Working for a homeowner on a residential construction project has some upsides: You’ll get to work directly with the decision-maker. Maybe you’ll be able to spread your creative wings a bit. But contractors need to understand the risks that a renovation, remodel, or other home construction project will bring. In this article, we look at common reasons why a homeowner doesn’t pay their contractor — and how to overcome them.

Home projects are often smaller-scale, which makes them attractive to newer contractors. They also need less coordination than large commercial projects as there are fewer moving parts.

The truth of the matter is that working for a homeowner can have the same if not more pitfalls than commercial projects. Homeowners rarely have any construction experience, and their expectations can be unreasonable. Sometimes, they don’t actually understand the contracts they sign. Also, getting paid for your work can become a problem.

Regulations for residential projects vary from state to state. Some make it very difficult for a contractor to protect their payments.

Why a homeowner won’t pay the contractor

Whether you’re building a new house or working on a kitchen remodel, working with a homeowner isn’t always rosy. They often have very little knowledge of construction or remodeling. Most of their expectations are likely based largely on their favorite HGTV show.

Learn more: 8 Ways for Contractors to Build Trust With a Homeowner

On home construction projects, the customer is not always right. Changes and unexpected issues can arise, and the homeowner’s reactions can rock the boat. They can affect the schedule and cause coordination issues with other contractors or subs. This can lead to disputes, both in personalities and payments. There are many reasons why homeowners don’t pay their contractors — here are a few of the key ones.

1. The homeowner can’t manage their money

If the homeowner took out a loan or HELOC against their home, it might be the first time they’ve had that much money in their lives. It’s tough for some homeowners to resist the urge to take an expensive vacation or go on a shopping spree (leaving less behind to pay their contractor).

They may also overestimate how much money they actually have for the project. This can leave very little money for the homeowner to pay the contractor by the time payment comes due.

2. The homeowner doesn’t understand contractor rights

Even if you’ve done everything correctly to protect your payment, a homeowner might not understand your rights as a contractor. Likely, they’ve never dealt with contractors in the past. They might not even believe that they’re legally required to pay you.

Given the homeowner’s inexperience, they may think you’ll go away if they ignore your notice and communication. The homeowner might also believe that their odds are better in court. It wouldn’t be the first time someone made up a story about a contractor’s lack of professionalism as an excuse for non-payment.

3. They don’t know about mechanics liens

When a homeowner refuses to pay, contractors have a powerful card to play: the mechanics lien. Though many homeowners have probably heard of (and want to avoid) a lien, they may not know that there are different types of liens or understand how they work. And unless they’re involved in construction themselves, it’s incredibly unlikely that they know about their state’s mechanics lien rules and requirements.

If you’re not sure exactly what the laws are, either, don’t worry. That’s what we’re here for.

Mechanics lien laws for home construction

Every state has mechanics lien rules and requirements that construction businesses need to follow. Some states treat home construction projects differently than commercial construction projects. They have a different set of rules that pertain to preliminary notices and notices of intent to lien. These rules could cause issues for a contractor when trying to get the homeowner to pay.

Below are just a few of the states that have unique guidelines for protecting a contractor’s lien rights on a home construction project. Some other states treat residential projects differently than they do commercial projects for the purposes of mechanics liens. Check your state’s regulations or let Levelset’s team manage your lien rights for you.

The thing about Texas homestead projects…

Texas mechanics lien rules treat “homestead” projects a bit differently than other types of construction jobs. A homestead is a property on which the homeowner actually lives. Texas puts a few extra roadblocks in the way of a contractor on these jobs. This is likely because, understandably, they don’t want to put someone out on the street because they didn’t understand the construction documents they were signing.

For any Texas contractor to have lien rights, there must be a written contract between the general contractor and the homeowner. Those parties must sign the contract before the work begins. Then, someone has to file the contract with the county clerk in the county where the project is taking place.

Oh, and if the homeowners are married, the contract requires both parties to sign it. This can be exciting in marital separation scenarios!

You might not need a notice in Mississippi

On most construction jobs, contractors need to provide preliminary notice in Mississippi in order to protect their payments. Lien rights are different for residential projects. If the contractor deals directly with the homeowner, preliminary notices aren’t required to preserve lien rights.

However, contractors must provide a detailed list of subs and material suppliers if the homeowner requests one. Failure to do so will result in giving up lien rights.

Subcontractors must provide ten days after serving a notice of intent to lien before filing a mechanics lien, as well.

New Jersey prioritizes property sales

New Jersey’s approach to mechanics liens protects the real estate market, attempting to keep homes as liquid as possible. The general idea is that the fewer liens there are on NJ homes, the easier properties are to buy and sell.

As such, before a contractor files a mechanics lien, an arbitrator gets involved. The arbitrator decides on the validity of the claim, the amount allowed, and the timeline for enforcement.

How to get paid on a homeowner project

There are some hoops to jump through to protect your rights on some residential projects. There are also some ways to protect your payments before and after you start working.

Prequalify the homeowner

Prequalifying a homeowner can mean a lot of things, from inquiring about the payment method to determining your credit policy. It’s a way to gather information to help you to hedge your bets against slow or non-payments. The time to do it is before the project begins.

When discussing the project, there are some important questions you can ask:

- Have you undertaken a [renovation/remodel/restoration] project before?

- What is your budget for the project?

- How do you plan to pay for the work?

Since you’re setting the credit policy for the job, you can even request a credit report to determine the risk involved. Depending on their credit, you might adjust your progress payment schedule. You might even decide to pass on the job altogether.

Set expectations with the homeowner up front

Unless the homeowner is a lawyer or business person, it’s unlikely that they’ll understand all of the clauses in the contract. The key here is to avoid miscommunication or misunderstandings. You don’t want any gray areas left open for interpretation. You should be explaining and requiring initials on every document you use.

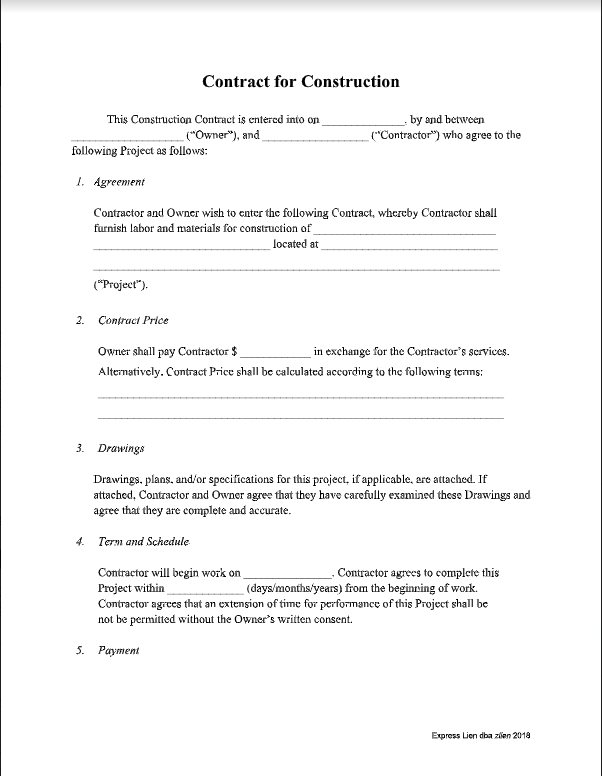

Download a simple contract

Get a free, easy-to-understand construction contract template that works for most home improvement or construction projects.

It’s also very important that the documents you’re using to protect your payment be clear and concise. You should outline your credit policy and the terms for late payments.

Provide construction notices that explain themselves in clear and simple language. Also, your paperwork needs to be clear on the consequences of non-payment.

The seriousness of your documentation alone may be enough for the homeowner to keep things on an even keel throughout the project.

Document everything

Since homeowners can be challenging to work with, it’s essential to keep records of all documentation. You should document any changes in the work scope with the new plan, date, time, and signatures.

You should also take pictures of the project’s progress at every significant step. If payment issues arise, document them right away with as much supporting information as possible.

Treat any change in the project as a new contract. Be sure to create change orders for every turn in the plan. Use clear language that describes the requested change and the cost. Make sure both parties understand the change order and expectations. Once everyone understands, sign the change order just like you would a major contract.

Since you’re changing the course of the project, the prime contract won’t cover the changes. Reviewing changes with the homeowner at each step provides an extra reminder that they need to pay their contractor.

File a mechanics lien when needed

Despite your best efforts, you may find that the homeowner doesn’t take the contract seriously. The good news is that a mechanics lien can speed up the payment process. Keep a close eye on your deadline in case you need to file a mechanics lien against their property. Mechanics liens are clear and direct, and they make sure that the homeowner knows you have a right to payment.

The time to check if you’re within your rights to file a mechanics lien isn’t when you need one. You should be sure of your rights and the guidelines and regulations in your state before you start the project. Laws do change from state to state, so do your research about protecting your lien rights ahead of time.

Filing a mechanics lien may become your only option when you’re trying to get paid for cash owed to you on a residential project. If you follow your state’s guidelines and use clear communication and documentation, you’re likely to recover your cash. If you have to foreclose on your lien, these steps will help to present your case to a court. You’ll show up in a better light than the homeowner does.