When you take on a new contract, the goal is always to align yourself with a like-minded general contractor. You’re hoping they value their work, appreciate their customer, and treat their subs fairly. But sometimes, you end up in a situation with a contractor refusing to pay for your work.

But you’re not alone. For every fast-paying contractor out there, there are just as many wallets welded shut. Levelset wants to help. We’ll show you what subs and suppliers can do when a contractor is refusing to pay. We’ll also go over why they might be reluctant to cut a check and how you can avoid payment issues moving forward.

Reasons why a contractor might be refusing to pay

Before we go too far, it’s important to understand the general contractor’s perspective — even if it is totally off-base. There are reasons why a contractor feels completely justified in holding back a check — and some circumstances that aren’t the contractor’s fault at all.

They aren’t getting paid

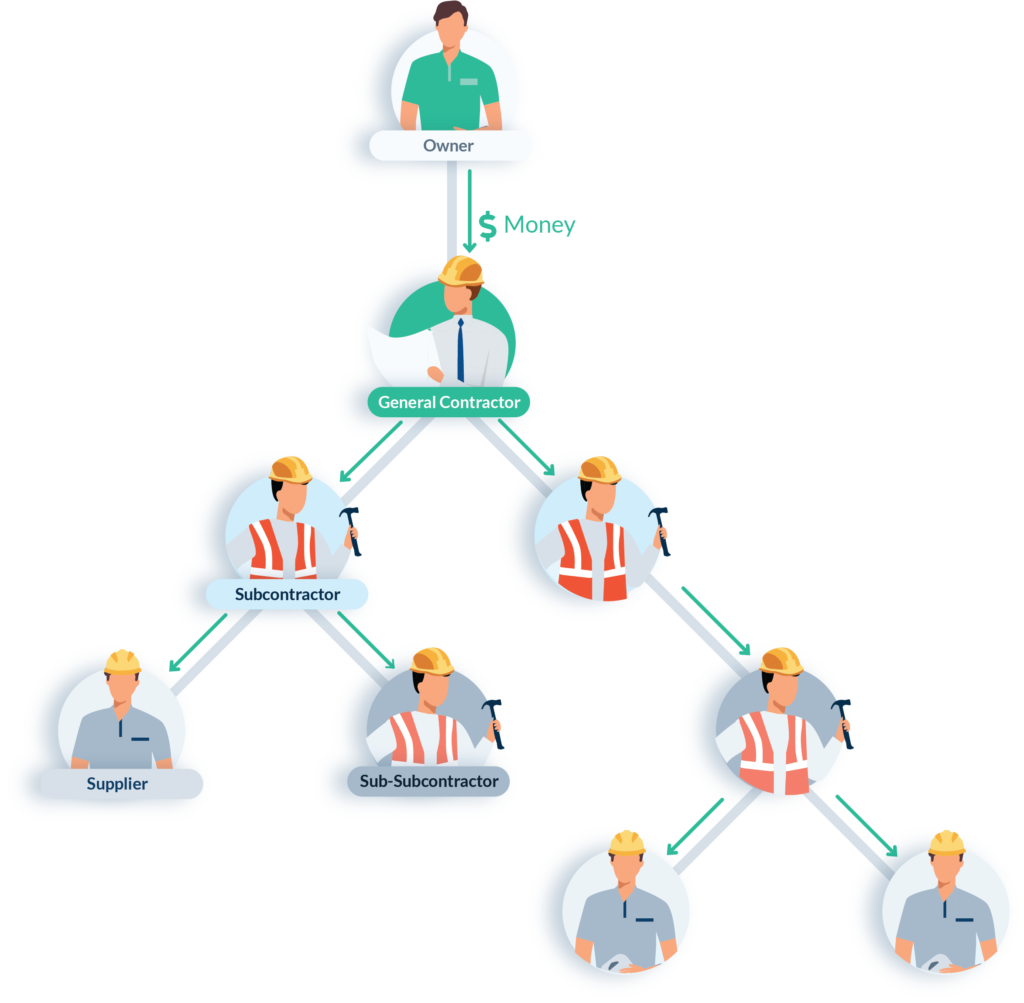

Most contractors don’t want to cut a check until they know they’re getting paid. If the property owner or company isn’t paying the contractor, the subcontractors down the line will probably pay the price.

This is true even if you signed a contract with the prime contractor and not the property owner. Is it right? Not really, as a deal is a deal. But is it a common issue on a lot of construction projects? Absolutely.

In fact, many contractors will use pay-when-paid clauses in their subcontracts, which leads subs to believe they’re only going to get paid once the prime sees some cash. But in fact, pay-when-paid statutes are in place to establish a reasonable timeframe for payment once the contractor receives payment. They’re not designed to protect the GC from non-payment. This one point can be misleading and cost subs a lot of time and money.

Further reading: Pay-When-Paid vs Pay-If-Paid: Contingent Payment Clauses Explained

Workmanship problems

If there are issues with your workmanship — or the workmanship of another contractor on the job site — watch out. A contractor might refuse to make any payments until the issue is resolved.

The issue doesn’t even have to be your own fault: For instance, say you’re a sub-sub. The sub who hired you runs a poorly managed crew of less than skilled workers. If there are workmanship issues with their work, the GC might hold back their payment. Without that cash, they won’t be paying you for your work, either.

Let’s look down the payment chain, as well. Say you were in a pinch and had to hire a sub-sub that you’ve never worked with before, and they end up performing shoddy work. The GC wants you to get them to fix it. How does he twist your arm? By holding back your cash until you get it straightened out.

Again, is this fair? No, and in many cases, it’s legally disallowed. But it happens, and subcontractors need to be aware of it.

They don’t know you’re expecting to get paid

If a GC doesn’t know you need to get paid, then you can rest assured that there won’t be a check coming your way. On a big project, this is entirely too common.

On a large-scale project, there are a lot of moving parts. To help streamline the payment process, the GC will usually put together some guidelines for getting paid. They’ll have certain documents they require, like schedules of values, payment applications, particular compliances, and other documents. They’ll also have deadlines, typically monthly, by which you need to submit those documents.

And on some projects, a GC could be juggling 30 or 40 subs. Do you think they’ll notice if one subcontractor’s payment application is missing? Probably not. Make sure you’re not that sub.

Learn more: Pay Applications: What Contractors Need to Know to Get Paid

They’re shoring up their bottom line

We all know construction can be tough, and margins can be tight. General contractors struggle with the same issues as the rest of a project’s participants. As their bottom line gets tighter and tighter, you can almost bet the payments will get slower and slower.

A little bit of extra cash in the bank can go a long way to keeping a GC afloat. If they need some reassurance, there’s no better way to get it than by holding on to the checks for a few extra days (or weeks) until they can get past a rough patch, make payroll, or bankroll another job.

How to prequalify potential contractors

Knowing why a contractor is refusing to pay might not make a bit of difference to a subcontractor waiting for a check. It’s far better to avoid a payment problem altogether. Easier said than done, right? Not necessarily. A little prequalification might be all it takes.

Some subs don’t view general contractors as customers or clients, but there isn’t much difference between a hiring GC and a homeowner hiring you for a renovation. They’re both entering into an agreement to pay you for your services and expertise. You vet your customers, don’t you? You should be vetting your GCs as well.

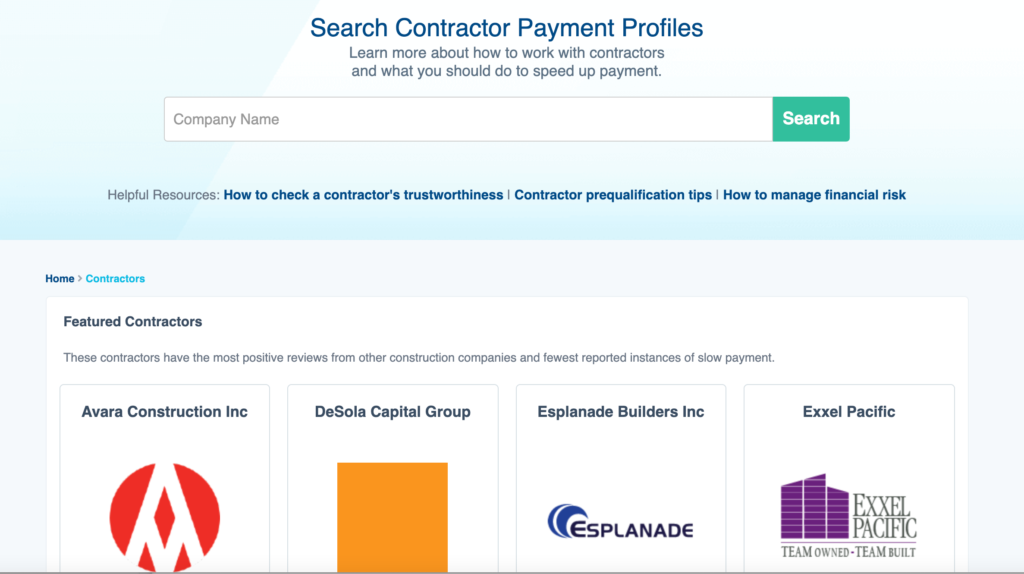

Check Levelset’s Payment Profiles

One of the best ways to prequalify a contractor is to use Levelset’s Payment Profiles.

These reports compile data from all of a GC’s projects, including the liens filed, the liens threatened, and slow payments. This data typically comes from the GC’s other subcontractors, so it’s as close to the source as you can get.

Check their credit

You might also consider digging into a GC’s credit history so you know what you’re getting into. Between the credit check and the Payment Profile, you should have most of the information you need to determine whether a contract is that GC is worth taking.

Red flags could include recent bankruptcies, settlements, foreclosures, and other less-than-stellar reports. While these might not be sure signs of issues down the pike, they can help paint a clearer picture of the GC’s money management skills.

Ask around

For such a huge industry, construction is a surprisingly small world. Asking around about a prospective GC can garner a lot of insight.

Are they alright to work for? How many other projects are they involved in? Does their office staff have its stuff together? These are all questions you can ask someone who knows the GC’s company, and the answers could be very telling.

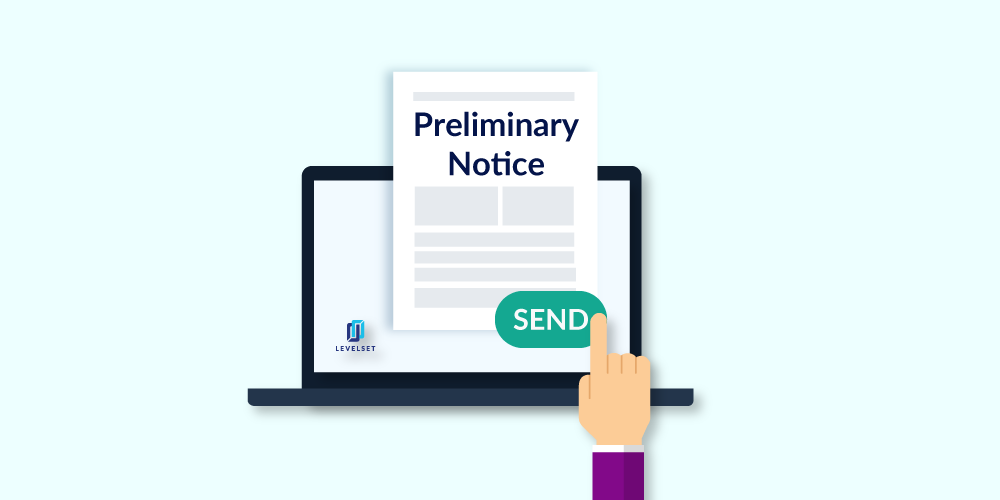

Send a preliminary notice

Preliminary notices aren’t really helpful in prequalifying a contractor, but they are helpful in preparing for a dispute. In many states, sending a preliminary notice is a requirement for protecting your lien rights.

A preliminary notice will also introduce your company to everyone who matters on the project. Not only will a GC see your notice, but so will the property owner and other decision-makers on the job. It shows them you know your rights, and you expect to be treated fairly.

What to do when a contractor is refusing to pay

Avoiding an issue in the future is a great strategy, but what if you’re dealing with a contractor refusing to pay right now? The following are some steps that you can take to let the contractor know you mean business and speed up the payment process.

Send payment reminders

If you’re in the beginning stages of a payment dispute, it’s always a good idea to give the general contractor the benefit of the doubt.

Sending a payment reminder opens the lines of communication. And, if there’s an honest mistake or miscommunication, a reminder might call attention to it. That might be all it takes to get the issue squared away.

Send a notice of intent to lien

If a payment reminder doesn’t get the payment ball rolling, you might have to bring in the heavy firepower. Sending a notice of intent is the next step, and it tells the contractor you know your rights, and you’re ready to enforce them if needed.

And since you protected your lien rights with a preliminary notice, the GC will know you’re not all bark — that NOI has bite.

File a mechanics lien

You’re running a business, and you can’t be a creditor to a contractor. If the GC still isn’t paying your invoices, you might need to file a mechanics lien.

Mechanics liens are the best tools subcontractors can use to get payments rolling. The thing about a mechanics lien is that it attaches to the property, not the contractor. For that reason, it’s especially useful in getting the ball rolling. If the GC isn’t paying you, the owner will find out, which could be trouble for the GC.

On the other hand, if the GC isn’t getting paid either, filing a mechanics lien against the property also helps them. The mechanics lien will affect the owner’s ability to get financing and can also make the property less liquid. Both of those scenarios are bad for an owner of a property under construction.

File a lien now!

Levelset takes all of the guesswork out of the filing process. We’ll research the project information and ensure your claim is done right.

Take them to court

On the off chance that you haven’t been following Levelset’s blog for long, you might not have realized how important it is to protect your lien rights. If you haven’t sent preliminary notice, it might be too late. But you do still have the chance to file a lawsuit.

Going to court is expensive, and it’s rarely fast. If your GC doesn’t owe you much, small claims court (or writing off the bad debt) might be best. But if it’s a lot of money, you’re going to need a lawyer, and court fees aren’t cheap. Court can be a means to an end, however, and you can recover at least some of your cash.

Learn more

File A Lien Or Go To Small Claims Court?

Small Claims Court: A Guide to Preparing and Winning Your Case

Do keep in mind that even if you file a mechanics lien, you might be forced to foreclose upon the lien. That means you might end up in court. However, foreclosing on a lien forces the sale of a property, which most owners won’t do willingly. You stand a far better chance of avoiding court if you protect your lien rights and file mechanics lien.

It doesn’t matter why — you need to get paid

If you’re protecting your lien rights, it doesn’t matter why you aren’t getting paid. Regardless of the reason, nothing about your course has to change. You’re going to send a preliminary notice, a reminder, and then a notice of intent, and file a mechanics lien regardless of who’s fault it is (outside of your own, of course). Your lien rights are the professional and preferred way to subcontractors to recover money owed to them. Make sure you’re being smart about yours.