If you’ve had a lien filed on your home or property, or you just heard about liens for the first time, we’re here to break it down for you. We talk about mechanics liens all the time, and we’ve covered it from all angles. But let’s take a step back and get down to some basics. What exactly is a lien? Are there different types? And how do they affect one another? This article will explain all you need to know about liens — including how to avoid them.

What is a lien?

A lien (pronounced like lean) is a word derived from the Latin word ligāre, which means “to bind.” This makes sense, as the purpose of a lien is to bind or otherwise encumber the title of a property. But let’s take a step back and look at the actual definition of a lien.

According to US law — 11 USC §101(37) — the term “lien” means a charge against or interest in the property to secure payment of a debt or performance of an obligation. Essentially, a lien is when a lender or creditor acquires an interest in some type of collateral, typically real property.

Having a lien filed on a piece of property essentially “clouds” the property title. If the owner is looking to refinance, sell, or otherwise transfer the property, the lender or prospective buyer will run a title search. Since lien filings are public record, these will show up.

No one wants to take on a property that has any liens filed against it. Liens are typically attached to and are transferred with the property. They don’t follow the property owner individually — they follow the physical property.

Note: For the sake of this article we are going to focus on property liens. As there are all types of liens: artisan liens, aircraft liens, attorney’s liens, mineral liens, even livestock liens!

Basic categories of liens

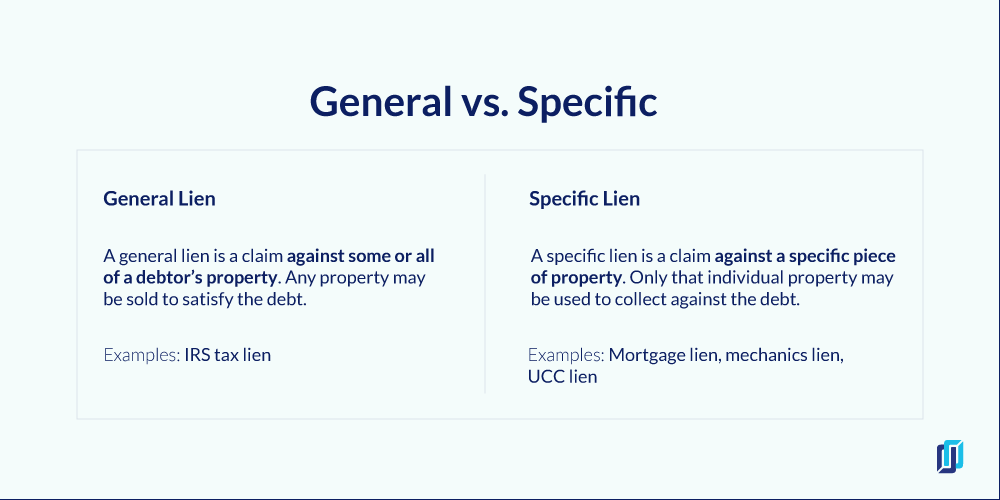

General vs. specific

Every type of lien will be fall under a combination of these two basic classifications. These are general or specific liens and voluntary or involuntary liens (also referred to as consensual and no-consensual liens).

A general lien is one that doesn’t attach to a specific piece of collateral. Instead, it attaches to all the assets of the borrower. This includes their house, bank accounts, vehicles, and any other personal property the borrower may own. An IRS tax lien is typically a general lien, since they have the authority to sell a variety of the owner’s property in order to recover the debt.

In contrast, a specific lien is one that attaches to a specific asset. For example, a mortgage bank has a lien on the piece of real estate they financed the purchase of. In a specific lien, the asset was specifically offered as collateral in exchange for the loan or credit.

When the borrower fails to make payments, a creditor’s specific lien is limited to the value of that specific asset. They can’t go after any unrelated assets that the borrower may have, like they can with a general lien.

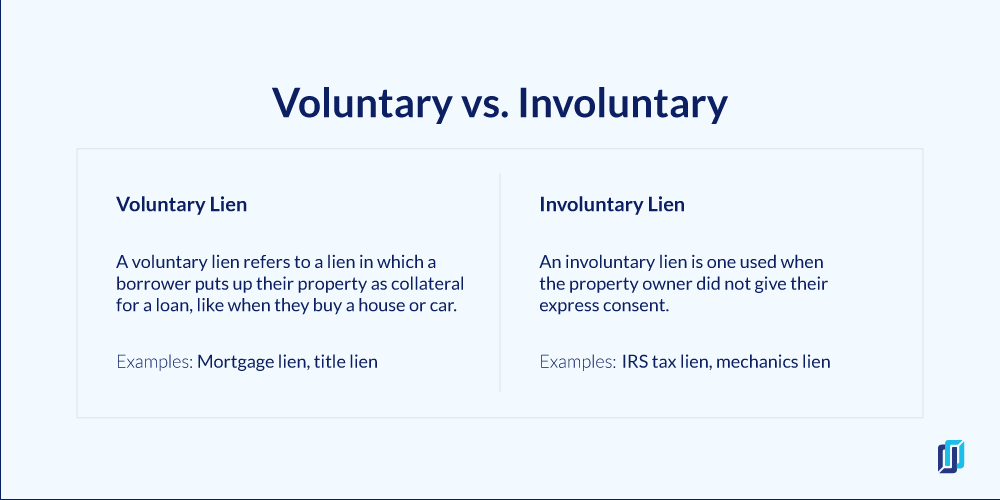

Voluntary vs. involuntary

Liens can also be voluntary or involuntary. This distinction is fairly simple. Did the owner of the property consent or voluntarily agree to have the lien placed on the property?

A voluntary lien refers to a lien used when the owner has given their consent. It may seem odd, since no one asks for a lien on their property. But anytime you finance the purchase of a piece of property with a loan, you are voluntarily giving the lender the right to a lien. If you buy a home and stop making your payments, you can expect the bank to enforce their lien. A mortgage is probably the most commonly known type of voluntary lien. The owner is agreeing to borrow money, allowing the lender to have a legal right (i.e. a security interest) on their property.

Involuntary liens, on the other hand, are those placed on the property by someone without the consent of the property owner. These include judgment liens and mechanics liens.

Types of property liens

Liens can be filed on two different types of property: real property and personal property. Real property includes land and any assets that are permanently attached, like a house. Personal property refers to moveable assets, which can include just about anything under the sun: cars, animals, boats, equipment, etc.

A title lien is probably the most common type of lien on personal property, used when someone borrows money to purchase a car. The lender has a lien on the title, and can repossess and sell the vehicle to recover the money owed.

Because real property is typically the most valuable asset that a debtor has, they will be the first type of property that a creditor will typically go after with a lien. Below, we’ll cover some of the types of liens used on real property.

Tax liens

Tax liens are involuntary general liens, created by state or federal statute. If an individual or company fails to pay their taxes, federal or local, the IRS or some other government entity can place a lien on the property for the amount of unpaid taxes.

This includes all types, such as income taxes, business taxes, and property taxes. These types of liens typically don’t result in foreclosure. Rather, they will usually stay on the property to ensure they are paid first.

Mortgage liens

A mortgage lien is a type of voluntary specific lien, used when a bank lends money to purchase or refinance a home. Mortgages are “secured loans,” which creates a mortgage lien on the property. This means that the borrower promises some type of collateral to secure the loan in case they stop making payments.

When it comes to mortgages, that collateral is the property. If the borrower stops making payments, the lender can take possession of the home and foreclose on the property to pay off the balance.

Mechanics liens

A mechanics lien is the most important type of lien that anyone in the construction industry should familiarize themselves with. These liens are involuntary specific liens, and are created through statutory rights. Every state has laws giving construction businesses and laborers the right to claim a mechanics lien.

Mechanics liens arise when a contractor, material supplier, equipment lessor, or other type of professional provides services for the construction or repair of real property. If those parties end up going unpaid, the individual or company can file a lien against the property being improved.

Since these are statutory liens, there are specific notice requirements and deadlines that must be met to secure these rights. In addition, they do not last forever. Every state sets an expiration date for mechanics liens. The unpaid contractor must enforce their claim before the state deadline, or it becomes ineffective.

UCC liens

The UCC (Uniform Commercial Code) is a set of uniform laws that govern commercial transactions in every state and across state lines. Anyone who lends money to another party can submit a UCC filing, known as a UCC lien, with the Secretary of State that puts a claim on a specific piece of real or personal property until the debt is repaid. A UCC lien is a voluntary specific lien, most often used when lending money that won’t be used to purchase a specific asset, especially when the borrower doesn’t have a good credit history.

For example, if a contractor purchases lumber from a material supplier on credit, the supplier may choose to file a UCC lien on a piece of the contractor’s property to secure their payment for the materials. A UCC lien can be filed on both real and personal property. At the time of the loan, the creditor and borrower will typically review a list of assets and agree on the piece(s) of property that the UCC filing will cover.

Judgment liens

A judgment lien is a direct result of a lawsuit. If a person is a party to a lawsuit and loses, the court will award damages as a money judgment. This makes the defendant a “judgment debtor” and the plaintiff a “judgment creditor.” The judgment itself forms the basis of the lien. If the award isn’t paid, then the judgment creditor can place a lien on the debtor’s property.

Read more: How to use a judgment lien to collect a debt

A mechanics lien can become a judgment lien if the unpaid contractor enforces their claim. If the lienholder wins a foreclosure lawsuit, the mechanics lien is converted to a judgment lien.

How creditors collect payment through a lien

If the lienholder wants to enforce their right to payment, this is done through a foreclosure action. What that means is that the collateral securing the debt will be seized and sold. After the sale, the proceeds will be distributed to pay off the liens on the property.

Lien priority

When a property is foreclosed, there is only so much money to go around to pay all of the creditors.

So, what if the sale price doesn’t cover all of the liens on the property? This is where lien priority comes into play. Each state has its own set of rules regarding priority.

The type of lien, and when they were filed, will determine the priority of payment — in other words, who gets paid first.

Typically, a tax lien will have first priority. Then mortgage liens will usually be paid off next. Most other types of liens or encumbrances will then be paid off according to their ranking.

When multiple mechanics lien claims exist, there generally two ways priority is determined: either first-to-file or equal priority.

First to file is basically, whoever files their claim first, will get paid first. However, a fair amount of other states follow the equal priority rule. In these states, when a claim is filed, it will “relate back” to the beginning of the project. In these states, claimants will all have equal priority and share the remaining proceeds pro rata (in proportion to the amount of their legal claim).

Bankruptcy

Liens are secured debts. This is crucial when dealing with a debtor who has filed for bankruptcy. Many times during a bankruptcy proceeding, particularly Chapter 7 bankruptcy, a fair amount of their outstanding debt will be discharged, or canceled.

A secured debt is among the few types of debt that can survive a bankruptcy. The bankrupt party will be forced to sell off certain (non-exempt) assets to pay off the secured debts.

Read more: Does a Mechanics Lien Secure Debt in Bankruptcy?

How to remove a lien from the property

No one likes liens (they’d prefer to be paid in the first place). But once a lien has already been filed, your options are more limited — but your hands aren’t tied entirely. There are still a few steps a property owner can take to remove a lien.

Pay off the debt

As obvious as this may seem, the best way to have a lien removed from the property is to pay what you owe. Once the debt has been paid, the lienholder will typically be required to have the lien removed.

To remove a mechanics lien after it’s paid, the claimant will usually need to file a lien release or lien cancellation with the clerk or recorder’s office – whichever office your state requires liens to be filed. Once the debt is paid, there are state requirements that the claimant release their lien within a certain period of time, or pay a penalty.

Dispute the lien

Just because a lien has been filed on the property, doesn’t necessarily mean it’s valid. It isn’t the job of the county recorder’s office to determine the validity of a lien claim (although they often attempt to).

As long as the claim meets the filing requirements, it will be recorded against the property. In the case of an invalid lien claim, the property owner will have a few options.

One is to just wait it out. An enforcement action for a mechanics lien must be initiated within a certain timeframe or its no longer valid.

Another option, if it’s available in your state, is to force their hand. In Florida, for example, the property owner can file a Notice of Contest. If filed and sent to the lienholder, they will only have 60 days to enforce their claim. It essentially calls the claimant’s bluff. If it’s valid, then they may choose to enforce it.

Lastly, the owner can just wait for the enforcement lawsuit. At trial, they can present evidence as to why the claim should not be enforced. And in many states, if the claim is dismissed, the owner may be awarded court costs and attorney’s fees.

Bonding off a lien

For mechanics liens in particular, a lien bond can be a useful way to remove the lien from the property title. When a lien is filed, a property owner can opt to discharge the lien by substituting a surety bond. This is referred to as bonding off the lien.

This doesn’t eliminate the claim altogether. Rather, it changes the collateral that is securing the debt. It substitutes a lien release bond for the property itself. This process is typically used by an owner looking to sell or refinance the property, before dealing with the lien claim.

When bonded off, the claim is still valid and intact, but it will be enforced against the bond — not the property.

Avoiding a lien in the first place

Most liens can be avoided by simply making timely payments on your bills, including your taxes. But, in the case of mechanics liens, it can get a little more complicated.

Construction projects are a complex chain of contracts and subcontracts. Sometimes the property owner may not even know who else is working on the project, or if they’re even being paid. Even if you make all of the payments on time to the General Contractor, the GC might forget to pay a subcontractor. That sub has the right to place a mechanics lien on your property.

This is where lien waivers come into play. Any time an individual working on a project gets paid, they should be required to execute a lien waiver for the amount they’ve been paid.

These waive that amount of lien rights on the project in exchange for payment. They act as both a receipt of payment, along with an assurance that a lien won’t be claimed for amounts that have already been paid. For more on this process, see: How to Handle Tracking & Requesting Lien Waivers.

No one likes liens. Before you start a construction project, make sure you understand what you can do to avoid mechanics lien claims, and keep your property title free and clear.