Construction participants know all about the struggles associated with payment. Slow or nonexistent payment is a pervasive problem in the industry, leading many companies to search for ways to get paid faster (or at all). One of the best ways to address the industry’s payment problem is through sending a preliminary notice to provide visibility and prioritize invoices. Sending notice helps to put your invoice on the top of the list, meaning, your invoice gets paid first which is a huge benefit to your cash flow. Sending notice correctly will also significantly reduce the risk of non-payment by maintaining your secured status, protecting your ability to file a lien (if required).

However, in order to “send notice correctly,” many specific rules and requirements must be successfully navigated. From the timing, to the content, to the mailing method, every step must be perfect to keep the lien right on the project in place. Unfortunately, these rules tend to be very complicated – and in some states, even more so. Keep reading to find out if one of the states where you do work also happens to be one of the states with the trickiest notice requirements.

Texas

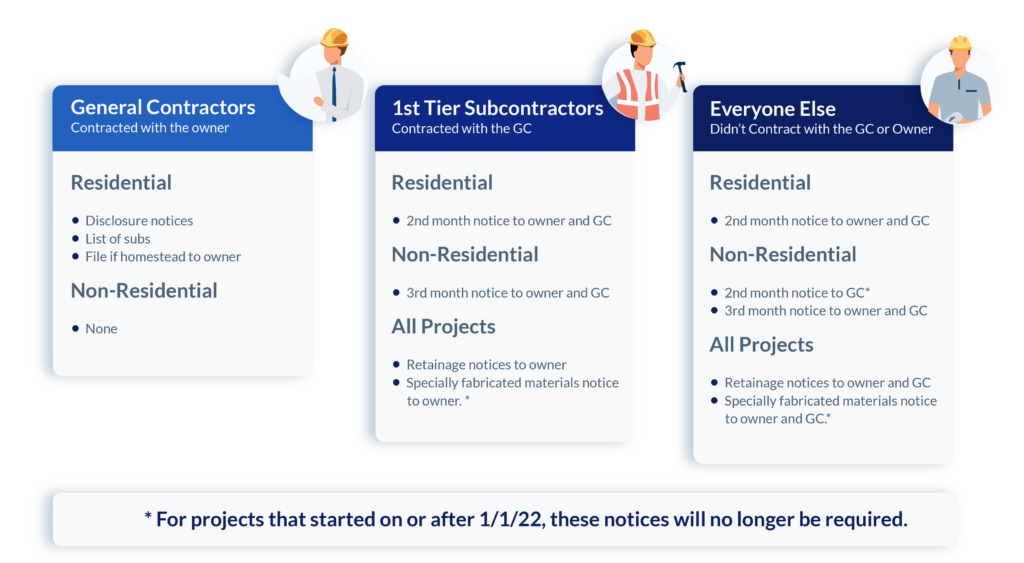

An article about tricky and complex notice requirements wouldn’t be complete without a mention of the Texas notice requirements. Texas is likely the run-away winner for the most confusing notice requirements (or at least the notice requirements that take the most work). Texas requirements are tricky in that there are some notices that only need to be sent once, and there are notices that may need to be sent multiple times throughout the project (and to multiple parties at different times).

First, there are the “one-time” notices:

- Notice of Contractual Retainage (§53.057)

- Notice of Specially Fabricated Materials (§53.058)

- Note: This will no longer be required on new projects started on or after 1/1/22

- Request for Notice of Termination (§53.107)

- Request for Surety information (§53.159)

Then, there are the “monthly” notices:

This type of notice is unique in that it is a recurring requirement based on months in which work was performed, but for which the claimant was not paid. These notices must be sent by the 15th day of the month either 2 or 3 months after the month in which the claimant provided labor or materials but for which the claimant remains unpaid. Which notice or notices must be sent depends on the type of project and the potential lien claimant’s tier in the project, and either 1 or 2 notices will be required. The general rules to keep in mind are as follows:

- Subs and suppliers on residential projects only need to send 1 notice

- Subs and suppliers who contract with the prime contractor on commercial projects only need to send 1 notice

- Those who do not contract with the prime contractor on commercial projects must send 2 notices*

- Note: For projects starting on or after 1/1/22, the 2nd month notice will no longer be required.

- Monthly notices must only be sent if you are not paid after a certain amount of time

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

North Carolina

Preliminary notice requirements can be tricky in the Tar Heel state, as well. North Carolina, pursuant to the dramatic change to its lien laws in 2013, generally requires that project participants send a preliminary notice to lien agent, and additional notices may or may not be required depending on project-specific circumstances. When required, the notice to mechanics lien agent must be sent by all project participants within 15 days of their first furnishing of labor or materials. The notice is required on all projects for which the original building permit was $30,000 or more (other than single family residences). There are a few potentially confusing things about this particular notice, however. One of these potential spots for confusion is how the notice must be sent. While, generally, the notice to lien agent is sent via posting through the liensnc.com website. But, while many parties believe that to be a statutory requirement – this is not the case. In fact, notice to the lien agent can be accomplished through a number of different means.

An additional point of confusion is the extent to which the notice mechanics lien agent is actually required. While the statutes and corresponding discussion seem clear that the notice to mechanics lien agent is required, it seems that the failure to provide the notice of lien agent only serves to disallow a lien filing if the property is transferred “to a bona fide purchaser for value protected under G.S. 47-18 who is not an affiliate, relative, or insider of the owner.” Making North Carolina notices even more confusing, there are additional notices that may be required depending on what other parties do – and depending on the desire and future actions of the claimant. A notice of subcontract may be required in order to preserve the ability to file and enforce a lien, but is only required of 2nd and 3rd tier subcontractors if the owner files “a completed and signed notice of contract form.” And, it is only effective to the extent certain actions are not taken by the GC. If a notice of subcontract is given pursuant to the above, a second or third tier subcontractor may enforce a claim of lien on real property unless:

“the contractor serves upon the second or third tier subcontractor, within five days following each subsequent payment, by the same means of service as described in G.S. 44A-19(d), the written notice of payment setting forth the date of payment and the period for which payment is made as requested in the notice of subcontract form set forth herein.”

A notice of lien on funds works kind of like a stop notice to trap funds. While there is some confusion surrounding whether it is specifically required as prerequisite to filing a claim of lien on real property through subrogation, it is definitely a best practice. If it is sent (and a notice to MLA is also delivered) the GC is rendered unable do anything to negatively affect the 1st tier sub’s rights without written consent. Man, I got tired just typing all of that! When it comes to preliminary notices, North Carolina is clearly a tough state to manage!

Oregon

The requirement that makes Oregon notices tricky is not that the notice is particularly difficult, recurring, or subject to odd delivery requirements – but that the deadline comes up fast. In Oregon, when the notice of right to lien is required, it must be served on owner (and lender, if any) within 8 days of first providing labor/materials. Additionally, parties who contract directly with the property owner on projects more than $2000 must provide an “information notice to owner” which is a form provided by the Oregon Construction Contractors Board. This notice must be provided to the owner at the time of signing a residential construction or improvement contract with the owner; and must be provided to “the first purchaser of residential property constructed by the contractor and sold before or within the 75-day period immediately following the completion of construction.” This is a interesting requirement in that a party who builds a residence must provide a particular notice to the purchaser of the residence even if it is sold 75 days after the property is complete.

Further Reading:

The 5 Trickiest States for Lien Waivers | levelset

Arizona

Arizona is unique in that not only does it have a general preliminary notice requirement, it also has a requirement to send an additional “amendment” to that preliminary notice in the event the job gets more expensive. Arizona preliminary notices require that the noticing party provide the estimated contract amount – and the party’s lien rights are protected up to 120% of that amount. However, if the value of the labor or materials exceeds the amount in the notice by more than 20%, an additional preliminary notice must be sent to cover the additional amount. This 20% excess notice requires the noticing company to pay attention to their notices and jobs on an ongoing basis, and react appropriately. It is important for parties to understand what the amount on the original notice was – and keep track of their invoicing / pay-apps to monitor the total labor/material furnished in relation to that amount. Since most preliminary notice requirements are “send it and forget it,” these requirements make Arizona’s requirements a bit trickier than normal.

Louisiana

Note: Louisiana’s lien and notice laws changed on January 1, 2020, so some information in this post might be outdated. You can learn about the changes here: Louisiana Mechanics Lien FAQs and Louisiana Notice FAQs. For a state that is traditionally a “non-notice” state, Louisiana’s notice requirements can be a bit more opaque than would be generally assumed. For GCs, Louisiana requires that a notice of contract be filed on all projects of more than $25,000 – and that a corresponding notice of completion is filed after the project is complete. Failure to do so can, in theory, leave the property subject to liens indefinitely. Additionally, Louisiana has tricky notice requirements for material suppliers and equipment lessors. The equipment lessor notice must be delivered to the owner and GC within 10 days of furnishing equipment. The tricky part is what the notice actually is. Historically, a Louisiana equipment lessor just had to deliver a copy of the lease itself to the property owner within the 10-day period. That requirement was amended to require a “notice” to be sent to the property owner, but that:

“the notice shall contain the name and mailing address of the lessor and lessee and a description sufficient to identify the movable property placed at the site of the immovable for use in a work. The notice shall state the term of rental and terms of payment and shall be signed by the lessor and lessee.”

This requirement (especially the last part – that it must be signed by the lessor and lessee) makes it seem like the requirement can be met by sending the lease itself, just like before the change. However, since the statutory language was purposefully changed, it is difficult to determine what exactly the legislature intended. (And as anyone with just a slight familiarity of Louisiana’s colorful political history can surely surmise, having difficulty determining exactly what ‘the legislature intended’ is a common occurrence in the Bayou State). Further, the notice required to be sent by material suppliers can be difficult as well, depending on which party hired the supplier. Material Suppliers must send a notice of non-payment 10 days before filing a mechanic’s lien if hired by a prime contractor. But, if hired by a subcontractor, the notice requirement changes to a recurring requirement and must be sent within 75 days of the last day of each month of furnishing labor and/or materials.

Conclusion – Preliminary Notice Requirements Are Crucial to Lien Rights

Meeting preliminary notice requirements is crucial to maintaining lien rights, and prioritizing invoices for prompt payments. If a project is on elf the above states, however, it may be worth taking a bit more time to make sure all your i’ are dotted and all your t’s are crossed. The Levelset website contains an encyclopedic collection of construction payment, mechanics lien, payment bond, and other related resources for all 50 states, freely available to anyone in the construction industry. Be sure to check it out if you haven’t already.