You just received a demand letter from a sub or supplier. It says something about…a prompt payment law? It even threatens interest penalties and potentially court costs if you don’t pay. Yikes! How should you respond when you’re facing a prompt payment demand from someone on a construction project? Does the law really say you need to pay interest and fees on the outstanding amount?

Before we get into that – and we will – you need to understand prompt payment laws. In this article, we’ll look at the basics of prompt payment laws, potential penalties for late payment, and how the demand process works.

The Basics of Prompt Payment

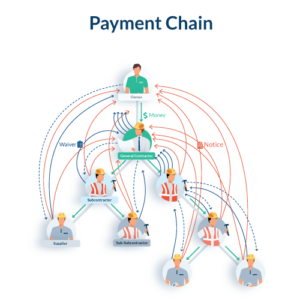

Nearly every state, as well as the federal government, has a prompt payment act that sets payment deadlines on construction projects. The US Prompt Payment Act applies to all federal construction projects. In addition, in all but 1 state (we’re looking at you, New Hampshire), the law applies to public construction jobs, often including state, municipal, or local government projects. 34 states also have a prompt payment law for private projects, whether commercial or residential.

Deadlines for construction payments

- Property owners must pay the GC within [X] number of days

- GCs must pay their subcontractors within [X] number of days

- Subs must pay their subs & suppliers within [X] number of days

State laws vary widely on the deadline, and the date from which the deadline is calculated. In most cases, however, the property owner must pay the GC within the specified number of days after they receive the GC’s invoice. After that, timing is generally based on the day that a party receives payment. The GC must pay their subs – again, in most cases – within the specified number of days after the GC receives payment from the owner.

For example, here’s what California’s prompt payment law says for progress payments (the deadline varies slightly for final payments):

- A property owner must pay the GC within 30 days after invoice

- A GC must pay their subs within 7 days of being paid

- A sub must pay their subs & suppliers within 7 days of being paid

- And so on down the payment chain…

Penalties for late payments

If you don’t pay within the deadline, there are legal penalties. Typically, the law requires you to pay interest on top of the money that you owe. Additionally, if you still don’t pay your sub, and they take you to court, you may have to pay their legal and court fees on top of the original amount.

Exceptions to prompt payment requirements

In most cases, states provide an exception in the event that you and the sub have a good faith dispute over the work that they’ve done. However, that doesn’t always mean you have the right to withhold a payment. The law may only allow you to withhold the amount that is under dispute. Or, it may allow you to withhold a percentage. It varies from state to state.

Your sub sent a prompt payment demand letter. Now what?

Receiving a prompt payment demand letter can be stressful. If you’re bristling in rage, take a deep breath. But responding to contractor requests (or demands) for payment comes with the territory. Getting paid on a construction project is hard and stressful for everyone. Your subcontractor is probably struggling to keep their head above water, and just wants to be able to pay their staff and suppliers. You’re all on the same team, after all – it’s in everyone’s best interest for all parties to receive payment on time.

Read through the letter thoroughly, and make sure you understand what the sub is asking for. Second, check the details in the letter against your state’s actual prompt payment law.

Scenario 1: You haven’t been paid yet

If you haven’t been paid, then you may not be subject to the demand requirement from your subcontractor. In most states, the prompt payment clock starts ticking when a contractor receives payment from the party above them. For example, Connecticut’s prompt payment law gives a GC 30 days to pay their subs.

If this is the case, communication is best. Let your sub know that you haven’t been paid by the owner yet, but that you’ll let them know when they can expect to be paid. Inform your subcontractor that state law gives you X number of days to pay them after you receive payment.

Scenario 2: You’ve been paid, but the deadline hasn’t hit

Let’s say you have already received payment from the owner, but you’re still within the prompt payment window to pay your sub. Again, communication is the best strategy (are you seeing a pattern here?). Let your subcontractor know when they can expect payment. The more you can communicate with your subs and suppliers on a project, the more patient and understanding they’ll be. In a 2019 construction payment survey, 75% of contractors said they wish they had more visibility into payment terms on

Scenario 3: You’ve been paid, and the prompt payment deadline has passed

If you received payment, and you waited too long to pay your sub, you should pay them as soon as possible. In some states, the law gives you a grace period before you have to start paying interest. The sooner you pay the invoice, the less you’ll have to pay in the end.

However, if interest is already accruing, the law entitles your sub to the interest payments automatically. It’s in your best interest (no pun intended) to pay the invoice, along with any interest that has accumulated. If you don’t, the sub could bring a legal action against you, potentially forcing you to pay their legal fees and court costs on top of additional interest.

On a small job, that extra interest may not be a big deal. But on a $1 million dollar contract, a monthly rate of just 1% tacks on $10,000 every 30 days.

Again, communication wins the day. If you don’t want to pay the extra interest, talk to the subcontractor directly. If they accommodate your request to waive interest, make sure you move them to the top of the payment pile next period. And keep them there.

How Can I Dispute My Subcontractor Invoice?

If you and the sub dispute the quality of their work, the law may allow you to withhold some or all of the payment.

For example, Florida’s prompt payment law allows a contractor to withhold payments due to:

- An improper pay request,

- A bona fide dispute, or

- A material breach of contract by the claimant.

However, if you only dispute some of the payment, Florida law doesn’t allow you to withhold all of it.

I’m going to make a recommendation here, and if you’ve read this far, I’ll bet you can guess what it is. Communication. (Did you guess it? Boy, you’re good.)

Talk to your sub. Pay them for any portion of their invoice that isn’t in dispute. Resolve any disagreements over the quality of work or material breach. Repair your relationship if you can, and move forward. You’re in this together! Projects progress much more smoothly when all parties work together well.

Now the sub is threatening to suspend work!

In some states, a contractor is allowed to walk off the job if you don’t pay them on time. However, the scenarios under which prompt payment laws give a contractor the right to stop work are pretty limited.

Generally, the sub is required to give you advance notice that they plan to stop working. If you don’t pay them by the end of their waiting period, they may have the right to suspend work. Then again, maybe not. Some states don’t permit the sub to stop work if there’s an active dispute.

Ultimately, it helps to understand the prompt payment law in your state, and the legal protection and penalties it provides for.

Also, it’s really, really helpful to communicate with your subs. (You thought I forgot, didn’t you?) Most disagreements over payment can be prevented by creating an open line of communication at the start of the project.

Prompt payment is good for everyone

Prompt payment laws exist for a reason: To make sure everyone on a construction project gets paid in a timely manner. That includes you! If you’re having trouble getting paid by the party that hired you, consider sending a prompt payment demand letter yourself. We’ve already covered all of the reasons it can be an effective way to encourage payment.

If you receive a prompt payment demand letter from a sub or supplier you hired on a project, don’t panic. Put yourself in their shoes for a moment. Take the time to understand your state’s payment requirements, and respond to their demand the way you would want someone to respond to you. And take steps to avoid a prompt payment demand in the future.