

- Texas 2nd Month Notice Form (Non-Residential)*

- TX 3rd Month Notice Form (Non-Residential)

- Texas Monthly Notice (Residential)

*Note: On all projects started on or after 1/1/22, this 2nd-month notice on non-residential projects will no longer be required.

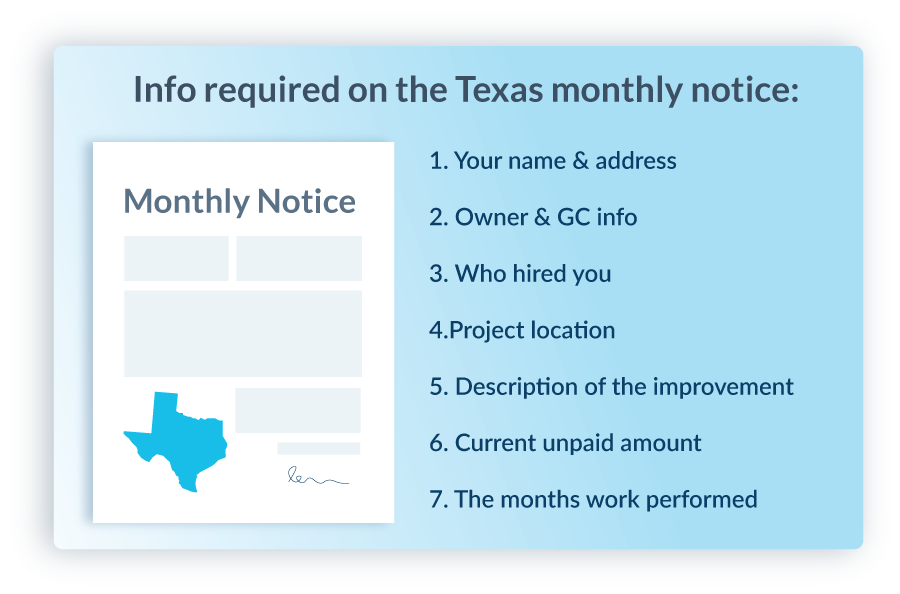

These forms require that you provide the following information:

- Your name & address: You need to identify yourself so that the receiving party knows who is owed the money, and who has the right to file a mechanics lien if unpaid;

- Owner & GC Info: Name & Address of the project’s (i) Property Owner; and (ii) General contractor;

- Who Hired You: Provide the name and address of the party that hired you. This may be the same as the general contractor, or not;

- Project Location: Identify the property and job location. Be as detailed and specific as possible. What if there are multiple APNs or multiple properties? See answer here;

- Description of the Improvement: Describe the work that is being done on the property. For example, if you’re building a school gym, you would say, “School gym;”

- Amount Currently Unpaid: Provide – in dollars – how much money is unpaid for work or materials you’ve already provided to the job;

- Identify Months Work Performed: For all the work that has not yet been paid for, list out the month or months when that work was provided to the job.

Step 4: Send your Monthly Notices & track delivery

After preparing your notices, you need to make sure that you properly send them to the right people.

Who needs to receive a Texas Monthly Notice?

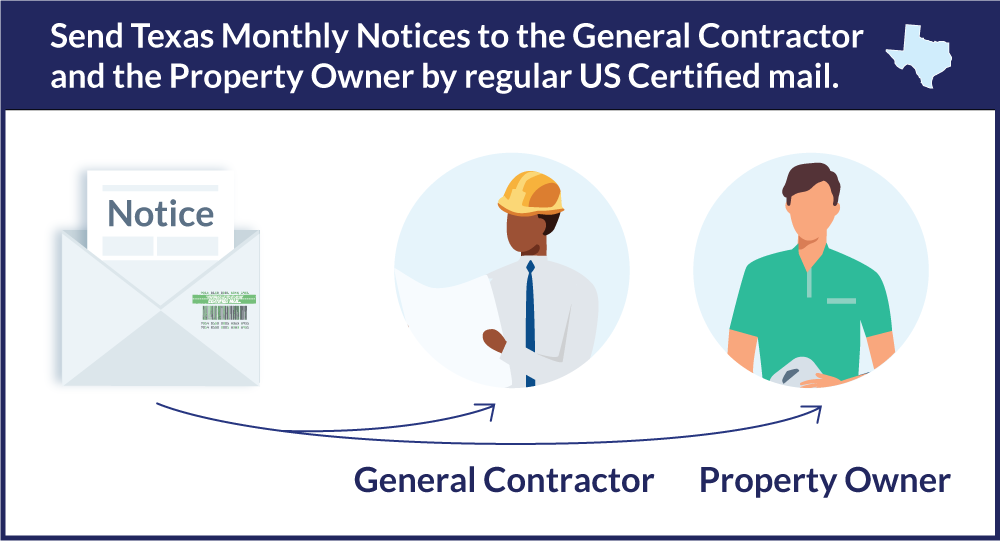

Generally speaking, you need to send almost all of the Texas Monthly Notices to both the project’s general contractor and the property owner. If you’re sending a 2nd Month or a 3rd-month notice, therefore, and want to make sure you’re doing it right, then send these notices to the property owner and the general contractor.

There is an exception. For parties who did not contract with the general contractor (i.e. sub-tiers), they only need to send the 2nd Month Notice to the general contractor, and not the property owner*. Accordingly, for this single specific notice, in this single specific circumstance, the required notice needs only go to the GC. If your notice qualifies, you may want to do this to save money on mailing, and also to give the general contractor one additional chance to make payment before escalating the problem to the owner (i.e. the GC’s customer).

*Note: On all projects started on or after 1/1/22, the 2nd-month notice will no longer be required on non-residential projects.

How you must send the Texas monthly notices

You should send your Texas Monthly Notices by regular US Certified mail. This method of delivery in Texas construction law is mandatory, which says that you can send notices via “certified mail.” Though it’s common to also pay for “return receipt requested”, this is not necessary. Learn about the differences in mail types and how they meet or don’t meet requirements here: Construction Preliminary Notice Delivery Methods.

It’s important to note that just putting the notice into the mail satisfies the requirements and “constitutes compliance with the notice requirement.” Therefore, you don’t have to worry about your notices not being received by the deadline (i.e. 15th). It’s good enough if you mail them before the deadline.

Also, even if you mail it incorrectly or otherwise make a mistake, if the party actually receives the notice, you cure the mistake. As per the Texas statute, “[i]f a written notice is received by the person entitled to receive it, the method by which the notice was delivered is immaterial.”

Keep evidence of mailing

Since it is the mailing of the notice that is most important, you want to make and keep evidence of your mailing the notice documents. One good way to do this is to execute an Affidavit of Mailing at the time of mailing.

Once you put this notice in the mail, you’ve completed all the requirements! Nice job. Keep an eye on your mailbox to make sure the delivery isn’t returned undeliverable for some reason. There are a few reasons why mail can be returned without delivery, and some of those reasons can be harmful to your lien rights.

Why should you send Texas Monthly Notices?

Managing Texas notice requirements can be a serious hassle. And then, when you actually do send out your notices, you may ruffle some feathers and even upset your customers. So, why should you even bother?

1. Protect your ability to file a mechanics lien

The top reason why you should send Texas monthly notices and manage this process is that it’s required to protect your mechanic’s lien rights. You can’t always predict which jobs and which contractors will give you payment headaches, or will stiff you on a job. You can’t easily predict bankruptcies and other project failures. The mechanic’s lien right could save you in a bad situation, and can even save your business. You definitely don’t want to be in the situation of needing to file a mechanics lien, but not having the right.

And that’s why you need to manage his Texas notice process. Without compliance, you’re without lien rights. And that’s just too risky.

2. You’ll get your money faster

Having a well-oiled Texas notice process will get your company consistently paid faster. This happens because of three reasons.

First, the notice lets project leaders know that you’re on the job and that you have outstanding invoices. Usually, general contractors, property owners, construction lenders, sureties, and other critical job participants don’t know this. They don’t know who you are and they don’t know you’re unpaid! Giving them this heads-up will result in them working to get your money through the system.

Second, the recipient will prioritize your invoices. Since you protected your lien rights and notified everyone, your invoices will jump to the top of the pile and get paid first.

Third, you’ll benefit from having a consistent, sophisticated collections process. The Texas Monthly Notice process can take the place of your invoice reminders, dunning letters, demand letters, collection calls, and more. You’ll pretty much be able to completely automate this, and it will result in you getting paid faster, and faster, and faster.

Discover how a Texas supplier cut their payment collection time in half after using software to send monthly notices.

3. You can make it easy & fast

The third reason why you should send Texas monthly notices is that it isn’t as hard as it looks!

You may be wondering here: how can you possibly keep track of these Texas notice requirements? The answer is that you absolutely need some type of system to help you track this stuff. It can’t be done with memory or paper, especially when you’re juggling multiple projects in the state. Thousands of Texas contractors and suppliers rely on Levelset to make the Texas notice process easier.

Common questions & issues when sending Texas Monthly Notices

The above guide provides you with step-by-step guidance on how to prepare & send Texas monthly notices. However, as you go through the Texas notice process, you’re likely to encounter issues or questions. Here are some common questions and issues that arise when sending Texas notices, as seen on our Expert Center, where Texas construction attorneys and payment experts answer people’s questions about Texas Monthly Notices.

The timing of Texas Notices — When work done/materials shipped, or invoiced?

You need to count from the month when you did work to calculate the Texas notice deadlines. The Texas rules talk about work in “calendar months,” but of course, projects don’t cleanly operate according to calendar months. Contractors and suppliers that work on or provide to jobs across different months, and then invoice. What happens when you work in one month, but invoice in the next? Or when you can’t even figure out whether you did work on the 30th day of one month or the 1st of the next?!

That was the subject of this question: How to handle Texas monthly notices if you invoice months before you ship? In this case, the invoices were actually months before the materials were ever shipped. The invoice could be quite overdue, but is a notice not necessary because the materials didn’t ship yet? The answer here explains that these nuances make calculating the timeframes even more difficult. Invoices “provide a strong marker for when notices might be required…[b]ut, ultimately, Texas monthly notices are based on months when work is performed but not paid for. So, for suppliers, the “work” being furnished is materials being delivered to the job site.”

The answer is the same regardless of whether the invoice is before the delivery of materials, or after. Or before the performance, or after. Or when an invoice includes materials/work that cuts across multiple months. The way that Texas laws work is that it is the work/materials itself that matter and when they were provided. The invoice date may help you keep track of this, but when push comes to shove, it’s got to line up with the work.

Should you send an invoice or billing item with the Texas Monthly Notice?

Texas is not very picky about what a Texas monthly notice must contain or include. The contents of the notice are pretty unregulated, and in fact, you may be able to not send any notice at all and just send a copy of your invoice! This is what led someone to ask on our Expert Center whether they were required to send their invoice with the Texas monthly notice, or whether they should.

The law requiring notice states “A copy of the statement or billing in the usual and customary form is sufficient as notice under this section.” However, as pointed out in the expert answer, “These sections do not state that a statement, billing, or invoice must be included when notice is sent. Rather, they state that a copy of the statement, billing, or invoice may be sent in place of monthly notice.”

What if payment is overdue & a lien is needed before the notice deadline?

An interesting question came across the Expert Center. The asker was wondering whether they could file a mechanics lien before any notice deadline was due. Practically speaking, this could happen on a very short job, or if you aren’t willing to compromise and wait past your standard payment terms. The question on the Expert Center asked this: Can a lien in Texas be filed before a preliminary notice is required? Can a lien be filed in month 1 when the notice is due in month 2?

Generally speaking here, this presents a practical “hmmm, I’m not sure”. Technically speaking, it’s not prohibited, but practically speaking, since the cost of sending a notice is so low, it’s not something you’d want to test out. Plus, as mentioned by one of the expert answers, you may be able to receive payment without the more expensive, complicated, and adversarial mechanic’s lien.