Bechtel tops the list of the largest contractors in the country. They are a powerhouse for engineering, construction management, and development in the United States. Subcontractors working with a GC like Bechtel are likely involved in an important and potentially lucrative project.

However, before jumping the gun and signing the contract, subcontractors should do all the research they can. Construction projects are unpredictable, and the industry is riddled with cash flow issues and other hang ups. Furthermore, working on a massive project with countless other subs means transparency on the job is limited—and your pay app could get buried underneath everyone else’s.

Since it’s vitally important for subcontractors to learn everything they can about their general contractor, this guide will introduce subcontractors to Bechtel’s payment process, helping you make informed decisions and greatly improving your chances of getting paid in-full and on-time.

About Bechtel

Like many other great construction firms, Bechtel had humble beginnings. Founded in 1898 by Warren A. Bechtel, the firm has been in business for more than 120 years. In 2019, Bechtel pulled in around $21.8 billion.

Bechtel is headquartered in Virginia, and has eight other offices around the US, including:

- Arizona

- Houston

- Los Angeles

- New York

- Tennessee

- Washington

- Washington DC

- Texas

Bechtel also has offices in nearly every continent across the globe.

Bechtel specializes in defense and nuclear, environmental cleanup and management, energy, infrastructure, mining and metals, petrochemicals, and water. Bechtel fulfills a wide variety of roles on their projects, including general construction, engineering, development, investment and financial, master planning, and much more.

Before Working With Bechtel

Always prequalify a general contractor before signing a contract with Bechtel or any other company. The pre-qualification process is relatively straightforward, and it can be completed in five simple steps:

- Review the GC’s payment history

- Check their credit history

- Find out what other subcontractors have said after working with the GC

- Call the general contractor and ask about their payment process directly

- Ask the GC for a copy of a subcontract for you or your attorney to read over

If the general contractor meets your criteria based on these five parameters, then you can feel a little bit more confident when it’s time to sign the contract and get to work.

Review Bechtel’s Payment Profile

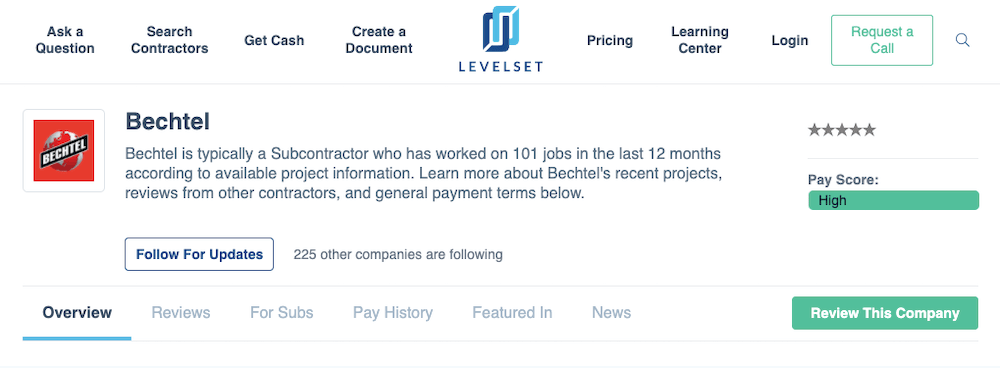

A great place to begin your pre-qualification is on Bechtel’s payment profile, where you can view their payment history, read subcontractor reviews, and see their overall payment score.

Despite their speedy rating, there are two incidences of slow payment on record and two liens threatened on projects in California three months ago. That means 96% of Bechtel projects in the last 12 months have had no reported payment issues from other contractors.

Bechtel’s Payment Process

Bechtel’s payment process isn’t unlike other comparably-sized general contractors, although a couple of their company standards may be slightly different.

Bechtel’s subcontractor & supplier page contains information and resources. Their Supplier Guide is for subcontractors, too. It contains information about their global supply chain and performance standards, selection process, and guidelines for working with the company.

On Bechtel’s Supplier Resources page, you can register for Oracle EBS, the software that Bechtel uses for communications and negotiations with the contractors they work with. Contractors and suppliers can begin the pre-qualification process here.

Getting Prequalified

Before working with Bechtel, you need to get prequalified. After registering your company, you will need to submit a Pre-qualification Questionnaire through the iSupplier portal.

Note: Subs and suppliers will need to get a DUNS number before registering their company on the iSupplier portal.

Prospective subcontractors receive the questionnaire if a Bechtel buyer is interested in learning more about their company and the products they offer.

You will find all the forms, documents, and other information you need to provide within the iSupplier portal.

After you answer the questionnaire and submit it, it will be reviewed by a Bechtel buyer, who will reach out if they wish to move forward with your company.

You can find more information about the pre-qualification process for Bechtel on the resources page.

Before the Job Begins

After you’re pre-qualified, you need to provide the necessary paperwork for insurance and payment purposes. Usually, this includes:

- A W-9 form

- The contract

- Any bonds related to the project

- Proof of insurance

Applying for First Payment

The first step in getting paid on time is to make sure all the information in your payment application is as accurate and thorough as possible. Bechtel uses standard AIA billing forms. These forms include the G702 Application for Payment and the G703 Continuation Sheet.

Pay apps, negotiation documents, and other invoice-related paperwork can be submitted through the iSupplier portal.

Applying for Progress Payments

To apply for progress payments, provide a detailed pay application as well as a thorough schedule of values.

Applying for Final Payment

As the project reaches its end, it’s time to apply for final payment. Upon sending your final pay application, complete and submit any requested closeout documents. These should be sent to you by the project administrator for you to submit along with the pay app.

Bechtel may also require you to submit lien waivers, written consent from the sureties, or any other related paperwork.

3 Tips to Get Paid With Bechtel

Whether or not you expect payment issues while working with Bechtel, it’s always a good idea to employ the best practices for construction payment in case anything go wrong on the project. The general contractor isn’t always in control. Project funding could fall through, the property owner could delay payment to the GC, or an architect could reject your pay application.

Subcontractors have payment rights that are backed up by law. Here are three easy ways to leverage your right to get paid on a construction project with Bechtel.

1. Always provide preliminary notice

A preliminary notice informs the people in charge of the project that you’re on the job, and what kind of work you’re doing. This simple step will do wonders for any company’s accounts receivables.

Construction projects with companies like Bechtel can be gigantic, and sometimes subs and suppliers can get lost under all the other parties and paperwork. Sending a preliminary notice is a requirement to protect your lien rights in many states, and failure to send one could leave you with little to no recovery options down the line.

2. Review lien waivers

General contractors will often ask subcontractors to sign lien waivers in exchange for payment. If you’re presented with one, always have a construction attorney look it over before you sign it.

If the terms aren’t agreeable, signing the waiver could leave you without options. Construction attorneys specialize in reading documents like these, and having one on your team greatly increases your chances of a complete and timely payment.

3. Secure your lien rights

Make sure your lien rights are secure so you can file a claim in case you go unpaid for the labor or materials you supplied. Since Bechtel operates in 10 states, you want to make sure you’re up-to-date on the mechanics lien laws in your state.