Whenever you invoice a property owner, receive a check from a customer, or pay a material supplier, you need to categorize those transactions properly. The Chart of Accounts is the heart of every contractor’s accounting system, whether you’re using QuickBooks or any other construction accounting software. Because construction accounting is so unique, the default Chart of Accounts in QuickBooks won’t work for most contractors – you will need to add certain accounts in order to track financial performance correctly. In this article, we’ll explain how a contractor’s Chart of Accounts should be set up in QuickBooks, with a free customizable template for construction.

Read first: Everything you need to know about construction accounting

Note: For this article, we are using QuickBooks Online. If you are using a different version of the software, the steps and language may vary slightly.

An Overview of the Chart of Accounts in QuickBooks

The chart in Quickbooks Online gives you a detailed list of all the financial accounts in a company’s general ledger (GL). They are grouped into categories that correspond to the structure of a construction company’s financial statements. These GL accounts are used to categorize every financial transaction a company makes.

In addition, the Chart of Accounts is used to build a contractor’s financial statements. Each account will correspond to a field on either the Balance Sheet or Income Statement.

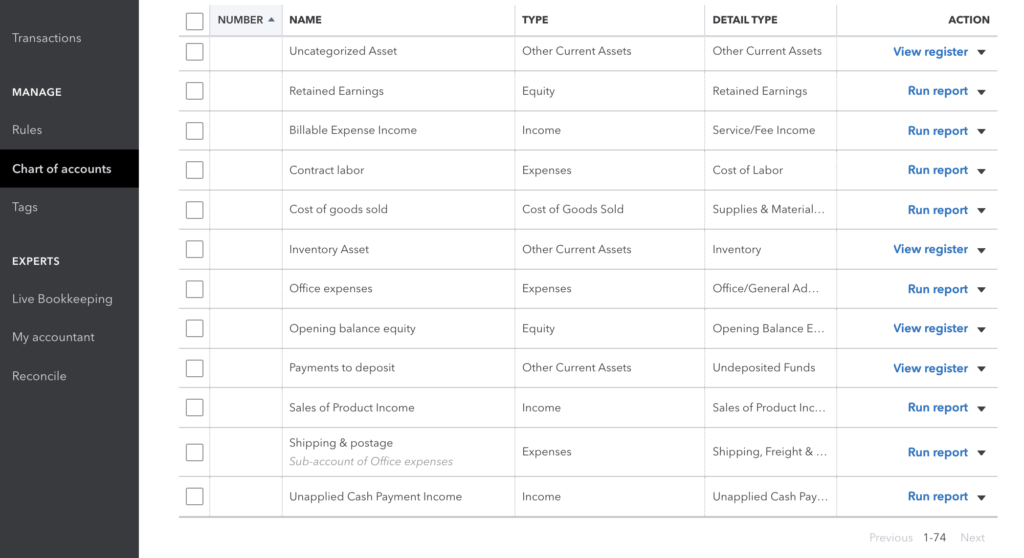

QuickBooks comes with a default Chart of Accounts, which includes generic accounts that are most commonly used by retail businesses: Accounts like Accounts Receivable, Cost of Goods Sold, Sales of Product Income, and others. While construction companies will use many of the default accounts, you will need to customize the chart to suit the way you do business.

Software suites like QuickBooks give you the ability to set up your Chart of Accounts according to your specific business needs. By fine-tuning your chart in QuickBooks, you can also eliminate options that wouldn’t apply to a construction firm, streamlining the view of your business’s financial framework.

Chart of Accounts fields

These are the fields shown for each account:

- Number: The account number for each account

- Name: The name of each account

- Type: The type of account (this will correspond to items on the financial statements)

- Detail Type: Learn the difference between “type” and “detail type”

- QuickBooks Balance: The balance of the account in QuickBooks

- Bank Balance: The balance of the corresponding account in your bank(s)

- Action: View Register (for Balance Sheet items), Run Report (for Income Statement items), Edit, or Make Inactive

You can toggle each of these on and off in the Chart of Account settings (look for the gear icon in the top right).

Accounts in a Construction Chart of Accounts

Construction is different from other industries, and contractors often have to deal with transactions that are specific to the building industry. A contractor’s Chart of Accounts will require the addition of certain accounts. These accounts are used to record transactions like:

- Retainage receivable

- Retainage payable

- Underbilling

- Overbilling

- Depreciation

- and others

How to Customize the QuickBooks Chart of Accounts for Construction

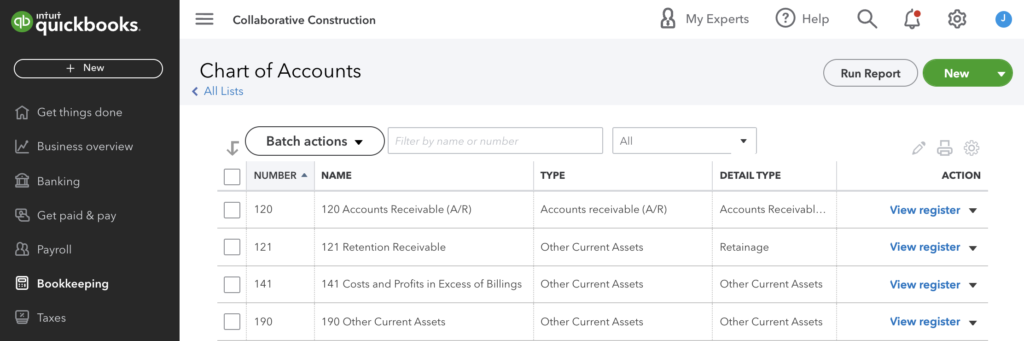

To get to the Chart of Accounts in QuickBooks, select Bookkeeping from the main menu. The Chart of Accounts is the default view under the Bookkeeping tab.

What you see next is the default setup for all QuickBooks Online accounts, and it becomes the blank slate on which to design the chart to your liking. Note the various categories in the Detail Type column, and you’ll see descriptions that include cash on hand, buildings, machinery, and equipment, etc.

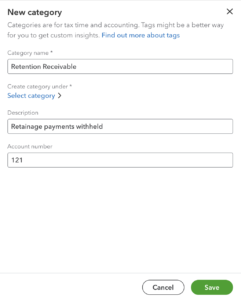

Add or edit accounts manually

You can add new accounts manually by clicking the “New” button. QuickBooks will prompt you to fill out the account details in order to save it.

Alternatively, you can edit certain existing accounts to change the name, description, or account number.

This method is useful if you only have a handful of accounts to add.

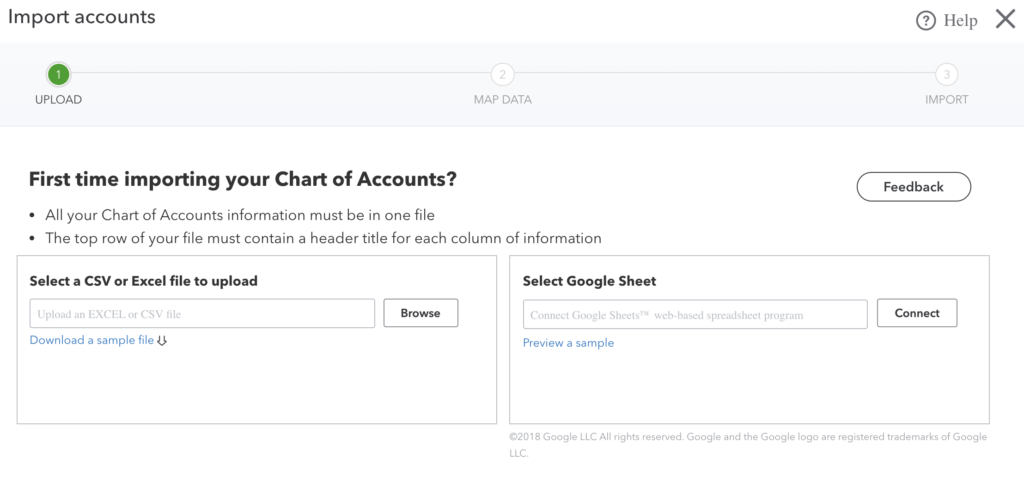

Uploading a Chart of Accounts

The easiest way to customize your Chart of Accounts is to import a full list of accounts.

If you are migrating to QuickBooks from another accounting software platform, you can import your existing Chart of Accounts from an Excel (XLS or CSV) file or Google Sheets.

The spreadsheet must be formatted correctly to correspond to the available fields in QuickBooks. The only required field is “Name,” which corresponds to the account name. After you upload the file, QB will prompt you to select the appropriate Type and Detail Type fields.

Download a QuickBooks Chart of Accounts Template for Contractors

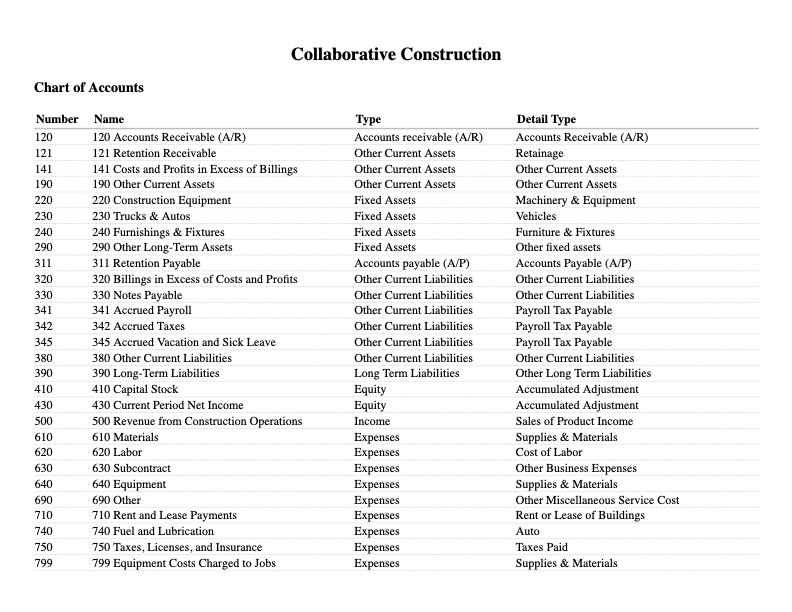

While every construction business is unique, this sample Chart of Accounts for construction includes many accounts common to companies in the building industry, especially those that use the percentage of completion method of accounting. You can customize this chart in QuickBooks either before or after uploading it.

Download a sample Chart of Accounts for construction companies

This free construction Chart of Accounts includes accounts for retainage, underbilling, and more, formatted for easy importing to QuickBooks.