The construction payment process is slow, and material suppliers are often at the bottom of the food chain and have to wait the longest. Supply chain finance provides suppliers with payment for their materials as soon as a sale is completed. It frees them from having to extend credit to contractors, carry debt, and wait until payment is made.

What is supply chain finance?

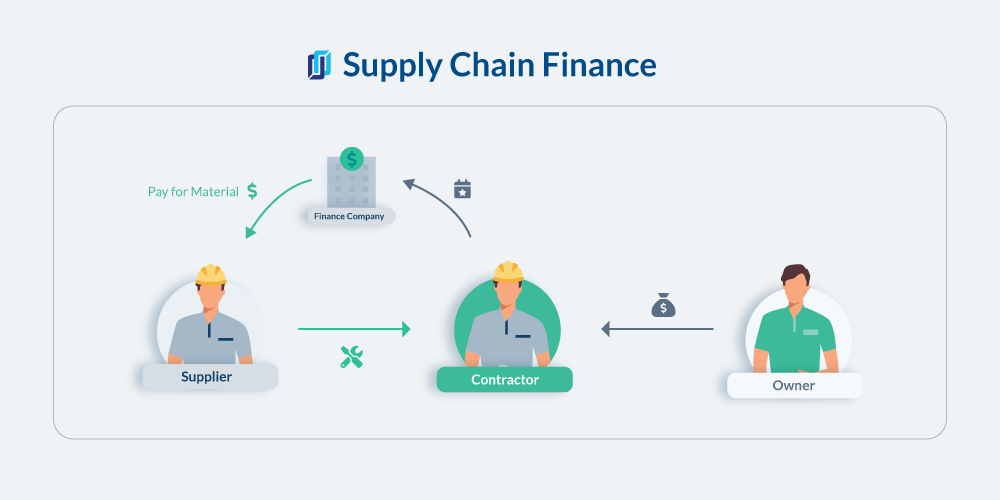

Supply chain finance — also called reverse factoring — enables contractors to purchase materials for projects and pay for them without affecting their cash flow. Instead of paying for materials directly, purchases are funded by a finance company specifically geared to supplier finance. The contractor then pays the finance company when they have been paid by their customer.

Using supply chain financing is beneficial for both suppliers and contractors. Suppliers get quick access to the money they are owed, and contractors get more time to pay off balances. Both parties can use the added cash they have available for other projects or expanding their business.

How supply chain finance works

Supplier finance is a fairly simple process. It begins when the contractor purchases materials from the supplier. Instead of the contractor paying for the materials, a finance company pays the supplier immediately after the sale.

Then, when the contractor gets paid from their client, they can pay the finance company for the materials they purchased, along with a fee, usually a percentage of the purchase. Repayment terms can be as long as 120 days from the date of purchase, giving contractors enough time to receive payment from their customers before payment is due.

Supplier financing is different from invoice factoring. Invoice factoring involves the selling of accounts receivable invoices in exchange for a discounted payment. Once the customer pays the invoice, the contractor receives the balance of the invoice less the factoring company’s fee. With supplier financing, the contractor is responsible for the financing fees, not the supplier.

Another option for paying for materials is a traditional bank loan. In this case, the bank loans money to the contractor who then pays the supplier for the materials. The contractor then pays back the loan according to the payment terms, including interest, which may be more than a supplier finance fee.

The material supply challenge in construction

Payments are slow in the construction industry. This is primarily due to the many layers of vendors and contractors who are involved in a project. It takes a while for payments to get through all the layers, all the way down to suppliers. Add in contract terms that try to delay payment to the last possible moment, and suppliers and lower-level subcontractors are often left waiting for payment for several months.

Suppliers would love to get paid upfront, but because contractors often don’t have the capital to purchase materials before they’re paid, they are forced to offer a line of credit. They end up carrying this trade credit debt for months, as they are often the last to get paid when payments are processed. Without this money, they cannot invest in their companies or create more materials. This inhibits their ability to grow their business and meet the needs of larger projects.

Learn more: How to Negotiate a Higher Credit Limit With Your Building Material Supplier

Contractors need to buy materials in order to start the job, knowing they may not get paid for months. If they can’t get trade credit with a supplier, they’ll need to find another way to come up with the cash in order to purchase the materials. Even if they can get a 30-day line of credit with a supplier, they still run the risk of late payment from their customer, which increases their costs as the supplier charges interest or late fees on the invoice.

The complex payment chain, long payment delays, and the risk of payment disputes makes construction much riskier for financing companies compared to other industries.

Many traditional lenders don’t want to finance construction businesses. Contractors are often forced to turn to high-interest (some would say price gouging) financing options like merchant cash advances to pay for job costs. The lack of financing options leaves many contractors with no option for expanding their business and taking on larger projects.

Deeper dive: Why a Merchant Cash Advance is a Bad Financial Move for Contractors

How supply chain finance solves contractor cash flow problems

Supply chain financing allows contractors the ability to expand their businesses and pay for their materials without breaking the bank. Since construction profit margins are so slim, many contractors don’t have the additional cash it takes to purchase materials for a project without being paid first by their clients.

The ability to purchase materials and delay payment until they receive funds from their customer gives contractors the flexibility they need to pursue more work.

With this type of financing, suppliers don’t have to keep credit debt on their books waiting for contractors to get paid. They can use the money they receive from the finance company to further expand their business and keep operations going. There’s less risk to suppliers with supplier financing than extending credit directly to their customers.

Supplier finance companies provide contractors and suppliers the money they need to keep their businesses running while managing their purchases. Cash flow problems can easily derail a project if they aren’t managed, and supplier finance offers a way to keep projects on schedule.