Construction payments come slowly, and sometimes, they don’t come at all. Every state has prompt payment laws (though they can vary from state-to-state) that set deadlines for payment — and interest penalties for late payments. If you are having trouble getting paid on a construction project, prompt payment laws are one avenue to speed up payments. In this article, we are going to take a look at the deadlines and penalties under California’s Prompt Payment Act.

Read California Prompt Payment FAQs

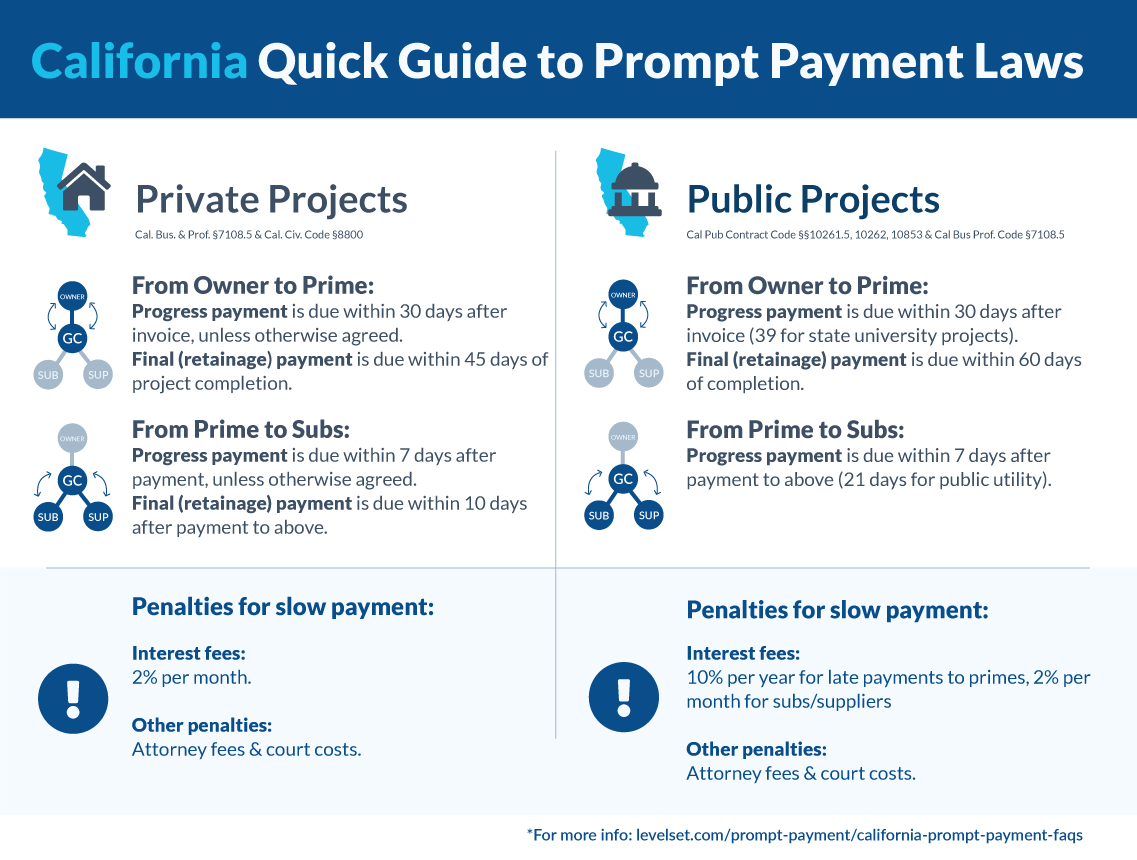

California Prompt Payment Deadlines

There are actually two different laws that govern the timing of payments in California, and they depend on the type of construction project. Some of the prompt payment laws apply to private projects1, and others apply to public works projects2.

Note: If you are working on a federal project, the Federal Prompt Payment Act applies.

Related:

How to write a prompt payment demand letter

How to get paid on California public projects

Payment Deadlines for the Owner

Each prompt payment law has deadlines for payments from the property owner or public agency to the prime contractor and other direct contractors.

Progress payments

On private construction projects, the owner must pay direct contractors within 30 days of the contractor’s request for payment. But that’s not written in stone, per se. There are exceptions if:

- parties agreed to another time frame in the contract, or

- there is a good faith dispute over payment due.

A good faith dispute isn’t a license to withhold everything, though – an owner may only withhold up to 150% of the amount in dispute.

On public construction projects, the rules may actually vary depending on the type of public entity. In particular, the California State University system must pay direct contractors within 39 days after receipt of an undisputed payment request. State & local agencies must pay progress payments within 30 days after receiving such a request. Payment requests that are rejected must be returned to the direct contractor with a written explanation within 7 days.

Retainage

On private construction projects, the owner must pay retainage within 45 days after completion of the improvement. However, if a good faith dispute exists regarding the amount of retention due, the owner may withhold up to 150% of any disputed portion. But, if the contractor corrects or completes the disputed work – and sends notice that the fix is complete – that work must be accepted or rejected within 10 days. Note: parties cannot modify the 45 day period applicable to retainage by contract like they can with progress payments. If the contract requires retainage to be withheld, it must be paid within 45 days to avoid the penalty.

On public construction projects, retention withheld by a public agency must be released within 60 days of completion of the work of improvement.

Dealing with Slow Payment?

Send a Prompt Payment demand. We’re experts at securing payment. With Levelset, it’s fast, easy, and done right.

Payment Deadlines for Direct Contractors

California’s prompt payment rules also set deadlines for the GC to make payments to subcontractors as well.

Progress Payments

Rules governing prompt payment to subs are generally the same for public and private projects.

On private construction projects, GCs must pay subcontractors within 7 days of receiving each progress payment relating to that sub’s work. The same exceptions that apply to direct contractors (above) also apply to subs. That means the time frame can be changed by contract, and payment can be withheld if a good faith dispute exists (up to 150% of the amount in dispute).

On most public projects within California, a general contractor must pay subs within 7 days of receiving a progress payment relating to that subcontractor’s work. One exception is projects for public utilities. General contractors on a project for public utility must pay subs within 21 days of receiving a progress payment relating to that subcontractor’s work. The timeframe can be changed by contract, and payment can be withheld for a good faith dispute (up to 150% of the amount in dispute).

Retainage

On private projects, the GC must pay retention to subcontractors within 10 days of receiving retention payments from the owner. If the GC is withholding retainage from a subcontractor until that sub corrects or completes their work, the GC must accept or reject that sub’s work within 10 days of the fix. If accepted, the GC must pay retention relating to that work within 10 days.

On public projects, GCs must pay the sub their portion of the retention within 7 days after receiving all or a portion of the retention from the public agency. The same retention exceptions apply here as well. If a good faith dispute exists, the contractor may withhold from retention to the sub an amount not exceeding 150% of the amount in dispute. These provisions may not be modified or waived by contract.

Payment Deadlines for Subcontractors

In general, subcontractors have the same payment deadlines as general contractors.

Progress Payments

On private projects in California, subcontractors must make progress payments to subs and vendors below them within 7 days of receiving payment from the property owner.

On public projects, subcontractors must pay lower tier subs and material suppliers within 7 days of receiving a progress payment relating to the work in question.

Retainage

Prompt payment penalties related to retention do not apply to lower tier subcontractors or material suppliers.

Download a free prompt payment demand letter template

Penalties for Slow Payment in California

On private construction projects in California, payments not made on time are subject to an interest penalty of 2% per month. Further, if forced to file a lawsuit to recover prompt payment penalties, the prevailing party is entitled to an award of attorney’s fees and costs.

On public construction projects, progress payments improperly withheld by a public entity are subject to an interest penalty of 10% per year. If the public entity improperly withholds retention, the interest penalty is 2% per month. For GCs and subcontractors who withhold payment, the interest penalty is 2% per month for both retention and progress payments.

Infographic: Quick Guide to California Prompt Payment Rules