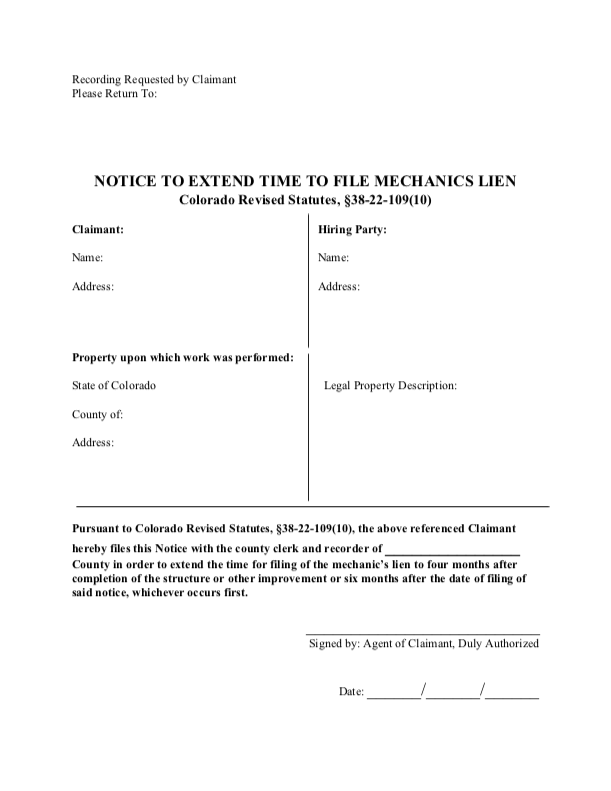

Colorado Notice To Extend Time to File Mechanics Lien

DISCLAIMER: These forms are provided as an informational resource only and are offered “as-is” without any warranties, express or implied. Their use is at your own risk and not intended for commercial purposes. They are not a substitute for legal advice, and we recommend consulting a licensed attorney. The use of these forms does not create an attorney-client relationship.

Download your Notice To Extend Time to File Mechanics Lien | Free Downloadable Template

Get help filing your Colorado Mechanics Lien

When properly filed, the Notice to Extend Time to File Mechanics Lien form extends a claimant’s deadline to file a Colorado mechanics lien.

Claimants must file this notice to extend with the clerk in the Colorado county where the project is located. They must do so before the mechanic’s lien filing deadline.

The Colorado Notice to Extend lengthens the time in which a mechanics lien can be filed. After filing the notice, the new lien filing deadline will be 4 months after the project is completed or 6 months after filing the extension of time – whichever occurs first.

This extension is likely not available for one- or two-family residential projects.

Generally, the deadline for an unpaid contractor or supplier to file a mechanics lien in Colorado is 4 months after the date of the last furnishing. Laborers who did not provide materials must file within 2 months of work completion. For a one or two-family home, the normal 4-month period in which a mechanics lien may be filed is shortened to 2 months if there is a bona fide purchaser of the dwelling.

Others are asking about Colorado Mechanics Lien

Sending a letter of intent to forclose

To your questions:

1. It should be delivered to all owners of record. It does not matter if they are married or not.

2. It makes sense to send it to all creditors as to the property.

An action to enforce a mechanics’ lien must be brought within six months after the last work or labor is performed, or materials furnished, or after the completion of the building, structure, or improvement. Miss that by a day and your rights to enforcement are invalid.

Robert Murillo

robert@pivotallegal.com

can filed a lien to a property that the owners is an llc company?

Yes you can Ffle if the property owner is an LLC, As long as you complete your due diligence on this matter which by your question you have the deadline is 120 days from the date of last work done, or supplies delivered. Once the lien is filed with your State/County feel free to reach out to me to help facilitate and execute upon this lien 972-872-8783 I would love to talk to you more on this

How do I put a lien on the property and sue these people for kicking me out after remodeling and getting my tools stolen

First, filing a lien under the circumstances you present is problematic. There are strict deadlines for noticing intent and recording your lien. Sounds to me like this is an afterthought and not within 4 months of your last date of work, but perhaps I'm wrong there. In any event, if you're seeking items from two years ago, I doubt that would go well for you under a mechanic's lien theory of recovery.

Second, it doesn't sound like there was much of an arrangement between you and the owner, this was something you were doing to improve the residence you were living in.

Third, if you're broke, what good is the mechanic's lien anyway? Even if it were valid, you'd still need to take action on it to pursue it. If they've just refi'd, I imagine the property is encumbered to a not-insignificant extent. The loan already closed, so presumably they aren't going to refi again or sell very soon. If you don't have the money to pursue a wrongful eviction, foreclosure likely isn't within your current financial ability to pursue. If you aren't going to foreclose, then you still have other claims and remedies, but I'd think you'd handle most of those claims and damages within a wrongful eviction case, should you ever have the means to pursue that case.

Other forms to use in Colorado

Colorado County Recorders

Looking to file/record a mechanics lien in Colorado? You'll need to get your Colorado mechanics lien filed and recorded with the county recorder in the county where the construction project is located. Here is a listing of all county recorders in Colorado. Click on any county to find more information about how to get your lien recorded in that county.

Adams

4430 S. Adams Parkway, Suite E2400

Brighton, CO 80601

Phone: 720-523-6020

Arapahoe

5334 S. Prince St.

Littleton, CO 80120

Phone: 303-795-4200

Fax: 303-794-4625

Baca

741 Main St

Springfield, Colorado 81073

Phone: (719) 523-4372

Boulder

1750 33rd Street, Suite 201

Boulder, CO 80301

Phone: 303-413-7770

Clear Creek

405 Argentine St.

Georgetown, Colorado 80444

Phone: 303-679-2340

Denver

201 W. Colfax Avenue, Dept. 101

Denver, CO 80202

Phone: 720-865-8400

Douglas

301 Wilcox St.

Castle Rock, CO 80104

Phone: (303) 660-7446

Fax: 303-814-2776

El Paso

1675 W Garden of the Gods

Colorado Springs, CO 80907

Phone: 719-520-6200

Fremont

615 Macon Ave. Room 102

Cañon City, Colorado 81212

Phone: (719) 276-7330

Jefferson

100 Jefferson County Parkway, Ste. 2560

Golden, CO 80419

Phone: 303-271-8121

Larimer

200 W. Oak Street, First Floor

Fort Collins, CO 80521

Phone: (970) 498-7860

Fax: (970) 498-7906

Moffat

221 W. Victory Way. Ste. 200

Craig, Colorado 81625

Phone: (970) 824-9119

Pueblo

215 W. 10th St Attn: Recording

Pueblo, CO 81003

Phone: (719) 583-6507

Fax: (719) 583-4894

Teller

101 W Bennett Ave

Cripple Creek, Colorado 80813

Phone: (719) 689-2951

Weld

1402 N. 17th Ave

PO Box 459

Greeley, CO 80632

Phone: (970) 304-6530

Fax: (970) 353-1964