The construction industry is not immune from the threat of bankruptcy. Far from it. In fact, the unfortunate reality is that construction businesses go bankrupt more often than businesses in other industries. Even worse, construction bankruptcies are more likely to happen in a growing economy than in a shrinking economy.

So, construction businesses are more likely to go bankrupt – which means as a construction business, you’re more likely to deal with a bankrupt partner, subcontractor, or customer. Then comes the important question: What can a construction company do to maximize its chance of getting paid when someone goes bankrupt on the job?

At the end of the day, all bankruptcies share just one common culprit: running out of cash. It’s really that simple. As long as a business or individual still has access to cash (via cash flow from operations, financing — like a line of credit, selling off a piece of equipment, or even from a generous relative), you can still live to fight another day. But when that incoming cash is tapped out….well, it’s just a matter of time before it all comes to an end.

One Bankruptcy on a Construction Project Will Affect Everyone

Before we discuss how bankruptcy can impact getting paid, let’s quickly tackle a few fundamental questions about bankruptcy in construction:

When a party that’s involved in a construction project files for bankruptcy protection and the project is ongoing, what’s the impact, and who is affected?

In answering, let’s consider three different scenarios:

When The Owner, Developer, or General Contractor Files For Bankruptcy

When the owner, developer, or general contractor files for bankruptcy, everyone on the project is directly impacted, and the impact can be quite severe. In most cases, the entire project will get shut down for some period of time. This leaves contracts with subs and suppliers frozen in time while the bankruptcy process slowly works its way through the court system.

Best case scenario? If there was a performance bond present, maybe the surety will step in and keep the job going. Or maybe some other party will step in and keep the job going – potentially at the direction of the bankruptcy court. Even that best-case scenario will significantly alter the schedule and budget for the project. Financial losses for the other parties involved can be significant — so significant that some of the other parties on the job may not even survive.

When The Company That Hired You Files For Bankruptcy Protection

The second scenario involves a situation where your customer — the party that hired your company to work on the project — files bankruptcy. In this case, that bankrupt party’s suppliers, equipment rental companies, subs, and others will have to deal with collecting while their customer is protected by the bankruptcy proceeding.

When An Unrelated Party on the Project Files For Bankruptcy

The third scenario is a by-product of the second scenario. It’s easy to see the impact when your customer has filed for bankruptcy. However, when one party files for bankruptcy, there is also an indirect effect on every other party on the project. The moment that someone files for bankruptcy protection, their assets, receivables, contractual rights, and more are frozen in the bankruptcy proceeding. This restricts all the other parties from interacting with their scope of work until released by the bankruptcy trustee, and since this impacts the job, this has a lot of direct and indirect scheduling and financial consequences to parties unrelated to the bankrupt party.

Learn more: The Three Main Types of Bankruptcy Chapters in Construction — and What They Mean

What Causes Construction Industry Bankruptcies?

When we talk about the “construction industry,” or even just a single project, we’re talking about many more participants than just the contractors, suppliers, and others that provide the actual labor and materials to the project. Any discussion of the construction must include the top of the “payment chain” — the property owners or developers that initiate the work, as well as their financing sources.

More on Cash Flow

It’s very easy for a property owner or developer to over-extended themselves financially. A property owner could lose the income source they were using to fund a project. A property developer might be hit with an interest rate hike on their loan. Other events like divorce, illness, a natural disaster, fraud, or other criminal activity could all lead toward bankruptcy. We’ve all heard the stories, and many of us have seen it first-hand. The point is, bankruptcy is a fact of life in business for even the largest and seemingly most “successful” entities.

For contractors, suppliers, and others that do the actual work on the construction jobs, the threat of bankruptcy is even more significant. As mentioned above, construction businesses go bankrupt more often than those in other industries. Not only that, but this risk of bankruptcy is even worse when the economy — and the individual business — is growing.

How can this be? The answer lies in the unique challenges presented by the construction industry. First and foremost, it takes a long time to get paid in construction. This means companies must float a huge amount of the costs and expenses associated with kicking off a new project — almost all of which are true “out-of-pocket” expenses like materials, labor, and other hard costs. This money goes out the door long before any revenue from the project comes in — and that’s a cash flow nightmare.

When a company is growing, that means that they will be taking on more and more jobs. And more work means more cash going out the door. This phenomenon is what people in the business world are referring to when they say “growth eats cash.”

On top of that, margins can be very slim in construction. So, not only do you have to wait a long time to get paid, when you finally do get paid, there isn’t a lot of extra cash that’s been generated and can be used to help keep the business afloat.

Construction Business Failure Rates Are Highest

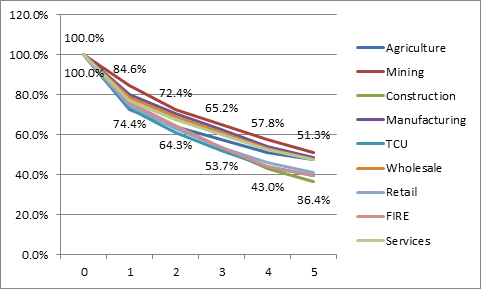

According to data compiled from the Census Bureau’s Business Dynamics Statistics in 2013 by Scott Shane for Small Business Trends, construction businesses have an almost 65% chance of failing within the first 5 years of their existence.

This failure rate was the worst measured for any industry surveyed.

Mechanics Liens — the Antidote to Construction Bankruptcy

Here’s the deal – if you are in construction, you know the perils of a bankruptcy filing. Your company will file a proof of claim and wait. That’s it. Sometimes you’ll get paid pennies on the dollar, and sometimes nothing. Often times, a bankruptcy proceeding is so long and drawn out that many companies simply give up and write off the amounts owed as bad debt.

However, there is an alternative to going it alone when dealing with a construction company bankruptcy — and that is to go into a bankruptcy proceeding armed with a valid mechanics lien claim.

Mechanics liens are not only useful to get construction companies paid in “regular” non-payment situations, but they are also one of the strongest tools available to construction companies to protect against non-payment due to bankruptcy.

The Mechanics Lien Exception to an Automatic Stay

One of the protections afforded to a debtor through a bankruptcy filing is the “Automatic Stay.” An automatic stay blocks collection efforts as well as other creditor actions taken against the debtor and/or his property while the automatic stay is in place. This is supposed to allow the debtor time to come up with a plan to pay back all of the parties they owe money to.

At first glance, an automatic stay would seem to spell disaster for a potential mechanics lien claimant — after all, doesn’t the automatic stay prevent the mechanics lien claimant from taking any action to get paid the money they’re owed?

We’ve got good news! There’s an exception to the automatic stay for mechanics lien claimants. This exception could allow a claimant to perfect their mechanics lien after bankruptcy has been filed and during the automatic stay, provided certain requirements are met.

Essential Reading: What Does ‘Perfecting a Lien’ Mean?

How does the automatic stay exception help lien claimants?

Lien laws vary between states, but the lien right generally arises when the materials are first delivered or the work was first performed (if not before then – at the start of the project as a whole), well before the lien is perfected. Therefore, it’s very likely that the lien right will be “earned” long before a bankruptcy filing.

The Bankruptcy Code permits the lien to be perfected after the filing and during the automatic stay. In other words, the Bankruptcy Code does not stop a mechanics lien creditor who performed work and/or supplied materials before the bankruptcy filing from perfecting or maintaining the lien.

If, however, the developer/general contractor owns the property, the property would become part of the bankruptcy estate – and subject to the provisions of the automatic stay.

The takeaway is this: If the bankrupt party does not have an ownership interest in the property being liened, the lien may be foreclosed upon despite the bankruptcy proceeding. If the bankrupt party does own the liened property and the claimant wants to enforce their lien, leave of the bankruptcy court is required to enforce the lien during the automatic stay. Otherwise, the lien might be enforced after the automatic stay is lifted.

Extending the Enforcement Period of Mechanics Liens

Despite the fact that the Bankruptcy Code allows for the perfection of a mechanics’ lien during the automatic stay, if the lien arose prior to the filing of the bankruptcy petition, a mechanics lien claimant is still left with a problem. The exception that allows the perfection of the lien does not apply to the enforcement of the lien. Since mechanics’ liens must be enforced within a certain time period, and bankruptcy proceedings are generally drawn out affairs, is there a way to retain the lien rights that were just perfected?

Fortunately, the Bankruptcy Code does provide a mechanism for preserving the lien claimant’s rights. The claimant is allowed to file a lien preservation notice with the bankruptcy court to notice his intention to preserve and enforce his lien rights.

This notice serves to show that the lien holder intends to enforce his mechanics lien against the real property that is subject to the lien. It must be filed with the Bankruptcy Court and served on the debtor’s bankruptcy trustee (in a Chapter 7 case), or on the debtor in possession (in a Chapter 11 case), prior to the deadline for commencing an action to enforce the lien rights in that state. If correctly filed, the notice tolls the foreclosure deadline until at least 30 days after the automatic stay is lifted.

Another possibility for a mechanics’ lien holder is to petition the bankruptcy court for relief from the automatic stay – but that’s a more complicated option, and it’s typically less successful

In either case — and the most important thing to remember — is that the mechanics lien claimant remains protected.

Enforcement of Mechanics Liens Despite the Automatic Stay

Above, we determined that a mechanics lien may be perfected during bankruptcy’s automatic stay and that the time period to enforce a mechanics’ lien may be tolled (extended) during the automatic stay. But, is it possible to enforce a mechanics lien despite, and during, a bankruptcy proceeding? Like many legal questions, the answer is: it depends.

Generally, if the property owner is the party who declared bankruptcy, a mechanics’ lien cannot be enforced during the bankruptcy proceeding. However, as mentioned in the previous section, a mechanics’ lien holder may petition the bankruptcy court for relief from the automatic stay. If the court grants this relief, the mechanics’ lien holder may proceed against the property for the payment of the debt.

While that seems pretty straightforward, what happens when it’s not the property owner who files for bankruptcy, but someone else on the project? In that situation, the mechanics’ lien holder may enforce their lien without requesting relief from the bankruptcy court.

Why? Because mechanics liens are rights against the property to secure the payment of a valid debt. The bankruptcy of the hiring party won’t negatively affect the lien, or the ability of the lien claimant to get paid by someone other than that hiring party.

The takeaway of mechanics lien enforcement during bankruptcy is this: If the bankrupt party does not have an ownership interest in the property being liened, the lien may be foreclosed upon despite the bankruptcy proceeding. If the bankrupt party does own the liened property, things get a lot more complicated.

Mechanics Liens, Bankruptcy, and Secured Debt

Everybody has the same question when a debtor files for bankruptcy protection — Will I get paid?

To determine the chances of recovery from a bankrupt party, one of the essential factors to consider is the nature of the debt. That is, is the debt secured or unsecured?

Unsecured debt is typically wiped out by a bankruptcy filing. If an unsecured creditor is lucky enough to get any money at all, it’s usually pennies on the dollar.

However, secured debts typically remain intact through the bankruptcy if the debtor holds onto the property securing the debt. Bankruptcy doesn’t just erase the obligation to pay a secured debt.

So, the question is whether a mechanics’ lien secures debt through bankruptcy. The answer? Yes, a mechanics lien is a secured debt.

Since a secured claim survives the bankruptcy, a mechanics lien holder is a good position. However, bankruptcy law is complicated and there is a unique wrinkle to the situation: a mechanics lien will remain enforceable after the bankruptcy adjudication — but the debt which gives rise to the lien may be discharged.

If this seems impossible, or at least counter-intuitive, remember that a mechanics lien is a right against property (which is why it is secured and survives the bankruptcy proceeding). So, the debtor’s personal obligation to pay may be extinguished by his bankruptcy, but the property’s obligation is not.

Unfortunately, this is not an iron-clad guarantee of payment. Generally (and absent specific rules providing differently), mechanics liens follow the “first-in-time, first-in-right” rule. So, if the property is mortgaged, the mechanics’ lien holder will usually only be paid after the initial mortgage is satisfied. If the property is over-mortgaged (underwater), then, the mechanics lien holder might not be paid, despite the fact that he holds secured debt.

That being said, having a debt secured by a mechanics lien greatly increases the chances that a construction company will be paid in the event the property owner declares bankruptcy.

Mechanics Liens and Bankruptcy Lien-Stripping

A mechanics lien is a powerful tool even when in the face of bankruptcy. This puts a mechanics lien holder in a pretty good position when attempting to recover a debt from the bankrupt party.

However, a bankrupt debtor can avoid certain types of liens in a process known as “lien-stripping,” even though these liens are “secured” by the debtor’s property.

Despite the fact that liens normally surviving bankruptcy are unaffected by the debtor’s discharge, some liens are “strip-able” and therefore avoidable by the debtor if the debtor takes specific affirmative action.

So, what liens can be avoided, and should a mechanics lien holder be worried?

The liens generally avoidable are liens attached to assets a debtor is entitled to claim as exempt, and to the extent that the lien impairs the value of the exemption. A lien impairs the value of the exemption if there is not enough equity in the liened asset to cover the non-avoidable liens, the exemption, and the avoidable lien.

At first blush, this appears to create a problem for a residential mechanics lien claimant, as the family home can be exempt from bankruptcy proceedings. Luckily for the lien claimant, though, a mechanics lien holder does not have to make the calculation of whether the lien impairs the value of an exemption.

The final requirement for a lien to be avoidable is that the lien must be either a judicial lien, or a non-possessory non-purchase money security interest. Mechanics’ liens are statutory liens, and as such are unavoidable in a bankruptcy proceeding and will survive the bankruptcy unaffected.

Facing a Construction Company Bankruptcy With vs. Without a Mechanics Lien in Place

Here is an example of how a mechanics lien can work for you in a construction bankruptcy:

Say you are a supplier who was hired by a subcontractor. Now say that you don’t get paid and that subcontractor files for bankruptcy. Let’s look at how your claim might proceed with or without a mechanics lien.

Without a Mechanics Lien

If you don’t file a mechanics lien, you only have the right to file a claim against the subcontractor with whom you contracted. If that contractor files for bankruptcy, you are, unfortunately, unlikely to be paid. You will be an unsecured creditor, and the subcontractor’s debt will likely be expunged through the bankruptcy proceedings.

With a Mechanics Lien

Now, if you have a mechanics lien, the situation is different. You have the right to file suit against not only the subcontractor that hired you but also the property owner and potentially the prime contractor — this opens up greater possibilities of getting paid. Further, if we change the above situation so that it was the property owner who went bankrupt — you are still protected. Your mechanics lien would ensure that your claim is a secured debt, and your lien would stay in effect through the bankruptcy proceedings.

So, a mechanics lien provides great opportunity to be paid — even in a bankruptcy situation where payment is otherwise unlikely.

Creditors with a secured mechanics lien right are in a unique position. Bankrupted parties typically owe a lot of creditors money, but all of those creditors are restricted and they’re only able to recover the money from the bankrupted party. Those with a secured mechanics lien right can actually escape that battle and go collect money from non-bankrupt parties: folks like the general contractor, the property developer, the lender…or, the project job site itself.

Quick Recap

So to recap: (1) Mechanics liens can be perfected during the automatic stay, (2) the deadline for enforcing the mechanics lien can be tolled (extended) during the automatic stay when the bankrupt debtor is the property owner, (3) the lien may be enforced during the bankruptcy proceeding if the bankrupt party is not the property owner, and (4) the lien is unavoidable.

Since mechanics liens have a rare ability to be perfected after the automatic stay and can emerge unscathed after the bankruptcy process, they provide a fantastic opportunity for companies in the construction industry to be paid, despite another party’s bankruptcy.

The Bottom Line

A few ways mechanics liens can better position companies to recover the money owed to them when faced with a bankruptcy petition follow:

- Mechanics liens are secured debt. Secured debt is much more likely to be paid in a bankruptcy proceeding than unsecured debt, because the secured creditor has an interest in the property of the debtor.

- Mechanics liens cannot be “stripped,” or otherwise avoided by the bankrupt party. A mechanics lien emerges after the bankruptcy discharges unscathed and in full effect and can be foreclosed upon.

- A mechanics lien allows you to sue all the parties “up the chain” from you to the owner, not just the party with whom you have a contract.

- A mechanics lien gives you leverage. At the end of the day, the bankruptcy filing may be used to assert leverage against creditors. The mechanics lien, on the other hand, asserts leverage against the debtor and other participants by bucking some of the benefits afforded by bankruptcy filings.

All in all, the utility of a mechanics lien claim is hard to understate. In a bankruptcy situation, however, it is literally the best available option.