This post will serve as a master-class for those subs, suppliers, and others, on how to fill out a California payment bond claim.

Wait…Is a Payment Bond Even Present on the Project?

Wait…Is a Payment Bond Even Present on the Project?

Payment bonds are required on public construction projects that meet or exceed a certain value. California’s Little Miller Act only requires a payment bond to be posted for public construction projects valued at more than $25,000. Any subcontractors or suppliers who are unpaid for work or materials furnished to a state or county construction project can bring a claim against the payment bond if it meets the threshold of $25,000.

If you also work on private jobs, this guide is essential reading: Practical Guide to Filing a California Mechanics Lien

Who’s Protected?

Even if the threshold for a payment bond on a public project is met in California, not all parties are entitled to protection under a bond claim. So make sure you are eligible to file a payment bond claim before putting in the work. Parties who are entitled to protection are those who provided work to the general contractor directly or through one or more subcontractors. Parties not provided protection are general contractors (since they’re the ones posting the bond in the first place), and suppliers to suppliers.

Deadline for Filing a California Bond Claim

The deadline to file a California bond claim is dependent on a few factors. In order to make a claim against a payment bond, you must provide a 20-day preliminary notice. But, if you failed to provide preliminary notice you aren’t completely out of luck. You can still enforce a claim by giving written notice to the surety and bond principal within 15 days after the notice of completion is recorded. If no notice of completion was filed, the time for giving written notice is extended to 75 days after the completion of the project.

Who Should Receive the Claim, and How Should it Be Sent?

A claim against the payment bond must be provided to the surety and to the general contractor by certified mail, registered mail, or personal service.

Further Reading: Don’t Surprise the Surety – Streamline Getting Paid On Bond Claims

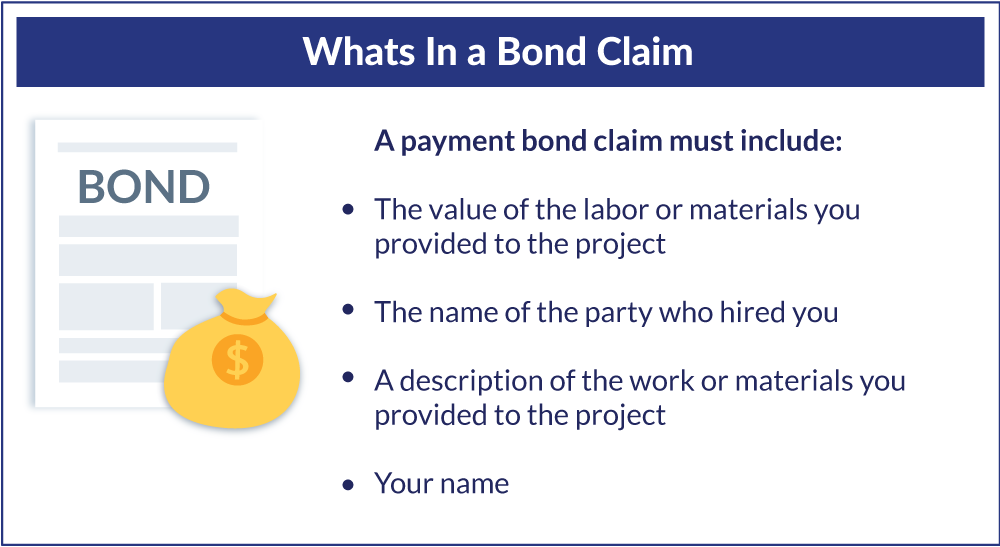

What’s In a Claim?

A payment bond claim must include:

- The value of the labor or materials you provided to the project;

- The name of the party who hired you;

- A description of the work or materials you provided to the project; and

- Your name!

What Happens if Payment Still Isn’t Made?

If payment isn’t forthcoming after a bond claim has been filed, there’s another step a claimant can take – enforcing the bond claim (which entails filing a lawsuit). An action to enforce a claim on the contractor’s bond must be initiated after all the claimant’s last furnishing date, but within 6 months after the time in which a stop notice may be given.

Learn more: How to Get Paid on California Public Projects

Wait…Is a Payment Bond Even Present on the Project?

Wait…Is a Payment Bond Even Present on the Project?