Before you start work on a residential or commercial construction project in California, it’s important to collect important information about the people you’ll be working with – especially the parties who are in charge of making sure you get paid. This includes the General Contractor, your hiring party (if not the GC), the lending company, and surety. Oh, and of course, perhaps the most critical of all: the property owner. But on many projects, it can be hard to know everyone that’s in charge of a project. If you don’t have a contract with them, and you’ve never met them, how do you find contact information for the California property owner in order to send a notice or a lien claim?

The importance of finding the property owner

When beginning work on a construction project, California requires a preliminary notice to be delivered within a certain time frame. The idea behind the preliminary notice is that since a mechanics lien encumbers the title of property in California, the property owner deserves to know who is working there, and who could potentially file a lien on the property.

The preliminary 20-day notice must be sent to the owner of the property. But what if you don’t know who that is?

Online Searching

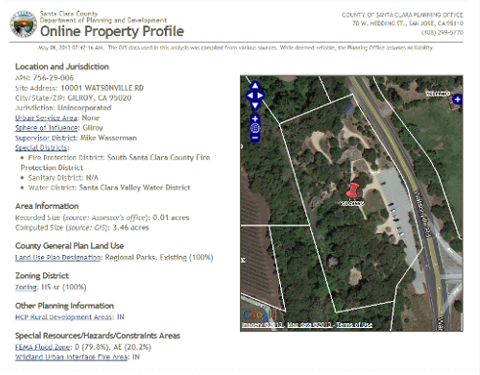

The property owner can be obtained from the county assessor. If you are able to personally go into the county assessor’s office, this is the most accurate way to obtain information regarding the property. However, it may be inconvenient to go into the county assessor office to verify who the property owner is each time you begin work on a new project.

If you are unable to go to the county assessor’s office to gather this information, most county assessor websites have a feature where you can search for the property by address or parcel number.

California, however, does not provide the name of the property owner online. To find more information about the online confidentially of property records for California, check out Government Code Sections 6250-6254, also known as the Public Records Act.)

Trying to find job information?

Learn more about job research at Levelset. We track down the property owner, GC, legal property description, and other hard-to-find information you need to file a lien or other documents.

Contact the County Assessor’s Office

The best way to find the owner of a California property is to call the county assessor with the parcel identification number. You can also use the address, but sometimes addresses as they are commonly known are not the same as they are recorded. Thanks to this nuance it is more accurate and to use the parcel ID.

If you do not have this, you can obtain it by searching the online property search with the address or using the county’s GIS interactive map search. Be aware that not all counties offer a map search feature online though. If this is the case, try searching by the city and see if they have a property search or GIS map. Orange county, for instance does not have a GIS map, but the City of Irvine (located in Orange county) does have one.

Once you have obtained the parcel number (sometimes referred to as APN, tax ID, PIN, or parcel identification number), simply call the county assessor and let them know you would like owner’s name and mailing address for the parcel number. Most counties will give you this information over the phone, but there are some counties that will not provide ownership information on the phone.

What if the County Does Not Give Info Over the Phone?

Most California counties have no problem giving the property owner’s name and mailing address over the phone. However, certain counties will not supply this information over the phone. These include Orange county and Fresno county.

If you happen to be performing work in a county that does not supply the information over the phone, and you are unable to make it into the office to get the information in person, you can pay a third party vendor online for ownership information or pay an abstractor to go into the office to get this information. The problem with these methods are that they can be expensive (an average abstractor costs around $50 – $70).