Skanska is one of the largest construction and development firms across the globe, including the USA. This is a guide for subcontractors who work with Skanska, or who are considering a project with the GC. Read on for resources and information to help subcontractors get paid on a project with Skanska.

For subcontractors, partnering with a powerhouse general contractor such as Skanska may appear extremely lucrative at first. However, the construction industry is littered with extreme cash flow challenges which can impact any sub that is working under any general contractor.

When working under a large GC such as Skanska, it’s important for subs to understand the payment challenges ahead, and what they can do to get paid faster.

About Skanska

Skanska is a major construction and design firm that holds domestic headquarters in New York, NY, but also operates out of ten locations in Europe, including Sweden, the United Kingdom, Poland, Denmark, and more.

According to Skanska’s most recent statistics and data, the company reached $7.6 billion in total U.S. revenue in 2019, which represents one-third of Skanska’s global revenue. They are #7 on the Engineering News Record’s Top 400 Contractors list for 2019.

Skanska’s projects range from hospitals to stadiums, airports to corporate headquarters, and power plants to tunnels and bridges.

Before Working with Skanska

Whether you are working with Skanska or any other GC, there are several strategies for subs to follow when looking to get paid on time. One of the most critical steps is prequalifying the GC prior to signing a contract with them.

Generally, prequalification processes will deal with the GC’s recent payment performances, how the project is being funded (such as partial financing that is managed by the property owner) or talking to other subs that have also worked under the same general contractor in the past.

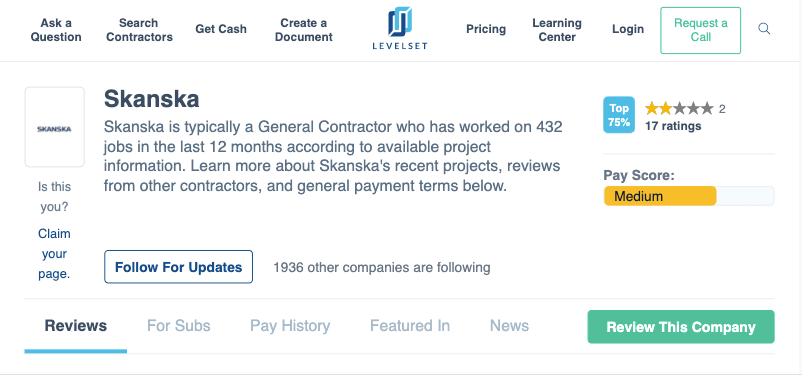

According to Skanska’s Payment Profile, the GC has a “Medium” payment score. Overall, subs give Skanska a rating of 2 out of 5 stars, with only negative reviews as of this writing.

The highest review on Skanska’s Payment Profile was a 3-star review, saying, “The payment process was arduous and very slow with major delays.” Another 1-star review of the GC warned subs to “avoid [Skanska] at all costs.”

While payment problems are not always caused by the GC, they are responsible for managing payments on the projects and ensuring that everyone gets paid on time. Subcontractors often play a role in slow payment when they do not pay their own subs or suppliers. Once a supplier isn’t paid, they often file a non-payment claim against the property, naming the GC in the process.

Looking into the general contractor’s credit and payment history is an important step, but it’s not the only one. The property owner or developer is the ultimate source of the funds on a project. If they haven’t secured funding or financing to cover the entire costs of the project — including change orders along the way — the risk of non-payment increases for everyone. One critical step before accepting a job is to request proof of project funding to protect yourself against this risk.

Skanska’s Payment Process for Subcontractors

Unlike many other big general contractors, Skanska does not publish documents and guides intended to help their subs and suppliers get paid on time through their website.

However, the company does include very limited resources for subcontractors on the Partner with Skanska page, which allows subs to search for opportunities to work with Skanska.

Skanska’s Partner page offers sub-related links for:

- Beginning the application to prequalify with Skanska

- Joining Skanska on BuildingConnected.com

- Viewing Current Project Opportunities

- Viewing Outreach Events by State

A supplier for Skanka addressed the company’s payment process in a review of the company, writing:

“As a supplier, we submit a pay application and invoice to Skanska by the 20th [of each month]. According to Skanska, they submit for payment to the owner by the 25th. If the owner approves, Skanska then retypes the pay application (that we’ve already submitted) and email back for signatures and notary (that was already done on the original pay application). Then it’s another 45-60 days before we receive payment. i.e 90-120 days from invoice.”

Getting Prequalified

Skanska prequalifies subs through their official online portal, which requires subs to request a login for first-time partners. Skanska’s prequalification process for subs is used to “ascertain if your firm possesses the necessary experience, financial resources, and commitment to safety and quality to ensure performance on our projects.”

If your company’s prequalification is approved by Skanska, the GC states that your company will be qualified to be considered for projects in the upcoming year.

Kathy Myers, a Risk Management representative from Skanska’s Parsippany, NJ office, states that subs will require the following information when going through the online portal to be qualified with Skanska:

- Surety bonding letter that outlines bonding capacity per project

- A reference letter

- Audited financial statements through the latest fiscal year

- EMR letter from your insurance agent with your past 3 years experience modification rating

- OSHA 300 and 300A logs for the previous 3 years

- Table of contents page from your company’s safety manual

- All other information on the qualification form provided by Skanska

Before the Job Begins

Myers also suggests that there is little-to-no documentation that is required to be sent to the Project Administrator before a job begins.

“This is because the information for subcontractors that are going to bid is taken from our pre-qualification software and the subcontractor’s original application,” said Myers.

Information that must be included in the sub’s Skanska pre-qualification profile will generally include:

- The subcontract

- Bonds

- Proof of insurance

Additionally, a sub is required to submit a W-9 during their original pre-qualification application.

Myers also stated that subs should be thorough and organize their required documents before applying to be pre-qualified with Skanska. “[Subs] should provide all applicable information and documentation. They should complete the pre-qualification form and send it to our database. The subs can then search in our database based on what type of work they are looking for.”

Applying for First Payment

In general, a key way to get paid on time during a project is by providing complete and accurate payment applications.

Skanska uses AIA contract documents, which includes the G702 Application for Payment and the G703 Continuation Sheet.

At Skanska, subs can upload and access their related billing files through their Partners portal by logging into a personal account.

Skanska also includes a sample contract used with subs. The sample states the following documents that will typically be required for your initial payment request:

- Payment Application (due by the 20th of the month)

- Schedule of Values submitted prior to the first payment request

Applying for Progress Payments

According to the sample subcontract, Skanska requires these documents for each subsequent progress payment request:

- Payment Application

- Conditional Waiver and Release for current billing cycle

- Unconditional Waiver and Release for previous billing cycle

- Lien waivers from all sub-subcontractors and suppliers

View samples of Skanska’s lien waiver documents

Note that several states regulate lien waivers, and specify the language required on the form itself. It is unlikely that Skanska’s waiver and release form would comply with statutory requirements in all locations.

Applying for Final Payment

When applying for the final payment, you will complete the Final Payment Application and submit any close-out documents.

According to their sample contract, these documents may be required when applying for final payment:

- Payment application

- Conditional waiver and release for final payment

- Unconditional waivers from all sub-subcontractors and suppliers

- Close-out documents required by contract

- Written consent from the surety (if a bond was required)

3 Tips for Subcontractors to Get Paid on Skanska Projects

Skanska’s massive global reach makes them an attractive partner to work with for subcontractors, but according to their payment history, subcontractors run a risk of suffering from slow payment or non-payment.

For subs, finding the right GC to work with does not always have to be a challenging task when you approach the project with these three tips to getting paid on Skanska jobs and beyond.

Send a Preliminary Notice on Every Job

By sending a preliminary notice at the beginning of every project you take on, it will ensure that all parties are made aware of who you are and the services your company will provide to the job site. These notices help the GC and property owner understand what your company’s role is, along with providing contact information for your company’s accounts receivable.

Additionally, preliminary notices are required by subs and suppliers in several states, so it is always a good idea to check and make sure your company is abiding by state laws when entering a project. Furthermore, preliminary notices will reserve a sub’s right to file a mechanics lien when they don’t receive payment in states that require notices.

Review Lien Waivers

Before your company signs a lien waiver with any GC, make sure you carefully read the language listed in the document. A construction lawyer can review the contract with the GC and the lien waiver so you can confidently enter a project knowing what your company has agreed to.

When you sign a lien waiver, there are legal consequences, which makes adding a construction lawyer to your team more valuable. Lien waivers will impact your legal rights, and they can affect your ability to file a mechanics lien on the project.

File a Mechanics Lien for Non-Payment

Keep a close eye on the mechanics lien requirements and deadlines in your project’s state to ensure your rights are always protected. If payment is late, you have the right to file a lien against the property. The longer you may wait to file a lien, the greater risk you face in not having the legal right to file one. A GC may even continue to promise the sub or the supplier that payment will be made. However, trusting a promise to pay could delay you past the lien window, thus jeopardizing your lien rights.