Hawaii

Preliminary Notice Deadlines

Hawaii

Hawaii

Hawaii

Hawaii

Hawaii

Bond Claim must be filed with the prime contractor and surety within 90 days from last furnishing labor and/or materials to the project. Lawsuit against the bond / to enforce the claim must be lodged within 1 year from last furnishing labor or materials.

Hawaii

Hawaii

Bond Claim must be filed with the prime contractor and surety within 90 days from last furnishing labor and/or materials to the project. Lawsuit against the bond / to enforce the claim must be lodged within 1 year from last furnishing labor or materials.

In Hawaii, it is unclear exactly who is allowed to make a claim against a payment bond. The statute is clear that at least parties who furnished labor and/or materials to the general contractor are protected. Because the Hawaii statute is intended to follow the Miller Act, lower-tier subs and suppliers (excluding suppliers to suppliers) may be covered – but the statute itself is unclear.

Also note that contracts involving the University of Hawaii may have differing requirements.

A Hawaii bond claim must be received within 90 days after the claimant’s last furnishing of labor and/or materials to the project. If the project involves the University of Hawaii the specific rules to follow must be obtained from the University.

In Hawaii, the bond claim must be delivered to the general contractor, and the surety. If the claimant wishes, a copy of the claim may also be sent to the contracting public entity. If the project involves the University of Hawaii the requirements may differ.

In Hawaii, suit must be initiated more than 90 days, but less than 1 year, after the claimant’s last delivery of labor and/or materials to the project.

In Hawaii, a bond claim must only include the amount of the claim, and the name of the party to whom the labor and/or materials were furnished. It is likely advisable to also include the identification of the general contractor (if claimant hired by lower-tier party), and the contracting public entity, and include some description of the project and the labor and/or materials furnished.

Hawaii does not have statutory lien waiver forms, and therefore, you can use any lien waiver forms. Since lien waivers are unregulated, be careful when reviewing and signing lien waivers. See this article: Should You Sign That Lien Waiver?.

Hawaii state law is unclear or silent about whether contractors and suppliers can waive their lien rights before any work on the project begins. Accordingly, you want to proceed with caution on this subject. You can learn more about such “no lien clauses” at this article: Where Can You Waive Your Lien Rights Before Payment?

No, suppliers to suppliers likely cannot file a bond claim in Hawaii.

The claim may be sent via registered or certified mail, or by personal service or other manner acceptable for service of process.

We are a subcontractor on a "public" job in Hawaii. The General Contractor was terminated from the job. Can we file a Stop Notice in...

what can I do to get paid from a bondHi I’m sub contractor that did a state job for a general contractor and have not received full payment. I sent an invoice for the...

Are claims against a subcontractor's payment bond governed by the bond terms themselves, or by some provision of the Hawaii Public Works Statute for a public project in Hawaii?The prime contractor had a subcontractor post a payment bond on a public Hawaii Department of Transportation project. The Hawaii Public Works statute speaks only...

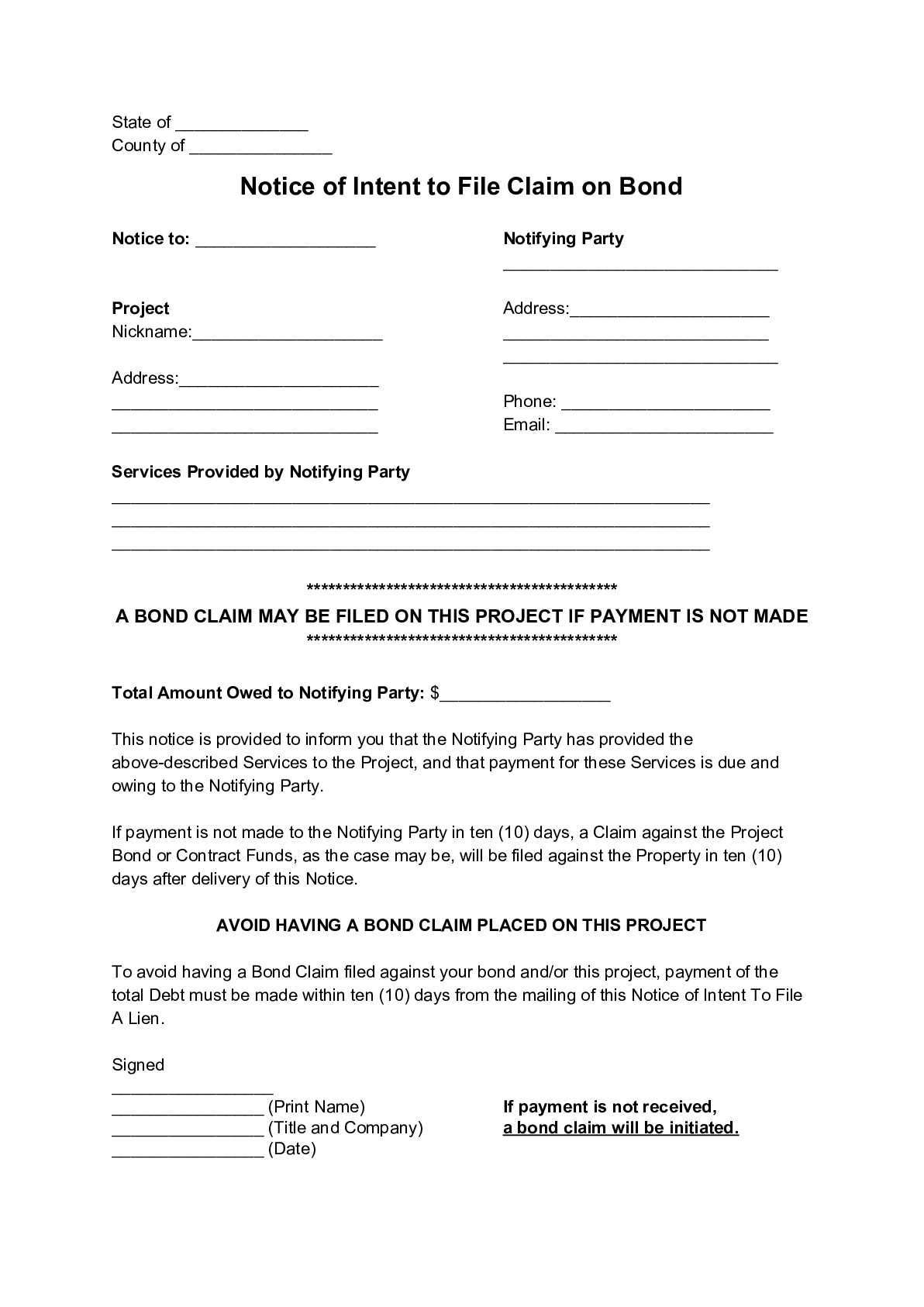

A Notice of Intent to Make Bond Claim is not a required document, but it can be a powerful one. By sending this notice, a...

When you perform work on a state construction project in Hawaii, and are not paid, you can file a “lien” against the project pursuant to Hawaii’s Little Miller Act. Since the claim is not against the state or county’s actual property, but instead against a posted bond, the claim is not really called a “lien” but is more frequently referred to as a “bond claim” or “little miller act claim.”

Hawaii’s Little Miller Act is found in Hawaii Revised Statutes, Chapter 103D, Part III, §103D-323 – §103D-325, and is reproduced below

(a) Unless the policy board determines otherwise by rules, bid security shall be required only for construction contracts to be awarded pursuant to sections 103D-302 and 103D-303 and when the price of the contract is estimated by the procurement officer to exceed $25,000 or, if the contract is for goods or services, the purchasing agency secures the approval of the chief procurement officer. Bid security shall be a bond provided by a surety company authorized to do business in the State, or the equivalent in cash, or otherwise supplied in a form specified in rules.

(b) Bid security shall be in an amount equal to at least five per cent of the amount of the bid.

(c) Unless, pursuant to rules, it is determined that a failure to provide bid security is nonsubstantial, all bids required to be accompanied by bid security shall be rejected when not accompanied by the required bid security.

(d) After the bids are opened, they shall be irrevocable for the period specified in the invitation for bids, except as provided in section 103D-302(g). If a bidder is permitted to withdraw its bid before award, no action shall be had against the bidder or the bid security.

(a) Unless the policy board determines otherwise by rules, the following bonds or security shall be delivered to the purchasing agency and shall become binding on the parties upon the execution of the contract if the contract which is awarded exceeds $25,000 and is for construction, or the purchasing agency secures the approval of the chief procurement officer:

(1) A performance bond in a form prescribed by the rules of the policy board, executed by a surety company authorized to do business in this State or otherwise secured in a manner satisfactory to the purchasing agency, in an amount equal to one hundred per cent of the price specified in the contract;

(2) A payment bond in a form prescribed by the rules of the policy board, executed by a surety company authorized to do business in this State or otherwise secured in a manner satisfactory to the purchasing agency, for the protection of all persons supplying labor and material to the contractor for the performance of the work provided for in the contract. The bond shall be in an amount equal to one hundred per cent of the price specified in the contract; or

(3) A performance and payment bond which satisfies all of the requirements of paragraphs (1) and (2).

(b) The policy board may adopt rules that authorize the head of a purchasing agency to reduce the amount of performance and payment bonds.

(c) Nothing in this section shall be construed to limit the authority of the chief procurement officer to require a performance bond or other security in addition to those bonds, or in circumstances other than specified in subsection (a).

(d) Every person who has furnished labor or material to the contractor for the work provided in the contract, in respect of which a payment bond or a performance and payment bond is furnished under this section, and who has not been paid amounts due therefor before the expiration of a period of ninety days after the day on which the last of the labor was done or performed or material was furnished or supplied, for which such a claim is made, may institute an action for the amount, or balance thereof, unpaid at the time of the institution of the action against the contractor and its sureties, on the payment bond or the performance and payment bond, and have their rights and claims adjudicated in the action, and judgment rendered thereon; subject to the State’s priority on the bonds. If the full amount of the liability of the sureties on the payment bond is insufficient to pay the full amount of the claims, then, after paying the full amount due the State, the remainder shall be distributed pro rata among the claimants.

As a condition precedent to any such suit, written notice shall be given to contractor and surety, within ninety days from the date on which the person did or performed the last labor or furnished or supplied the last of the material for which claim is made, stating with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed.

The written notice shall be served by registered or certified mailing of the notice, to the contractor and surety, at any place they maintain an office or conduct their business, or in any manner authorized by law to serve summons.

(e) Every suit instituted under subsection (d) shall be brought in the circuit court of the circuit in which the project is located, but no such suit shall be commenced after the expiration of one year after the day on which the last of the labor was performed or material was supplied for the work provided in the contract. The obligee named in the bond need not be joined as a party in any such suit.

The terms “labor” and “material” have the same meanings in this section as the terms are used in section 507-41.

(a) The policy board shall specify the form of the bonds required by this chapter by procurement directive.

(b) Any person may request and obtain from the State a certified copy of a bond upon payment of the cost of reproduction of the bond and postage, if any. A certified copy of a bond shall be prima facie evidence of the contents, execution, and delivery of the original.