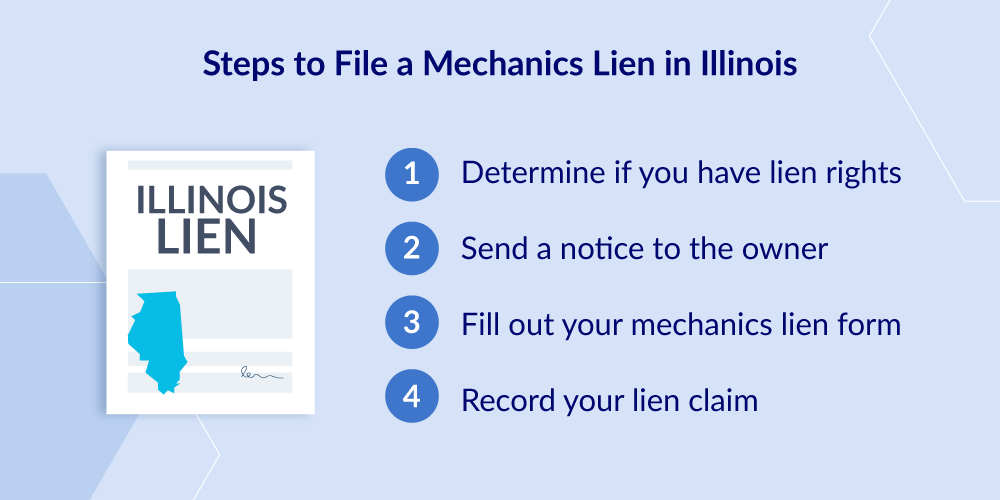

Filing a mechanics lien in Illinois, just like any other state, can be a technical, error-prone task. Mistakes are common, and even the smallest one can invalidate your entire lien claim. This article will guide you step-by-step through the process of filing an Illinois mechanics lien, along with downloadable forms.

Watch: How to file a lien in Illinois

Step 1: Determine if you have lien rights

Each state describes who is eligible to file a mechanics lien, and who is not. Eligibility is often determined by the services that a person or business provides, and their place in the payment chain. (For example, material suppliers that provide to other suppliers are often not allowed to file a lien).

In Illinois, most construction professionals who provide any labor or services, including architects and engineers, are entitled to file a mechanics lien.

The Illinois Mechanics Lien Act (770 ILCS 60/), automatically gives lien rights to contractors, subcontractors, material suppliers, engineers, and architects that have provided “labor, services, material, fixtures, apparatus or machinery, forms or form work” for the improvement of real property.

The caveat is that the materials or services must be “attached” or “used in” the construction. This is somewhat of a gray area.

The nature of lien rights – and the actions required to perfect a lien – also varies depending on the type of construction project:

- Private vs. Public

- Commercial vs. Residential

- Investment vs. Owner-Occupied

Step 2: Send a notice to the owner

Illinois does not require traditional preliminary notices. However, certain parties on a project must provide a notice to the property owner or agency in charge of the project, depending on the type of job.

Sworn statement to owner

On projects of all types in Illinois, the General Contractor must provide a written sworn statement to the owner — prior to payment — that reveals the names and addresses of all those furnishing labor or materials to the project.

The sworn statement should set out the amount due or to become due to each party. Failure to provide the sworn statement to the owner could cause a GC to lose their lien rights. It could also cause subcontractors to lose lien rights — if they don’t send a notice of intent to lien (see below).

This sworn statement gives the owner of the project “notice” of how much to have on hand in order to make expected future payments.

Learn more: Why Subcontractors Shouldn’t Rely on the GC’s Sworn Statement in Illinois

Notices on owner-occupied projects

On owner-occupied residential projects, General Contractors must provide the sworn statement as on any other project. But on these projects, other sub-tier parties must also provide a notice to the owner in order to preserve their right to file a valid lien.

Subcontractors and suppliers must provide the Notice to Owner within 60 days of starting work on – or first providing materials to – an owner-occupied residential project in Illinois.

Notice of intent to lien

If you haven’t been paid, it’s best practice to send an Illinois notice of intent to lien within 90 days after providing labor or materials.

While Illinois doesn’t require anyone to send a notice of intent to lien (NOI) in order to secure their lien rights, sending this notice gives subcontractors and suppliers extra protection.

If a sub fails to send an NOI, but they were listed on the GC’s sworn statement, their lien will be limited to the amount listed as owed to them on the sworn statement. It’s never a good idea to rely on the sworn statement to protect your lien rights. Always deliver an NOI to ensure that your full contract amount is protected by the power of a mechanics lien.

Download a free Illinois notice of intent to lien form

An NOI must be sent by registered or certified mail, with return receipt requested. Delivery should be limited to the addressee only. Alternatively, it can be personally served on the owner or his agent.

What if the notice is never actually delivered? Or worse, what if the customer keeps ducking delivery and refuses to accept it? Find out what you can do if the owner refuses to receive the Notice of Intent to Lien.

Step 3: Prepare your Illinois lien claim form

Choose the right form

In order to file a valid mechanics lien claim in Illinois, you need to be sure you have the proper form. Choosing the right form in Illinois depends on who you contracted with. There are different forms for:

- Direct contractors (those who contracted with the property owner)

- Subs & suppliers (anyone who didn’t contract with the property owner)

- Parties hired by a tenant

Beware of sites that provide generic lien forms — many are not actually valid according to the statutory requirements.

Download a free Illinois mechanics lien form

Levelset forms are created and reviewed by construction attorneys. Thousands of Illinois contractors and suppliers have successfully used these forms to get paid.

General Contractor’s Mechanics Lien Form

Fill out the form correctly

It’s time to put pen to paper, and get your mechanics lien claim filled out. This may seem pretty basic, but this should be filled out cautiously. A simple mistake could potentially result in the entire lien claim being invalidated. On the other hand, a big mistake could result in some harsh penalties for filing a fraudulent mechanics lien.

1. Your information

Let’s start with the easy stuff. This section requires your full name and address. If you are filing on behalf of a company, be sure to use the full, registered business name.

2. Property owner information

Although a mechanics lien is filed against the property, the property owner’s information should still be included as a matter of indexing and filing for the recorder’s office. If you contracted directly with the owner, then this information should be found in your contract. However, if you are a sub or supplier on the project, this may be a bit more challenging. The property may have been sold during the course of the project, or there may be multiple property owners. This article may prove helpful in your search: How to Find the Property Owner on a Construction Project.

3. Hiring party

Here’s another easy one. Who is your client? This is simply the name and address of the person who signed a contract with you. If you were hired directly by the property owner, this section wouldn’t show up on your claim form. Also, if you were hired by a tenant, make sure you put their info down correctly.

4. Description of services

The description of the services or materials provided to the project goes in this section. This doesn’t need an exhaustive, itemized list of tasks or materials. Rather a brief description of the work or materials provided that is the subject of your lien claim.

5. Amount of claim

The statute states that the amount should be the balance due after deducting any credits. This is a pretty broad/vague statement. Professional fees, interest accrued, and collection costs can potentially be included, but don’t press your luck. Try to keep it limited to the amount owed to you for the labor and materials provided that are the subject of the lien claim. The more costs you add to your lien claim, the more likely the court may determine that the amount is exaggerated.

6. Contract information

By contract information, we just mean the basics. What type of contract were you working under? The four most common types of construction contracts are lump sum, cost-plus, time and materials, and unit pricing contracts. Additionally, the lien claim should also provide the full contract price.

7. Contract date & last date of furnishing

These two are pretty straightforward. The contract date is, the date the contract was signed. As for the last date of furnishing, this is whenever the last time you provided labor or materials to the project.

8. Property description

The state of Illinois doesn’t require a full legal description of the property. The property description only requires a “sufficiently correct description of the lot, lots, or tracts of land to identify the same.” This falls somewhere in between a legal property description and a simple street address. In any case, the more details, the better. For assistance on how to find the property description of the project, you can download our Legal Property Description Cheat Sheet.

9. Signature & notarization

Lastly, it’s time to sign the lien claim form. But wait! Be sure you are in front of a notary before you go putting your signature on there. Illinois mechanics liens must be notarized in order to be valid.

Step 4: Record your Illinois mechanics lien

Now that you have the right form, and it’s filled out properly, it’s time to record the lien.

Deadline to file your mechanics lien claim

In Illinois, there are technically two different deadlines to file your claim. When you file will determine who the lien will be enforceable against. If the lien is filed within 4 months of completion of the overall project, then the lien will be enforceable against the property owner and any subsequent purchasers.

On the other hand, a lien claim that’s enforceable against just the original/current owner can be filed within 2 years of completion of the last lienable work to the project.

Where to file a mechanics lien in Illinois

Under Illinois law, a mechanics lien should be filed in the County Recorder of Deeds where the property is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well.

The fees and specific document formatting vary depending on your county. It’s important to check with your county’s recorder office to be sure you have everything you need to file your claim right the first time around.

To simplify this process, we’ve put together a list of all the Illinois recorder’s offices and a link to their website.

Illinois county recorder offices

E-recording

Illinois allows county recording offices to adopt e-recording under the IL Uniform Real Property Electronic Recording Act. And in fact, many counties have adopted this technology.

Most notably, Cook county, which we touched on some of the requirements in this article: Information on Filing in Cook County, IL. Along the same lines, e-signatures are also allowed under the Act as well.

How to serve notice that a lien was filed

Serving a notice after filing a lien is only required on owner-occupied, single-family residential projects. A direct contractor working on such a project must give notice of recording within 10 days after the lien claim was filed.

This notice can be sent by mail or delivered personally. If this deadline is missed, and the owner suffered some sort of damages (such as not being able to close on a sale of the property), the lien will be extinguished to the extent of the damages.

What to do after filing a lien

Congratulations! If you’ve followed all these steps, you have successfully filed a mechanics lien, and are one step closer to getting paid what you’ve earned. But the story doesn’t end here.

After filing a lien in Illinois, you will need to take one of two actions at some point:

- Foreclose on the lien if you still haven’t been paid by the deadline

- Release the lien after you receive payment

Initiate a foreclosure action

An Illinois mechanics lien is valid and effective for 2 years. That’s a substantial amount of time! Nevertheless, you’ll still want to track this deadline to be sure you don’t miss it.

Keep in mind that a foreclosure action is a full-blown lawsuit. This can be a costly and time-consuming process. Depending on the amount in controversy, a foreclosure may not be worth it.

If the amount owed is under $10,000, you may be better off taking your customer to small claims court. To get a better idea of what exactly this entails, check out this rundown from the Illinois Attorney General.

There is one more optional step you can take to extract payment, and that is a Notice of Intent to Foreclose. This is like a final warning shot, that if payment isn’t made in x amount of days, you are willing to initiate a foreclosure action.

Download a free, Notice of Intent to Foreclose Form

Release the lien

If the debt is ultimately paid, it may be time to cancel the lien claim from the county books.

This isn’t an automatic requirement. Instead, it is triggered when the owner (or other interested party) sends a written demand to remove the lien. Upon receipt of this demand, the lien claimant should file a cancellation within 10 days.

Download a free Illinois Lien Release Form

In any case, it’s best practice to release the lien claim once the debt is settled. Not only is it just good business, but the owner will eventually request that you do so.