If you’ve been around infrastructure jobs for a while, you know Granite Construction is one of the best names in the game. And subcontracting with Granite could be a great way to fill your funnel and grow your business. With ongoing projects and a nationally recognized name behind you, it could be an excellent move for your company. That is, if it’s a good fit.

Before you even consider bidding on a project with Granite Construction, you need to do as much research as possible. You want to know ahead of time whether the companies will work well together or mix like oil and water. That’s why Levelset put together this subcontractor’s guide to working with Granite Construction, so keep reading to learn more about this infrastructure giant.

Granite Construction company overview

Granite Construction’s roots date back to the days right after the gold rush, when a banker and his son started a granite business from an old quarry in Watsonville, California. In the years that follow, Granite Construction would start rebuilding San Francisco’s infrastructure after The Great 1906 Earthquake.

Today, Granite Construction is an award-winning infrastructure builder, winning a 2021 CIO 100 award for innovation, strategy, and excellence. Along with locations in Mexico and Canada, Granite now has several offices and quarries in:

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New York

- North Carolina

- Ohio

- Oklahoma

- Tennesee

- Texas

- Utah

- Washington

- Wisconsin

Granite Construction’s areas of expertise include:

- Transportation

- Water treatment

- Specialty mining, tunneling, oil, gas, and renewable energy

- Materials mining

- Federal projects

Before working with Granite Construction

Anytime you’re working with a new general contractor, it pays to do as much research as possible before you sign a contract. You want to take the opportunity to prequalify them just as much — if not more — than they’re prequalifying you.

But prequalifying a general contractor might be new to your policies. The good news is that Levelset aims to make it as simple and painless as possible. Here’s a roadmap to prequalification:

- Dig into the company’s payment history

- Review the company’s credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with the company’s payment process

During the process of prequalifying a business, it’s doubtful that you’ll find a squeaky clean company history. Construction is a tough business, and Granite has been in it for over 100 years. With that type of history, there’s bound to be a rough patch or two along the way.

Don’t let that deter you. Not right away, at least.

Instead of just shutting the book on Granite Construction because of a few red flags, reach out to them for answers. Give Granite, or any company you’re prequalifying, the opportunity to explain what happened. Remember that a slighted subcontractor is much more likely to complain about a company than a happy one is to brag about them. Hear out Granite’s side of the story — their willingness to talk might mean more than a sub’s poor review.

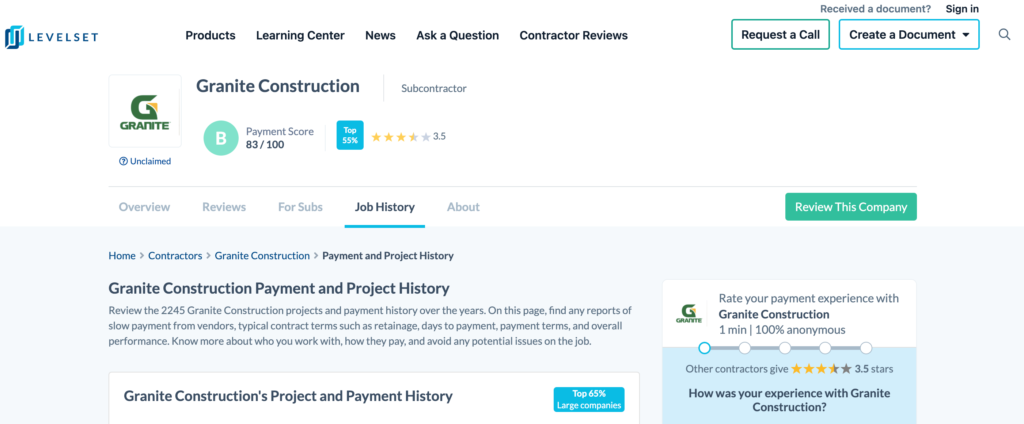

Granite Construction’s Payment Profile

As mentioned, Levelset wants to make the prequalification process as smooth and painless as possible while also offering all the info you might need. That’s why we put together our Contractor Payment Profiles. These reports take a deep dive into a general contractor’s payment practices, disputes, lien history, and payment speeds to give subs like you a clearer look. They can be an incredibly valuable tool to a sub.

At the time of writing this article, Granite Construction boasts an 83/100 payment score, giving the company a B rating. That score puts Granite in the top 55 percent of contractors, which is pretty impressive for a larger GC.

The payment profile scores highlight a company’s payment practices, and we compare them with the data of thousands of other contractors. These scores provide a benchmark for subcontractors to shop their prospective GCs, and if you’d like to know more about how we calculate these contractor payment scores, click here.

Granite Construction’s payment disputes

It wouldn’t be fair to rant about Granite’s shining payment score without giving subs the whole picture. While Granite does quite well among large GCs, the company’s projects don’t all go off without a hitch.

At the time of this article, Granite is managing a few projects suffering from slow payment complaints, and there are a few liens on the record.

- In December 2020, a subcontractor filed a mechanics lien against a project in Washington, DC. The amount was $23,098.15, and it has since been canceled.

- In November 2020, a subcontractor filed a mechanics lien on a project in Minneapolis, MN. The amount was $6,676.29, and the lien is still active.

- In August 2020, a subcontractor filed a mechanics lien on a project in Independence, MO. The amount was $10,456.71, and the lien is still active.

- In July 2020, a subcontractor filed a mechanics lien on a project in Independence, MO. The amount was $8,193, and the lien is still active.

- On top of those liens, subcontractors have reported the Granite Construction has been slow to pay their invoices 23 times in the past year.

While that might seem like a lot of issues, it’s all about perspective. Levelset provides a payment history summary that might paint a clearer picture:

- In the last year, 97 percent of Granite’s projects have gone off without a payment issue

- In 2021 alone, that number drops just slightly to 96 percent

- In 2018, 2019, and 2020, the percentage of projects completed without payment issues is 100, 99, and 98 percent, respectively.

Levelset also likes to provide a bit of background on the payment terms and policies that contractors use whenever possible. Granite Construction typically holds back 10 percent retainage on about 63 percent of its projects, 5 percent retainage on 9 percent of its projects, and no retainage on 23 percent. Granite also prefers to use pay-when-paid verbiage in its contracts.

Recent subcontractor reviews

Granite Construction’s written reviews are limited, but 50 percent of reviewers give the company 5 stars when it comes to working with them, with 67 percent total giving 3 or more stars. This gives Granite Construction an overall rating of 3.5 stars.

Reviews can often be the most telling, but a middle-of-the-road review had this to say about Granite’s payment process, speed, and policies: “It is a little better than some of the other big companies.”

Getting paid with Granite Construction

Even with a good overall score, not everything goes off perfectly with Granite Construction. For that reason, understanding what it takes to get paid can give you a layer of protection from payment issues.

Before work starts

Before you start working with a large general contractor like Granite, they’ll typically need a few important documents and pieces of information about you and your company. Those documents tend to include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

The project manager will typically contact you for these documents and explain if any additional paperwork requirements before work can start.

First payment

Large contractors like Granite work with thousands of subcontractors nationwide, so standardized paperwork tends to be the name of the game. Documents like AIA billing, G702 payment applications, and G703 continuation sheets help keep things uniform across several jobs.

When you speak to the project manager, be sure to find out when payment applications are due. They’re typically due on the 1st, 5th, 15th, or 20th of each month, but find out for certain so you don’t miss a payment window.

Progress payments

Large-scale infrastructure projects can carry on for years, so waiting until a project wraps up to get paid is not going to work. Leaning on progress payments, on the other hand, will help keep cash flowing in while the project is underway.

While you’re sending in your payment application, be sure to include an updated schedule of values to streamline the process.

Project close-out

Every GC has a different close-out method or their own unique requirements, but universally, these are the common documents:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

Here’s the thing about close-out: Be sure to read every document carefully. Close-out tends to be when lien waivers start popping up. Signing one for work you haven’t been paid for yet could forfeit your rights to a lien prematurely.

3 tips for getting paid on every construction project

Even folks that don’t work in the construction industry know it has its pitfalls. Issues abound, and the potential for a payment issue is always present. The following tips will help you avoid a slow-paying (or non-paying) GC, so learn them and put them into practice.

1. Send preliminary notices

Sending preliminary notices should be second nature on all of your construction projects. In many states, they’re a requirement for protecting your rights to a mechanics lien. If you don’t send one within the proper time frame, you’re throwing away your chance at a mechanics lien in the event of a payment dispute.

But some states don’t require contractors to send preliminary notices to protect their rights. Does that mean you can afford to skip this step? Not a chance. Preliminary notices serve as a professional introduction between your company and the GC. They explain who you are and what work you’ll be doing. But what they actually say is that you’re a professional, and you know your rights.

2. Send other visibility documents

Preliminary notices aren’t the only docs you should be sending on your jobs. Visibility documents like invoice reminders, notices of intent to lien, and demand letters help bring your company’s name to the attention of the folks cutting the checks. These documents are often all it takes to get a check written with your name on it.

3. Maintain your right to file a mechanics lien

Maintaining your lien rights on all of your projects can save your neck when payments slow down and things get dicey. If a project owner or GC refuses to pay you for your work, you’ll have the right to file a lien against the property. The property then becomes less liquid to the owner, and they could have issues securing further financing.

Filing a mechanics lien is the fastest way for a contractor to get paid in a dispute. Because they’re so powerful, states have stringent requirements that contractors must meet to preserve their rights to them. Be sure to check out your state’s laws about mechanics liens to ensure your money is always protected.