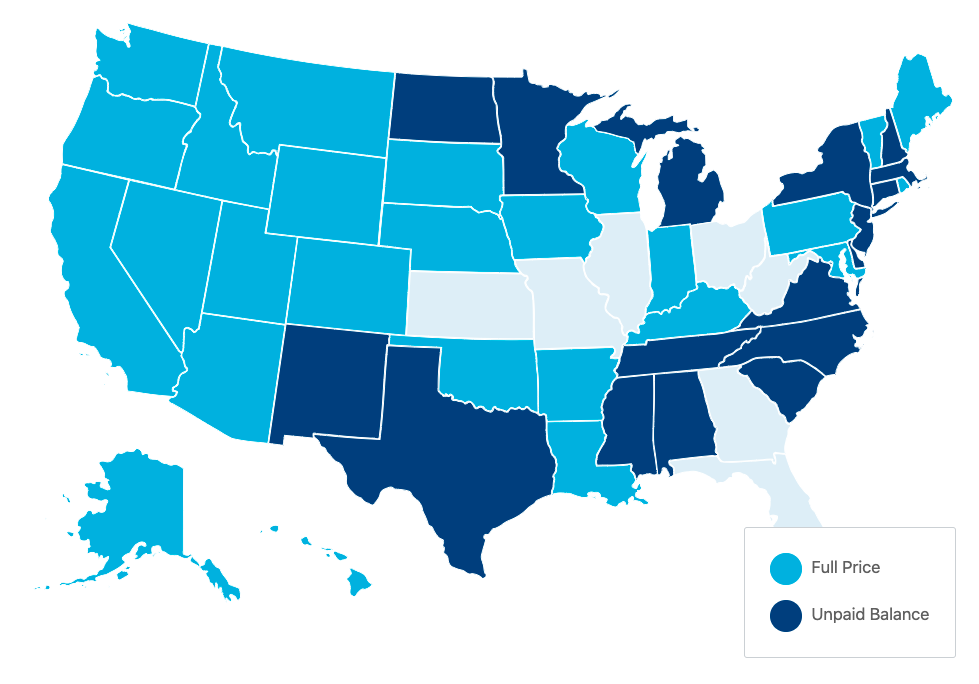

The amount of money that can be secured under mechanics lien rules varies from state-to-state. Most state laws follow one of two rules:

- Full Price Lien: The lien secures money for the total amount of work that has been provided by the lien claimant.

- Unpaid Balance Lien: The lien secures the amount of money that the property owner has not already paid to the general contractor (at the time the lien is filed).

Exceptions to the Rules

Of course, there are exceptions and nuances to any rule. The type of construction project can determine whether a claimant can file a full price or unpaid balance lien. In other states, sending preliminary notice can be the difference between full and limited lien protection.

Yet other states’ laws are a bit more complex, and don’t clearly lean one way or the other. These states are listed as “special rules” on the map below. The rules in these states are difficult to summarize in one blog post, but we are working on compiling that information and will update it here soon.

Some of the full price or unpaid balance states also have small quirks, which we’ve detailed below.

The “Hidden” Deadline in Unpaid Balance Liens

Every state sets a deadline to file a mechanics lien. This deadline is usually tied to the last date of providing services or materials. It’s fairly straightforward in each state, and mechanics liens filed after this deadline are considered void and unenforceable.

States that only allow for unpaid balance liens, however, present another sort of cutoff date. Imagine you’ve subcontracted in Alabama and your deadline to file a lien is in 25 days, but the property owner has already paid the general contractor in full. You can file your lien, but because you can only claim the amount still owed by the owner to the GC, there is no money left to lien.

There is no clear remedy to this situation, other than to communicate with your contractor and the property owner, be attentive, and send your required preliminary notices.

Specific Exceptions to Full Price Lien States

Pennsylvania. Per PA § 1405, if the aggregate lien claims of subcontractors on a project total to more than the amount still unpaid from the property owner to the general contractor (GC), then the property owner can limit the amount of the claims. The amount of any individual claim would be limited if the subcontractor was given notice of the contract price and schedule between the property owner and the GC, or if “such contract or the pertinent provisions thereof were filed in the office of the prothonotary…”

In the event that a lien claim is limited, it would be limited as follows: the claim would be pro-rated according to its share of total claims, such that the total amount of all claims does not exceed the remaining balance owed from the owner to the GC.

Wyoming. Wyoming § 29-2-108 requires prime contractors to defend lien claims brought by employees, subcontractors, subcontractors’ employees, or contracted material suppliers. While any action is in progress, the property owner can withhold from the GC the amount of the lien. If the lien claim is successful, the property owner can deduct from the GC’s payment the amount of the lien, and costs associated with the lien foreclosure. (If the owner had already paid the GC, the owner can recover these costs.)

Nevada. Per Nevada § 108.235, if a claimant files a lien (known as a Notice of Lien in Nevada), and the prime contractor has been paid for the work associated with the lien, the prime contractor has a duty to defend (at his expense) the owner from the lien. If the prime contractor has not already been paid, the owner may withhold payment up to the amount of the lien.

List of Full Price Lien and Unpaid Balance States

Full Price Lien States

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine (the lien claim cannot exceed the contract amount)

- Maryland (the lien claim cannot exceed the contract amount)

- Mississippi (non-residential projects)

- Missouri

- Montana

- Nebraska

- Nevada

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Dakota

- Utah

- Washington

- West Virginia

- Wisconsin

- Wyoming

Unpaid Balance States

- Alabama

- Connecticut

- Delaware

- Illinois (if Sworn Statement given)

- Washington D.C.

- Michigan

- Minnesota

- Mississippi (residential projects)

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- South Carolina

- Tennessee

- Texas

- Vermont

- Virginia