As a credit manager, you will inevitably run into a customer who declares bankruptcy while their credit file is still open with you. Dealing with bankruptcy can be an awful pain, and you may have to jump through a lot of hoops. But bankruptcy doesn’t mean you should close the file and give up trying to collect. If you do, you may be leaving money on the table. Let’s take a look at what the different types of bankruptcy chapters actually mean — and what to do in each scenario.

Note: This article contains excerpts from Thea Dudley’s credit management course and her book, A Credit Overlord’s Guide to Credit & Collections.

Understanding the bankruptcy chapters

Bankruptcy can mean a variety of different things. It all depends on the type — and whether a bankruptcy court agrees with their petition to file.

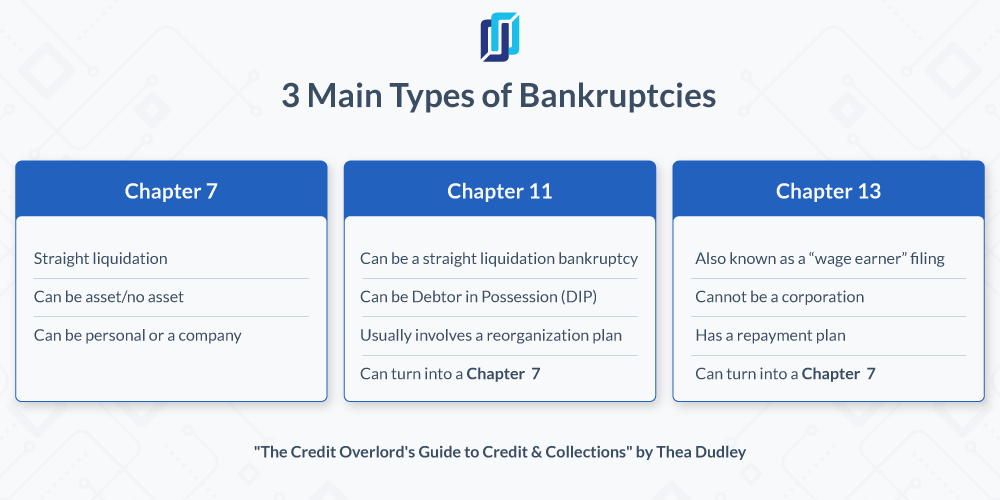

There are three main bankruptcy chapters among construction businesses:

- Chapter 7

- Chapter 11

- Chapter 13

A Chapter 7 bankruptcy typically means liquidation: They’re going out of business. If you get a notice and it says “no asset” at the top, it means there’s nothing to collect. Close your file and get ready for a rough conversation — it can be tough. If there are assets, it can still be difficult, but it’s not game over.

Chapter 11 usually means the company is trying to reorganize and get back on their feet. It’s probably my favorite, because it’s like a three-ring circus. Chapter 11 can be what they call DIP, or “debtor-in-possession.” (I find ironic, since you’re leaving the same guy who took your company into bankruptcy to get you out of it.)

They are often trying to stay in business, but not always. This can be the most complicated, because there are so many nuances. There may or may not be trustees involved. It could be “asset” or “no asset.” It could be a reorganization or a liquidation.

Chapter 13, known as a “wage earner” bankruptcy, is for sole proprietors. This allows them to pay back debt over a period of time, usually 5 years, and is usually overseen by a trustee.

Chapter 7

- Straight liquidation

- Can be asset/no asset

- Can be personal or a company

Chapter 11

- Can be a straight liquidation bankruptcy

- Can be Debtor in Possession (DIP — ironic right?)

- Usually involves a reorganization plan

- Can flip into a Chapter 7

Chapter 13

- Also known as a “wage earner” filing

- Cannot be a corporation

- Has a repayment plan

- Can flip into a Chapter 7

Related: Thinking about filing for bankruptcy? Read this first.

Bankruptcy freezes collection — for now

If there is any pending litigation, with the exception of criminal, the bankruptcy filing grants an automatic stay. In non-legalese, that means you have to stop any litigation or collection action, including phone calls asking for payment, or you will be in violation of the court order).

The automatic stay acts like a cease and desist order against most collection action against the debtor and debtor’s property. If you have a personal guarantee, you may continue to pursue the guarantor if the company has filed for bankruptcy protection, unless the guarantor has done the same. Then you are back to your limited options.

What to do when you receive a bankruptcy notice

When you get that bankruptcy notice in the mail, there are 10 things you should do immediately:

- Place the account on hold, or stop work immediately.

- Stop shipments in transit.

- Arrange for the return of the materials in transit.

- File a reclamation claim for any shipment received by the bankrupt debtor within a specific amount of time. Bankruptcy code requires the creditor to make a written demand within 10 days after the bankruptcy debtor’s receipt of the goods. If this 10-day period expires after the commencement of the bankruptcy case, the seller is entitled to an extra 10 days. Therefore, it is commonly thought of as a 20-day reclamation, although that can be a stretch.

- Refuse to extend credit to the bankrupt debtor. Seems like a no-brainer, but you would be surprised how many debtors and creditors are surprised by this.

- Ask the court to appoint a trustee to run and manage the business if the debtors’ management is incompetent. (I have never been able to get the court to do this, which seems ironic considering in a Chapter 11 “debtor in possession,” the same people who got the company into that situation are still in charge —what will be different?) If there is proof of theft or fraud, you can also ask the court to appoint a trustee as well. Don’t go into either unarmed.

- Ask to be part of the Official Unsecured Creditors Committee. Don’t wait, because they form quickly. Let the Trustee know you are interested and available.

- Refuse any unsolicited invitation from the trustee, if extended, to join the Official Unsecured Creditors Committee.

- Petition the Court to convert Chapter 11 reorganization to a liquidating 11 or a Chapter 7.

- Keep informed of the timelines with the bankruptcy, such as the 341 hearing (meeting of the creditors), proof of claim deadlines, and changes in the bankruptcy (like a dismissal for not filing timely, etc).

In the first stage, you want to make sure your debt is included on the list of creditors. Next, figure out where you are in the list — and what assets the company has to cover their outstanding debts. Is it going to be possible for you to get paid? It may or may not be worth pursuing it further. But don’t give up before you figure out if you actually have a chance of collecting something.

Related: What to do when someone goes bankrupt on a jobsite

“When we see what all the assets are, if we’re way too far down the line, then we decide to give up then, but I always recommend to go in stages,” construction lawyer Jonathan Forester. “And so let’s figure out where we are in our list to get paid. Is it going to be possible for us to get paid or not?”

What type of creditor are you in a bankruptcy filing?

In a bankruptcy, there are two types: secured creditors and unsecured creditors. Secured creditors are first in line when assets are distributed. Unsecured creditors are pretty limited in what they can do once the debtor files for bankruptcy protection.

“When it comes to a debtor’s bankruptcy, you’re going to have more rights with a mechanics lien than just a standard debt owed under a contract,” says Jonathan Forester. “But to specifically see where you fall in line, you need to know all the other parties, their lien rights, their contractual rights, the timing of their claims.”

Related: What happens to a mechanics lien in a bankruptcy?

Case dismissed…or discharged?

A bankruptcy hearing can be dismissed or discharged. They sound similar, but they actually mean two opposite things.

When the court orders a bankruptcy discharge, it means the petitioner’s debt is wiped out. If you are the credit manager waiting to collect, this is NOT what you want to hear. It essentially means the game is over.

When a bankruptcy case is dismissed, it essentially means the court threw out their petition. As a lender, this is what I want to hear. It means I can resume nagging — I mean, calling — the debtor, and restart my collection efforts again.

Don’t give up. Get to work.

Bankruptcy is probably one of my least favorite topics, but it is a huge hot button. And the misconception is that once you get that bankruptcy notice, just write it off and shut the file. Boom, we’re done. And that’s absolutely leaving money on the table.

When you get a bankruptcy notice from a debtor, read all of the documents and contact a bankruptcy attorney. Bankruptcy law is very complicated and unique — you want someone who understands the process in detail. An experienced construction attorney is a wonderful partner, but they may or may not have experience with bankruptcy law or bankruptcy courts.

“The first thing you see is people put up their hands and give up,” says Jonathan Forester. “You need to get a bankruptcy attorney, find out what they’re going to charge you to track it. And then you’re making that decision to go through this stage of the process.

“Spend the resources to get to that point,” Forester says, “so you can make an intelligent decision.”

Thea Dudley teaches credit & collections

Join the free certificate course to learn the foundations of credit & collections in construction with 30-year industry veteran Thea Dudley.