Getting paid in the construction industry can be art because there are so many obstacles: pay when paid provisions, bankruptcy, joint check agreements, workmanship disputes, change orders, the scope of work issues, prevailing wage claims, etc.

And we’ve explored the cost to your business of this payment problem in the past. In fact, to the right is a great video published by Levelset that underscores how much write-offs can impact your company’s bottom line.

Every time your company can’t collect on $100,000 of debt it will need at least $1 million in revenue before breaking even on the bottom line. This can become a huge anchor for the success of your company, and if the circumstances align, can even sink your business. This is especially risky in the current rebounding construction economy since construction businesses are three times more likely to fail in a recovering economy than within a downturn or recession.

Time flies. Before you know it, accounts have migrated into the final payment bucket (i.e. 90+ days past due), and the accounts receivable aging report is cluttered seemingly beyond repair. It’s understandable how write-offs happen, however. In addition to the complications enumerated at the beginning of this article, companies also have practical challenges in collecting on accounts. The paperwork load is heavy and accounts age so quickly as time simply flies by and right past controllers and company collectors.

Before you know it, accounts have migrated into the final payment bucket (i.e. 90+ days past due), and the accounts receivable aging report is cluttered seemingly beyond repair. Collectors and controllers can’t call everyone, and the followup to-do list simply grows too long. The result? Debts slip away. They get written off. The company moves on to the next account hoping to press some sort of reset, but they just start the tail chasing process all over again.

What can you do?

Create A Payment Funnel Utilizing Notices And Liens To Motivate Payment

Companies can achieve remarkable success at cleaning their (and sustaining a clean) accounts receivables report by utilizing notice and lien tools, and placing all accounts into a formal “payment funnel” that handles accounts in different ways as they age to influence other parties to make payments.

To understand why such a payment funnel would work it’s important to think about why customers aren’t paying on your accounts in the first place. You may have hundreds or thousands of aged receivables, even though non-paying customers are not all in bankruptcy. These customers are paying bills every day – they are simply not paying your bill. As we explored in “Why Customers Don’t Pay And What To Do When It Happens,” this is simply because your customers are prioritizing other accounts over your accounts.

The trick to getting paid every time, therefore, is to influence your customers to prioritize your accounts above others.

This is done by adopting and sticking to a well-defined credit policy. This will set the parameters for your payment or A/R action funnel. Each company’s funnel should look something like this:

- Start of Furnishing To A Project: Send notice to protect mechanics lien rights

- After Account in Default after some period of time: Send a notice of intent to lien

- If payment is not received 20 days after NOI sent: File a mechanics lien

- If mechanics lien not paid within 45 days: Send to collections/attorney

- If mechanics lien not paid within 6 months: File a foreclosure/collection suit

Funnel Part I: Send Preliminary Notices to Preserve Your Lien and Bond Claim Rights

Last month we wrote an article titled “Some Contractors Get Paid. Some Don’t. Learn Why.” This article simply explained the fact that contractors and material suppliers who protect their lien and bond claim rights get paid faster, and more often.

In a review of software like Textura that helps contractors and owners manage their “financial risk,” the following is stated about the power of preliminary notices to get companies paid more consistently:

When push comes to shove, the owner and the general contractor are going to be most concerned about getting those parties paid who delivered a preliminary notice. They are using Textura or some other product to distinguish between those who did and those who did not send notice, and the notice-providing parties are prioritized over the non-notice parties.

If 10-15% of your accounts go into default before payment is received simply adopting a policy of sending preliminary notices could reduce that percentage down to something closer to 5% of less. Not only will this lighten the load on your company’s controllers, but it will also lower your DSO substantially and increase your cash flow. Your controllers will be able to focus on accounts that are truly non-paying accounts, and not simply those customers dragging their feet.

Funnel Part II: Send Notices of Intent to Lien on Overdue Accounts and get >50% Paid Immediately

Your controllers will be able to focus on accounts that are truly non-paying accounts, and not simply those customers dragging their feet. Sending preliminary notices will reduce the volume of projects that go into a default state. Nevertheless, some accounts will still go into default and start to age on your receivables report. The trick is to implement a policy of sending “Notice of Intent to Lien” documents on these accounts at a certain trigger point (i.e. 30 days past due).

In studies of the notice of intent to lien document we’ve found that payment is received within 20 days of sending these documents in 47% of cases. The number goes up even further as more time goes on.

Imagine what this statistic could mean to your accounts receivables process. If you have 100 accounts in default and each owe $10,000, you could collect on at least half of these accounts within 20 days of sending a very inexpensive document.

Sending 50 notices of intent to lien documents will cost you approximately $1950, and under this hypothetical it would collect you nearly $500,000 in cash in less than 3 weeks. That’s an ROI that cannot be ignored. Sending 50 notices of intent to lien documents will cost you approximately $1950, and under this hypothetical it would collect you nearly $500,000 in cash in less than 3 weeks. That’s an ROI that cannot be ignored.

Funnel Part III: File Mechanics Liens on Remaining Accounts and get >65% Paid Without Further Legal Effort

Adoption of this payment funnel will reduce your DSO, increase your cash, and reduce the volume of problem accounts handled by your company, however, there will still be some accounts that require more substantial legal action to get paid. If the notice of intent to lien document doesn’t work to get you paid, the next step you should take is to file a mechanics lien.

Mechanics lien claims are inexpensive and hard-hitting. If you’re curious about why these claims work and are so effective, check out this presentation we did on the 17 Ways A Mechanics Lien Works To Get You Paid.

- “A personal guarantee or joint check agreement is nice to have, but not a substitute for a lien or bond claim.” Joe Virene, Construction & Energy Law Blog.

- “An unpaid contractor’s best friend.” David T. Arena, Illinois Mechanics Liens: Di Monte & Lizak LLC

- “An essential collection tool for contractors and material providers in construction projects.” Paul Bauducco, Smart Tools of the Construction Industry

In addition to our studies on the notice of intent to lien, we’ve also conducted some review of the success of mechanics lien filings across the country. According to our research, over 64% of mechanics lien claims were paid within just 90 days of filing with any further legal action.

Some folks have questioned the utility of lien claims because they may need to be foreclosed, and, as the argument goes, the foreclosure process can be expensive and empty. This argument, however, is misguided. As the graphic to the left explains, the foreclosure process is extraordinarily rare, and it is even more rare that a foreclosure suit goes all the way through judgment without a settlement.

Case Study of Success with Notice & Lien Payment Funnel

Does this actually work? Yes. In fact, it works really well, and you may be shocked by the success your company can have in collections by adopting a technology to help manage notice and lien compliance and assist with this payment funnel.

We’ve conducted a case study of a mid-sized company (approximately $15-20m annual revenue) who has used Levelset’s technology since 2010 to manage their preliminary notice and mechanics lien compliance. Almost every project gets put into the “payment funnel,” and the company follows their adopted policy.

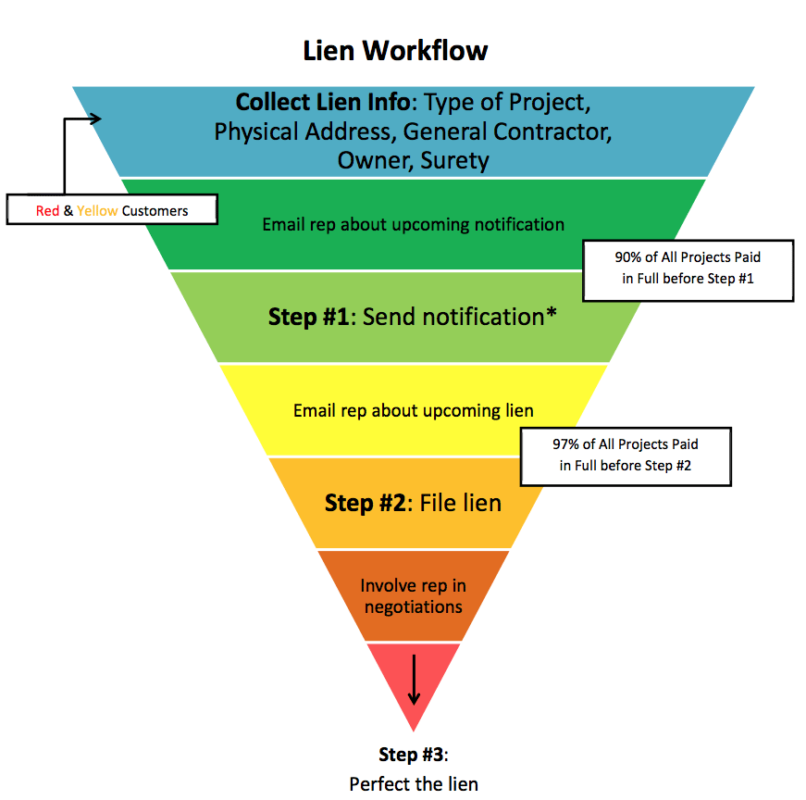

To the right you can see the “Lien Workflow” funnel that they created. Unlike the suggestion above, which drives actions based on the account’s age, their funnel drives actions based on the lien and notification deadlines required by law; something they are enabled to manage because of Levelset’s powerful and patent pending lien deadline management technology.

The results of this “Lien Workflow” are impressive. Their uncollectable account percentage in 2010 (.035%), 2011 (.067%), and 2012 (.012%) was less than 1%. Furthermore, since the risk of non-payment is so low, the company remarks that they are actually empowered to grow their revenue because they have “a lot more options now if we want to work with someone who has risky credit or can’t pay our deposit upfront.”

The fact is that setting up a clear payment funnel within your credit policy is important, and can lead to drastic results. Incorporating mechanics lien compliance in your company’s collections efforts is going to give you consistent and impressive collection results.

Furthermore, your company will be empowered to increase your revenue and take business from more customers, which is opposite many company’s fear that adopting lien compliance practices will scare customers away. It will not scare your customers, and you’ll be enabled to take new customers you previously turned away.

Lien Compliance In The Cloud Is The Technology You’ve Been Dreaming About

This all sounds fantastic, but how can your company possibly manage all of its mechanics lien and bond claim compliance requirements? Your probably using a single vendor or multiple vendors in a fragmented and manual way. Can you actually implement this type of payment funnel without over-burdening your staff?

The answer is yes, you can. Even further, you can make the entire process invisible to your company’s staff. Here is how it works:

Levelset has developed patent-pending proprietary technology to take all of the hassle and leg work out of preliminary notice, mechanics lien, and bond claim compliance. Regardless of whether your company uses Oracle, Epicor Eclipse, Quickbooks, Peachtree, Get Paid, Sage, SAP, or any other software platform, our cloud-based technology can use the project information stored in those systems to calculate all of your legal compliance needs, and to completely automate the process for you.

What About The Accounts That Are Already Aging and in Default?

If you’ve made it this far into the article you can probably see that we’ve discussed a very proactive approach to cleaning up your company’s accounts receivables process. Implementing a payment funnel as contemplated herein will eventually clean up your receivables, but it will only start with the projects that have yet to begin. What about the projects that are completed already, and unpaid? Is there any way to clean up the aged receivables already cluttering your aging report?

The answer is yes.

A few months ago we published an article titled: Why and How To File Mechanics Lien Claims in Bulk. This issue of cleaning up already aged or defaulted receivables was precisely the aim of that article, and while the title refers to mechanics lien claims, you could very well substitute that for “notice of intent to lien” to create a back end or reactive payment funnel.

Many companies come to us at Levelset and ask us to do some damage control to their accounts receivables report.

They export the information from their system and we import it into our system for them free of charge. Our system will examine all of the projects and calculate lien deadlines, letting the company know exactly which aged receivables still have active lien deadlines and which are dead in the water. From there, the company can decide whether to send notices of intent and/or file mechanics liens on some of the accounts.

The results are astounding.

Companies can take accounts that are near defunct and get payment on them in greater than 75% of the cases, and for a very modest investment. The return on investment, depending on the per-account debt amounts in your portfolio, can be astronomical.