Texas

Preliminary Notice Deadlines

Texas

Texas

Texas

Texas

A notice must be sent to the prime contractor and surety following delivery of any unpaid materials and/or labor to a project. If the party contracted with the prime contractor, notice is due by the 15th day of the 3rd month following every month unpaid materials and/or labor are furnished. If the party did not contract with the prime, a notice is required by the 15th day of the 2nd month following furnishing, in addition to the third month notice. Specialty Fabricated Materials requires an additional 2nd month notice calculated from the date work is accepted, and if the contract hold retainage, an additional 2nd month notice is due from the first delivery of materials.

Texas

Lawsuit must be filed within one year from mailing of the third month notice. If claim is for retainage, a notice of claim on retainage is also due within 90 days from the final completion of the entire public work.

Texas

A notice must be sent to the prime contractor and surety following delivery of any unpaid materials and/or labor to a project. If the party contracted with the prime contractor, notice is due by the 15th day of the 3rd month following every month unpaid materials and/or labor are furnished. If the party did not contract with the prime, a notice is required by the 15th day of the 2nd month following furnishing, in addition to the third month notice. Specialty Fabricated Materials requires an additional 2nd month notice calculated from the date work is accepted, and if the contract hold retainage, an additional 2nd month notice is due from the first delivery of materials.

Texas

Lawsuit must be filed within one year from mailing of the third month notice. If claim is for retainage, a notice of claim on retainage is also due within 90 days from the final completion of the entire public work.

On public projects in Texas, a claim may be made against the bond, against the contract funds, or against trust funds held by the general or subcontractor. The parties allowed to recover through each claim type are as follows:

Bond Claim: Parties furnishing labor and/or materials to general contractor, subcontractor, or sub-subcontractor.

Contact Funds: Furnisher of labor and/or materials when original contract totals less than $25,000;

Trust Funds: Contractors, subcontractors, laborers, or materialmen – note that no final notice must be given for a claim on trust funds (proceed directly to lawsuit), so that claim will not be addressed further in these FAQs.

Bond claims in Texas don’t operate as they do in other states – rather than one single claim, Texas bond claims are made on a recurring basis. A bond claim must be mailed no later than the 15th day of the 3rd month after each month in which the claimant furnished labor and/or materials for which there is an unpaid balance. Notice of claim must be given prior to the 15th of the month if the 15th falls on a Saturday, Sunday, or legal holiday. Note that claims on retainage must be mailed no later than 90 days after the completion of the contract.

A claim on contract funds is required to be sent by the 15th day of the second month following each month in which the claimant furnished labor and/or materials for which there is an unpaid balance. While the requirement is satisfied by sending the notice of claim no later than the 15th of the month, it may be best practice to send early enough that it is received by that date.

A bond claim (and claim on retainage) must be sent to the general contractor and the surety.

A claim on the contract funds must be provided to the public official with the duty to pay the general contractor and to the general contractor.

An action to enforce a claim on the contractor’s bond must be initiated more than 60 days after giving notice of the claim, but less than 1 year after giving the notice of the claim or the completion of the project, whichever is earlier.

An action to enforce a lien against the contract funds must be initiated within 6 months after the contractor files a bond with the public official for that purpose.

The requirements of a bond claim depend on whether or not there was a written contract. If there was a written contract, the claim requires a sworn statement of account, which states that the amount claimed is just and correct, and that all applicable credits known to claimant have been allowed. It must also include any retainage that has not become due under the terms of the claimant’s contract. A copy of the written agreement or contract and a statement of the completion or the value of partial completion of the agreement may be attached. If there was not a written contract the claim must include the following: 1) Name of party for whim the labor and/r materials were furnished; 2) Date of furnishing; 3) Description of labor and/or materials furnished; 4) the amount due; and 5) itemization of the claim including invoices or other documents.

Claims on retainage must include 1) Contract amount; 2) Amount Paid; 3) Outstanding Balance; and possibly 4) Description of labor and/or materials furnished; 5) Hiring Party; 6) Date of furnishing; and 7) Whether contract was written or oral.

Claims on contract funds must include: 1) Amount claimed; 2) Hiring Party; 3) Date and place of furnishing; 4) Description of labor and/or materials furnished; 5) Description of the project; 6) Claimant’s business address; 7) Statement under oath that the amount claimed is correct, and all credits have been allowed.

It is unclear whether any party other than the claimant himself/herself may sign the claims.

All types of public claims must be sent by registered or certified mail, return receipt requested. However, the statutes only require sending the claim – there is no requirement of actual receipt.

I missed a claim deadline and my payment is not protected. I am wanting to know the step I need to take in order to...

Lien or Bond (?) Rights for City Job?We are the GC on a job we bid for the City. What types of rights do we have and monthly notice etc requirements. Thank...

Can we still file a bond claim? Or what options do we have here to get paid?We missed the deadlines to be able to file a claim on the prime contractor's bond, but is there still a way that we can...

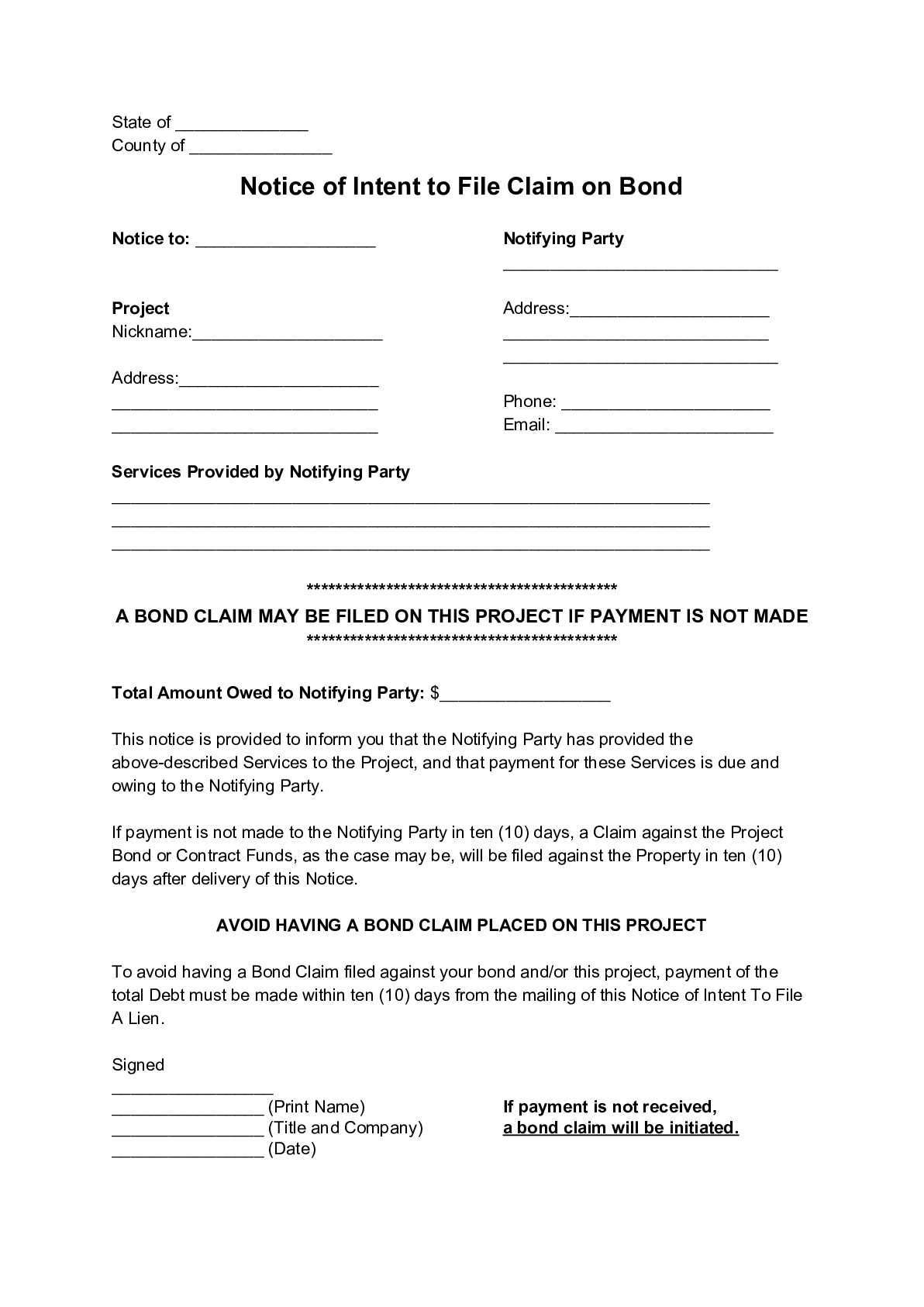

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Texas, and are not paid, you can file a “lien” against the project pursuant to Texas’ Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” Texas’ Little Miller Act is found in Texas Government Code Title 10, Subtitle F and Texas Property Code, Title 5, Subtitle B, Chapter 53 and Sub-chapter J, and is reproduced below.

In this chapter: (1) “Governmental entity” means a governmental or quasi-governmental authority authorized by state law to make a public work contract, including: (A) the state, a county, or a municipality; (B) a department, board, or agency of the state, a county, or a municipality; and (C) a school district or a subdivision of a school district. (2) “Payment bond beneficiary” means a person for whose protection and use this chapter requires a payment bond. (3) “Prime contractor” means a person, firm, or corporation that makes a public work contract with a governmental entity. (4) “Public work contract” means a contract for constructing, altering, or repairing a public building or carrying out or completing any public work. (5) “Public work labor” means labor used directly to carry out a public work. (6) “Public work material” means: (A) material used, or ordered and delivered for use, directly to carry out a public work; (B) specially fabricated material; (C) reasonable rental and actual running repair costs for construction equipment used, or reasonably required and delivered for use, directly to carry out work at the project site; or (D) power, water, fuel, and lubricants used, or ordered and delivered for use, directly to carry out a public work. (7) “Retainage” means the part of the payments under a public work contract that are not required to be paid within the month after the month in which the public work labor is performed or public work material is delivered under the contract. (8) “Specially fabricated material” means material ordered by a prime contractor or subcontractor that is: (A) specially fabricated for use in a public work; and (B) reasonably unsuitable for another use. (9) “Subcontractor” means a person, firm, or corporation that provides public work labor or material to fulfill an obligation to a prime contractor or to a subcontractor for the performance and installation of any of the work required by a public work contract. Back to Top

This chapter does not apply to a public work contract entered into by a state agency relating to an action taken under Subchapter F or I, Chapter 361, Health and Safety Code, or Subchapter I, Chapter 26, Water Code. Back to Top

(a) A governmental entity that makes a public work contract with a prime contractor shall require the contractor, before beginning the work, to execute to the governmental entity:

(1) a performance bond if the contract is in excess of $100,000; and

(2) a payment bond if:

(A) the contract is in excess of $25,000, and the governmental entity is not a municipality or a joint board created under Subchapter D, Chapter 22, Transportation Code; or

(B) the contract is in excess of $50,000, and the governmental entity is a municipality or a joint board created under Subchapter D, Chapter 22, Transportation Code.

(b) The performance bond is:

(1) solely for the protection of the state or governmental entity awarding the public work contract;

(2) in the amount of the contract; and

(3) conditioned on the faithful performance of the work in accordance with the plans, specifications, and contract documents.

(c) The payment bond is:

(1) solely for the protection and use of payment bond beneficiaries who have a direct contractual relationship with the prime contractor or a subcontractor to supply public work labor or material; and

(2) in the amount of the contract.

(d) A bond required by this section must be executed by a corporate surety in accordance with Section 1, Chapter 87, Acts of the 56th Legislature, Regular Session, 1959 (Article 7.19-1, Vernon’s Texas Insurance Code).

(e) A bond executed for a public work contract with the state or a department, board, or agency of the state must be payable to the state and its form must be approved by the attorney general. A bond executed for a public work contract with another governmental entity must be payable to and its form must be approved by the awarding governmental entity.

(f) A bond required under this section must clearly and prominently display on the bond or on an attachment to the bond:

(1) the name, mailing address, physical address, and telephone number, including the area code, of the surety company to which any notice of claim should be sent; or

(2) the toll-free telephone number maintained by the Texas Department of Insurance under Subchapter B, Chapter 521, Insurance Code, and a statement that the address of the surety company to which any notice of claim should be sent may be obtained from the Texas Department of Insurance by calling the toll-free telephone number.

(g) A governmental entity may not require a contractor for any public building or other construction contract to obtain a surety bond from any specific insurance or surety company, agent, or broker.

(h) A reverse auction procedure may not be used to obtain services related to a public work contract for which a bond is required under this section. In this subsection, “reverse auction procedure” has the meaning assigned by Section 2155.062 or a procedure similar to that described by Section 2155.062.

(a) A governmental entity shall ensure that an insurance company that is fulfilling its obligation under a contract of insurance by arranging for the replacement of a loss, rather than by making a cash payment directly to the governmental entity, furnishes or has furnished by a contractor, in accordance with this chapter: (1) a performance bond as described by Section 2253.021(b) for the benefit of the governmental entity; and (2) a payment bond as described in Section 2253.021(c) for the benefit of the beneficiaries described by that subsection. (b) The bonds required to be furnished under Subsection (a) must be furnished before the contractor begins work. (c) It is an implied obligation under a contract of insurance for the insurance company to furnish the bonds required by this section. (d) To recover in a suit with respect to which the insurance company has furnished or caused to be furnished a payment bond, the only notice required of a payment bond beneficiary is the notice given to the surety in accordance with Subchapter C. (e) This section does not apply to a governmental entity when a surety company is complying with an obligation under a bond that had been issued for the benefit of the governmental entity. (f) If the payment bond required by Subsection (a) is not furnished, the governmental entity is subject to the same liability that a surety would have if the surety had issued the payment bond and the governmental entity had required the bond to be provided. To recover in a suit under this subsection, the only notice required of a payment bond beneficiary is a notice given to the governmental entity, as if the governmental entity were the surety, in accordance with Subchapter C. Back to Top

(a) A bond furnished by a prime contractor in an attempt to comply with this chapter shall be construed to comply with this chapter regarding the rights created, limitations on those rights, and remedies provided. (b) A provision in a bond furnished by a prime contractor in an attempt to comply with this chapter that expands or restricts a right or liability under this chapter shall be disregarded, and this chapter shall apply to that bond. Back to Top

(a) A prime contractor, on the written request of a person who provides public work labor or material and when required by Subsection (c), shall provide to the person: (1) the name and last known address of the governmental entity with whom the prime contractor contracted for the public work; (2) a copy of the payment and performance bonds for the public work, including bonds furnished by or to the prime contractor; and (3) the name of the surety issuing the payment bond and the performance bond and the toll-free telephone number maintained by the Texas Department of Insurance under Subchapter B, Chapter 521, Insurance Code, for obtaining information concerning licensed insurance companies. (b) A subcontractor, on the written request of a governmental entity, the prime contractor, a surety on a bond that covers the public work contract, or a person providing work under the subcontract and when required by Subsection (c), shall provide to the person requesting the information: (1) the name and last known address of each person from whom the subcontractor purchased public work labor or material, other than public work material from the subcontractor’s inventory; (2) the name and last known address of each person to whom the subcontractor provided public work labor or material; (3) a statement of whether the subcontractor furnished a bond for the benefit of its subcontractors and materialmen; (4) the name and last known address of the surety on the bond the subcontractor furnished; and (5) a copy of that bond. (c) Information requested shall be provided within a reasonable time but not later than the 10th day after the receipt of the written request for the information. (d) A person from whom information is requested may require payment of the actual cost, not to exceed $25, for providing the requested information if the person does not have a direct contractual relationship with the person requesting information that relates to the public work. (e) A person who fails to provide information required by this section is liable to the requesting person for that person’s reasonable and necessary costs incurred in getting the requested information. Back to Top

(a) A payment bond beneficiary, not later than the 30th day after the date the beneficiary receives a written request from the prime contractor or a surety on a bond on which a claim is made, shall provide to the contractor or surety: (1) a copy of any applicable written agreement or purchase order; and (2) any statement or payment request of the beneficiary that shows the amount claimed and the work performed by the beneficiary for which the claim is made. (b) If requested, the payment bond beneficiary shall provide the estimated amount due for each calendar month in which the beneficiary performed public work labor or provided public work material. Back to Top

(a) A governmental entity shall furnish the information required by Subsection (d) to any person who applies for the information and who submits an affidavit that the person: (1) has supplied public work labor or material for which the person has not been paid; (2) has contracted for specially fabricated material for which the person has not been paid; or (3) is being sued on a payment bond. (b) The copy of the payment bond or public work contract is prima facie evidence of the content, execution, and delivery of the original. (c) An applicant under this section shall pay any reasonable fee set by the governmental entity for the actual cost of preparation of the copies. (d) A governmental entity shall furnish the following information to a person who makes a request under Subsection (a): (1) a certified copy of a payment bond and any attachment to the bond; (2) the public work contract for which the bond was given; and (3) the toll-free telephone number maintained by the Texas Department of Insurance under Subchapter B, Chapter 521, Insurance Code, for obtaining information concerning licensed insurance companies. Back to Top

(a) If a governmental entity fails to obtain from a prime contractor a payment bond as required by Section 2253.021: (1) the entity is subject to the same liability that a surety would have if the surety had issued a payment bond and if the entity had obtained the bond; and (2) a payment bond beneficiary is entitled to a lien on money due to the prime contractor in the same manner and to the same extent as if the public work contract were subject to Subchapter J, Chapter 53, Property Code. (b) To recover in a suit under Subsection (a), the only notice a payment bond beneficiary is required to provide to the governmental entity is a notice provided in the same manner as described by Subchapter C. The notice must be provided as if the governmental entity were a surety. Back to Top

(a) To recover in a suit under Section 2253.073 on a payment bond for a claim for payment for public work labor performed or public work material delivered, a payment bond beneficiary must mail to the prime contractor and the surety written notice of the claim. (b) The notice must be mailed on or before the 15th day of the third month after each month in which any of the claimed labor was performed or any of the claimed material was delivered. (c) The notice must be accompanied by a sworn statement of account that states in substance: (1) the amount claimed is just and correct; and (2) all just and lawful offsets, payments, and credits known to the affiant have been allowed. (d) The statement of account shall include the amount of any retainage applicable to the account that has not become due under the terms of the public work contract between the payment bond beneficiary and the prime contractor or between the payment bond beneficiary and a subcontractor. Back to Top

A payment bond beneficiary has the option to enclose with the sworn statement of account, as the notice for a claim under a written agreement for payment for public work labor performed or public work material delivered, a copy of the written agreement and a statement of the completion or the value of partial completion of the agreement. Back to Top

(a) Except as provided by Section 2253.044, if a written agreement does not exist between the payment bond beneficiary and the prime contractor or between the payment bond beneficiary and the subcontractor, the notice for a claim for unpaid bills must contain: (1) the name of the party for whom the public work labor was performed or to whom the public work material was delivered; (2) the approximate date of performance or delivery; (3) a description of the public work labor or material for reasonable identification; and (4) the amount due. (b) The payment bond beneficiary must generally itemize the claim and include with it copies of documents, invoices, or orders that reasonably identify: (1) the public work labor performed or public work material delivered for which the claim is made; (2) the job; and (3) the destination of delivery. Back to Top

The notice for a claim for lump-sum payment for multiple items of public work labor or material must: (1) describe the labor or material in a manner that reasonably identifies the labor or material; (2) state the name of the party for whom the labor was performed or to whom the material was delivered; (3) state the approximate date of performance or delivery; (4) state whether the contract is written or oral; (5) state the amount of the contract; and (6) state the amount claimed. Back to Top

The notice for a claim for public work labor performed or public work material delivered by a payment bond beneficiary who is a subcontractor or materialman to the prime contractor or to a subcontractor and who has a written unit price agreement that is wholly or partially completed is sufficient if the beneficiary attaches to the sworn statement of account: (1) a list of units and unit prices set by the contract; and (2) a statement of those completed and partially completed units. Back to Top

(a) To recover in a suit under Section 2253.073 on a payment bond for a claim for payment of retainage, a payment bond beneficiary whose contract with a prime contractor or subcontractor provides for retainage must mail written notice of the claim to the prime contractor and the surety on or before the 90th day after the date of final completion of the public work contract. (b) The notice shall consist of a statement of: (1) the amount of the contract; (2) any amount paid; and (3) the outstanding balance. (c) Notice of a claim for payment of retainage is not required if the amount claimed is part of a prior claim made under this subchapter. Back to Top

(a) To recover in a suit under Section 2253.073 on a payment bond, a payment bond beneficiary who does not have a direct contractual relationship with the prime contractor for public work labor or material must mail notice as required by this section. (b) A payment bond beneficiary who contracts with a subcontractor for retainage must mail, on or before the 15th day of the second month after the date of the beginning of the delivery of public work material or the performance of public work labor, written notice to the prime contractor that: (1) the contract provides for retainage; and (2) generally indicates the nature of the retainage. (c) The payment bond beneficiary must mail to the prime contractor written notice of a claim for any unpaid public work labor performed or public work material delivered. The notice must be mailed on or before the 15th day of the second month after each month in which the labor was performed or the material was delivered. A copy of the statement sent to a subcontractor is sufficient as notice under this subsection. (d) The payment bond beneficiary must mail to the prime contractor, on or before the 15th day of the second month after the receipt and acceptance of an order for specially fabricated material, written notice that the order has been received and accepted. (e) This section applies only to a payment bond beneficiary who is not an individual mechanic or laborer and who makes a claim for wages. Back to Top

(a) A notice required by this subchapter to be mailed must be sent by certified or registered mail. (b) A notice required by this subchapter to be mailed to a prime contractor must be addressed to the prime contractor at the contractor’s residence or last known business address. (c) A person satisfies the requirements of this subchapter relating to providing notice to the surety if the person mails the notice by certified or registered mail to the surety: (1) at the address stated on the bond or on an attachment to the bond; (2) at the address on file with the Texas Department of Insurance; or (3) at any other address allowed by law. Back to Top

(a) The proceeds of a public work contract are not payable, until all costs of completion of the contract work are paid by the contractor or the contractor’s surety, to a contractor who furnishes a bond required by this chapter if: (1) the contractor abandons performance of the contract; or (2) the contractor’s right to proceed with performance of the contract is lawfully terminated by the awarding governmental entity because of the contractor’s default. (b) The balance of the public work contract proceeds remaining after the costs of completion are paid shall be paid according to the contractor’s and the surety’s interests as may be established by agreement or by judgment of a court. (c) A surety that completes a public work contract or incurs a loss under a performance bond required under this chapter has a claim to the proceeds of the contract prior to all other creditors of the prime contractor to the full extent of the surety’s loss. That priority does not excuse the surety from paying an obligation under a payment bond. Back to Top

The state is not liable for payment of a cost or expense of a suit brought by any party on a payment bond furnished under this chapter. Back to Top

(a) A payment bond beneficiary who has provided public work labor or material under a public work contract for which a payment bond is furnished under this chapter may sue the principal or surety, jointly or severally, on the payment bond if the claim is not paid before the 61st day after the date the notice for the claim is mailed. (b) Suit may be brought under Subsection (a) for: (1) the unpaid balance of the beneficiary’s claim at the time the claim was mailed or the suit is brought; and (2) reasonable attorney fees. Back to Top

A court may award costs and reasonable attorney fees that are equitable in a proceeding to enforce a claim on a payment bond or to declare that any part of a claim is invalid. Back to Top

A third party to whom a claim is assigned is in the same position as a payment bond beneficiary if notice is given as required by this chapter. Back to Top

(a) The amount of a subcontractor’s claim, including previous payments, may not exceed the proportion of the subcontract price that the work done bears to the total of the work covered by the subcontract. (b) A claim for specially fabricated material that has not been delivered or incorporated into the public work is limited to material that conforms to and complies with the plans, specifications, and contract documents for the material. The amount of the claim may not exceed the reasonable cost, less the fair salvage value, of the specially fabricated material. (c) A claim for retainage in a notice under this subchapter is not valid for an amount greater than the amount of retainage specified in the public work contract between the payment bond beneficiary and the prime contractor or between the payment bond beneficiary and the subcontractor. A claim for retainage is never valid for an amount greater than 10 percent of the amount of that contract. Back to Top

A suit under this chapter shall be brought in a court in a county in which any part of the public work is located. Back to Top

(a) A suit on a performance bond may not be brought after the first anniversary of the date of final completion, abandonment, or termination of the public work contract. (b) A suit on a payment bond may not be brought by a payment bond beneficiary after the first anniversary of the date notice for a claim is mailed under this chapter. Back to Top

(a) A suit on a performance bond may not be brought after the first anniversary of the date of final completion, abandonment, or termination of the public work contract. (b) A suit on a payment bond may not be brought by a payment bond beneficiary after the first anniversary of the date notice for a claim is mailed under this chapter. Back to Top

(a) A person commits an offense if the person willfully files a false and fraudulent claim under this chapter. (b) An offense under this section is subject to the penalty for false swearing. Back to Top

(a) A person who furnishes material or labor to a contractor under a prime contract with a governmental entity other than a municipality or a joint board created under Subchapter D, Chapter 22, Transportation Code, that does not exceed $25,000 and that is for public improvements in this state and who gives notice required by this subchapter has a lien on the money, bonds, or warrants due the contractor for the improvements.

(b) A person who furnishes material or labor to a contractor under a prime contract with a municipality or a joint board created under Subchapter D, Chapter 2, Transporation Code, that does not exceed $50,000 and that is for public improvements in this state and who gives notice required by this subchapter has a lien on the money, bonds, or warrants due the contractor for the improvements. Back to Top

The lien claimant must send written notice of his claim by registered or certified mail to: (1) the officials of the state, county, town, or municipality whose duty it is to pay the contractor; and (2) the contractor at the contractor’s last known business or residence address. Back to Top

The lien claimant must send written notice of his claim by certified mail to:

(1) the officials of the state, county, town, or municipality whose duty it is to pay the contractor; and

(2) the contractor at the contractor’s last known business or residence address.

(a) Whether based on written or oral agreement, the notice must contain:

(1) the amount claimed;

(2) the name of the party to whom the materials were delivered or for whom the labor was performed;

(3) the dates and place of delivery or performance;

(4) a description reasonably sufficient to identify the materials delivered or labor performed and the amount due;

(5) a description reasonably sufficient to identify the project for which the material was delivered or the labor performed; and

(6) the claimant’s business address.

(b) The notice must be accompanied by a statement under oath that the amount claimed is just and correct and that all payments, lawful offsets, and credits known to the affiant have been allowed. Back to Top

The lien claimant must give notice not later than the 15th day of the second month following the month in which the labor was performed or the material furnished. Back to Top

A public official who receives the notice may not pay all of the money, bonds, or warrants due the contractor, but shall retain enough to pay the claim for which notice is given. Back to Top

(a) If a claim is filed attempting to fix a lien under this subchapter, the contractor against whom the claim is made may file a bond with the officials of the state, county, town, or municipality whose duty it is to pay the money, bonds, or warrants to the contractor.

(b) If the bond is approved by the proper official, its filing releases and discharges all liens fixed or attempted to be fixed by the filing of a claim, and the appropriate officials shall pay the money, bonds, or warrants to the contractor or the contractor’s assignee. Back to Top

The bond must be:

(1) in an amount double the amount of the claims filed;

(2) payable to the claimants;

(3) executed by:

(A) the party filing the bond as principal; and

(B) a corporate surety authorized, admitted to do business, and licensed by the law of this state to execute the bond as surety; and

(4) conditioned that:

(A) the principal and surety will pay to the obligees named or to their assignees the amount of the claims or the portions of the claims proved to be liens under this subchapter; and

(B) the principal and surety will pay all court costs adjudged against the principal in actions brought by a claimant on the bond. Back to Top

The official with whom the bond is filed shall send an exact copy of the bond by registered mail or certified mail, return receipt requested, to all claimants.

The official with whom the bond is filed shall send an exact copy of the bond by certified mail, return receipt requested, to all claimants.

(a) A claimant must sue on the bond within six months after the bond is filed.

(b) The bond is not exhausted by one action on it. Each obligee or his assignee may maintain a separate suit on the bond in any court of jurisdiction. Back to Top