The credit policy is a critical document for any business, but especially one in the credit-heavy construction industry. Your company should clearly lay out its philosophy on extending terms to customers and collecting on overdue accounts. If there’s no plan, there’s no hope for survival.

What is a Credit Policy?

Simply put, a credit policy is a set of guidelines that sets credit and payment terms for customers and establishes a clear course of action for late payments.

A good policy will generally do four things:

- Determine which customers are extended credit and billed

- Set the payment terms for parties to whom credit is extended

- Define the limits to be set on outstanding credit accounts

- Outline the steps or procedures used to deal with delinquent accounts

When it’s broken down into its component parts, it establishes how risk averse a company is vis-a-vis extensions of credit and other monetary policies with respect to accounts receivable.

Many businesses rarely extend credit, and require payment immediately upon purchase. For this type of business, a credit policy is a low priority, and for good reason. There isn’t any exposure from extending credit when the business is not in the practice of extending credit to begin with.

For most other business, especially those involved in the construction industry, a sound credit policy should be an integral part of the company’s business plan, monetary policy, and overall risk-management strategy.

Why construction businesses need a credit policy

The construction industry is notorious for slow or partial payments. When your customers don’t make payments on time, it increases your carrying cost and strains your cash flow.

A strong credit policy is one of the many tools that construction companies use to speed up payment, maintain a positive bank balance, and even take on bigger projects. It also greatly reduces the amount of bad debts that a company will have to write off each year. But beyond cash flow, it also helps establish strong business relationships. Sharing your business policies helps to create a professional impression — especially when you follow through on your word.

Deep dive: How (and Why) to Implement Credit Policy and Procedures

Set Expectations

A huge part of improving payment speed is setting expectations from the start. A good credit policy lets your customer know exactly what to expect, especially when you share it before signing the construction contract. When you submit an invoice or pay application, your customer knows when you expect payment and what will happen if they don’t follow through on time. It creates a clear and consistent approach.

If your company needs to take action to collect, your customer has very little room for excuses. They knew a mechanics lien was coming, because a $20,000 payment was 30 days overdue. It was right there in your policy in black-and-white.

Build better relationships

Because construction projects are complex and highly variable, contractors and property owners alike value consistency and reliability. This is true both in terms of quality of work and in back-office business practices. A general contractor likes working with subs and suppliers that follow through on their promises. They know what to expect from them every time.

A credit policy is actually an incredibly helpful communication tool. And better communication is key to building strong customer relationships in construction.

Deciding on a credit policy

Once you have decided to formalize your credit policy, whether that entails creating one from scratch or piecing one together from elements your company already has in place, the question is: How do I make my credit policy a good one?

The end goal of all credit policies is to maximize the company revenue/business while minimizing the risk generated by extending credit. Credit policies are generally not off-the-shelf or grab-and-go products.

Factors to consider

While it’s true that the end goal of all credit policies is to maximize the company revenue while minimizing the risk generated by extending credit – the ways to get there can vary depending on many factors, such as:

- The size of the business

- The specific cash flow of the business

- The industry of which the business is a part

- The overall economic climate

The credit department plays a huge role in controlling the flow of sales through the pipeline. Clearly, the easier it is to get credit, the more customers are able to purchase, and sales go up.

A restrictive credit policy can squash sales, since fewer contractors would qualify for a credit line. However, as we have seen more than enough of recently, making credit too easy to obtain can result in more failures to pay as more of the customers default on the obligations.

Clearly, some balance must be reached between very restrictive and very lenient credit terms. You may want to outline some of the tools your team can use to make a sale when a customer has poor credit, like a UCC lien or personal guaranty.

As outlined in the definition above, credit policies set forth the credit terms, the credit limits, the type of customer to whom credit will be extended, and the policies for dealing with late payments and delinquent accounts.

Lien & notice strategy

Fortunately for parties in the construction industry, having a good lien and notice management strategy can enable businesses in the industry to have a more lenient credit policy without as much worry as a blind extension of credit.

The mechanics lien laws, bond claim rules, and corresponding notice requirements give construction businesses protection out-of-the-gate when writing a policy.

These rules turn the extension of credit into secured debt by tying the debt to the property being improved (or the bond securing the work). It makes more parties liable for the payment of that debt. This can dramatically reduce the chances of not getting paid.

How to Write a Credit Policy for Construction

Since a sound credit policy isn’t a one-size-fits-all proposition, it must be tailored to the individual business. Nevertheless, when starting to craft your organization’s policy, there is some value in reviewing and starting with a comprehensive and expertly written credit policy template.

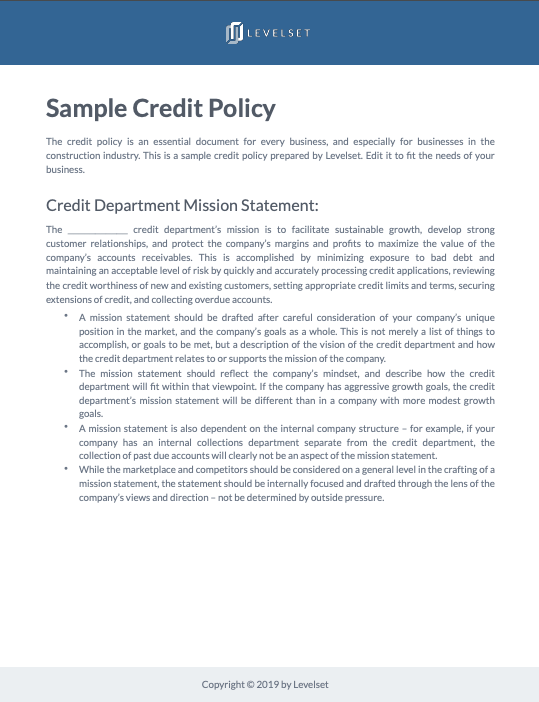

Download a sample credit policy

Download a free sample credit policy for construction businesses.

In order to draft a policy that fits with the goals of your business, you must first examine and understand how the extension of credit relates to the financial goals of your individual company. It may not be enough to simply go by the book in terms of understanding the financial exposure of extending credit.

For example, a business where 100% of the credit extended is secured debt is in a much different position than a business who extends credit on an unsecured basis.

Sections to include

In any event, and no matter how restrictive or lenient you wish your credit policy to be, there are certain sections that should be evaluated and included in the policy.

These are as follows (but are by no means limited to):

- The objectives of extending credit

- The terms and conditions of each sale on credit

- Your billing procedures

- A credit application process

- Policies and procedures for dealing with past due accounts

As it stands, the creation of a credit policy is an individual endeavor and is more of an art than a set list of rules to follow blindly. An effective policy is directly tied to the goals of your business and the amount of risk your business is comfortable incurring.

A small business may be able to function with a “credit policy” kept solely in the head of a few people, or even one person. But having a written policy ensures that there is less subjectivity and streamlines credit decisions.