Credit risk is important for all lenders when evaluating a new loan opportunity, but when it comes to construction contractors there is another vertical to consider — performance risk. While banks and traditional lenders typically rely more heavily on credit risk, lenders who are willing to analyze performance risk are in a great position to help contractors and succeed in this growing niche of specialized lending.

- Why is it so hard for construction contractors to secure financing?

- What is credit risk in construction finance?

- What is performance risk in construction finance?

- What can contractors due to mitigate performance risk?

Why is it so hard for construction contractors to secure financing?

Despite construction lending having the ability to be profitable for lenders, many avoid it because construction lending is simply more work. It typically requires more paperwork, more due diligence and more administrative burden on the lender’s team. It also involves more risk, especially when it comes to smaller subcontractors, which are the businesses who often need funding most.

Why are lenders so wary of construction lending? Volatility is one answer. There are huge shifts in profit margins between jobs and between a “good” season and a “bad” one. Project scopes change and delays are almost inevitable, impacting the overall profit for the job and the company. Many contractors operate with one or two big projects at a time, which means the majority of the company’s receivables are tied to one or two customers. In addition, being that the revenue is coming from projects it also places a greater burden on the contractor’s ability to continuously win new projects to maintain or grow revenue.

Credit risk is another answer. It is normal for contracting firms, and contracting firm owners, to have or have had credit issues and challenges, especially after the Great Recession. Tax issues and high debt ratios are common, as is a history of risky financial options like Merchant Cash Advances (MCAs).

In addition, most commercial lenders understand the need to evaluate performance risk when lending to construction contractors, but lack the systems or people in place to effectively manage this risk.

All of this sounds pretty scary to a traditional lender, which is why so few are willing to regularly lend to contractors.

What is credit risk in construction finance?

Simply put, “credit risk” is defined as an analysis of the borrower’s ability to pay back a debt. It is the probability of you, the contractor, failing to pay a loan or meet contractual obligations. Properly assessing credit risk helps to lessen the possibility, or the severity, of a loss for the lender. It also helps them set the credit limit and other terms for the borrower, as well as their organization’s overall credit limit.

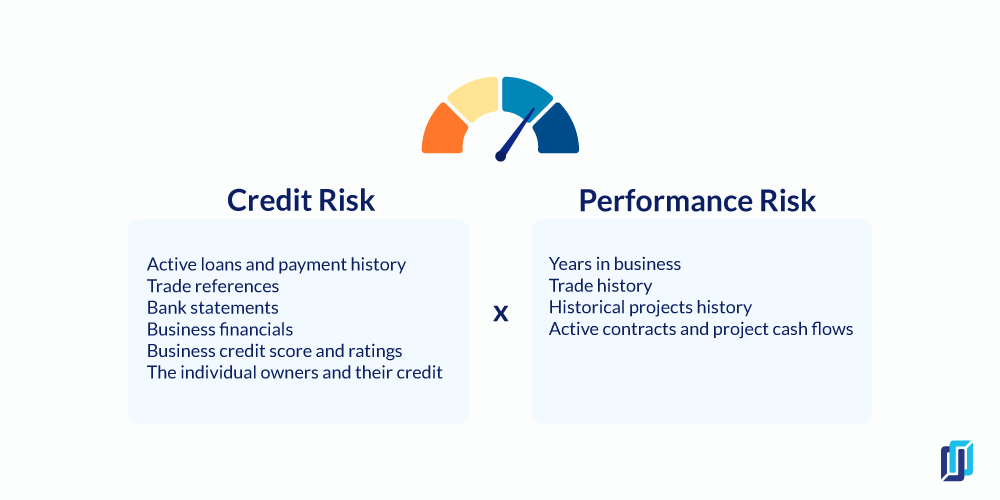

It’s impossible to know with 100% certainty who will default on a loan and who won’t, but a thorough assessment of the contractor’s tax returns, income statement, balance sheet and other aspects of the business’s financial profile help reduce the financial risk to the lender. A business’s risk profile is often made up of items such as:

- Active loans and payment history

- Trade references

- Bank statements

- Business financials

- Business credit score and ratings

- The individual owners and their credit

Construction is unique in the lending space because the lender also faces risk from the general contractor paying the subcontractor or the general contractor being paid by their customer. For this reason, many lenders providing project-based funding like ours will also run a similar, but less thorough, credit risk assessment on the general contractor.

Credit risk analyzes your ability to pay back the debt and the likelihood that they will do so. Performance risk, on the other hand, is about analyzing your ability to execute on the contract successfully so that you can earn the revenue associated to the contract.

Thea Dudley teaches credit & collections

Join the free certificate course to learn the foundations of credit & collections in construction with 30-year industry veteran Thea Dudley.

What is performance risk in construction finance?

It is crucial to evaluate performance risk when lending to construction contractors. Any business operating under the model in which work must be completed before payment is received carries a performance risk. There is an exponential amount of risk added when the business has no significant assets, like inventory, equipment, or real property, to leverage.

When we analyze performance risk, we are evaluating the contractor’s ability to do the job. This includes data points such as:

- Years in business

- Trade history

- Historical projects history

- Active contracts and project cash flows

When we look at a new borrower, we not only want to know how long they have been in business and what their general financial picture looks like — we want to analyze their ability to complete the project.

Is the work in their trade, or something new? Do they often work on projects of this size and scope, or not? Have they ever worked with this GC before, and if so, what is their payment history?

Let’s say for example that a commercial electrical company wins a contract to do the wiring on a 10-story apartment building. They’ve been in business for several years, and their credit risk is minimal.

That sounds good on the surface, but a performance risk analysis might uncover things like the project being out of state, or the business might never have worked on a project of this size before. These are performance risk items. They don’t necessarily mean a loan isn’t possible, but they require a closer look at the project’s contract, schedule of values, and cash flows.

What can contractors do to mitigate risk?

Contractors should get proactive about mitigating risk as part of their growth strategy. If you know you want to grow aggressively next year, it makes sense to clean up your credit risk and your performance risk now.

So, what can contractors due to reduce risk to a future lender?

Get your books right

QuickBooks is great, but a tool is only as good as the person who wields it. Hire an accountant, or better yet a CPA, and start cleaning up your company’s financials now. In a world where many things are out of your control — this is one that is 100% in your control!

Create a borrowing strategy

Too many business owners borrow out of a state of scarcity or panic. They need money right now and don’t think about the long-term consequences of the debt. Good financials will help the business owner forecast potential borrowing needs and make a plan for the debt. Only borrow what you need, and borrow with a clear goal in mind for the money and a plan to pay it back.

Show your math in your bid

This is especially true if the project is much larger than your company has executed in the past, but it is a good practice for all bids. You need to show that you have accurately estimated the costs and timelines in your bid. Remember that electrical contractor? It’s going to take longer to get materials and people up to the higher floors than the lower ones, which will increase labor time.

Properly document the job

Profit margins in construction are infamously low and continuing to decline. This makes lenders wary. You need to be able to present to the lender a history of good business practices, and that includes safeguarding your profit margin on each project. This includes documenting change orders and implementing a job status reporting system. Make a healthy profit margin on each job – your business’ success or failure literally depends on it!

Lending to construction contractors does pose unique risks to lenders, but it is no reason to avoid the industry. There are plenty of great people running successful businesses who need and deserve the same access to cash as other businesses.

By reducing your credit and performance risk, you can increase the likelihood the funding is there when you need it.