Filing a false lien is a hazardous game to play. Mechanics liens are valuable tools that contractors can use to recover funds in the event of a dispute, but they are regulated closely. The penalties for filing a false lien can be extremely steep in an effort to deter their use as a weapon of extortion and harassment — also known as “paper terrorism.”

The value of a mechanics lien

Appropriately used, mechanics liens are incredibly powerful tools that contractors can and should use to ensure the growth of their company. They can safeguard their businesses from non-payment and immoral business practices. Take an owner or GC abusing the pay schedule, for example. A mechanics lien can be the consequence of their action. Just knowing that a lien is a possibility can deter these would-be offenders.

But, just as owners and GCs have the ability to abuse payment schedules, deadlines, and change orders, subcontractors can easily misuse the lien process. In some cases, particularly in states with lax lien laws, anyone can file a false lien — even if they didn’t perform any work on the property.

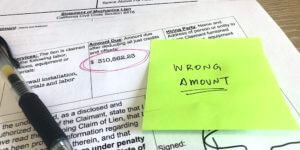

In other cases, contractors with actual lien rights can include excessive amounts in their lien, which most states consider a form of fraud.

What, if any, are the consequences of filing a fraudulent lien, then? Well, the answer is there are many, and some are very severe.

What is a false lien?

The definition of a false lien varies according to each state’s penal law. However, there are some general bad lien practices that you should avoid.

Excessive lien amounts

One way to land yourself in hot water is to file a lien with a demand for an excessive amount. Generally speaking, this means including amounts explicitly prohibited by state law.

Many states will only allow a lien filer to include the contractual amount agreed upon at the project’s offset, plus change orders in some cases. This usually means you cannot include late fees for missed payment dates. You also cannot charge interest on the amount due or offset the interest you’ve had to pay to your creditors. On top of that, you won’t have the option to include filing fees or lawyers’ fees in your lien amount.

Some states are more lenient, but you should still be careful. If your state allows, you can include late fees and interest. However, in some states, these fees need specific outlining in the original contract to be applicable. Also, including lawyers’ and filing fees might not be advisable, as the court may award them to you anyway.

Liens for work not performed

It might seem obvious that you could consider filing a fraudulent lien for work you didn’t even perform. It’s dishonest and basically stealing, right?

However, not everyone on this path is trying to extort money. For example, in some states, some consultants do not qualify for rights to mechanics liens. Unless their work leads directly to an improvement on real property, filing a mechanics lien is not in the cards.

Something else to consider is a project that falls through. You schedule the project, pay for lodging, organize mobilization, and then get word that the project won’t be going forward. Do you have lien rights? Probably not. None of that time or money went to the improvement of a real property.

In both of these cases, a contractor may not realize that they don’t have lien rights. Technically, they’d be filing a false lien if they decided to move forward.

Obviously, making up and filing a fictitious lien is a horrible thing to do to someone. But, billing for work not performed, or work that doesn’t technically qualify for a lien is entirely possible — even if you’re completely honest in your intentions.

Paper terrorism

Paper terrorism is a tactic used by a citizen to harass, annoy, or extort money from a government official. It includes filing a false lien against the property of the public official for fictitious work.

Paper terrorism is a popular weapon of sovereign citizens, who often file these false liens from the confines of prison. Several states now allow their filing offices to reject any claim they reasonably believe to be fictitious. While it’s unlikely that the filing clerk will recognize the name of every public official at first glance, this does help root out some of the paper terrorism against major public officials.

While public officials are the usual targets, paper terrorism can also affect private citizens and businesses. These paper terrorists often weave complicated webs of liens in order to harass and annoy everyday people or companies that they feel wronged them in one way or another.

Because liens are so powerful yet potentially easy to manipulate with bad intentions, there are consequences for abusing them. States are continually evaluating the threat of paper terrorism and increasing the legal consequences.

The consequences of a false lien

In general, filing a false, fraudulent, or exaggerated lien is a bad idea, and there are a lot of potential consequences. Let’s take a look at what can happen if you decide to or mistakenly file a false or fraudulent lien claim.

You won’t receive the full lien amount

Depending on where the project takes place, the governing state may be very strict in regard to lien amount inclusions. Increasing your lien amount by including filing fees, interest, late charges, and lawyers’ fees might not be the best practice.

Even if your contract states that you’ll charge X amount for interest or late fees, the court will likely remove that amount from your lien’s value. This is an important consideration to keep in mind with smaller lien amounts with weaker footing. The lawyers’ fees and filing fees can potentially exceed the amount of the lien: That can be a big hit to your lien amount.

A reduced lien amount is a relatively mild consequence for an exaggerated lien amount. If you’re in this boat, feel fortunate.

The court can throw out your lien

Mistakenly exaggerating your lien amount by including a contractually agreed-upon late fee is one thing. Stuffing your lien amount with extras in a state that doesn’t allow it is another.

If a court believes that a claimant is purposely stuffing a lien with frivolous amounts, it will consider them a red flag. This is especially true in a state that doesn’t allow for extras in a lien amount. The court will likely see it as a false lien, which it will throw out or rule against right away, meaning your chances of getting paid are all but gone.

One other thing to keep in mind: Just because a lien is invalid or frivolous, that doesn’t necessarily mean it’s fraudulent.

The takeaway: It’s best to be conservative with your lien amount. Learn more about what costs you can include in a mechanics lien here.

Jail time

In many states, losing your right to your payments may be the least of your concerns. While most states have some legal ramifications for filing fraudulent liens, some states have very strict penal laws around the matter.

Filing a false lien can result in a misdemeanor or even a felony charge.

For example, Section 32.49a sub 1 of the Texas Penal Code states that any person who “owns, holds, or is the beneficiary of a purported lien or claim asserted against real or personal property or an interest in real or personal property that is fraudulent,” may find themselves charged with a Class A Misdemeanor.

Maryland’s Penal Code, Section 3-807(a) states, “A person may not file a lien or an encumbrance in a public or private record against the real or personal property of another if the person knows that the lien or encumbrance is: (1) false; or (2) contains or is based on a materially false, fictitious, or fraudulent statement or representation.” Again, this is a misdemeanor charge.

Florida is home to quite a few sovereign citizens, so it’s had to take a hardline for fraudulent lien claims. The Sunshine State’s answer for paper terrorism is a third degree felony, according to Florida Penal Law 713.31(3). It’s hard to enjoy all that sunshine from a prison cell.

Making a habit of false liens in Utah, another paper terrorism hotbed, is a big no-no. Utah’s Penal Code Section 503.5 states a violation of 503.5 “is a third degree felony unless the person has been previously convicted of an offense under this section, in which case the violation is a second degree felony,” according to Section 4 sub B.

Each state has its own approach and penalty for false and fraudulent liens. While individual state penal law sections can be confusing, a quick search or call to a construction lawyer should clear any confusion up.

Mechanics lien rights are worth protecting

While all of this red tape might make it seem like state laws discourage the use of mechanics liens, they are actually protecting the process. By deterring fraudulent liens, these laws help keep them available to everyday citizens that are trying to recover their money.

Mechanics liens are an incredibly powerful tool that, when used correctly and morally, help keep food on the table and people employed. That’s something worth protecting.