Indiana

Preliminary Notice Deadlines

Indiana

Indiana

Indiana

Indiana

Indiana

Must file bond claim within 60 days from last furnishing labor and/or material to the project. Must file lawsuit: (i) On general state owned properties within 1 year from the project's substantial completion; (ii) On state university and other state projects, within 60 days from the project's substantial completion; and (iii) On Department of Transportation projects, within 90 days of receiving a notice of rejection of claim.

Indiana

Indiana

Must file bond claim within 60 days from last furnishing labor and/or material to the project. Must file lawsuit: (i) On general state owned properties within 1 year from the project's substantial completion; (ii) On state university and other state projects, within 60 days from the project's substantial completion; and (iii) On Department of Transportation projects, within 90 days of receiving a notice of rejection of claim.

In Indiana, parties entitled to protection include subcontractors, and suppliers of labor and/or materials to the general contractor or a first tier sub. More remote claimants and suppliers to suppliers are not covered in Indiana.

State Projects – Title 4: Claim must be received within 60 days after the last furnishing of labor and/or material to the project by any party.

State Projects – Title 5: Claim must be received within 60 days after the last furnishing of labor and/or material to the project by the claimant.

Transportation Projects: Claim must be received less than 1 year after acceptance of the labor and/or material furnished.

The party that must receive a bond claim in Indiana is dependent upon the contracting public entity.

State Projects – Title 4: Claim must be delivered to the board, officer, or clerk of the contracting public entity, and the surety.

State Projects – Title 5: Claim must be delivered to the board, commission, trustee, officer, authorized clerk, or agent of the state or contracting commission.

Local Projects: Claim must be delivered to the board, officer, or clerk of the contracting public entity.

Transportation Projects: Claim must be delivered to the surety.

State Projects – Title 4: Suit must be initiated more than 30 days after filing claim, but less than 1 year after final settlement of the contract between the public entity and the general contractor.

State Projects – Title 5: Suit must be initiated more than 30 days after filing claim, but less than 60 days after final completion and acceptance of the work.

Local Projects: Same as Title 5 State Projects.

Transportation Projects: Suit must be initiated more than 60 days after filing claim, but less than 18 months after final completion and acceptance of the work. However, if the claimant receives a notice from the public entity requiring suit to be filed within 90 days of that notice, the claimant must comply.

State Projects – Title 4: Claim must include 1) the amount due and owing; 2) detailed explanation of the claim; 3) statement informing the public works division that the surety was notified. This claim must be verified.

State Projects – Title 5: Claim must include 1) the amount due and owing, and the statement must be verified.

Local Projects: Claim must be verified and in duplicate.

Transportation Projects: Claim must include 1) the amount due and owing.

For all projects, it may be advisable to also include a description of the labor and/or materials furnished, and an identification of the project, the general contractor, and the hiring party.

Indiana does not have statutory lien waiver forms, and therefore, you can use any lien waiver forms. Since lien waivers are unregulated, be careful when reviewing and signing lien waivers. See this article: Should You Sign That Lien Waiver?.

Also, Indiana state law prohibits contractors and suppliers from waiving their right to file a mechanics lien in contract. You can learn more about the prohibition of such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

No, suppliers to suppliers likely cannot file a bond claim in Indiana.

State Projects – Title 4: Claim must be “sent” to the surety. It may be advisable to send the claim via certified or registered mail.

State Projects – Title 5: Duplicate copies of the claim must be filed with the board, commission, trustee, officer, authorized clerk, or agent of the state or contracting commission – they will notify the surety.

Local Projects: Duplicate copies of the claim must be filed with the board, officer, or clerk of the contracting public entity – they will inform the surety.

Transportation Projects: Claim must be “furnished” to the surety. It may be advisable to send via certified or registered mail.

I have a lot of unpaid invoices.. Most of these invoices were last year .. I did however finish a small job on this project...

(Follow Up on Previous Question 1402) In the state of Indiana are the PERFORMANCE BOND and the PAYMENT BOND the same legal document; we have a performance bond so if they are separate documents are we still covered.I had asked a question and you answered but as a follow up we actually have a Performance bond NOT a payment bond and need...

Would Lindsay (us) be covered under a bond that states it covers "principal or subcontractor in the construction of the work, including labor, service, and furnished materials"?The bond on account is RS-40584-A-- Lindsay is leasing their equipment. Milestone is the Prime contractor, E & B paving ( is whom we are...

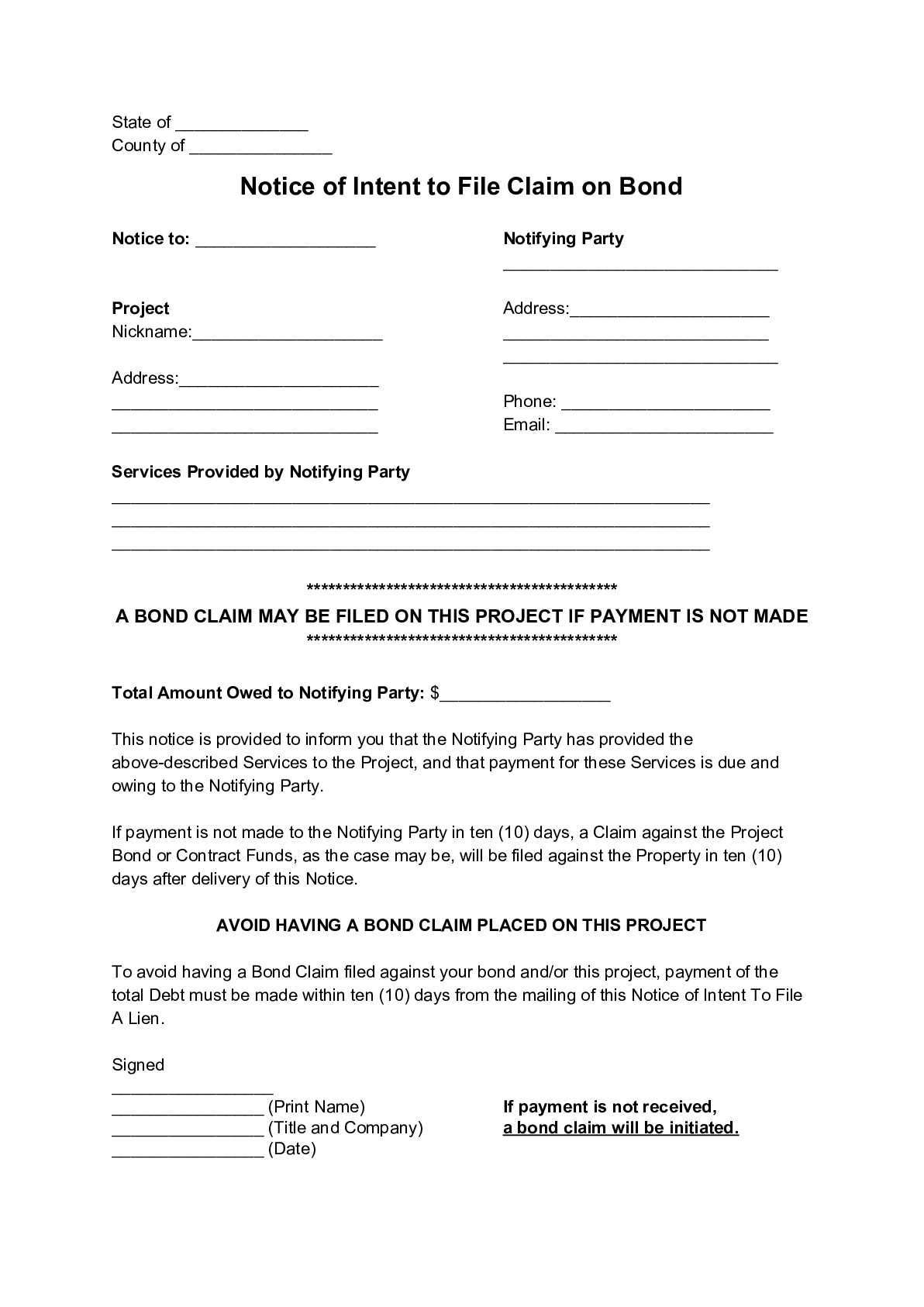

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Indiana, and are not paid, you can file a “lien” against the project pursuant to Indiana’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Indiana’s Little Miller Act is found in Indiana Code Title 4, Article 13.6, §4-13.6-7-5 – §4.13.6-7-12, and Title 5, Article 16, §5-16-5-1 – §5-16-5.5-8, and is reproduced below.

Sec. 5. (a) The director:

(1) may require each contractor of a public works project with an estimated cost of not more than two hundred thousand dollars ($200,000); and

(2) shall require each contractor of a public works project with an estimated cost of more than two hundred thousand dollars ($200,000); to submit a good and sufficient bid bond with the bid. The bid bond may equal any percentage of the estimated cost of the public works project that the director requires.

(b) The division may accept bonds provided on forms specified by the department or on forms given by surety companies.

Sec. 6. (a) If the estimated cost of the public works project is more than two hundred thousand dollars ($200,000), the division shall require the contractor to execute a good and sufficient payment bond to the department for the state in an amount equal to one hundred percent (100%) of the total contract price. The bond shall include at least the following provisions:

(1) The contractor, its successors and assigns, whether by operation of law or otherwise, and all subcontractors, their successors and assigns, whether by operation of law or otherwise, shall pay all indebtedness that may accrue to any person on account of any labor or service performed or materials furnished in relation to the public work.

(2) The bond shall directly inure to the benefit of subcontractors, laborers, suppliers, and those performing service or who may have furnished or supplied labor, material, or service in relation to the public work.

(3) No change, modification, omission, or addition in or to the terms or conditions of the contract, plans, specifications, drawings, or profile or any irregularity or defect in the contract or in the procedures preliminary to the letting and awarding of the contract shall affect or operate to release or discharge the surety in any way.

(4) The provisions and conditions of this chapter shall be a part of the terms of the contract and bond.

(b) The division may permit the bond given by the contractor to provide for incremental bonding in the form of multiple or chronological bonds that, if taken as a whole, equal the total contract price.

(c) The division may accept bonds provided on forms specified by the division or on forms given by surety companies.

(d) The division shall hold the bond of a contractor for the use and benefit of any claimant having an interest in it and entitled to its benefits.

(e) The division shall not release sureties of a contractor until the expiration of one (1) year after the final settlement with the contractor.

(f) If the estimated cost of the public works project is less than or equal to two hundred thousand dollars ($200,000), the director may require one (1) of the following:

(1) The contractor must execute a good and sufficient payment bond. The director may determine the amount of the bond to be any percentage, but no more than one hundred percent (100%), of the cost of the project.

(2) The division will withhold retainage under this chapter in an amount of ten percent (10%) of the dollar value of all payments made to the contractor until the public work is substantially completed.

Sec. 7. (a) If the estimated cost of the public works project is:

(1) at least two hundred thousand dollars ($200,000), the division shall; or

(2) less than two hundred thousand dollars ($200,000), the division may; require the contractor to execute a good and sufficient performance bond to the department for the state in an amount equal to one hundred percent (100%) of the total contract price.

(b) The bond required under subsection (a) shall include at least the following provisions:

(1) The contractor shall well and faithfully perform the contract.

(2) No change, modification, omission, or addition in or to the terms or conditions of the contract, plans, specifications, drawings, or profile or any irregularity or defect in the contract or in the procedures preliminary to the letting and awarding of the contract shall affect or operate to release or discharge the surety in any way.

(3) The provisions and conditions of this chapter shall be a part of the terms of the contract and bond.

(c) The division may permit the bond given by the contractor to provide for incremental bonding in the form of multiple or chronological bonds that, if taken as a whole, equal the total contract price.

(d) The division may accept bonds provided on forms specified by the division or on forms given by surety companies.

(e) The division shall not release sureties of a contractor until the expiration of one (1) year after the final settlement with the contractor.

Sec. 8. (a) Except for amounts withheld:

(1) from the contractor under section 3 of this chapter for uncompleted minor items; and

(2) under subsection (b);

the division may make a full, final, and complete settlement with a contractor, including providing for full payment of all escrowed principal and escrowed income, not later than sixty-one (61) days following the date of substantial completion if:

the contractor has materially fulfilled all of its obligations under the public works contract;

(b) If the division receives a claim from a subcontractor or a supplier under section 9 this chapter, the division shall withhold the amount of the claim until the claim is resolved under section 9(c) of this chapter.

(c) After the division makes a final settlement with a contractor, all claims by subcontractors and suppliers to funds withheld from that contractor under section 2 of this chapter are barred.

Sec. 9. (a) If a subcontractor or a supplier files a claim with the division under section 10 of this chapter, and the claim is undisputed, the division shall:

(1) pay the claimant from the amounts retained from the contractor under section 2 of this chapter;

(2) take a receipt for each payment; and

(3) deduct the total amount paid to subcontractors and suppliers from the balance due the contractor.

(b) If there is not a sufficient amount owing to the contractor to pay all subcontractors and suppliers making undisputed claims under section 10 of this chapter, then the division shall prorate the amount withheld from the contractor and shall pay the prorated amount to each subcontractor and supplier entitled to a portion of the amount.

(c) If there is a dispute among the contractor, the subcontractors, and the suppliers to the funds withheld by the division, the division shall retain sufficient funds until the dispute is settled and the correct amount to be paid to each person is determined. When the dispute is resolved, the division shall make payments to persons making claims as provided in this section.

Sec. 10. (a) In order to receive payment under section 9 of this chapter or to proceed against the bond of the contractor required under section 6 of this chapter, a subcontractor or supplier making a claim for payment on account of having performed any labor or having furnished any material or service in relation to a public works project must file a verified claim with the division and deliver a copy of the claim to the contractor not later than sixty (60) days after the date the last labor was performed, the last material was furnished, or the last service was rendered by that subcontractor or supplier. The claim shall state the amount due and owing to the person and shall give as much detail explaining the claim as possible. The division shall notify the contractor of any filed claims before taking action under section 9 of this chapter.

(b) In order to proceed against the bond of the contractor required under section 6 of this chapter, the claimant must notify the surety of the contractor by sending a copy of the claim required by subsection (a) to the surety company. The claimant shall also inform the division and the contractor that the surety has been notified. The division shall supply the claimant with any information the claimant requires to notify the surety and the contractor.

(c) The claimant may not file suit against the contractor’s surety on the contractor’s bond before thirty (30) days after filing of the claim with the division and delivering a copy of the claim to the contractor. If the claim is not paid in full at the expiration of the thirty (30) day period, the claimant may bring an action in a court of competent jurisdiction in the claimant’s own name upon the bond.

Sec. 11. Unless the bond provides a greater period of time, all suits must be brought against a surety on a bond required by this chapter within one (1) year after final settlement with the contractor under section 8 of this chapter. All suits against the surety after this time are barred.

Sec. 12. This chapter is intended to supplement all other laws protecting labor, subcontractors, or suppliers and shall not be construed as conflicting with them.

Sec. 1. (a) Except as hereinafter otherwise provided, when a public work is performed under contract at the expense of the state or a commission created by law, the public body shall withhold final payment to the contractor until such contractor has paid to:

(1) all subcontractors;

(2) all suppliers of materials for material furnished;

(3) all labor employed in the public work; and

(4) all those furnishing any service in relation to or in connection with the public work;

all bills due and owing to the persons described in subdivisions (1) through (4) who have filed a claim under subsection (c).

(b) If there is not a sufficient sum owing to the contractor on the contract to pay all the bills, then the sum owing on the contract shall be prorated in payment of all the bills among the persons entitled to payment.

(c) A person claiming payment under this section must file with the public body a claim not later than sixty (60) days after the last labor is performed, the last material is furnished, or the last service is rendered by that person, as provided in section 2 of this chapter.

(d) If there is no dispute among the claimants, the public body shall pay all claims out of the funds due the contractor and take receipt for each payment. The total of amounts paid under this subsection shall be deducted from the contract price.

(e) If there is a dispute among the claimants, the public body shall retain sufficient funds until the dispute is settled, the correct amounts are determined, and payment of those amounts shall be made as provided in subsection (d).

(f) Except for amounts required to be withheld under subsection (e) or as otherwise provided in this chapter, this chapter does not preclude a full, final, and complete settlement upon a contract with a contractor after thirty (30) days from the date of the completion and acceptance of the work as completed upon.

(g) The surety of a contractor may not be released until the expiration of one (1) year after the final settlement with the contractor.

Sec. 2. (a) A contract awarded for a public work must provide for the payment of subcontractors, labor, suppliers of materials, and those performing service in connection with the public work. The contract must provide for the payment of subcontractors by withholding by the public body funds sufficient from the contract price to pay the subcontractors, labor, suppliers of materials, and those furnishing service in relation to or in connection with the public work. The contractor shall execute a bond to the state, approved by the public body in an amount equal to the total contract price. The bond shall be conditioned for payment by the contractor, the contractor’s successors and assigns, and by the subcontractors, their successors and assigns, of all indebtedness, which may accrue to any person for any labor or service performed, materials furnished, or service rendered in the public work. The bond by its terms shall be conditioned to directly inure to the benefit of subcontractors, laborers, suppliers of materials, and those performing service who have furnished or supplied labor, material, or service for the public work.

(b) The bond required under subsection (a) shall be deposited with the public body for the benefit of a person interested in and entitled to the bond. The bond shall be conditioned that:

(1) a change, modification, omission, or addition in and to the terms or conditions of the contract, plans, specifications, drawings, or profile; or

(2) any irregularity or defect in the contract or in the proceedings preliminary to the letting and awarding of the contract;

does not affect or operate to release or discharge the surety.

(c) The provisions of this chapter become a part of the terms of a contract awarded under this chapter. A bond for a public work is subject to this chapter.

(d) A person to whom money is due for having performed labor or having furnished material or service for a public work under this chapter must, not later than sixty (60) days after that person completed the labor or service or after that person furnished the last item of material:

(1) file with the public body duplicate verified statements of the amount due to the person; and

(2) deliver a copy of the statement to the contractor.

The public body shall deliver to the surety on the bond one (1) of the duplicate statements. The failure to deliver a duplicate statement by the public body does not affect or invalidate the rights of the person to whom money is due, nor does the failure to deliver a duplicate statement operate as a defense for the surety.

(e) A suit may not be brought against a surety on a bond under this section before thirty (30) days after both of the following have occurred:

(1) The filing of the verified duplicate statement.

(2) A copy of the notice has been delivered to the contractor.

If the indebtedness is not paid in full after thirty (30) days, the person, may bring an action in a court of competent jurisdiction upon the bond. The action must be brought not later than sixty (60) days after the date of the final completion and acceptance of the public work. An action on the bond against a surety is barred if not brought within this time.

(f) IC 8-23-9, and not this chapter, applies to bonds and claims on state highway road and bridge contracts.

Sec. 3. This chapter shall not be construed as conflicting with any other laws for the protection of labor, subcontractors, or materialmen, but is supplemental to those laws.

Sec. 1. As used in this chapter:

“State agency” means the state of Indiana or any commission or agency created by law.

“Agent” shall include any board, commission, trustee, officer or agent which acts on behalf of a state agency.

“Public building”, “public work” and “public improvement” or combinations thereof shall be construed to include all buildings, work or improvements the cost of which is paid for from public funds but shall not include highways, roads, streets, alleys, bridges and appurtenant structures situated on streets, alleys, railroad projects (as defined in IC 8-5-15-1) and dedicated highway rights-of-way.

“Substantial completion” shall be construed to mean the date when the construction of a structure or building is sufficiently completed, in accordance with the plans and specifications, as modified by any completed change orders agreed to by the parties, so that the state agency can occupy the structure or building for the use for which it was intended. Furthermore, the warranty period shall commence no later than the date of substantial completion.

“Contractor” shall mean any person, firm, limited liability company, or corporation who is party to a contract with a state agency to construct, erect, alter or repair any public building or is any way involved in public work or public improvement.

“Subcontractor” shall mean and include any person, firm, limited liability company, or corporation who is a party to a contract with the contractor and who furnishes and performs on-site labor on any public building, work or improvement. It also shall include materialmen who supply contractors or subcontractors as contained herein.

“Retainage” means any amount to be withheld from any payment to a contractor or subcontractor pursuant to the terms of a contract until the occurrence of a specified event.

“Escrowed principal” shall mean the value of all cash and securities or other property at the time placed in an escrow account.

“Escrowed income” shall mean the value of all property held in an escrow account over the escrowed principal in such account.

Sec. 2. To the extent that this chapter is applicable, all contracts between a contractor and a state agency concerning any public building, work, or improvement entered into after May 1, 1972, and which contracts are in excess of two hundred thousand dollars ($200,000) are to be governed by the provisions of this chapter, as are the rights and duties among the parties to the contract and any subcontractors who do any work under the contract. A state agency may elect to have a contract that is for not more than two hundred thousand dollars ($200,000) be governed by this chapter. All contracts governed by the provisions of this chapter shall include provisions for the retainage of portions of payments by a state agency to contractors, by contractors to subcontractors, and for the payment of subcontractors.

Sec. 3. Any state agency which enters into a contract for any public building, work or improvement, and any contractor subcontracting portions of such contract, which contracts contain provision for retainage shall include in their respective contracts a provision that at the time any retainage is withheld, the state agency and/or contractor shall place such retainage in an escrow account, with a bank, savings and loan institution, or the State of Indiana or an instrumentality thereof, as escrow agent selected by mutual agreement between the affected contract parties, pursuant to a written agreement among the bank or savings and loan institution, the state agency, and the contractor as appropriate. The escrow agreement shall provide as follows:

(a) The escrow agent shall promptly invest all escrowed principal in such obligations as shall be selected by the escrow agent in its discretion.

(b) The escrow agent shall hold the escrowed principal and income until receipt of notice from the state agency and the contractor, or the contractor and the subcontractor, specifying the portion or portions of the escrowed principal to be released from the escrow and the person or persons to whom such portion or portions are to be released. Upon receipt of such notice the escrow agent shall promptly remit the designated portion of escrowed principal and the same proportion of then escrowed income to such person or persons.

(c) The escrow agent shall be compensated for its services as the parties may agree on a commercially reasonable fee commensurate with fees then being charged for the handling of escrow accounts of like size and duration. The fee must be paid from the escrowed income of the escrow account.

(d) The agreement may include such other terms and conditions not inconsistent with the foregoing paragraphs (a), (b) and (c) including but not limited to provisions authorizing the escrow agent to commingle the escrowed funds with funds held pursuant to other escrow agreements and limiting the liability of the escrow agent.

Sec. 3.1. The treasurer of state may charge a reasonable fee for services that the treasurer renders in connection with the establishment and administration of escrow accounts. If the treasurer charges such fee, the treasurer shall prepare a fee schedule and make it available to the contractor. Any fee must be paid by the contractor at the time the escrow account is established.

Sec. 3.5. (a) To determine the amount of retainage to be withheld, a state agency shall elect one (1) of the following options:

(1) Withhold no more than ten percent (10%) nor less than six percent (6%) of the dollar value of all work satisfactorily completed until the public work is fifty percent (50%) complete, and nothing further after that.

(2) Withhold no more than five percent (5%) nor less than three percent (3%) of the dollar value of all work satisfactorily completed until the public work is substantially complete.

(b) If upon substantial completion of the work there are any remaining uncompleted minor items, an amount computed under section 6 of this chapter shall be withheld until those items are completed.

Sec. 4. At the time of entering into any contract covered by the provisions of this chapter, the contractor shall furnish a valid performance bond which is acceptable to the state agency involved in an amount equal to his total contract price. If it is acceptable to the state agency involved, this performance bond may provide for incremental bonding in the form of multiple or chronological bonds which, when taken as a whole, equal the total contract price. The surety on the bond shall not be released for a period of one (1) year after final settlement with the contractor. No change, modification, omission or addition in and to the terms or conditions of said contract, plans, specifications, drawings or profile or any irregularity or defect in said contract or in the proceedings preliminary to the letting and awarding thereof shall in any way affect or operate to release or discharge the surety.

Sec. 5. Within ten (10) days of the receipt of any payment by the state agency or escrow agent, the contractor or escrow agent shall pay all subcontractors with whom he has contracted their share of the payment the contractor received based upon the service performed by the subcontractor. The contractor shall furnish upon request a sworn statement or certification at the time of payment to him that the subcontractor has received his share of the previous payment to the contractor. The making of an incorrect certification may be considered a breach of contract by the state agency, and it may exercise all of its prerogatives set out in the contract in addition to the remedies for falsifying an affidavit. Such an action may also result in a suspension of prequalification with the certification board established under IC 4-13.6-3-3.

Sec. 6. The contractor shall be paid in full including all escrowed principal and escrowed income by the state agency and escrow agent within sixty-one (61) days following the date of substantial completion, subject to IC 1971, 5-16-5. If at that time there are any remaining uncompleted minor items, an amount equal to two hundred percent (200%) of the value of each item as determined by the architect-engineer shall be withheld until said item or items are completed.

Sec. 7. All suits must be brought against a surety on a bond required by this chapter within one (1) year after the completion of the work or service in question.

Sec. 8. This chapter shall not be construed as conflicting with any other laws for the protection of labor, subcontractors or materialmen, but is supplemental thereto.