The UK Prompt Payment Code was instated in 2008. Much like the Prompt Payment Acts here in the US, it sets standards for good payment practices in the construction industry. As of early 2019, a number of construction companies were suspended under the code, or had their signatory status revoked completely. However, in recent months, several of those suspended companies were reinstated after demonstrating improvement.

Overview of UK’s Prompt Payment Code

The UK Prompt Payment Code is a voluntary code that encourages construction companies to be more transparent about their payment practices by setting goals to ensure timely payments to their subcontractors and suppliers.

In order to sign up, companies must prove they pay at least 95% of their invoices within 60 days while striving to make payment within 30 days the norm. This is done by submitting detailed payment records to the Chartered Institute of Credit Management (CICM) and the Department for Business, Energy, & Industrial Strategy (BEIS). The construction companies that gain approval can display the PPC logo on their website to show they comply with the code.

Although the UK PPC is voluntary, construction companies are required to have signed it before bidding on government contracts.

As of this writing, there are 2,481 total signatories.

Prompt Payment Code enforcement

There is no enforcement method built into the code. However, along with the restriction of bidding rights for non-signatories, the Compliance Board routinely reviews the payment records submitted by signatories. If they don’t meet the requirements, they’re publicly removed from the list. This means they’re no longer able to bid on government contracts, and that contractors and suppliers are made aware of their slow payment status.

In order to be reinstated, a suspended company can submit an action plan to improve their payment practices. Companies that fail to submit this plan are removed from the list permanently.

Companies currently suspended

In recent months, several construction and construction-related companies were suspended from the UK Prompt Payment Code. As of this writing, the current suspended companies include:

- Eurovia Infrastructure Ltd

- FM Conway Ltd

- Kier Highways Ltd

- Kier Integrated Services Ltd

- McNicholas Construction Services Limited

- Screwfix

- Seddon Construction Ltd

These companies have failed to adhere to the 95% within 60 days requirement, and they have yet to submit an approved plan of action for reinstatement.

Along with the recent suspensions from the Prompt Payment Code, a handful of previously suspended construction companies were reinstated.

Companies reinstated under PPC

Suspended companies can apply for reinstatement after submitting an action plan to improve their payment practices. The following list of construction-related companies have done just that, allowing them to be Prompt Payment Code signatories once again.

The reformed contractors to the UK PPC are:

Balfour Beatty

London-based contractor with global offices. Works in the transportation, power and energy, water, and social infrastructure sectors.

View Balfour Beatty’s Contractor Profile

Ferrovial Agroman

UK and Ireland-based infrastructure company. They focus their efforts on large projects such as highways, airports, railways, tunnels, and more.

John Sisk & Son

International construction company based out of the UK and Ireland. Their services include the design, planning, delivery, and maintenance of projects across a broad spectrum of sectors.

Kier

UK construction and infrastructure company. They operate within the aviation, defense, education, energy, environmental, and health sectors to name a few.

Galliford Try

UK-based construction company that works in a broad spectrum of contracts, including infrastructure, health, defense, education, hotels, and telecommunications.

Laing O’Rourke

Global engineering and construction company headquartered in England. Their sectors include buildings, transportation, power, mining & natural resources.

Persimmon Homes

One of the UK’s largest home building companies. Founded in 1972, they have built over 16,000 homes across the island.

The CICM appoints members to the Compliance Board which enforces the code and responds to complaints. Philip King, the Chief Executive of the CICM, made the following statement after the reinstatement of these firms:

“We will continue to challenge signatories to the Code if the obligatory Payment Practice Reporting data suggests that their practices are not compliant…We are encouraged by those who have already submitted action plans to achieve future compliance, and we are working closely with those businesses to support a better payment culture.”

Reinstatement process under UK Prompt Payment Code

Action plans required for reinstatement to the UK Prompt Payment Code are extensive. Suspended companies must provide the CICM and the BEIS with the main causes of non-compliance along with proposed actions to resolve each one. After that, the suspended company must provide quarterly updates that indicate measurable progress towards resolving the listed causes of late payment. If the company cannot meet those requirements, they risk being permanently removed from the PPC.

The action plan system is designed to achieve compliance with the PPC within 12 months. Companies can expect a response as to whether or not their action plan was approved within 28 days of submission.

Sample PPC Action Plans

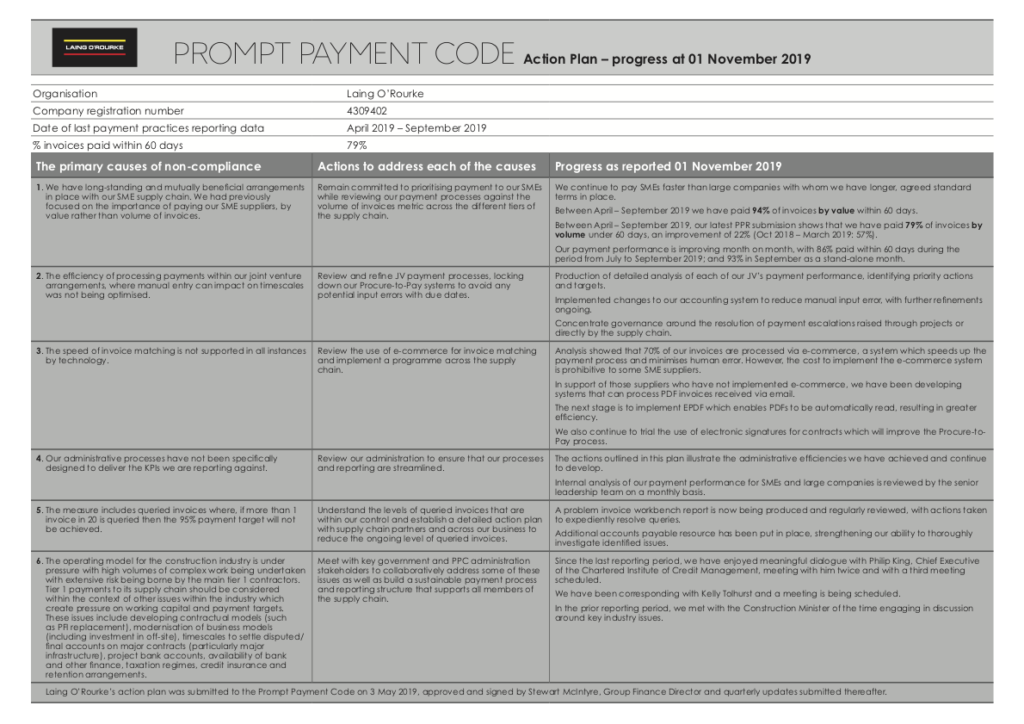

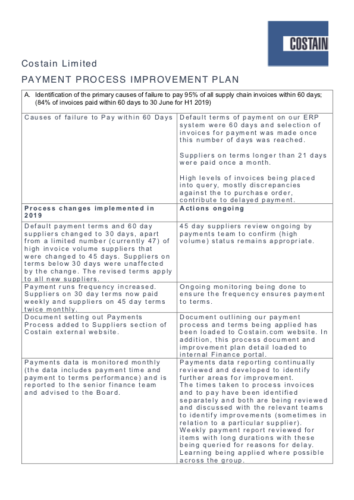

A few reformed contractors have published their action plans online, including Laing O’Rourke and Costain. Drawing on examples from these companies’ action plans, they have displayed measurable progress towards improving their internal communications, prioritizing invoice organization, and striving towards complete transparency with their partners, subs, and suppliers.

Laing O’Rourke’s Action Plan

Laing O’Rourke addresses several causes of non-compliance, including:

- Speed of invoice matching

- Administrative processes

- Complexity of the construction industry

Costain’s action plan

Costain’s list of “causes of failure” included:

- Default payment terms of 60 days in their ERP

- Purchase order discrepancies

UK doubles down on faster payments with Late Payments Bill

Although there’s no legal penalty for non-compliance, PPC status has spurred change in some of the UK’s top construction-related companies, helping them push towards quicker payments and improved communication.

While PPC is a major step in the right direction, it isn’t the only indicator of the UK’s attitude towards late construction payments. The Small Business Commissioner and Late Payments Bill is the latest measure taken by the UK government to protect small businesses and SMEs from late payment and other predatory practices. In short, the bill:

- Establishes a shorter payment deadline for private projects

- Creates a new dispute resolution process

- Cracks down on predatory practices, such as “subbie-bashing”

- Makes late payment public

- Protects the funds of public projects over £5,000

Transparency is something the construction industry needs more of, and measures such as these certainly work towards that. But, as time goes on and more developments and advancements are made, more regulations aren’t always the answer to slow payment. However, when paired with systems like the Prompt Payment Code and Prompt Payment in the US, it’s always nice to know the government is on your side.