New Jersey

Preliminary Notice Deadlines

New Jersey

New Jersey

New Jersey

New Jersey

Bond Claims: Notice required prior to commencing of work if no direct contract with contractor furnishing the bond.

Lien on Funds: Notice required within 20 days of first furnishing labor or materials.

New Jersey

Bond Claim: Within 1 year from last furnishing labor or materials - lawsuit 90 days after sending claim, but no more than 1 year after last furnishing labor or materials.

Lien on Funds: Any time prior to the completion/acceptance of the total work or 60 days thereafter - Lawsuit within 60 days of completion/acceptance of the total work.

New Jersey

Bond Claims: Notice required prior to commencing of work if no direct contract with contractor furnishing the bond.

Lien on Funds: Notice required within 20 days of first furnishing labor or materials.

New Jersey

Bond Claim: Within 1 year from last furnishing labor or materials - lawsuit 90 days after sending claim, but no more than 1 year after last furnishing labor or materials.

Lien on Funds: Any time prior to the completion/acceptance of the total work or 60 days thereafter - Lawsuit within 60 days of completion/acceptance of the total work.

On public projects in New Jersey, there are two potential types of protection: a claim against a contractor’s payment bond, and a lien claim against the contract funds for municipal public projects.

Bond claims

Bond claim rights are available on all state and municipal projects in New Jersey. The parties who have a right to file a claim against the payment bond are 1st and 2nd tier subcontractors and suppliers. Meaning anyone who contracted directly with the prime contractor, and anyone who contracted with those parties.

Lien on contract funds

This remedy is only available on public works projects that are not commissioned by the state or state agency; only county, city, town, township, or other municipal commission, board, or entity, The parties who can claim a lien on contract funds in New Jersey are any party who contracted directly with the prime contractor, 1st tier sub, or 2nd tier subcontractor.

Bond claims

A claim against the payment bond must be made no later than one year from the date of last furnishing labor and/or materials to the project. However, a lawsuit to enforce the claim must be initiated at least 90 days after filing the claim, but no later than 1 year after the date of last furnishing. Thus, best practice is to send the claim no later than 90 days prior to the 1 year after the date of last furnishing (i.e. 275 days after the date of last furnishing at the latest).

Lien on contract funds

A claim of lien on funds can be filed at any time during the course of the project, but must be filed no later than 60 days after the completion or acceptance by the public entity.

Bond claims

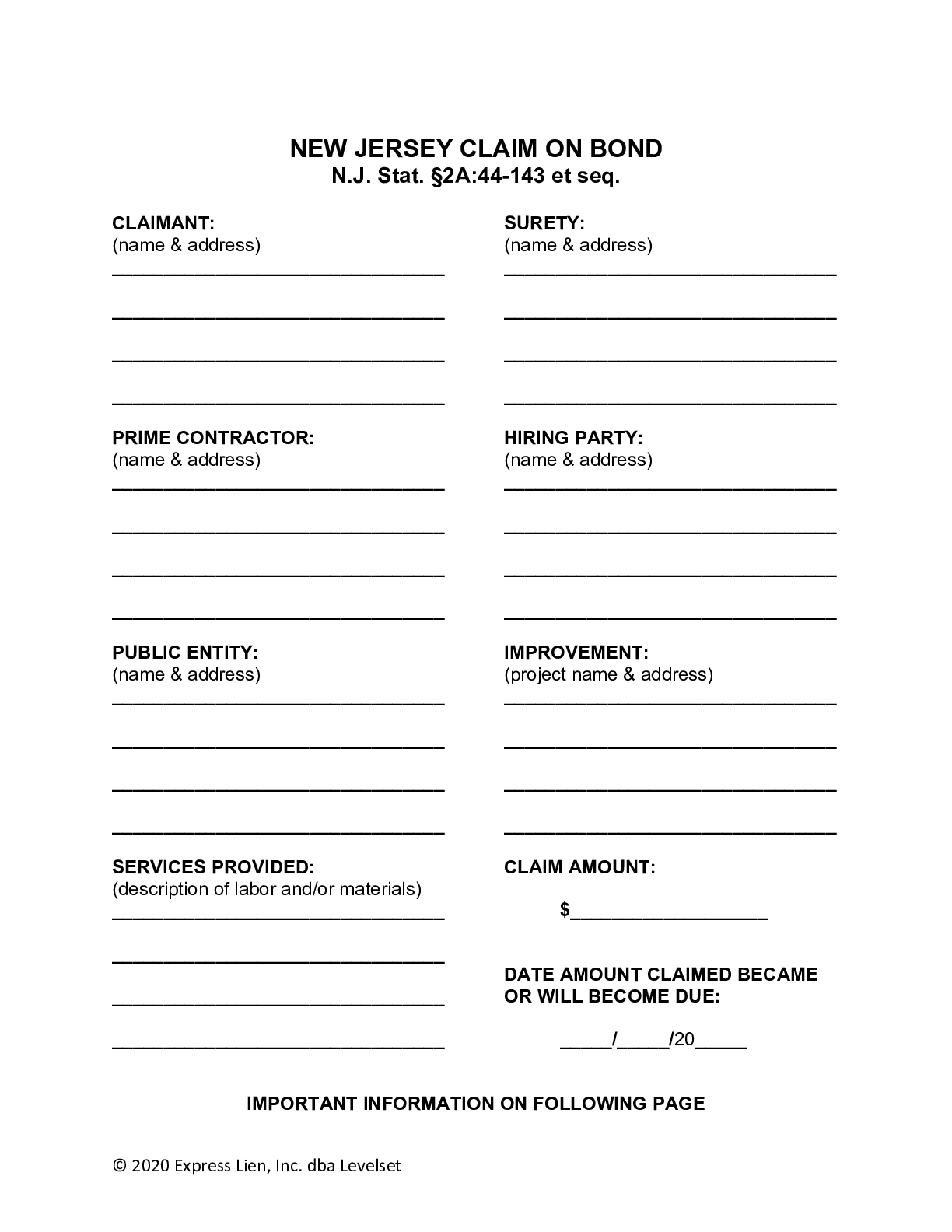

A claim against the contractor’s bond must only include a statement of the amount due. It is probably advisable to include at least a description of the project, and the name of the claimant, general contractor, and contracting party, as well. The claim does not need to be verified, but it is probably advisable for the claimant to at least sign the claim.

→ Download a free New Jersey Public Bond Claim form

Lien on contract funds

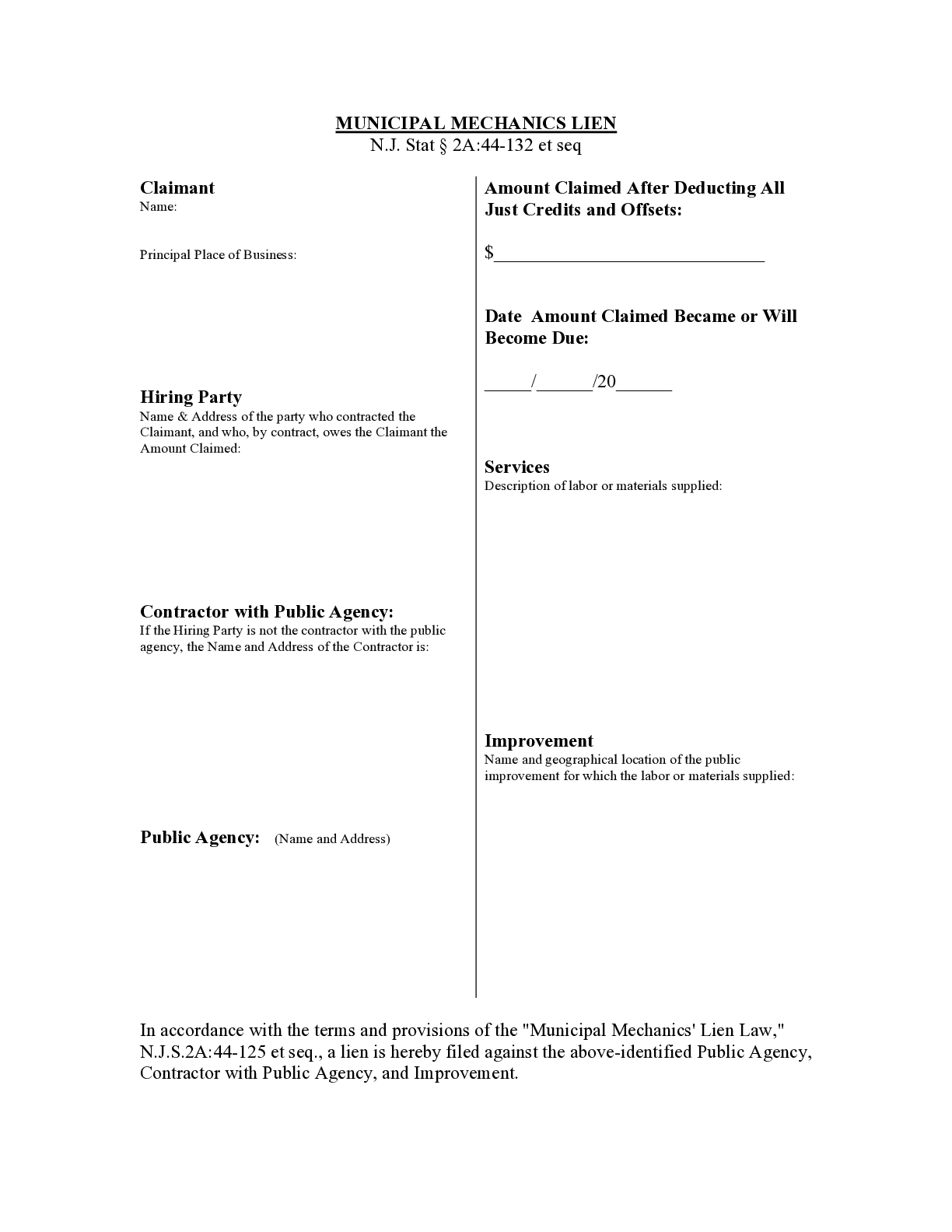

A New Jersey Lien on Contract Funds must include the following information:

• Claimant’s name & address

• Amount claimed and from whom the amount is due

• If amount is not due, the date the payment will become due

• Hiring party’s name and their role on the project

• General nature of the public work

• Prime contractor’s name

• Public entity’s name

• Statement that labor and/or materials were provided and actually used in the project

• Verification by claimant or claimant’s agent

→ Download a free New Jersey Municipal Lien on Contract Funds form

Bond claims

A claim against a public payment bond in New Jersey must be sent to the surety and the general contractor who posted the bond on the project.

Lien on contract funds

A lien on contract funds claim must be filed with the chairman (or other head officer), or with the secretary or clerk of the public agency who commissioned the project.

Bond claims

There is no specific method for sending a public payment bond claim in New Jersey. Registered or certified mail is likely the best option to ensure receipt of the claim.

Lien on contract funds

A lien on contract funds only needs to be filed with the appropriate party of the public entity.

Bond claims

The deadline to file a lawsuit to enforce a public payment bond claim is more like a window. The lawsuit must be initiated at least 90 days after the claim was sent, but no later than 1 year after the claimant’s last furnishing labor and/or materials to the project.

Lien on contract funds

A lawsuit to enforce a municipal lien on contract funds must be initiated within 60 days after the completion or acceptance of the overall project. If an action has already been initiated by another claimant, you can preserve your claim by filing an answer in that action.

I worked on a project for a GC with a subcontract agreement to subtract actual payroll costs from the subcontract during the progress of the...

US Department of Energy construction project located in New JerseyAre subcontractors required to provide a payment bond performing work on a federal government construction project costing $80,000.00??

Can I file a Bond in New JerseyCan a supplier file a Bond on a city's project in New Jersey if there is no recorded of a bond being filed with the...

When working on any New Jersey public works project, claimants may file a Public Bond Claim against the project payment bond at any time before...

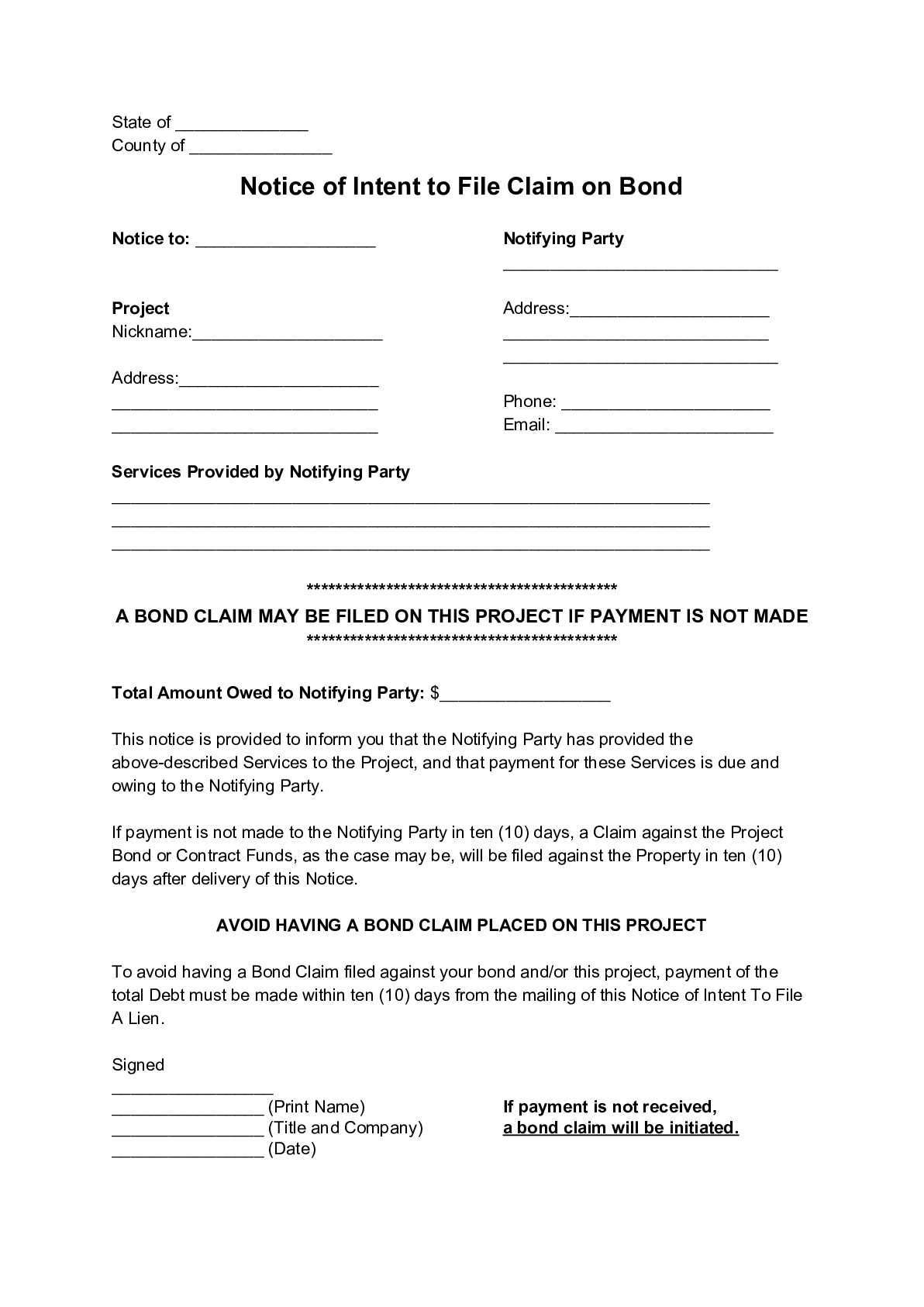

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When working on a public works project, other than a state project, claimants may file a Municipal Mechanics Lien against the project at any time...

When you perform work on a state construction project in New Jersey , and are not paid, you can file a “lien” against the project pursuant to New Jersey’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.” New Jersey’s Little Miller Act is found in N.J.S.A. § 2A:44:143-147, and are reproduced below. Updated as of 2020.

a.

(1) When public buildings or other public works or improvements are about to be constructed, erected, altered or repaired under contract, at the expense of the State or any contracting unit, as defined in section 2 of P.L. 1971, c.198 (C. 40A:11-2 ), or school district, the board, officer or agent contracting on behalf of the State, contracting unit or school district, shall require delivery of the payment and performance bond issued in accordance with N.J.S. 2A:44-147 and otherwise, as provided for by law, with an obligation for the performance of the contract and for the payment by the contractor for all labor performed or materials, provisions, provender or other supplies, teams, fuels, oils, implements or machinery used or consumed in, upon, for or about the construction, erection, alteration or repair of such buildings, works or improvements provided by subcontractors or material suppliers in contract with the contractor, or subcontractors or material suppliers in co ntract with a subcontractor to the contractor, which class of persons shall be the beneficiaries of the payment and performance bond. The board, officer or agent shall also require that all payment and performance bonds be issued by a surety which meets the following standards:

(a) The surety shall have the minimum surplus and capital stock or net cash assets required by 17:17-6 or 17:17-7, whichever is appropriate, at the time the invitation to bid is issued; and

(b) With respect to all payment and performance bonds in the amount of $850,000 or more, (i) if the amount of the bond is at least $850,000 but not more than $3.5 million, the surety shall hold a current certificate of authority, issued by the United States Secretary of the Treasury pursuant to 31 U.S.C.9305, that is valid in the State of New Jersey as listed annually in the United States Treasury Circular 570, except that if the surety has been operational for a period in excess of five years, the surety shall be deemed to meet the requirements of this subsubparagraph if it is rated in one of the three highest categories by an independent, nationally recognized United States rating company that determines the financial stability of insurance companies, which rating company or companies shall be determined pursuant to standards promulgated by the Commissioner of Insurance by regulation adopted pursuant to the “Administrative Procedure Act,” P.L. 1968, c.410 (C. 52:14B-1 et seq.), and (ii) if the amount of the bond is more than $3.5 million, then the surety shall hold a current certificate of authority, issued by the United States Secretary of the Treasury pursuant to 31 U.S.C.9305, that is valid in the State of New Jersey as listed annually in the United States Treasury Circular 570 and, if the surety has been operational for a period in excess of five years, shall be rated in one of the three highest categories by an independent, nationally recognized United States rating company that determines the financial stability of insurance companies, which rating company or companies shall be determined pursuant to standards promulgated by the Commissioner of Insurance by regulation adopted pursuant to the “Administrative Procedure Act,” P.L. 1968, c.410 (C. 52:14B-1 et seq.). A surety subject to the provisions of subsubparagraph (ii) of this subparagraph which does not hold a certificate of authority issued by the United States Secretary of the Treasury shall be exempt from the requirement to hold such a certificate if the surety meets an equivalent set of standards developed by the Commissioner of Insurance through regulation which at least equal, and may exceed, the general criteria required for issuance of a certificate of authority by the United States Secretary of the Treasury pursuant to 31 U.S.C.9305. A surety company seeking such an exemption shall, not later than the 180th day following the effective date of P.L. 1995, c.384, certify to the appropriate contracting unit that it meets that equivalent set of standards set forth by the commissioner as promulgated.

(2) When such contract is to be performed at the expense of the State and is entered into by the Director of the Division of Building and Construction or State departments designated by the Director of the Division of Building and Construction, the director or the State departments may: (a) establish for that contract the amount of the bond at any percentage, not exceeding 100%, of the amount bid, based upon the director’s or department’s assessment of the risk presented to the State by the type of contract, and other relevant factors, and (b) waive the bond requirement of this section entirely if the contract is for a sum not exceeding $200,000.

(3) When such a contract is to be performed at the expense of a contracting unit or school district, the board, officer or agent contracting on behalf of the contracting unit or school district may: (a) establish for that contract the amount of the bond at any percentage, not exceeding 100%, of the amount bid, based upon the board’s, officer’s or agent’s assessment of the risk presented to the contracting unit or school district by the type of contract and other relevant factors, and (b) waive the bond requirement of this section entirely if the contract is for a sum not exceeding $100,000.

b. A surety’s obligation shall not extend to any claim for damages based upon alleged negligence that resulted in personal injury, wrongful death, or damage to real or personal property, and no bond shall in any way be construed as a liability insurance policy. Nothing herein shall relieve the surety’s obligation to guarantee the contractor’s performance of all conditions of the contract, including the maintenance of liability insurance if and as required by the contract. Only the obligee named on the bond, and any subcontractor performing labor or any subcontractor or materialman providing materials for the construction, erection, alteration or repair of the public building, work or improvement for which the bond is required pursuant to this section, shall have any claim against the surety under the bond.

c. A board, officer or agent contracting on behalf of the State, contracting unit or school district shall not accept more than one payment and performance bond to cover a single construction contract. The board, officer or agent may accept a single bond executed by more than one surety to cover a single construction contract only if the combined underwriting limitations of all the named sureties, as set forth in the most current annual revision of United States Treasury Circular 570, or as determined by the Commissioner of Insurance pursuant to 17:18-9, meet or exceed the amount of the contract to be performed.

d. A board, officer or agent contracting on behalf of the State, contracting unit or school district shall not accept a payment or performance bond unless there is attached thereto a Surety Disclosure Statement and Certification to which each surety executing the bond shall have subscribed. This statement and certification shall be complete in all respects and duly acknowledged according to law, and shall have substantially the following form:

SURETY DISCLOSURE STATEMENT AND CERTIFICATION

…………………………, surety(ies) on the attached bond, hereby certifies(y) the following:

(1) The surety meets the applicable capital and surplus requirements of 17:17-6 or 17:17-7 as of the surety’s most current annual filing with the New Jersey Department of Insurance.

(2) The capital (where applicable) and surplus, as determined in accordance with the applicable laws of this State, of the surety(ies) participating in the issuance of the attached bond is (are) in the following amount(s) as of the calendar year ended December 31,……… (most recent calendar year for which capital and surplus amounts are available), which amounts have been certified as indicated by certified public accountants (indicating separately for each surety that surety’s capital and surplus amounts, together with the name and address of the firm of certified public accounts that shall have certified those amounts):

………………………………………

………………………………………

………………………………………

(3)

(a) With respect to each surety participating in the issuance of the attached bond that has received from the United States Secretary of the Treasury a certificate of authority pursuant to 31 U.S.C.9305, the underwriting limitation established therein and the date as of which that limitation was effective is as follows (indicating for each such surety that surety’s underwriting limitation and the effective date thereof):

……………………………………..

……………………………………..

……………………………………..

(b) With respect to each surety participating in the issuance of the attached bond that has not received such a certificate of authority from the United States Secretary of the Treasury, the underwriting limitation of that surety as established pursuant to 17:18-9 as of (date on which such limitation was so established) is as follows (indicating for each such surety that surety’s underwriting limitation and the date on which that limitation was established):

…………………………………….

…………………………………….

…………………………………….

(4) The amount of the bond to which this statement and certification is attached is $ …… .

(5) If, by virtue of one or more contracts of reinsurance, the amount of the bond indicated under item (4) above exceeds the total underwriting limitation of all sureties on the bond as set forth in items (3) (a) or (3) (b) above, or both, then for each such contract of reinsurance:

(a) The name and address of each such reinsurer under that contract and the amount of that reinsurer’s participation in the contract is as follows:…………………………

……………………………………

……………………………………

……………………………………..; and

(b) Each surety that is party to any such contract of reinsurance certifies that each reinsurer listed under item (5) (a) satisfies the credit for reinsurance requirement established under P.L. 1993, c.243 (C. 17:51B-1 et seq.) and any applicable regulations in effect as of the date on which the bond to which this statement and certification is attached shall have been filed with the appropriate public agency.

CERTIFICATE

(to be completed by an authorized certifying agent for each surety on the bond)

I . ………………….. (name of agent), as ………………………………… (title of agent) for ………………………… (name of surety), a corporation/mutual insurance company/other (indicating type of business organization) (circle one) domiciled in ……………………. (state of domicile), DO HEREBY CERTIFY that, to the best of my knowledge, the foregoing statements made by me are true, and ACKNOWLEDGE that, if any of those statements are false, this bond is VOIDABLE.

…………………………………………

(Signature of certifying agent)

…………………………………………………

(Printed name of certifying agent)

……………………………………………….

(Title of certifying agent)

The bond required by this article shall be executed by the contractor with such sureties in accordance with N.J.S. 2A:44-147 as shall be approved by the board, officer or agent acting on behalf of the State, contracting unit or school district, in an amount equal to 100 per cent of the contract price. The payment bond shall be conditioned for the payment by the contractor of all indebtedness which may accrue to any person, firm or corporation designated as a “beneficiary” pursuant to N.J.S. 2A:44-143, in an amount not exceeding the sum specified in the bond, on account of any labor performed or materials, provisions, provender or other supplies, or teams, fuels, oils, implements or machinery used or consumed in, upon, for or about the construction, erection, alteration or repair of the public building or public work or improvement.

The payment bond shall be deposited with and be held by the board, officer or agent acting on behalf of the State, contracting unit or school district, for the use of any beneficiary thereof.

Any person who may be a beneficiary of the payment bond, as defined in this article, and who does not have a direct contract with the contractor furnishing the bond shall, prior to commencing any work, provide written notice to the contractor by certified mail or otherwise, provided that he shall have proof of delivery of same, that said person is a beneficiary of the bond. If a beneficiary fails to provide the required written notice, the beneficiary shall only have rights to the benefits available hereunder from the date the notice is provided.

Any beneficiary, as defined in N.J.S. 2A:44-143, to whom any money shall be due on account of having performed any labor or furnished any materials, provisions, provender or other supplies, or teams, fuels, oils, implements or machinery in, upon, for or about the construction, erection, alteration or repair of any public building or other public work or improvement, shall, at any time before the expiration of one year from the last date upon which such beneficiary shall have performed actual work or delivered materials to the project, in the case of a material supplier, furnish the sureties on the bond required by this article a statement of the amount due to him.

No action shall be brought against any of the sureties on the bond required by this article until the expiration of 90 days after provision to the sureties and the contractor of the statement of the amount due to him, but in no event later than one year from the last date upon which such beneficiary shall have performed actual work or delivered materials to the project.

If the indebtedness due to any person as shown by the statement required to be filed by N.J.S. 2A:44-145 shall not be paid in full at the expiration of 90 days from the date of notice of the amount due to the person, such person shall, within one year from the last date that work was performed or materials were supplied by that person, bring an action in his own name upon the bond required by this article.

The bond required by this article shall be in substantially the following form:

“Know all men by these presents, that we, the undersigned as principal and as sureties, are hereby held and firmly bound unto in the penal sum of dollars, for the payment of which well and truly to be made, we hereby jointly and severally bind ourselves, our heirs, executors, administrators, successors and assigns.

“Signed this ……. day of ……………….., 19….. .

“The condition of the above obligation is such that whereas, the above named principal did on the ………….. day of ……………………………., 19 …….., enter into a contract with, which said contract is made a part of this the bond the same as though set forth herein;

“Now, if the said ……………………….. shall well and faithfully do and perform the things agreed by …………………………….. to be done and performed according to the terms of said contract, and shall pay all lawful claims of beneficiaries as defined by N.J.S. 2A:44-143 for labor performed or materials, provisions, provender or other supplies or teams, fuels, oils, implements or machinery furnished, used or consumed in the carrying forward, performing or completing of said contract, we agreeing and assenting that this undertaking shall be for the benefit of any beneficiary as defined in N.J.S. 2A:44-143 having a just claim, as well as for the obligee herein; then this obligation shall be void; otherwise the same shall remain in full force and effect; it being expressly understood and agreed that the liability of the surety for any and all claims hereunder shall in no event exceed the penal amount of this obligation as herein stated.

“The said surety hereby stipulates and agrees that no modifications, omissions or additions in or to the terms of the said contract or in or to the plans or specifications therefor shall in anywise affect the obligation of said surety on its bond.”

Recovery of any claimant under the bond shall be subject to the conditions and provisions of this article to the same extent as if such conditions and provisions were fully incorporated in the form set forth above.