Today’s construction CFOs and CFMs are reigning over one of the most interesting periods for the industry. The landscape is rapidly changing to look much different than our grandfather’s marketplace which was recently explored by Thomas Schliefer’s ENR piece, “Consolidation’s Consequences in Construction Services.” BIM and virtual reality is migrating from science fiction to reality. Construction technology and technology in general is improving exponentially. And after years of economic recession, the construction market is looking upwards at a recovery.

The contemporary challenges for construction financial managers presents a compelling opportunity to make a sizable impact to organizations. As this article will explore, these challenges and current trends suggests that the companies with the most innovative CFOs will come out of the recovery on top.

Challenges of Recovering Economy Includes Staying Solvent And Capitalizing on Growth Opportunities

Construction’s financial challenges in a recovering economy have been well-covered in the past year, and they should be intuitively understood by CFMs.

It’s no secret that the construction economy took a significant dive after 2008 – it is now just barely more than half the size of its former self. Anyone who survived that period remembers the construction pains of the economic downturn, when contractor failure and defaults soared and CFMs had to fight tough cash management battles.

This puts CFMs in a tricky position.

On the one hand, the CFM will be called upon to put an organization in the best position to capitalize on the new market’s growth opportunities. This will mean lining up capital, forecasting cash flows, modeling growth strategies, and more. Growing through a well planned strategy should mitigate an organization’s risk from falling victim to a recovering economy’s challenges.

However, it may do little to mitigate the risk of other companies in the industry sustaining growth problems. Therefore, CFMs must protect their companies against the risk of all other industry participants. This means implementing prequalification and credit monitoring procedures, understanding and protecting lien rights, and staying ahead of the company’s receivables performance.

How will CFMs do it?

Construction CFOs / CFMs Must Participate in Innovation

The days of CFOs and CFMs locking themselves in a room to drown in Excel sheets are gone. These practices must be replaced with active engagement in the analysis, implementation, and adoption of technological solutions. This should also spur the eternal search for more innovative ways to perform core processes and leverage big data. We’re not the only ones to announce this.

The CFO Journal published by Deloitte recently wrote that it’s time to “Add Innovation to the CFO’s Agenda.” Yes, we all know that the term innovation is overused (i.e. Harvard Business Review’s Stop Me Before I ‘Innovate’ Again!”). Deloitte even acknowledges this at the onset, saying “‘the term innovation has become meaningless and has been applied to just about anything that can justify budgets in a company’…it’s no wonder some CFOs are skeptical.”

Bansi Nagji, co-author of the HBR’s “Managing Your Innovation Portfolio” also participated in the Deloitte article. According to the article 50% of the large company CFOs confirm “they are being asked by their CEOs to play a key role in evaluating, financing and driving innovation in their companies. Of the remaining CFOs, 36% confirmed their CEO expects them to support and enable the execution of innovation decisions.”

It’s clear that CFOs are being called upon within organizations to move the needle in innovating business processes. And why shouldn’t they? As Tuff confirms in “Managing Your Innovation Portfolio,” “if anyone in the organization understands what drives the economics of the business, it’s the CFO.”

Much of what Deloitte suggests is echoed by a 2013 white paper series published by PwC and Wharton Business School faculty, especially July 2013’s “Innovation champions: How CFOs can keep companies vital.” It’s also a topic at the Stanford Executive Education program for CFOs: The Emerging CFO: Strategic Financial Leadership Program.

Innovating Before Recovery Is In Full Swing Will Pay Dividends To Mitigate Market Risks And Position for Growth

The construction industry may be treading water in a “calm before the storm” moment, and as foreshadowed in the preceding sections, this puts CFMs in a real trick bag.

The aforementioned PwC /Wharton white paper summarized the problem nicely in its introduction:

CFOs can play a critical role [in innovation], but for them, supporting innovation presents a particular challenge…embracing innovation requires monitoring risk closely without smothering ideas. For finance executives who have spent the past five years cutting costs and managing cash flow, the balancing act is as formidable as it is essential [emphasis ours].

The idea of apprehension to innovation investments is supported by a recent CFO.com survey and analyzed in “Reinventing Innovation.” According to CFO Research (in collaboration with American Express) 45% of 275 senior CFOs say they plan to spend and invest “about the same” or some amount less than they did last year. See: Chart of Responses to the left.

The article surrounding that research, however, suggests that CFOs ought to look more closely into their investment goals:

Investing in innovation during the early stages of a recovery can yield abundant benefits when the economy regains its full sheen. Armed with new offerings, a business can position itself to grab market share from its less-prepared rivals [emphasis ours].

We might add to this insight that in addition to “[grabbing] market share” from less-prepared rivals, the recovering economy brings with it the additional opportunity of gaining market share organically.

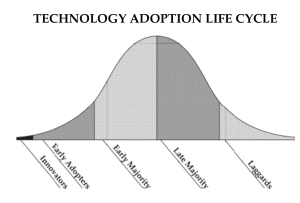

These impressions from PwC, Wharton, and CFO.com fall right in line with Geoffrey Moore’s “technology adoption lifecycle” theory, as popularized by his marketing book Crossing the Chasm. Moore’s theory is well known among technology providers. He suggests that the adoption of technology products and consequent advancements follow a certain curve as illustrated in the graphic to the right. At the start of every technology offering are the “innovators” and “early adopters.” These folks seek out interesting technology products that have unique promise, and they leverage that technology before anyone else – including their competition.

In describing such “innovators” and “early adopters,” Moore explains, “They know they are going outside the mainstream, and they accept that as part of the price you pay when trying to leapfrog the competition.”

For CFMs, mitigating the risks of the recovering economy while simultaneously taking advantage of enormous growth opportunities is a challenging task, albeit a daunting one. Those who come out on top will certainly, upon later reflection, have been the innovators.

Where To Invest and Innovate? Start with Working Capital Management.

It’s difficult to understate the importance of working capital to an organization. Working capital management becomes even more important in high-growth situations, as it exists in a recovering economic market. Moving the needle in working capital management will be key for organizations who want to scale into the new economy’s opportunities.

In the CFO.com Research Report Cash & Liquidity Management, three “main dimensions of working capital” are identified: Receivables performance, inventory management, and payables performance. When survey respondents were asked to rank these three dimensions in importance, “receivables performance” scored as the most important item that impacts working capital.

“They know they are going outside the mainstream, and they accept that as part of the price you pay when trying to leapfrog the competition.” – Geoffrey A. Moore, Crossing the Chasm

Legacy ERP systems are great, but they aren’t the most agile platforms. Nevertheless, as ERPs continue to move into the cloud, they will become more easily connectable to third-party platforms through Application Programming Interfaces (i.e. APIs). This empowers enterprise companies (and even small businesses) to take advantage of new innovative technologies that are being built around the standard ERP processes.

There are several products and technologies coming out that help companies manage and impact their working capital.

Get Money Paid Faster By Digitizing Invoicing and Payments

Electronically sending invoices and receiving payments is a no-brainer. It’s probably the most direct way to improve a company’s days sales outstanding (DSOs), as it directly and immediately erases days away by eliminating mail delay and lost invoice excuses. BillTrust is the best in class product for enterprises. Smaller mom & pop organizations (i.e. Handyman outfits, small electricians, etc.) may be better served by a simpler solution such as Freshbooks or InvoiceASAP.

Improve Credit Processes

When CFOs were asked about what would make the biggest impact to working capital, they responded by selecting “improve receivables performance.” Companies, of course, can’t expect that their receivables will be improved with hope alone or by asking their credit and collection departments to just work harder. The credit process itself needs to be improved. This starts when a new account’s credit application or performing prequalification review begins and extends through the collection of final invoices. Innovative CFMs will look past the collection agencies and “services” who have traditionally helped in this function. Instead, they will look to innovative technologies that can improve the process. Check out the neat stuff Bectran is doing for the credit application process, or in the prequalification space, what JBKnowledge is doing with Compliance Review and Monitoring with its SmartCompliance product. And although they are pretty new to the scene and information is only available in a few states, it will be very interesting to see how SimpleVerity matures, which promises to provide “credit and risk alerts on every licensed contractor.”

Security Rights & Financial Risk

Security rights – liens and bond claims – are a cornerstone of financial risk management in the construction industry; in other industries it’s clear that when security rights are available, they get used. The problem for CFMs has been that these rights are known for being overly complicated by nuanced laws and compliance requirements. This leaves companies to wrangle a policy together relying on custom-built buggy solutions or inconsistent collection agency-type service providers. There is an opportunity to do other note-worthy things with secured receivables. Not to mention the enormous impact security rights will have with the speed and frequency of payments.

Dynamic Discounting and Working Capital Access

Factoring is dead (was it ever alive?). There are some terrific products bubbling up on the service that reinvent access to working capital. In recent years, new opportunities have arisen for construction businesses to use outside capital to purchase materials up front. The concept of dynamic discounting by companies like Taulia or SAP’s Ariba is especially interesting.

Conclusion: Go Be An Innovator

The time is now for CFMs to become better acquainted with the new technology landscape. Truly understand cloud-enabled technology and SaaS offerings. Start digging into the exciting technology products out there, and then go be an innovator.