There comes a time when many subcontractors outgrow the smaller GCs they’re used to working with and decide to align themselves with a larger outfit. A relationship with a big-time general contractor like Brasfield and Gorrie can help keep the funnel full of projects and encourage a company to grow. Bigger projects, bigger payoffs!

But before you start working with a new general contractor, regardless of the size, you need to know as much about the company as possible. You’ll want to know about their history, the types of projects they manage, and if they’ll be a good fit with your company.

At Levelset, we want to offer as much of that information as we can, so you’ll be able to make an informed decision about working with a contractor like Brasfield and Gorrie.

Brasfield and Gorrie: Company overview

Brasfield and Gorrie is one of the largest general contractors in the country. Based in Birmingham, Alabama, the company got its start as Thos. C. Brasfield Company in 1921. A little more than 40 years later, a takeover by Miller Gorrie led to the company renaming itself to Brasfield and Gorrie.

Initially, the company focused on small commercial and remodeling projects. But by the 1980s, it was in full swing as a large-scale commercial, institutional, healthcare, waste/wastewater, and industrial project managing outfit. Today, Brasfield and Gorrie operates 12 offices in eight states, including:

- Atlanta, Georgia

- Birmingham, Alabama

- Charlotte, North Carolina

- Columbus, Georgia

- Dallas, Texas

- Greenville, South Carolina

- Huntsville, Alabama

- Jackson, Mississippi

- Jacksonville, Florida

- Nashville, Tennessee

- Orlando, Florida

- Raleigh, North Carolina

ENR ranked Brasfield Gorrie at number 22 on its Top 400 Contractors of 2020 — up from number 25 in 2019.

Brasfield and Gorrie works on many types of projects, including:

- Aerospace

- Commercial

- Education

- Energy

- Government

- Healthcare

- Hospitality

- Industrial

- Infrastructure

- Mission critical

- Multifamily buildings

- Science and technology

- Senior living

- Sports and entertainment

- Water/wastewater

Before working with Brasfield and Gorrie

When you’re considering partnering with Brasfield and Gorrie — or any general contractor — it’s important to do some research. You’ll need as complete a background as possible in order to prequalify any GC.

But, for some smaller subcontractors, the concept of prequalifying a GC might be new. If you’re not sure how to prequalify a general contractor, Levelset suggests the following:

- Familiarize yourself with the company’s payment history

- Get a close look at the company’s credit history

- Read reviews from other subcontractors that have worked with the GC

- Check out a sample contract if one is available

- Familiarize yourself with the company’s payment process

While the prequalification process might seem like you should be looking for reasons to avoid a general contractor, it’s more than that: The truth is, any company with a few projects under its belt will have a blemish or two in its past. Construction is a complicated business, and angry subcontractors are all too willing to say something nasty on the internet.

Yes, you should be looking for red flags, but they might not be enough to shut the door on a GC. If you find something particularly concerning in a company’s history, reach out to them and ask questions. When a large GC is willing to talk about a situation that occurred, and they’re very honest, that could be a sign of good things to come.

Brasfield and Gorrie’s payment profile

Levelset wants to provide as much information and data as possible so you’ll be able to make an informed decision about working with a company. That’s why we put together our Contractor Payment Profiles. These profiles are essentially reports on a company’s payment history, recent disputes, and complaints from other subs and contractors.

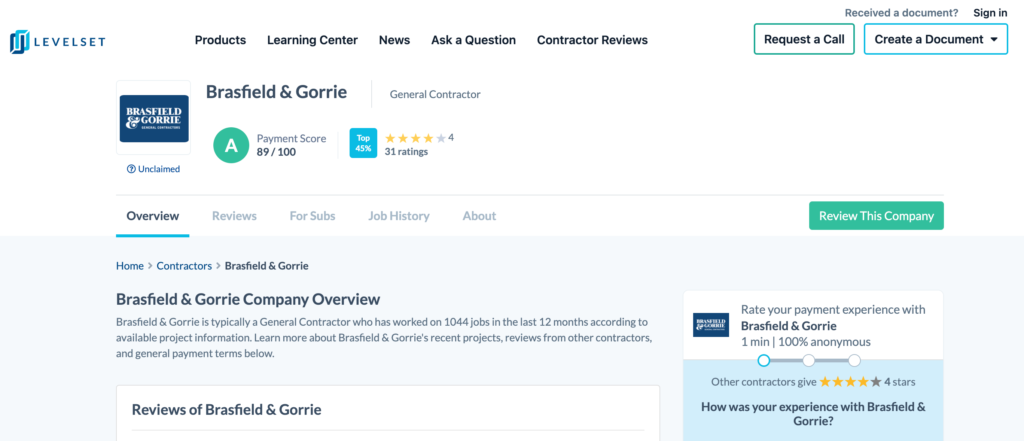

At the time of writing this article, Brasfield and Gorrie’s payment profile shows a score of 88 out of 100, giving the company an A rating. This score highlights a company’s payment practices and gives an inside look at their payment speed and reliability for would-be subs.

The score considered Brasfield and Gorrie’s on-time and late payments, and compared them against the data from thousands of other contractors. If you’d like more information about how we calculate contractor payment scores, click here.

Recent payment disputes

Now, reporting Brasfield and Gorrie’s shining payment score without discussing its payment disputes would not be fair. Levelset wants to offer all the information it can to help you prequalify a GC, and these disputes are important pieces of the puzzle.

At the time of writing this article, Brasfield and Gorrie is managing several projects with 11 mechanics lien claims:

- In January 2021, a subcontractor filed a mechanics lien against a project in Sherman, TX. The amount was $1,557.60, and the lien is still active.

- In November 2020, a subcontractor filed a mechanics lien against a project in Orlando, FL. The amount was $188,529.40, and the lien is still active.

- In October 2020, a subcontractor filed a mechanics lien against a project in Frisco, TX. The amount was $490,496.26, and the lien is still active.

- In October 2020, a subcontractor filed a mechanics lien against a project in Dallas, TX. The amount was $48,591.40 and the lien is still active.

- In August 2020, a subcontractor filed a mechanics lien against a project in Lebanon, TN. The amount was $39,543, and the lien is still active.

- In August 2020, a subcontractor filed a mechanics lien against a project in Denison, TX. The amount was $100,040.33, and the lien is still active.

- In August 2020, a subcontractor filed a mechanics lien against a project in Jackson, MS. The amount was $34,531.88, and the lien is still active.

- In July 2020, a subcontractor filed a mechanics lien against a project in Atlanta, GA. The amount was $38,118.40 and it’s now canceled.

- In June 2020, a subcontractor filed a mechanics lien against a project in Dallas, TX. The amount was $1,540, and the lien is still active.

- In June 2020, a subcontractor filed a mechanics lien against a project in Dallas, TX. The amount was $45,712, and the lien is still active.

- In June 2020, a subcontractor filed a mechanics lien against a project in Plano, TX. The amount was $16,573.07, and the lien is still active.

In addition to those liens, there have been over 80 complaints of slow payment or threats of liens on projects run by Brasfield and Gorrie.

Those numbers might seem concerning, but it’s the following numbers that might tell a better story. Despite the volume of liens, complaints, and threats, 95 percent of Brasfield and Gorrie’s projects have gone off without a payment hitch. In 2021 alone, that number is up to 96 percent, a three-point jump from 2020’s 93 percent and right on par with 2019’s 96 percent.

And, when data’s available, Levelset likes to offer as much insight as possible on a general contractor’s payment terms. While it varies by state, Brasfield and Gorrie prefers to use 5 or 10 percent retainage language in its contracts. Also, pay-when-paid verbiage makes its way into about 66 percent of contracts, and paid-on-invoice language in the remaining percentage.

Learn more: What Does “Pay When Paid” Mean in a Construction Contract?

Recent subcontractor reviews

31 subcontractors who have worked with Brasfield and Gorrie have left reviews on the company, and they’re rather promising. Out of those 31 contractors, 42 percent left 5 stars, 19 percent left 4 stars, 35 percent left 3 stars, and 3 percent left 2 stars, giving an overall score of 4 out of 5 stars — admirable for such a large GC.

Two contractors also had the following to say when asked about Brasfield and Gorrie’s payment process, speed, and policy:

“Payment is on time. Change order processing can be slow depending on PM.”

“We have a very good relationship with B&G. We were paid on time and most always have a good experience with them from precon to closeout.”

Not exactly the scathing reviews many large GC’s garner, which is a good sign in and of itself.

Getting paid with Brasfield and Gorrie

Brasfield and Gorrie has one of the better overall ratings in Levelset’s database, but things still happen. Understanding what it takes to get paid will help ensure you get paid on time.

Before work starts

Large general contractors will usually require several pieces of information and documents upfront before you even start work:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

A project manager will most likely contact you about these and any other requirements.

First payments

Large GCs that work in several states and on several types of projects will typically streamline their documents with standardized forms. By using documents like AIA billing, G702 payment applications, and G703 continuation sheets, the company’s practices will be consistent and uniform in every office and on every job.

Payment applications are typically due on the 1st, 5th, 15th, or 20th of each month, but you need to ask when you speak with the project manager. Missing a deadline for a payment application can really hurt your cash flow.

Progress payments

Brasfield and Gorrie works on some large projects, and they take time. Waiting until a stage of the project wraps up for payment just won’t do. Instead, opting for progress payments will keep the cash rolling in throughout the project.

Be sure to send an updated schedule of values with each pay app to speed things up.

Project close-out

The close-out process is different for each GC, but there are some universal documents you can expect to see:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

Be careful during close-out: Look at each document closely. Lien waivers tend to make their way into the paperwork at the close-out stage. If you accidentally sign one for a project you haven’t been paid for, you could be giving away your lien rights prematurely.

3 tips for getting paid on every construction project

It’s a fact that construction is volatile, and even well-established companies with outstanding payment scores can have issues. The following tips will help you minimize the effects those issues can have on your payments.

1. Send preliminary notices

At this point, you should be sending preliminary notices on all of your projects. These documents are often required by the state in order to preserve your lien rights. If you don’t send a preliminary notice in a state that requires them, you could be forfeiting your rights to a lien.

Even if preliminary notices aren’t required in the state in which you work, send one anyway. They also serve as a friendly introduction between your company and the folks writing the checks. They also show that you’re a professional, outline your payment practices, and you intend to get paid for your work.

2. Send other visibility documents

It’s not just preliminary notices that you should be sending. Visibility documents like invoice reminders, notices of intent to lien, and demand letters will bring your company to the top of the pile, and that can be often be all it takes to get a check cut to your company.

3. Always maintain your right to file a mechanics lien

Filing a mechanics lien is the fastest way for a contractor to get paid in disputes, so preserving your lien rights needs to be a priority. Because a mechanics lien is so powerful, most states have stringent deadlines and requirements that contractors must meet in order to preserve their rights, so familiarize yourself with the laws of the states in which you work to ensure you’re able to maintain your right to a lien.